Price forecast from 2 to 6 December 2024

-

Energy market:

Adherents of the dollar, gold, real estate, bitcoin are over. All the assets have been driven high. Everyone who wanted to bank deposits has brought them. What are we supposed to do now? Enjoy life. Let’s play the stock market. Stocks are low now, though they may be even lower, but we can already think in their direction.

Here’s to deep sell-offs in the stock market, where we’ll buy them. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Based on rumors, OPEC+ will not increase production on December 5th. That’s right. Trump will increase it, and the cartel and others will have to reduce it. Otherwise, by the end of the 25th year, the surplus will be not 400 thousand but 1 million barrels per day. That’s a lot.

So far we are observing a balance. Traders (rather large funds) do not want to take risks and make bets, as the situation may change at any moment, which will force to cut losses, and there may be nobody in the stack, which will entail a significant slippage in the execution of stop orders. On the contrary, fans of option strategies can now witchcraft, as the market has been standing in the corridor for a long time and volatility is not high.

Grain market:

Russia and France have crushed wheat prices. Overseas, Trump is running around shouting about duties on everyone and everything, he is already threatening to impose 100% duties on the entire BRICS, and this does not add confidence in the future. Including American farmers, who will have difficulties in selling agricultural products on the foreign market, because those who will be imposed duties, will respond in the same coin. Therefore, wheat prices on the Chicago Board of Trade will tend to fall on terror of Trump. Most likely it will not be possible to make America great again, there are too many military and bureaucrats, and give to everyone, but it is possible to run and shout. So far it’s all fear-mongering. Politics in a word. The main thing is not to move from shouting to business. Otherwise, the flow of goods to the U.S. will decrease, and Mr. President will wake up, and he has inflation of 10% and the Fed Funds rate of 15%. And that’s it. And the stock market is on the floor and no economic miracle.

The ruble continues to weaken, which gives grain exporters a margin of safety to offer competitive prices on the foreign market. Both regular and new buyers are happy. Russia — an inflow of currency. Any kind of currency. Any currency. The main thing is “inflow”.

USD/RUB:

Another package of sanctions has clearly complicated the flow of hard currency into the country, which will also affect the exchange rate of the dollar, sorry, the yuan. And with the dollar, apparently, everything is over. There is no “GAZPROMBANK” for settlements now. Who to credit them inside the country?

So, we visited 110.00 after which we got a pullback on the background of administrative decisions. Levels 102.50 and 100.00 can be considered for building up positions on dollar (yuan). It is premature to speculate about the trend reversal downwards.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 1.5 thousand contracts. Buyers and sellers left the market in insignificant volumes. Bulls keep control.

Growth scenario: we consider December futures, expiration date December 31. We are not looking upwards yet.

Downside scenario: you can open selling. Especially for those who are very impressed with Trump and not impressed with OPEC+.

Recommendations for the Brent oil market:

Buy: no.

Sell: now (71.84). Stop: 73.55. Target: 66.44!

Support — 71.57. Resistance — 73.35.

WTI. CME Group

US fundamental data: the number of active drilling rigs fell by 2 units to 477.

US commercial oil inventories fell by -1.844 to 428.448 million barrels, with -1.3 million barrels forecast. Gasoline inventories rose by 3.314 to 212.241 million barrels. Distillate stocks rose 0.416 to 114.717 million barrels. Cushing storage stocks fell by -0.909 to 24.142 million barrels.

Oil production increased by 0.292 to 13.493 million barrels per day. Oil imports fell by -1.601 to 6.083 million barrels per day. Oil exports rose by 0.285 to 4.663 million barrels per day. Thus, net oil imports fell by -1.886 to 1.42 million barrels per day. Oil refining rose by 0.3 to 90.5 percent.

Gasoline demand increased by 0.087 mb/d to 8.506 mb/d. Gasoline production increased by 0.457 to 9.744 million barrels per day. Gasoline imports rose 0.262 to 0.636 million barrels per day. Gasoline exports increased by 0.247 to 1.063 million barrels per day.

Distillate demand fell by -0.057 to 3.718 million barrels. Distillate production rose by 0.259 to 5.096 million barrels. Distillate imports rose 0.021 to 0.144 million barrels. Distillate exports increased by 0.262 to 1.463 million barrels per day.

Demand for petroleum products increased by 0.7 to 20.471 million barrels. Petroleum products production fell -0.089 to 21.806206 million barrels. Petroleum product imports rose 0.276 to 1.74 million barrels. Exports of refined products rose 0.08 to 6.657 million barrels per day.

Propane demand increased by 0.945 to 1.685 million barrels. Propane production increased by 0.055 to 2.757 million barrels. Propane imports rose 0.029 to 0.153 million barrels. Propane exports fell -0.811 to 1.369 million barrels per day.

Growth scenario: we consider January futures, expiration date December 20. Buyers have nothing to offer us. Jews and Arabs have made peace, and China is shaken by Trump. The horror is about to come to world trade (maybe).

Downside scenario: you can sell, but the deal will not bring a big profit. Or you can look for opportunities in other markets.

Recommendations for WTI crude oil:

Buy: no.

Sell: Now (68.00). Stop: 71.00. Target: 60.00?

Support — 66.29. Resistance — 72.43.

Gas-Oil. ICE

Growth scenario: we consider December futures, expiration date December 12. We hold the previously opened long. We note that there is no clear outperformance on either side.

Downside scenario: it makes sense to work out the probability of a fall when approaching 710.0.

Gasoil Recommendations:

Buy: no. Who is in position from 645.00, keep stop at 664.00. Target: 910.00 (revised).

Sell: when approaching 710.0. Stop: 720.0. Target: 600.0.

Support — 652.50. Resistance — 705.25.

Natural Gas. CME Group

Growth scenario: we switched to January futures, expiration date is December 27. Bulls are still holding the market. There are fears about gas shortage in Europe, it should help quotations.

Downside scenario: out of the market.

Natural Gas Recommendations:

Buy: No. Those in position from 3.287, move your stop to 3.140. Target: 5.000.

Sale: no.

Support — 3.170. Resistance — 3.642.

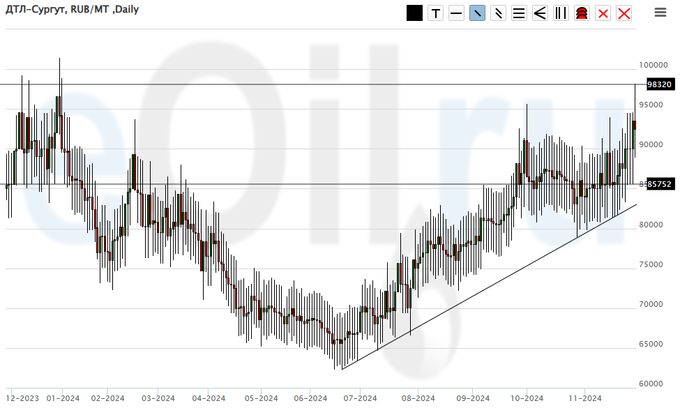

Diesel arctic fuel, ETP eOil.ru

Growth scenario: keep longing. In case of growth above 100000 we will pull up stop orders. We will not fix profit at 100000, as it was supposed to do earlier.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Who is in position from 65000, move stop to 82000. Target: 120000 (revised).

Sale: no.

Support — 85752. Resistance — 98320.

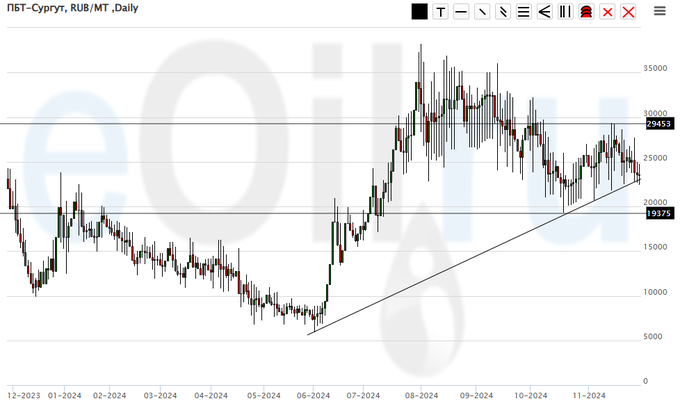

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will keep longs from 23800 and from 20000. There is a danger of market falling. Let’s set stop orders.

Downside scenario: we will not sell, while we should note the market’s ability to go below 20000.

PBT Market Recommendations:

Buy: No. Who is in position from 20000 and 23800, move the stop to 19800. Target: 40000.

Sale: no.

Support — 19375. Resistance — 29453.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation around 1000. We are unlikely to fall below 900, but to confirm the growth it is better to wait for a move above 1100.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 931. Resistance is 1076.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we moved to the March contract, expiration date March 14. We have 527.0 at the bottom, and only 435.0 and 375.0 beyond that. If we really fall that low, farmers will go to work in the mine. There will be nothing to do in the fields at these prices.

Downside scenario: shorts? Seriously? The market looks weak. This idea is better to work on hourly intervals.

Recommendations for the wheat market:

Buy: no.

Sale: no.

Support — 527.0. Resistance — 579.0.

Corn No. 2 Yellow. CME Group

Growth scenario: we switched to March contract, expiration date is March 14. The bulls are somehow clinging to the situation, but deep failures lately make us give up buying for now.

Downside scenario: we will keep shorting. Corn will not hold at current levels if wheat “suddenly” falls. And it is frankly weak, and everything is ready for a strong move down.

Recommendations for the corn market:

Buy: no.

Sell: no. Who is in the position from 435.2 (taking into account the transition to a new contract), move the stop to 441. Target: 351.0.

Support — 425.4. Resistance — 442.2.

Soybeans No. 1. CME Group

Growth scenario: we consider January futures, expiration date January 14. Nothing new. Don’t think about buying while we are below 1025.0.

Downside scenario: we will continue to keep open shorts. Soybeans are plentiful. The market is on the verge of a strong fall.

Recommendations for the soybean market:

Buy: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: no. Those who are in position from 1049.0, move the stop to 1041.0. Target: 835.0.

Support — 971.4. Resistance — 1013.2.

Growth scenario: we consider December futures, expiration date December 27. Nothing new. It makes sense to continue holding longs, as politicians and the military do not calm down. Whether the Jews have reconciled with the Arabs or not. Doesn’t matter. The stakes are much higher now.

Downside scenario: out of the market for now. We can only dream of peace.

Gold Market Recommendations:

Buy: no. Who is in position from 2550, keep stop at 2590. Target: 2838 (3100).

Sale: no.

Support — 2604. Resistance — 2723.

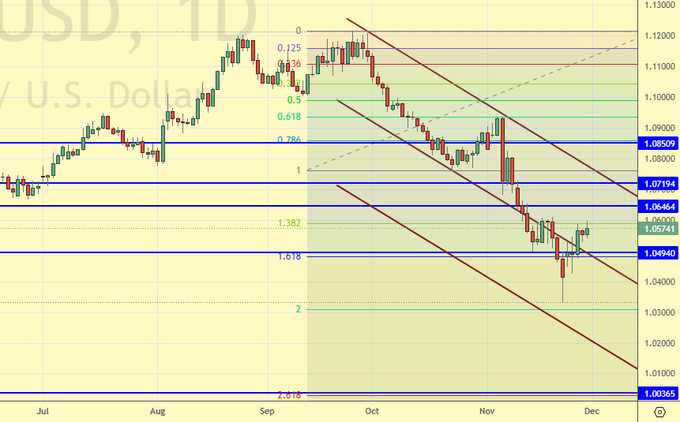

EUR/USD

Growth scenario: Eurozone inflation is 2.3%, which raises the question of further ECB rate cuts. We may not see parity. Let’s be patient. Out of the market for now.

Downside scenario: There are a number of questions about what is happening before our eyes. We need clarity on the situation. Outside the market.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.0494. Resistance — 1.0646.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. Let’s take a piece of growth by moving the stop order close. We can correct to 104500, deeper pullbacks to 102500 and 100000 are possible.

Downside scenario: we give up on shorts.

Recommendations on dollar/ruble pair:

Buy: No. Those in position from 96234, move your stop to 106200. Target: 150000, 200000?! (these are the benchmarks for now).

Sale: no.

Support — 104396. Resistance — 108866.

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. We continue to refuse to buy. Recovery to 80000 is possible, but the market is unlikely to go higher.

Downside scenario: like a week ago, we believe that the market is able to continue falling. If it happens from 80000 we will be glad, if from 85000, it is also acceptable level.

Recommendations on the RTS index:

Buy: no.

Sell: on a pullback up to 80000. Stop: 82000. Target: 60000. Or on a pullback to 85000. Stop: 87000. Target: 60000.

Support — 70260. Resistance — 79520.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.