19 August 2024, 11:11

Price forecast from 19 to 23 August 2024

-

Energy market:

Prices in Moscow restaurants are going up. Ladies are in shock. We have to start cooking at home. The cost of villas in the Italian region of Liguria continues to rise, it is simply the collapse of all “dreams”. Now for less than 100 euros and tea and cakes can not drink in France. How is that possible?! We continue to be in white in the midst of all this evil. Inflation just doesn’t stick to us, we don’t see it. Why? Because we think day and night about one thing: what the Fed will tell us after the next meeting, we meditate on Powell.

No. We’re not in white, we’re in gold. Gold looks like it’s going to climb Everest. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

A ball of nerves has spun around 80.00 on Brent. Despite the fact that finally, after six weeks, oil reserves in the U.S. rose for the week, this does not bring us any closer to the fact that oil will cost 55, as dreamed by those who wish Russia “all the best”. As long as we have OPEC, we should not be afraid of any horrors. Yes, it is possible that China is already in ruins, it’s just that Beijing hasn’t admitted it yet, but in the USA there are no significant problems yet. Even the stock market there has fully recovered after the failure in early August. Retail sales grew stronger than expected in July, and the labor market remains strong. So what? It means China will stay afloat.

Analysts note that at current price levels, the oil market will see a significant increase in investments in offshore production. Investments in the development of subsoil under water may grow to 50 billion dollars a year by the 30th year from the current 30 billion dollars, which means an annual 8-10% increase in the market. This is not only a question of commercialization, but for a number of countries it is a question of economic security, in case the slurry is not delivered tomorrow, and one has to pay for security.

Grain market:

USDA’s gross harvest forecast is out. The changes are not significant. It should be noted that the gross harvest of soybeans increased by 1.63% to 428.7 million tons, which should put pressure on corn as a feed component, which will be harvested 1219.8 million tons (-0.41% to the July forecast). Wheat showed a rise to 798.2 million tons (+0.26%). And this amidst Jaroslavna’s (analysts) cries that things could be worse than expected. Yes. Europe is down to 128 million tons from 130 million tons compared to the last forecast, but that’s not terrible. It’s just slightly sub-optimal weather conditions. Wheat will tend to show a low around Sept. 10, as it should by seasonal cyclicality.

In connection with the current events already inside Russia, and a little outside it, it is worth noting that, yes, there will be some losses in the gross harvest of agricultural crops this year and already next year because of the fighting in the Kursk and Belgorod regions. If this year’s crops could be brought out before the invasion, who will plow over mines and under mines and sow winter crops in a couple of months is a very big question. But, in any case, the damage should hardly be estimated at more than 1% of the total grain harvest in Russia. The topic is unpleasant, but it is necessary to voice it. Any speculation about the threat to the food market in the current state of affairs is simply dismissed.

USD/RUB:

And Zabotkin, that’s the deputy chairman of the Central Bank, said (threatened) that the rate will be 20% if you don’t stop buying butter, which is getting more expensive all the time. Stop eating butter, and producers will lower prices. It makes sense. But, no, people go to the store and keep eating it. No kidding, we’ll see a price increase in the fall in the chains. Already the clan of manufacturers (they are green alien lizards strangling humanity), wrote a letter that all selling prices will raise “at any rate” from 5 to 40%. Thank you for not 50%. And nothing, we will take for free, as in America, up to 1000 dollars is not theft.

Yes, we will say a word about the dollar against the ruble: the vision is that we will stand around 90.00. Most likely, the pair will gravitate to growth in the long term. At the same time, we do not deny short-term downward breakdowns on the supply-demand imbalance.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 46.4 thousand contracts. The change is significant. Buyers entered the market. Sellers reduced positions significantly. Buyers increased their control over the market.

Growth scenario: we consider the August futures, expiration date August 30. Nothing new. We refrain from buying for now.

Downside scenario: the situation is confusing. Off-market.

Recommendations for the Brent oil market:

Purchase: no.

Sale: no.

Support — 78.63. Resistance — 82.43.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 2 units to 483.

U.S. commercial oil inventories rose by 1.357 to 430.678 million barrels, against a forecast of -1.9 million barrels. Gasoline inventories fell -2.894 to 222.203 million barrels. Distillate stocks fell -1.673 to 126.123 million barrels. Cushing storage stocks fell by -1.665 to 28.764 million barrels.

Oil production fell by -0.1 to 13.3 million barrels per day. Oil imports rose by 0.061 to 6.285 million barrels per day. Oil exports rose by 0.118 to 3.756 million barrels per day. Thus, net oil imports fell by -0.057 to 2.529 million barrels per day. Oil refining rose by 1 to 91.5 percent.

Gasoline demand rose by 0.078 to 9.045 million barrels per day. Gasoline production fell -0.318 to 9.722 million barrels per day. Gasoline imports fell -0.052 to 0.578 million barrels per day. Gasoline exports fell -0.026 to 0.873 million barrels per day.

Distillate demand rose 0.08 to 3.549 million barrels. Distillate production fell -0.267 to 4.769 million barrels. Distillate imports fell -0.034 to 0.081 million barrels. Distillate exports fell -0.006 to 1.54 million barrels per day.

Demand for refined products increased by 0.549 million barrels to 20.523 million barrels. Petroleum products production rose by 0.458 to 22.482 million barrels. Petroleum product imports fell -0.764 to 1.34 million barrels. Exports of refined products rose by 0.006 to 6.799 million barrels per day.

Propane demand fell -0.165 to 0.867 million barrels. Propane production fell -0.026 to 2.623 million barrels. Propane imports fell -0.034 to 0.071 million barrels. Propane exports fell -0.131 to 1.517 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 19.1 th. contracts. There were no buyers. Sellers have fled. The bulls are maintaining control.

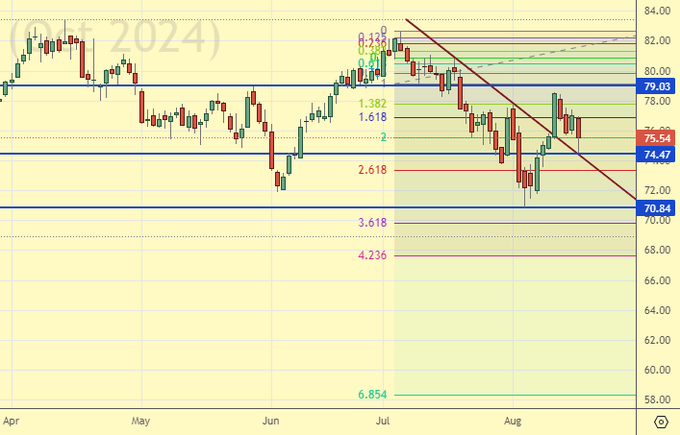

Growth scenario: we consider October futures, expiration date September 20. We refrain from buying for now.

Downside scenario: out of the market. Bulls have slightly better odds, but there could be surprises.

Recommendations for WTI crude oil:

Purchase: no.

Sale: no.

Support — 74.47. Resistance — 79.03.

Gas-Oil. ICE

Growth scenario: we consider September futures, expiration date September 12. We remain out of the market for now.

Downside scenario: keep shorting. A move below 700.0 cannot be ruled out.

Gasoil Recommendations:

Purchase: no.

Sell: No. Who is in position from 807.50, keep stop at 752.00. Target: 660.00 (revised).

Support — 695.25. Resistance — 744.50.

Natural Gas. CME Group

Growth scenario: we consider October futures, expiration date September 26. We continue to refuse to buy.

Downside scenario: when approaching 2,800, we can go short. But, remember that we have winter ahead of us. It is unlikely that when approaching winter, something will fall. So there is not much time for shorting.

Natural Gas Recommendations:

Purchase: no.

Sell: when approaching 2.800. Stop: 3.050. Target: 1.555.

Support — 1.987. Resistance — 2.431.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Purchase: No. Those in position from 65000, move your stop to 67000. Target: 100000!

Sale: no.

Support — 70635. Resistance — 93838.

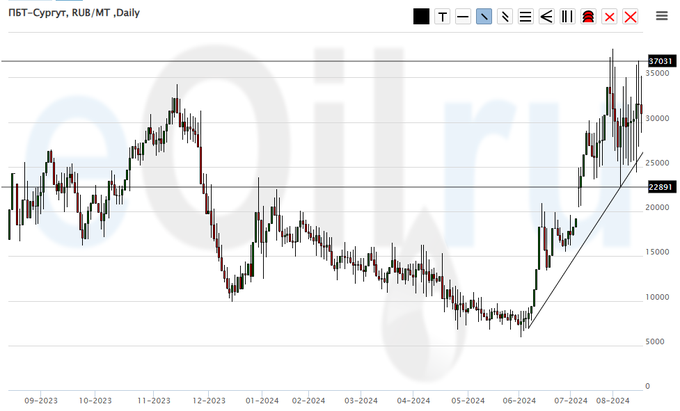

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Purchase: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 22891. Resistance — 37031.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: no.

Sale: no.

Support — 1018. Resistance — 1525.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 0.2 th. contracts. Buyers and sellers entered the market in meager volumes. Bears keep control.

Growth scenario: moved to December futures, expiration date December 13. Until September 10, sellers will press. Don’t buy.

Downside scenario: we remain in sales. Taking into account smooth change of quotations, we can assume a sharp reset.

Recommendations for the wheat market:

Purchase: when approaching 400.0. Stop: 385.0. Target: 650.0!

Sell: no. Who is in the position from 553.0 (taking into account the transition to the new futures), move the stop to 577.0. Target: 404.0.

Support — 496.4. Resistance — 575.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 4.2 th. contracts. Buyers and sellers entered the market. Sellers did it more actively. Bears increased their control.

Growth scenario: we switched to December futures, expiration date December 13. Most likely, we will fall further. We need lower marks to buy.

Downside scenario: we will keep shorting. The sellers’ position looks strong.

Recommendations for the corn market:

Purchase: when approaching 310.0. Stop: 290.0. Target: 410.0.

Sell: no. Who is in the position from 390.0 (taking into account the transition to the new futures), move the stop to 395.0. Target: 310.0.

Support — 308.6. Resistance — 385.0.

Soybeans No. 1. CME Group

Growth scenario: switched to November futures, expiration date November 14. We are waiting for low prices. The market is able to go deeper on the background of the new harvest.

Downside scenario: we will keep shorting.

Recommendations for the soybean market:

Purchase: at touching 880.0. Stop: 850.0. Target: 1090.0.

Sell: no. Who is in the position from 1060.0 (taking into account the transition to a new contract), move the stop to 1044.0. Target: 820.0!

Support — 957.0. Resistance — 1030.6.

Growth scenario: we consider the December futures, expiration date December 27. We see a new high. Why is that? We have to buy at some point. But not this week. Buying on “hourly” intervals is possible.

Downside scenario: nothing good came out of our attempts to sell. We take a break for a week.

Gold Market Recommendations:

Purchase: no.

Sale: no.

Support — 2468. Resistance — 2567.

EUR/USD

Growth scenario: we will continue to stand in longs in the expectation that the market will spin up to 1.2000.

Downside scenario: bulls consolidated their positions over the week. Don’t sell.

Recommendations on euro/dollar pair:

Purchase: no. Who is in position from 1.0908, move the stop to 1.0840. Target: 1.2000.

Sale: no.

Support — 1.0942. Resistance — 1.1138.

USD/RUB

Growth scenario: we consider September futures, expiration date September 19. The market is able to go higher. Hold long.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Purchase: No. Who is in position from 85976, keep stop at 84900. Target: 100000.

Sale: no.

Support — 87331. Resistance — 89869.

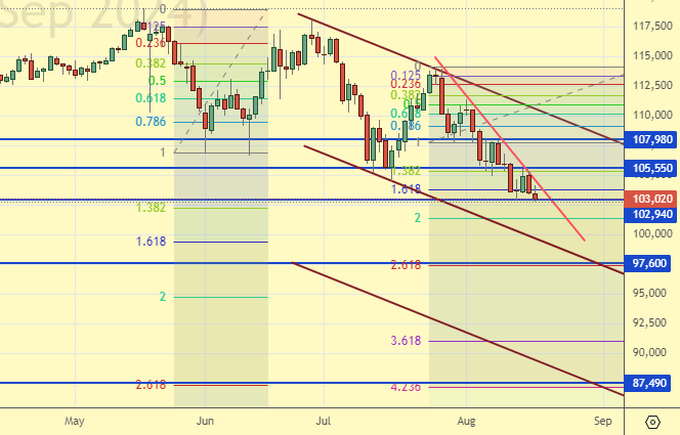

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: we will keep shorting. The external and internal background disposes to sales.

Recommendations on the RTS index:

Purchase: no.

Sell: no. Who is in the position from 115200, move the stop to 108600. Target: 87600 (revised).

Support — 97600. Resistance — 105550.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.