Price forecast from 19 to 23 of December 2022

-

Energy market:

Europe is going to be environmentally neutral by 2050. Zero emissions. It’s fantastic. This can only happen when there are no factories left and this entire appendix from Eurasia will turn into one big office, bank, parking lot and restaurant.

All strong immunity, hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

OPEC predicts a 10% drop in oil production in Russia in 2023 due to sanctions. However, Russia must continue to produce more than 10 million barrels of oil per day. So far, it seems that the Government and companies have decided not to reduce production and sell oil at a significant discount in order not to destroy the tuned technological process of production and transportation, counting on the normalization of the situation in the future.

The United States began to replenish its strategic reserve again. While purchase volumes are minimal, they will not exceed 3 million barrels in the next month, but it is possible that this process will gain momentum in the future and will be insignificant, but still bullish.

It is difficult for the oil market to grow now, as the increase in the US rate leads to an increase in demand for the dollar, which puts pressure on the commodity sector. In addition, the risk of a recession in 2023 is already estimated at 50%, which is a lot. Classically, high Fed rates should cool the economy. The stock market tells us that serious problems are possible in the real sector in half a year.

On the electronic trading platform eOil, quotes for diesel fuel claim to take the level of 85,000 and rise to the mark of 90,000 thousand rubles per ton. The move up may occur due to increased demand for diesel from Europe. A month and a half remains before the embargo is introduced, and during these weeks, purchases will be the maximum possible. After February 5, the growth of quotations for diesel on the domestic market should come to naught, as the supply will grow rapidly.

By reading our forecasts, you could make money on the Brent oil market by taking a move down from $90.00 to $77.30 per barrel. You could also make money on the gasoil market by taking a move up from 800.0 to 940.00 dollars per ton. In addition, you could make money in the wheat market by taking a move down from 840.0 to 762.0 cents per bushel.

And finally, Moldova announced that it had achieved independence from Russian gas.

Grain market:

At the moment, the grain market is in equilibrium. During the grain deal, 14 million tons of grain were exported from Ukraine. This volume played a significant role in the fall in wheat prices in Europe, and then in the world, mainly due to the fact that there was no reason for panic. Note that any deficit would have been covered even without these volumes, however, negative emotions would have prevailed in the market, which would have pushed prices on the stock exchanges up.

The governors of the Krasnodar Territory, the Stavropol Territory and the Rostov Region appealed to the president to limit the participation of foreign companies in grain exports. Governors are pointing out that profits end up abroad, while it is necessary to create and maintain their own structures.

At the moment, there are no grounds for increasing grain prices on the domestic market, as we have a significant surplus at the end of the year, while the mechanism of export duties will most likely continue to work. This is not only about replenishing the budget, but also about ensuring that there are sufficiently high carry-over stocks within the country during a period of instability.

USD/RUB:

The US Federal Reserve raised the rate by 0.5% to 4.5%, which makes US bonds a very attractive savings instrument. Despite the fact that inflation in the US is still at the level of 7.7% per annum, now it is better to go into bonds than to hope for the growth of the stock market. The current situation will support the demand for the dollar.

The Central Bank of Russia left the rate unchanged at 7.5%. If budget expenditures continue to grow, then it is unlikely that we should expect inflation to fall below 10% in 2023, as well as a rate cut by the Central Bank in the future.

The impact on the Russian economy of sanctions, including the imposition of an embargo on the supply of petroleum products to Europe, will be moderate, provided that the growth of confrontation with the West can be avoided. If the degree of rejection of each other continues to grow, then it is likely that by August 2023, problems will be exposed in the form of an overgrown budget deficit that will have to be addressed. First of all, due to the exchange rate of the ruble.

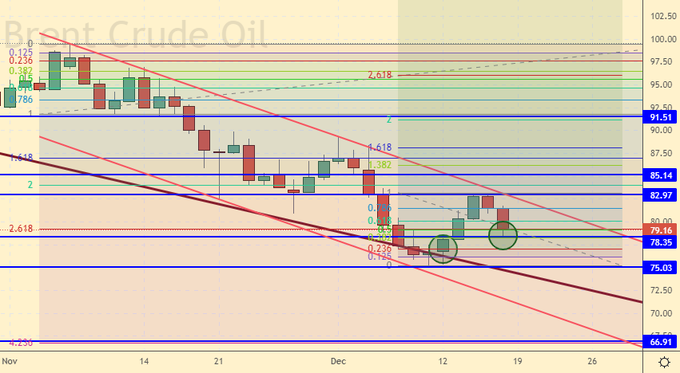

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers has decreased by 5.7 thousand contracts. Sellers entered the market more actively than buyers. The spread between long and short positions narrowed slightly, the bulls continue to control the situation.

Growth scenario: consider the December futures, the expiration date is December 30th. From current levels, you can buy, provided that the stop order is close. The chances of a move above 90.00 are not great, but they are there.

Fall scenario: the bulls failed to approach 85.00, which tells us about the strong mood of the sellers. If we fall below 75.00, we will quickly go to the level of 67.00 dollars per barrel.

Recommendations for the Brent oil market:

Purchase: now. Stop: 78.20. Target: 95.00. Or when touching 67.00. Stop: 63.20. Target: 95.00.

Sale: in case of growth to 85.00. Stop: 87.00. Target: 67.00. Think after falling below 75.00.

Support — 78.35. Resistance is 82.97.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 5 units and now stands at 620 units.

Commercial oil reserves in the US increased by 10.231 to 424.129 million barrels, while the forecast was -3.595 million barrels. Inventories of gasoline rose by 4.496 to 223.583 million barrels. Distillate inventories rose by 1.364 to 120.171 million barrels. Inventories at Cushing rose 0.426 to 24.368 million barrels.

Oil production fell by -0.1 to 12.1 million barrels per day. Oil imports rose by 0.855 to 6.867 million barrels per day. Oil exports rose by 0.886 to 4.316 million barrels per day. Thus, net oil imports fell by -0.031 to 2.551 million barrels per day. Oil refining fell by -3.3 to 92.2 percent.

Gasoline demand fell by -0.103 to 8.255 million barrels per day. Gasoline production increased by 0.129 to 9.194 million barrels per day. Gasoline imports rose by 0.271 to 0.79 million barrels per day. Gasoline exports rose by 0.191 to 1.203 million barrels per day.

Demand for distillates rose by 0.218 to 3.768 million barrels. Distillate production fell -0.164 to 5.168 million barrels. Distillate imports fell -0.095 to 0.277 million barrels. Exports of distillates rose by 0.209 to 1.483 million barrels per day.

Demand for petroleum products increased by 0.33 to 19.956 million barrels. Production of petroleum products increased by 0.257 to 22.044 million barrels. Imports of petroleum products fell by -0.086 to 2.233 million barrels. The export of oil products increased by 0.213 to 6.508 million barrels per day.

Propane demand fell by -0.176 to 1.117 million barrels. Propane production increased by 0.025 to 2.581 million barrels. Propane imports fell by -0.02 to 0.124 million barrels. Propane exports fell by -0.05 to 1.494 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 0.4 thousand contracts. The change is minor. The spread between long and short positions has increased, the bulls continue to control the situation.

Growth scenario: we consider the February futures, the expiration date is January 20. Long entry from 65.00 is possible. Current levels are also of interest in case of tight risk control.

Fall scenario: sellers keep the situation under control. Keep open shorts. When approaching 83.00, you can sell or increase positions. The target may be extremely low, for example at the level of $40.00 per barrel.

Recommendations for WTI oil:

Purchase: now. Stop: 73.40, Target: 90.00. Also, when approaching 66.00. Stop: 64.00. Target: 90.00.

Sale: when approaching 83.00. Stop: 83.80. Target: 67.00 (40.00). Who is in position from 86.80, move the stop to 83.80. Target: 67.00 (40.00) dollars per barrel.

Support — 70.29. Resistance — 77.74.

Gas-Oil. ICE

Growth scenario: consider the January futures, the expiration date is January 12. Purchases from 800.0 brought us a profit of 940.0. Now we will buy only when the market falls to 750.0.

Fall scenario: while we insist on sales. We enter short from the current levels.

Gasoil recommendations:

Purchase: when approaching 750.0. Stop: 720.0. Target: 1200.0.

Sale: now. Stop: 926.0. Target: 750.0.

Support — 866.75. Resistance is 967.00.

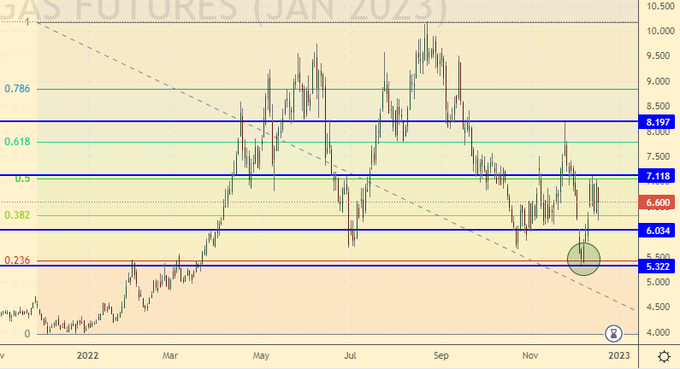

Natural Gas. CME Group

Growth scenario: consider the January futures, the expiration date is December 28. You don’t have to think of anything. We continue to hold longs. A fall in gas prices is possible, but most likely closer to spring.

Fall scenario: here you could think of selling if we were taller. It makes no sense to sell from current levels.

Recommendations for natural gas:

Purchase: now. Stop: 5.600. Target: 15.000. Those who are in position from 5.500 move the stop to 5.600. Target: 15.000 per 1 million BTUs.

Sale: no.

Support — 6.034. Resistance — 7.118.

Summer diesel (Surgut), ETP eOil

Growth scenario: the market grows on the background of increased demand for diesel from the EU. Most likely, before the introduction of the embargo on the supply of petroleum products on February 5, Europeans will continue to buy Russian diesel in December and January in increased volumes, which will keep prices at a high level within the country. A short-term move to the level of 90,000 rubles per ton cannot be ruled out.

Fall scenario: It makes sense to look for options to sell. The rise in prices should stop along with the introduction of an embargo on petroleum products by the EU, as there will be a surplus in the domestic market.

Diesel market recommendations:

Purchase: no.

Sale: now. Stop: 85600. Target: 60000. Or when approaching 90000. Stop: 93000. Target: 70000 rubles per ton.

Support — 74922. Resistance — 83984.

Propane butane (Surgut), ETP eOil

Growth scenario: we consider the March futures, the expiration date is February 28. Prices are at their lowest levels for this year. Purchases from current levels are possible.

Fall scenario: the market is oversold. Further downward movement looks unlikely. Sales are not recommended.

Recommendations for the PBT market:

Purchase: now. Stop: 2900. Target: 8000 rubles per ton.

Sale: no.

Support — 3213. Resistance — 8818.

Helium (Orenburg), ETP eOil

Growth scenario: After a summer rise, the market returned to its usual price levels. Current prices give buyers a chance to earn in the future. Can buy.

Fall scenario: do not sell. In the current situation, the market is unlikely to be able to go below 1830.

Recommendations for the helium market:

Purchase: now. Stop: 1820. Target: 2700 rubles per cubic meter.

Sale: no.

Support — 1832. Resistance — 2406.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers remained the same, while both buyers and sellers entered the market in insignificant volumes. The spread between short and long positions remained the same, sellers retain the advantage.

Growth scenario: we consider the March futures, the expiration date is March 14. Buys from current levels are somewhat provocative, but they can be recommended. We are able to rise to 840.0, but it is unlikely that we will be able to go even higher.

Fall scenario: you need to sell again. While we have time to cool down a little after the turbulent events of this year.

Recommendations for the wheat market:

Purchase: now. Stop: 730.0. Target: 800.0. Or when approaching 650.0. Stop: 620.0. Target: 800.0.

Sale: now. Stop: 772.0. Target: 650.0. Also when approaching 840.0. Stop: 870.0. Target: 650.0 cents per bushel.

Support — 722.6. Resistance — 768.6.

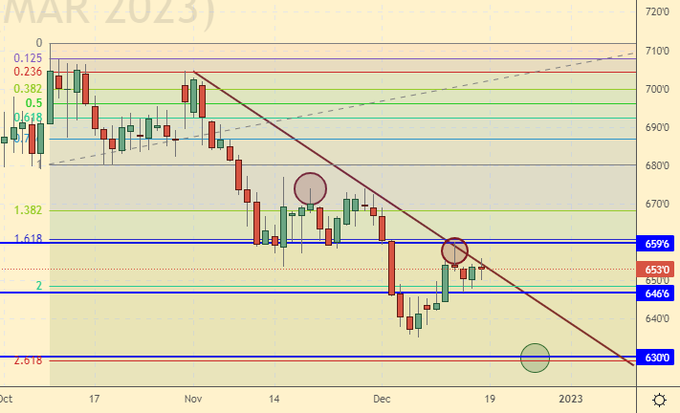

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 8.4 thousand contracts. The sellers left the market, while the bulls remained indifferent to what was happening. The spread between longs and shorts has widened and the bulls’ lead has increased.

Growth scenario: we consider the March futures, the expiration date is March 14. We continue to believe that modest purchases from 630.0 are possible, however, at the same time, we must understand that a failure to 580.0 is also possible.

Fall scenario: here you can sell, and aggressively. There are big doubts that we will be able to take the resistance line around 660.0 cents per bushel and go up.

Recommendations for the corn market:

Purchase: when approaching 630.0. Stop: 617.0 Target: 675.0.

Sale: now. Stop: 678.0. Target: 500.0. Who is in position from 670.0, move the stop to 678.0. Target: 500.0 cents per bushel.

Support — 646.6. Resistance — 659.6.

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, the expiration date is January 13th. We will continue to hold longs from 1425.0.

Fall scenario: the ability to pass above 1500.0 here can be called into question. Let’s go short from current levels.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1425.0, move the stop to 1438.0. Target: 1600.0.

Sale: now. Stop: 1497.0. Target: 1000.0.

Support — 1424.2. Resistance — 1493.2.

Gold. CME Group

Growth scenario: we do not perceive the current hitch as a reason to close longs. We remain shopping. The market could potentially rise well above 1890.

Fall scenario: The current candle configuration gives a small chance of a fall. Can be sold.

Recommendations for the gold market:

Purchase: no. For those in positions between 1675 and 1780, keep your stop at 1759. Target: $2,350 a troy ounce.

Sale: now. Stop: 1820. Target: 1480.

Support — 1766. Resistance — 1825.

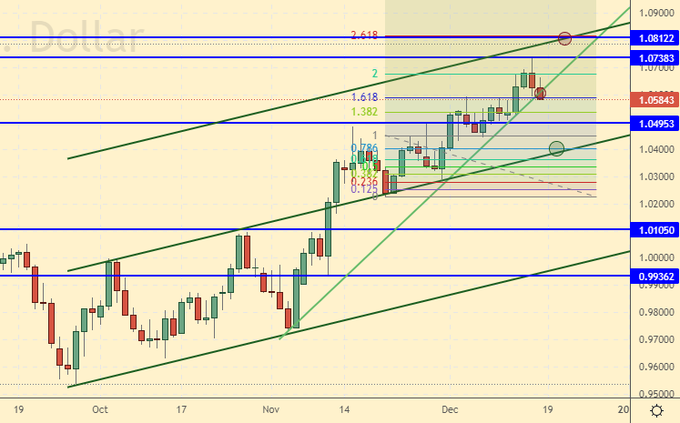

EUR/USD

Growth scenario: we continue to believe in the possibility of hitting 1.0800. Above this level, the market is not visible. Purchases are possible only when approaching 1.0400.

Fall scenario: we will sell when we approach 1.0800. Shorting from current levels is not optimal, but possible.

Recommendations for the EUR/USD pair:

Purchase: when approaching 1.0400. Stop: 1.0370. Target: 1.0800.

Sale: now. Stop: 1.0670. Target: 0.8700. When approaching 1.0800. Stop: 1.0870. Target: 0.8700?!!!

Support — 1.0495. Resistance is 1.0738.

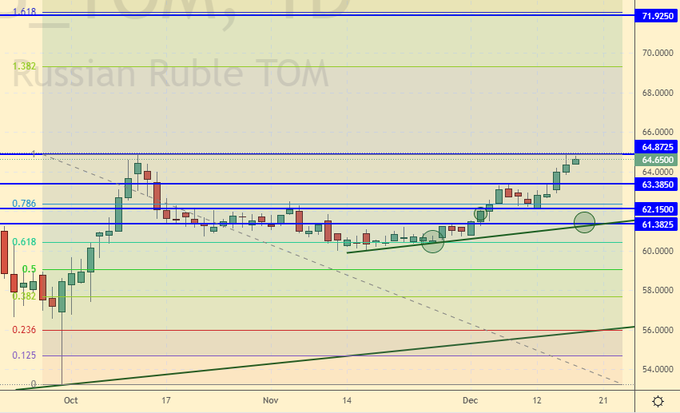

USD/RUB

Growth scenario: bulls keep the market under control. There is not a single red candle for the week. We have the right to expect a passage above 65.00 and the development of events up to the level of 72.00.

Fall scenario: it is difficult to wait for the strengthening of the national currency with an outflow of capital of 250 billion dollars a year. Moreover, this historical fact does not bother Nabiullina. All that the ruble is capable of at the moment is a rollback to the level of 61.50.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 61.50. Stop: 60.40. Target: 72.00. Those in positions between 60.00 and 61.60 keep the stop at 60.40. Target: 72.00 rubles per dollar.

Sale: now. Stop: 64.97. Target: 61.50.

Support — 63.38. Resistance — 64.87.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. Since the West is not going to abandon its policy of cutting economic ties with Russia, it is difficult to count on the emergence of good prospects for large Russian companies. Even Potanin was sanctioned. Under the current conditions, we are not buying anything.

Fall scenario: we will most likely touch the 101000 level next week. There will be a small struggle, after which the fall will continue. Keep shorts.

Recommendations for the RTS index:

Purchase: think when approaching 101000.

Sale: when approaching 107000. Stop: 109300. Target: 80000 (50000). Who is in position from 106000, keep the stop at 109300. Target: 80000 (50000) points.

Support — 100840. Resistance — 104900.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.