18 September 2023, 12:52

Price forecast from 18 to 22 of September 2023

-

Energy market:

Tolerant people, those who live in the West, according to climatologists, will have to rebuild their lives according to the Siberian version this year and beyond, and beyond, and beyond. That is, with central heating, with felt boots and fur coats, everything is as it should be, with an even greater waste of resources on heating. And all why, but because the Gulf Stream is cooling and moving further from the border with Europe.

It’s okay, Australian rabbits will go for fur. Their skins will be sent as help to those in need of a warm from the countries of the British Commonwealth. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

OPEC, against the backdrop of the artificially created deficit, has tightly clung to the market. Out of despair, prices continue to rise, as traders understand that every day they have to withdraw 2 million barrels from storage to cover the current deficit.

The situation is very much reminiscent of blackmail, let’s not be shy, that’s what it is. It wouldn’t be surprising if Americans took a can opener and started opening a can with the word «Venezuela» written on it. They have already begun to twirl small holes there, but have not yet moved on to full-scale development. Few people have seen 10 tons of dollars in 100 dollar bills, but when they show this to Maduro, he will forget about everything and there is no country, and OPEC will go quietly smoke, away from their barrels. We are looking forward to preparations for free elections in Saudi Arabia in 2024.

Reading our forecasts, you could take a step up in the helium market from 2900 to 3900 rubles per cubic meter.

Grain market:

Russia has made it impossible for Ukraine to export grain through the Black Sea ports. And last week it became known that deliveries would not be possible through Poland, Hungary and Romania. If the situation is not resolved in the next few weeks, then it can be stated that a large volume, several tens of millions of tons, will be blocked. All the grain will not fit into the elevators, which will mean gradual spoilage of food. At the same time, Ukrainian grain will “hang” over the market, since if the situation is resolved, all of it will quickly be exported, which will negatively affect prices.

Expensive rice in Asia will support the grain market. It’s good that there is a lot of wheat and you can solve the food problem without any problems. It’s scary to imagine how hungry Indians run in all directions in search of calories. India’s weak economy is one of the reasons why the West does not block Russian oil supplies. White people don’t want problems in the former colony. And without this, the UK has a Hindu prime minister, and if the flow of energy resources is blocked, London will become de facto Delhi.

USD/RUB:

The Fed will hold a rate meeting next week on Wednesday. Judging by what the ECB did, and it raised the rate on Thursday, the Americans will also raise it in order to contain inflation, which has begun to accelerate again. Over many, many years, practically since the 80s, American bonds will become very popular among investors, which can accelerate the dollar index to obscene heights.

The Bank of Russia on Friday raised the rate by 1% to 13%, but this had no effect on the rate, which remains around 95 rubles per dollar. The national currency does not want to strengthen. It is possible that, taking advantage of the situation, commercial banks are imposing game conditions on the Government under which they are ready to buy government debt at significantly higher rates than those offered by the Central Bank. The current rate increase may not be a fight against inflation, but an increase in the attractiveness of loans within the country. Greed has no limits. Therefore, it’s hard to believe in songs and fairy tales that now we won’t raise rates for a long time. While maintaining budget spending on defense at the level of 10 trillion. the debt will have to increase every year, there is only one “but”: you need someone else to lend you a loan. Apart from internal borrowing, Russia currently has no other sources of financing. This must be understood.

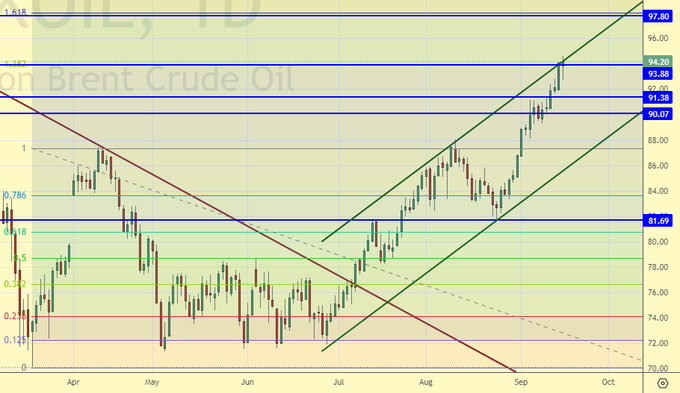

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 22.8 thousand contracts. Buyers keep coming. There are no sellers. The spread between long and short positions has widened and the bulls remain in control.

Growth scenario: we are considering September futures, expiration date is September 29. Recoilless growth does not allow you to enter a long position. Off the market.

Fall scenario: when approaching 98.00, we must sell. It will be possible to count on prices returning to the level of 88.00.

Recommendations for the Brent oil market:

Purchase:

Sale: when approaching 98.00. Stop: 100.30. Goal: 88.00.

Support – 91.38. Resistance – 97.80.

WTI. CME Group

US fundamentals: the number of active drilling rigs increased by 2 to 515.

Commercial oil reserves in the United States increased by 3.955 to 420.592 million barrels, with a forecast of -1.912 million barrels. Gasoline inventories increased by 5.561 to 220.307 million barrels. Distillate inventories increased by 3.931 to 122.533 million barrels. Inventories at the Cushing storage facility fell by -2.45 to 24.965 million barrels.

Oil production increased by 0.1 to 12.9 million barrels per day. Oil imports increased by 0.812 to 7.582 million barrels per day. Oil exports fell by -1.842 to 3.09 million barrels per day. Thus, net oil imports increased by 2.654 to 4.492 million barrels per day. Oil refining increased by 0.6 to 93.7 percent.

Gasoline demand fell by -1.014 to 8.307 million barrels per day. Gasoline production fell by -0.576 to 9.212 million barrels per day. Gasoline imports fell by -0.083 to 0.899 million barrels per day. Gasoline exports fell by -0.092 to 0.911 million barrels per day.

Demand for distillates fell by -0.288 to 3.578 million barrels. Distillate production fell by -0.006 to 5.011 million barrels. Imports of distillates increased by 0.055 to 0.185 million barrels. Exports of distillates fell by -0.066 to 0.125 million barrels per day.

Demand for petroleum products increased by 0.788 to 20.991 million barrels. Production of petroleum products increased by 1.817 to 23.705 million barrels. Imports of petroleum products fell by -0.161 to 1.901 million barrels. Exports of petroleum products fell by -0.532 to 5.962 million barrels per day.

Propane demand fell by -0.487 to 0.502 million barrels. Propane production fell by -0.106 to 2.557 million barrels. Propane imports fell -0.032 to 0.061 million barrels. Propane exports fell -0.102 to 0.058 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 31.1 thousand contracts. Buyers have reduced their activity, but many of them are still coming to the market. The bears continued to retreat. The advantage of bulls in the market is growing aggressively.

Growth scenario: we are considering November futures, expiration date October 20. If we consolidate above 90.00, we will go to 103.80. However, we will only buy on a pullback.

Fall scenario: we don’t sell. There are no signs of a downward reversal.

Recommendations for WTI oil:

Purchase: with a rollback to 83.00. Stop: 81.00 Target: 96.00 (105.00).

Sale: no.

Support – 86.78. Resistance – 103.81.

Gas-Oil. ICE

Growth scenario: we are considering the October futures, expiration date is October 12. The market continues to fly upward, not allowing entry at acceptable levels. Off the market.

Fall scenario: you can enter short from 1075.0. Entry into shorts from current levels can be practiced at hourly intervals.

Recommendations for Gasoil:

Purchase: no.

Sale: when approaching 1075.0. Stop: 1130.0. Goal: 930.0.

Support – 869.75. Resistance – 1075.00.

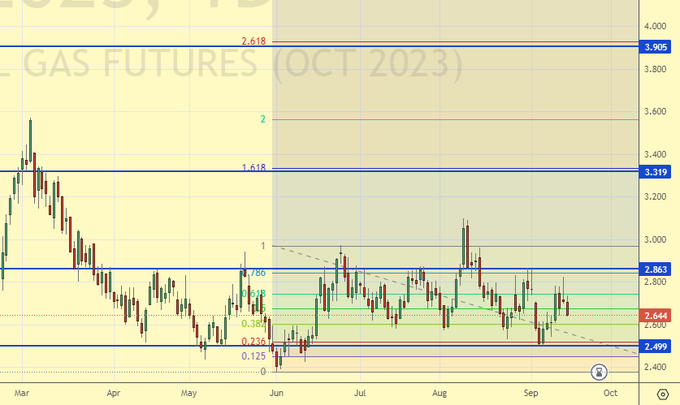

Natural Gas. CME Group

Growth scenario: we are considering October futures, expiration date is September 27. If there is a cold winter in Europe, and the prerequisites are there, then the gas will fly into space. We hold longs.

Fall scenario: do not sell, levels are too low.

Natural gas recommendations:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep stop at 2.320. Goal: 3.900.

Sale: no.

Support – 2.499. Resistance – 2.863.

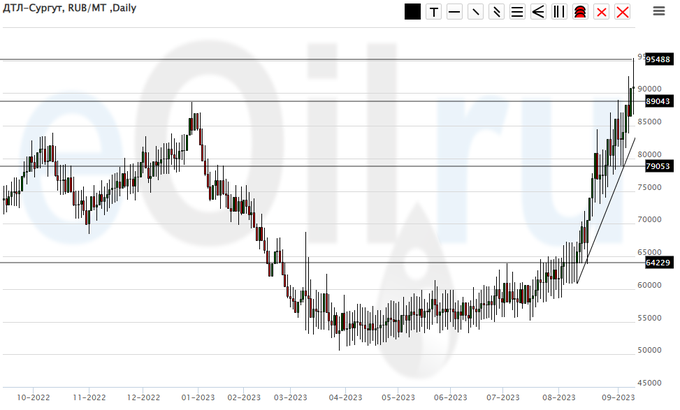

Diesel arctic fuel, ETP eOil.ru

Growth scenario: there is nowhere to buy here. We need a correction to at least 80,000. Out of the market for now.

Fall scenario: let’s hold the shorts. Stop at 96000 after the end of the week looks quite harmonious.

Recommendations for the diesel market:

Purchase: think when approaching 80,000.

Sale: now. Stop: 96000. Target: 81000. If you are in a position from 88000, keep your stop at 96000. Target: 81000.

Support – 79053. Resistance – 95488.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: they don’t let us take advantage of growth. Off the market.

Fall scenario: can be sold. The chances are small, but there is no panic yet. There may be a price correction.

Recommendations for the PBT market:

Purchase: no.

Sale: now. Stop: 26000. Target: 16000.

Support – 20156. Resistance – 27129.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we earned 900 rubles on a long trade. And they didn’t give us any more. Off the market.

Fall scenario: the position is inconvenient for entering a short position. Off the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 3313. Resistance – 4281.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 6.1 thousand contracts. There are more sellers entering the market than buyers. Sellers continue to hold the advantage.

Growth scenario: we are considering December futures, expiration date is December 14. We entered long from 570.0. Now we hold longs in the hope that we have hit the minimum of the season. We do not exclude a move to 550.0. From this level you will need to buy even more aggressively.

Fall scenario: sales will be interesting from 710.0. Current levels are too low.

Recommendations for the wheat market:

Purchase: no. If you are in a position from 570.0, move your stop to 568.0. Goal: 710.0.

Sale: no.

Support – 568.2. Resistance – 623.1.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers increased by 42.0 thousand contracts. The sellers crushed the market to pieces. There are a lot of them. Sellers have increased control over the market.

Growth scenario: we are considering December futures, expiration date is December 14. The week was a mess for the bulls. We still don’t buy. We wait. We remove the buy recommendation from 455.0. Only from 425.0.

Fall scenario: shorting is possible with a close stop order.

Recommendations for the corn market:

Purchase: when approaching 425.0. Stop: 405.0. Goal: 600.0.

Sale: now. Stop: 486.0. Target: 426.0.

Support – 455.6. Resistance – 486.6.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date is November 14. Let’s continue to refuse purchases. Off the market.

Fall scenario: we expect the price fall to accelerate. We keep short. Those who wish can increase their position.

Recommendations for the soybean market:

Purchase: no.

Sale: no. If you are in a position from 1370, move your stop to 1390.0. Goal: 1000.0?

Support – 1281.6. Resistance – 1383.7.

Growth scenario: they didn’t let us make money on the purchase. Off market this week.

Fall scenario: keep short. If the Fed raises rates on Wednesday, the fall will continue.

Recommendations for the gold market:

Purchase: no.

Sale: no. Who is in position from 1940, move the stop to 1936. Target: 1600?!

Support – 1899. Resistance – 1930.

EUR/USD

Growth scenario: we continue to believe that a move below 1.0600 could open the way to 1.0100. We don’t buy.

Fall scenario: if we go below 1.0600, we can sell. There is a risk of high volatility on Wednesday evening (Fed). Be careful.

Recommendations for the euro/dollar pair:

Purchase: no.

Sale: when it falls below 1.0600. Stop: 1.0730. Target: 1.0100.

Support – 1.0632. Resistance – 1.0773.

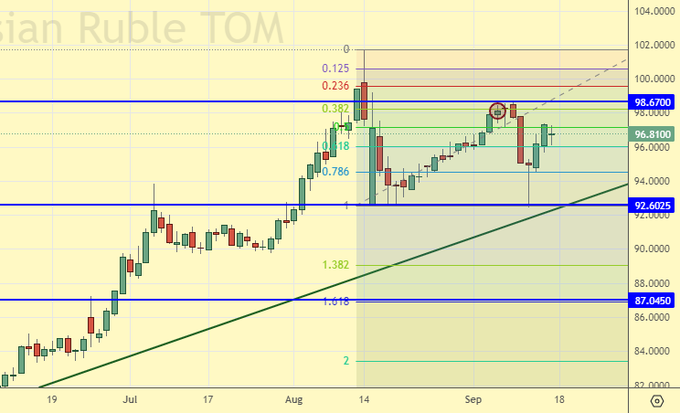

USD/RUB

Growth scenario: do not buy. But if it rises above 101.00, we will be forced to go long.

Fall scenario: levels remain attractive for sales. But the market somehow suspiciously easily digested a 1% rate increase. The ruble did not strengthen before the weekend. Reduce the capital risk for the short by half, since the ruble will now strengthen as a result of a miracle.

Recommendations for the dollar/ruble pair:

Purchase: in case of growth above 101.00. Stop: 98.00. Consider the risks!!!

Sale: now. Stop: 99.30. Target: 87.00. If you are in a position from 97.50, keep your stop at 99.30. Target: 87.00.

Support – 92.60. Resistance – 98.67.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. We will keep the previously opened long, although it becomes uncomfortable, since there is no growth. We do not open new positions.

Fall scenario: we will keep shorts from 105800 and 105000. Note that a move below 99000 can cause a nervous breakdown in bulls with a fast move at 90000.

Recommendations for the RTS Index:

Purchase: no. If you are in a position from 104000, move your stop to 102000. Target: 113600.

Sale: no. For those in positions between 105800 and 105000, keep your stop at 107000. Target: 90000 (50000, 20000).

Support – 101570. Resistance – 106200.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.