20 November 2023, 13:52

Price forecast from 20 to 24 of November 2023

-

Energy market:

The price of chicken is rising, the price of eggs is rising. What to do? How to get out of this situation? This is some kind of horror!!! There is a proposal: switch to ostriches! This is an egg, and meat, and a feather. Moreover, one head gives all the products many times larger. All our ladies will be on the street, in taxis, in public transport and in the subway wearing feathers. Beauty! Oh, there you iron and we’ll get to the peacocks, and this is, you know, a real pheasant, and again, what a feather!

Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Together with the hoteliers, we are waiting for OPEC in Vienna on the 25th. Judging by the current situation on the market, we can assume that if no additional cuts are announced, then we will try the strength of the support at 75.00.

China continues to be alarming. All these meetings in America between presidents, statements that large states must look for ways to cooperate no matter what. All this is alarming. That is, the States have grown together with China in such a way that they can no longer tear themselves away from each other. And if one begins to collapse, then nothing good will happen to the other. From here, China’s problems may spread to the United States. And this is bad for oil prices.

OPEC’s dreams of demand of 105 million barrels per day in the 4th quarter of 2024 may turn out to be unrealistic.

Grain market:

The market tried to accelerate in the last two weeks, but these attempts ended in complete fiasco. Sellers are able to organize a drop in prices, and for corn it can be dramatic, up to 400 cents per bushel, since the weather problems in South America resolved themselves — it started to rain. We note, however, that the economies of Argentina and Brazil continue to be in a weak state, which implies complete submission of these two countries to market prices. That is, they will not be able to dictate the will of the market by holding back supplies. And this creates predictability and stability.

Ukraine slowly continues to supply something to the foreign market. In October, 700 thousand tons were shipped. There have been reports that a grain cargo ship hit a mine on Saturday, but this is unlikely to stop the whole process, but the crews will have to pay more.

Egypt confirmed that it will continue to buy Russian wheat and urged not to believe rumors about a reorientation to Bulgarian and French products.

USD/RUB:

Over the past week, the ruble showed what was expected of it. He’s gotten stronger. Strengthening, while we are above 88.00, will be considered local in nature, but a move below this level can be regarded as an attempt to break the negative trend in the national currency.

Most likely, importers are now purchasing some consumer goods before the New Year holidays, which should increase demand for the currency, so there will not be a very strong fall in the dollar, but after the New Year, at current oil prices, it is possible that an attempt will be made to reach 75.00. But lower levels will be disastrous for the budget. Sooner or later we will still return to 100.00.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 3.4 thousand contracts. Both buyers and sellers left the market in small numbers. The bulls continue to control the market.

Growth scenario: we are considering November futures, expiration date is November 30. We were at 76.60, but didn’t go lower. Let’s not rush into shopping. Next week is likely to be slow ahead of the OPEC meeting.

Fall scenario: we have reached strong support levels. There is no point in selling.

Recommendations for the Brent oil market:

Purchase: when approaching 76.00. Stop:74.00. Goal: 150.00.

Sale: no.

Support – 75.14. Resistance – 82.13.

WTI. CME Group

US fundamentals: the number of active drilling rigs increased by 6 units to 500.

Commercial oil reserves in the US increased by 3.6 to 425.493 million barrels, with a forecast of +1.793 million barrels. Gasoline inventories fell by -1.5 to 222.022 million barrels. Distillate inventories fell by -1.4 to 109.895 million barrels. Inventories at the Cushing storage facility increased by 1.9 to 23.398 million barrels.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 11.7 thousand contracts. We see a small influx of sellers and a small outflow of buyers. The bulls continue to control the market.

Growth scenario: we are considering January futures, expiration date is December 19. We took it from 73.50. You can keep long. If the market can move below 71.00 from the current situation, it will break it.

Fall scenario: we closed everything last week. We have no new ambitions below. Off the market.

Recommendations for WTI oil:

Purchase: no. Anyone in position from 73.50, move the stop to 71.00. Target: 83.00.

Sale: no.

Support – 71.57. Resistance – 78.93.

Gas-Oil. ICE

Growth scenario: we are considering December futures, expiration date is December 12. The idea is the same: we’ll take it when we approach 700.00, if the market gives such an opportunity. We do nothing at current prices.

Fall scenario: stabilized. If we rise to 860.0, we can sell.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sale: when approaching 860.0. Stop: 880.00. Goal: 700.00.

Support – 775.75. Resistance – 836.00.

Natural Gas. CME Group

Growth scenario: we are considering January futures, expiration date is December 27. Most likely there will be nothing interesting on the gas market. The market is saturated. We don’t buy.

Fall scenario: out of market. Prices are low.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 2.994. Resistance – 3.464.

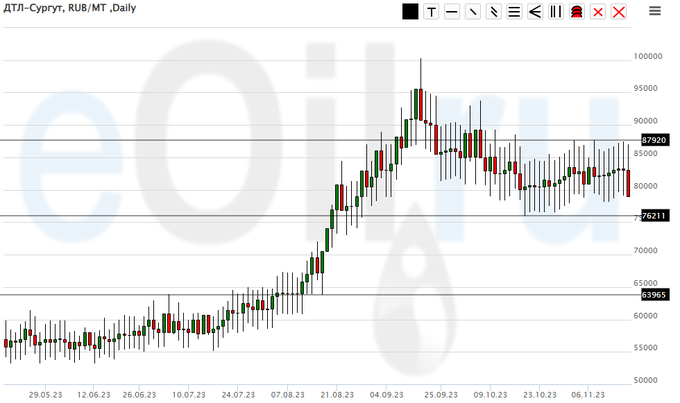

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 65,000. It will be possible to buy there.

Fall scenario: also no change. Let’s continue to stay short.

Recommendations for the diesel market:

Purchase: when approaching 65,000. Stop: 58,000. Target: 85,000.

Sale: no. If you are in a position from 85000, keep your stop at 91000. Target: 66000.

Support – 76211. Resistance – 87920.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: too aggressive growth. We continue to refrain from shopping.

Fall scenario: knocked out of short. No problem, let’s go in again.

Recommendations for the PBT market:

Purchase: no.

Sale: now. Stop: 33600. Target: 23300.

Support – 23105. Resistance – 31216

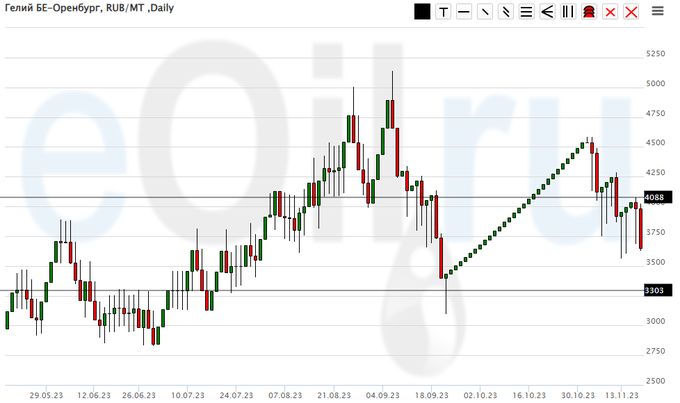

Helium (Orenburg), ETP eOil.ru

Growth scenario: good levels for purchases. You can go long.

Fall scenario: we continue to remain out of the market. There is strong support around 3300.

Helium Market Recommendations:

Purchase: Now. Stop: 3100. Target: 5000.

Sale: no.

Support – 3303. Resistance – 4088.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 2.8 thousand contracts. Both buyers and sellers left the market. Buyers did this a little more actively. Sellers retain the advantage.

Growth scenario: we are considering December futures, expiration date is December 14. We will count on the market falling to around 500.0. You can buy it there.

Fall scenario: as before, we refuse to sell. It is better to work out a possible move to 500.0 on the clock.

Recommendations for the wheat market:

Purchase: when approaching 500.0. Stop: 480.0. Target: 647.0 (710.0).

Sale: no.

Support – 500.2. Resistance – 567.4.

Corn No. 2 Yellow. CME Group

We look at the volume of open interest of managers in corn. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers has decreased by 1.4 thousand contracts. Both buyers and sellers came to the market. Buyers were more active. Sellers retain the advantage.

Growth scenario: we are considering December futures, expiration date is December 14. We are falling. It is possible that we will go very low. We are not buying yet.

Fall scenario: we will sell with targets at 400.0.

Recommendations for the corn market:

Purchase: no.

Sale: now. Stop: 483.0. Goal: 393.0.

Support – 461.0. Resistance – 481.3.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date January 12. There are big doubts about the ability of soybeans to grow, there is a lot of it. Off the market.

Fall scenario: we will think about selling if it falls below 1320. Out of the market for now.

Recommendations for the soybean market:

Purchase: no.

Sale: no.

Support – 1334.2. Resistance – 1398.4.

Growth scenario: hold longs. In case of growth above 2010, you can add.

Fall scenario: you can go short from current levels. The target for 1880 is realistic.

Recommendations for the gold market:

Purchase: when approaching 1880. Stop: 1860. Target: 2400. If you are in a position from 1840, move the stop to 1940. Target: 2400.

Sale: now. Stop: 2010. Goal: 1880.

Support – 1930. Resistance – 2008.

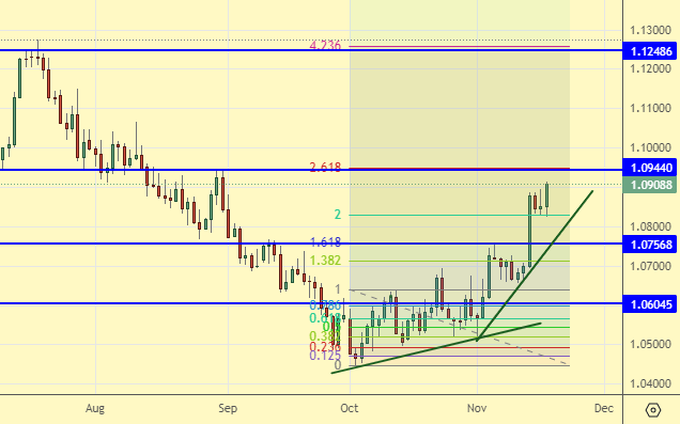

EUR/USD

Growth scenario: everything is fine, we keep buying. The market began to accelerate upward. At the top we have 1.1250, and somewhere high 1.2000.

Fall scenario: we will not sell, although we do not deny that the dollar may rise against the background of the war.

Recommendations for the euro/dollar pair:

Purchase: no. If you are in a position from 1.0700, move your stop to 1.0720. Target: 1.2000.

Sale: no.

Support – 1.0756. Resistance – 1.0944.

USD/RUB

Growth scenario: buying from 88.00 will be a normal transaction. There was no contact yet. But we are ready, mentally.

Fall scenario: maniacally want to buy from 96.00. Current levels for entering shorts are too low.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 88.00. Stop: 86.00. Goal: 100.00.

Sale: no. If you are in a position from 91.80, move your stop to 91.70. Goal: 88.00.

Support – 87.93. Resistance – 91.61.

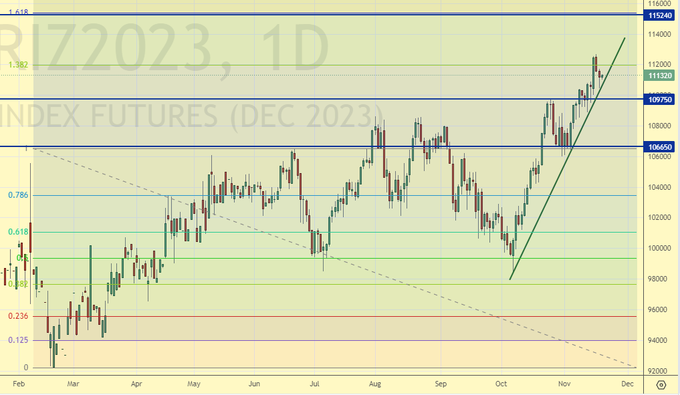

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. At current levels, purchases are not interesting. Off the market.

Fall scenario: shorts from 115,000 look good. Russian securities in rubles have been growing for more than a year, compensating for the collapse of the Russian currency. At the same time, who said that the dollar valuation of Russian enterprises should not fall during the period of sanctions? You need to look soberly in the mirror. There is no need to pour water on it and distort the essence.

Recommendations for the RTS Index:

Purchase: no.

Sale: when approaching 115000. Stop: 117600. Goal: 50,000?!

Support – 109750. Resistance – 115240.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.