18 March 2024, 11:30

Price forecast from 18 to 22 March 2024

-

Energy market:

The spread of the Russian language around the world is in full swing, albeit through the names of military equipment. And Ilon Musk dreamed of the Angara rocket, which he does not have and will not have.

And we’ve got some market analysis. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

Brent has pushed back from the 80.00 area and is trying to consolidate above 85.00. It is not excluded that the growth will continue, but we are unlikely to see any sharp surges. There is a feeling that the West is not ready to leave China without Russian oil, as in this case it will be left without cheap Asian goods. At the same time, the price of gasoline at gas stations will become obscenely high. Despite the strong, and in some cases insoluble contradictions, business is trying to prevent a complete unbalancing of the global market, which has developed over decades.

India will probably not be able to impose its idea of buying oil for rupees, including from Arab countries. Rather, it will be kept on starvation rations for some time, and then the country will become more contractual.

We have to write about the fact that attacks on oil refineries in Russia have begun to cause tangible damage. Localized fuel shortages are possible, but we should not expect a strong global shortage and rising prices.

Grain market:

The IGC report on the outlook for the 24/25 season looks optimistic: 799 million tons of wheat, 1233 million tons of corn and 413 million tons of soybeans will be harvested. At the same time, we note an increase in consumption for all crops, which means higher prices on the market if the volumes expected by traders will not be supplied by farmers as a result of some events. Thus: there will be no famine. But artificial trade barriers may be put up, which may lead to localized food shortages.

It is regrettable to state that the Baltic states are determined to stop any trade exchange with Russia and Belarus. As long as statements are made at the level of politicians, business does not need it. But lately few people care about trade. The game is being played at such high levels that we are even afraid to imagine at what levels.

The Russian government will allocate 7 billion rubles to replenish grain stocks in the state intervention fund. It should be noted that over the past two years Russia has been harvesting excellent grain crops, which allows us to look forward to the next two to three years. And if they export slowly, they will do so for the whole five years ahead.

USD/RUB:

Next week we are waiting for the meeting of the Central Bank of Russia on the 22nd, and before it on Wednesday the Fed meeting. The Americans are unlikely to lower the rate, we are unlikely to raise the rate, under these conditions the pair will continue to go up to 97.00. If the Central Bank of Russia raises the rate (by 1%), the growth of the dollar will be less rapid.

Note that, as in the previous year, the Government financed the work of defense enterprises and demands the result. It is possible that large amounts of money will create excessive inflationary pressure in the first half of the year, which will force the Bank to further tighten financial conditions. Judging by the RGBI index, professional market participants expect higher government bond rates.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 2.0 thousand contracts. The change in the positions of the parties was minimal. The bulls retain the advantage.

Growth scenario: we consider April futures, expiration date April 30. A move above 86.00 will take us to 93.00. We can continue to hold longs, however, the position build-up is not welcomed.

Downside scenario: bulls have created a springboard for attack. Don’t sell.

Recommendations for the Brent oil market:

Buy: no. Who is in position from 83.55, move the stop to 82.40. Target: 93.34.

Sale: no.

Support — 81.03. Resistance — 88.57.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 6 to 510.

US commercial oil inventories fell by -1.536 to 446.994 mln barrels, with +0.9 mln barrels forecast. Gasoline inventories fell by -5.662 to 234.083 million barrels. Distillate stocks rose 0.888 to 117.898 million barrels. Cushing storage stocks fell by -0.22 to 31.451 million barrels.

Oil production fell by -0.1 to 13.1 million barrels per day. Oil imports fell by -1.731 to 5.491 million barrels per day. Oil exports fell by -1.49 to 3.147 million barrels per day. Thus, net oil imports rose by 0.928 to 2.585 million barrels per day. Oil refining rose by 1.9 to 86.8 percent.

Gasoline demand increased by 0.031 to 9.044 mln barrels per day. Gasoline production increased by 0.207 to 9.626 mln barrels per day. Gasoline imports rose 0.046 to 0.634 million barrels per day. Gasoline exports increased by 0.217 to 0.999 mln barrels per day.

Distillate demand fell by -0.699 to 3.375 million barrels. Distillate production rose by 0.056 to 4.345 million barrels. Distillate imports fell -0.024 to 0.171 million barrels. Distillate exports rose 0.176 to 1.231 million barrels per day.

Demand for refined products increased by 0.509 mln barrels to 20.803 mln barrels. Production of petroleum products increased by 1.016 to 21.933 mln barrels. Imports of refined petroleum products rose 0.225 to 2.065 million barrels. Exports of refined products fell -0.232 to 6.128 million barrels per day.

Propane demand increased by 0.397 to 1.236 mln barrels. Propane production rose 0.033 to 2.515 million barrels. Propane imports fell -0.067 to 0.114 million barrels. Propane exports fell -0.034 to 0.096 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 14.0 th. contracts. Buyers were leaving the market. Sellers slightly increased their positions. Bulls keep control.

Growth scenario: we consider May futures, expiration date April 22. We keep buying, expect a move to 90.00.

Downside scenario: refuse to sell for now. Winter is over. Fuel demand has clearly increased.

Recommendations for WTI crude oil:

Buy: on a pullback to 78.00. Stop: 77.00. Target: 90.00. Those who are in the position from 79.97, move the stop to 77.00. Target: 90.00.

Sale: no.

Support — 76.46. Resistance — 81.19.

Gas-Oil. ICE

Growth scenario: we switched to April futures, expiration date April 11. We will continue to hold the long. So far the situation is favorable.

Downside scenario: it is possible to sell from current levels. Extremely close stop order.

Gasoil Recommendations:

Buy: No. Those in position at 804.25, move your stop to 807.00. Target: 1000.00?!

Sell: Now (834.25). Stop: 844.0. Target: 760.0. Those who are in the position from 825.0, move the stop to 844.0. Target: 760.0.

Support — 789.00. Resistance — 842.00.

Natural Gas. CME Group

Growth scenario: we switched to April futures, expiration date March 26. We continue to be in the falling channel. Out of the market.

Downside scenario: refrain from selling.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.591. Resistance — 2.099.

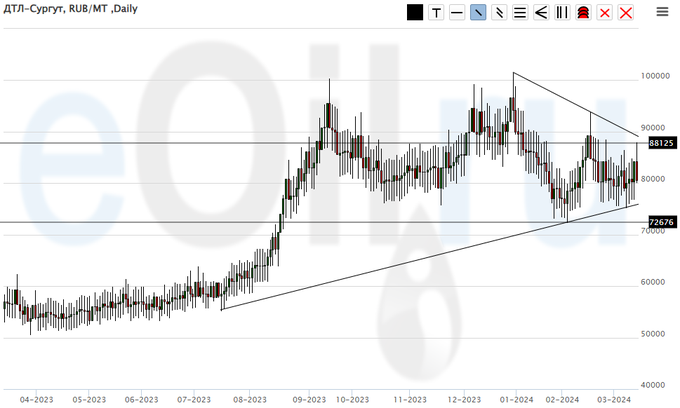

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 90000, we don’t think about buying. Out of the market.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 72676. Resistance — 88125.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to keep longing. If the market goes below 10000, it may lead us to 5000. And there we will definitely need to buy.

Downside scenario: out of the market. Movement to 5000 is possible, but selling is risky now.

PBT Market Recommendations:

Buy: No. Who is in position from now 13000, move stop to 10700. Target: 25000.

Sale: no.

Support — 10000. Resistance is 16250.

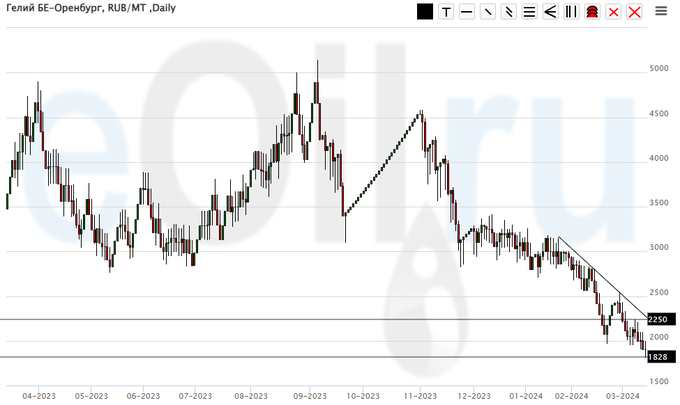

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market has gone below 1900. Out of the market for now. But we will come back to it with purchases after growth above 2000.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1828. Resistance is 2250.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 13.8 th. contracts. Buyers fled from the market, the number of sellers increased insignificantly. Bears keep control.

Growth scenario: we consider May futures, expiration date May 14. Nothing new. We are waiting for the market at 515.0. We can buy there. There is not much left.

Downside scenario: the market continues to look down. The movement target at 516.0 looks natural. A deeper dive is unlikely to take place now.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sale: no.

Support — 514.7. Resistance — 555.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 33.3 th. contracts. Sellers fled, buyers cautiously entered the market. Bears are keeping control.

Growth scenario: we consider the May futures, expiration date May 14. We have to buy here, otherwise there is a risk to miss the growth to 468.0.

Downside scenario: do not sell. There are prerequisites for growth continuation.

Recommendations for the corn market:

Buy: now (436.6). Stop: 430.0. Target: 468.0. Or when approaching 370.0, add at 350.0 aggressively. Stop: 320.0. Target: 500.0.

Sale: no.

Support — 423.4. Resistance — 445.7.

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date May 14. Growth continues. We are waiting for an approach to 1230.0. Growth to 1300.0 is also interesting, but it is still very far.

Downside scenario: there are good chances to touch 1235.0. If it happens, we will sell.

Recommendations for the soybean market:

Buy: no. Who is in position from 1141.6, move the stop to 11650.0. Target: 1230.0.

Sell: at touching 1235. Stop: 1246. Target: 1000.00.

Support — 1183.4. Resistance — 1235.5.

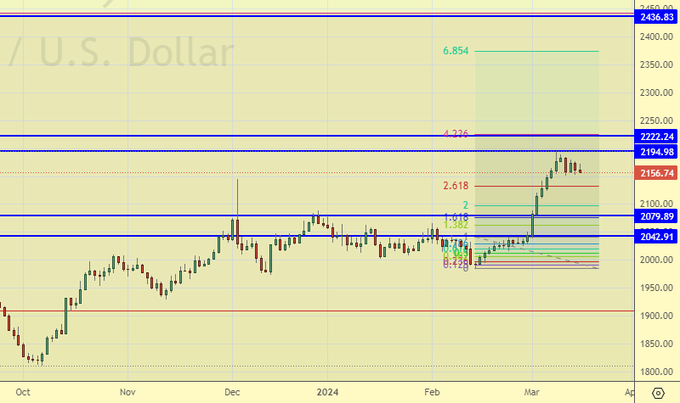

Growth scenario: in order to enter longing nicely, we need to roll back to 2080. If this does not happen, we will have to look for less favorable points for buying.

Downside scenario: refrain from selling. It is not excluded that for a long period of time.

Gold Market Recommendations:

Buy: on a pullback to 2080, 2040. Stop: 2000. Target: 2400. Consider the risks!

Sale: no.

Support — 2079. Resistance — 2194.

EUR/USD

Growth scenario: the growth has paused. We need a move above 1.1000 to believe in the success of the bulls. We hold longs.

Downside scenario: there is a strong temptation to sell. The short is technically justified, but still, we will enter the trade after falling below 1.0720.

Recommendations on euro/dollar pair:

Buy: no. Who is in position from 1.0722, keep stop at 1.0810. Target: 1.2000.

Sell: to think after falling below 1.0720.

Поддержка – 1.0866. Сопротивление – 1.0964.

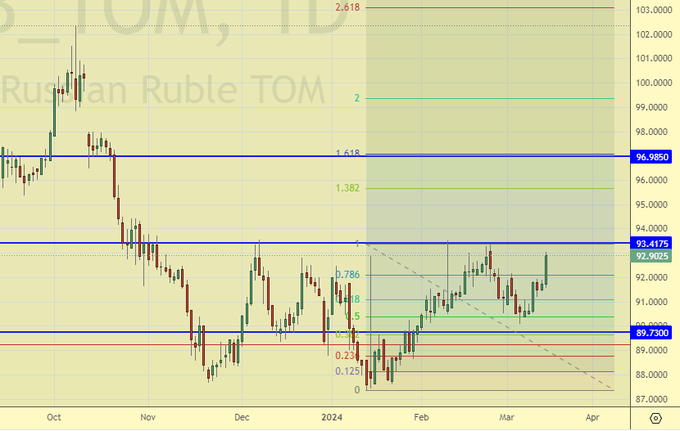

USD/RUB

Growth scenario: we will have to buy at current prices and at a pullback to 91.00. The target is at the top at 97.00. We do not think about higher marks yet.

Downside scenario: we will not sell the pair. Two years of SWO make themselves felt.

Recommendations on dollar/ruble pair:

Buy: now (92.90) and on a pullback to 91.00. Stop: 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 89.73. Resistance — 93.41.

RTSI

Growth scenario: we consider the June futures, expiration date is June 20. Probably, this is the last situation, in which bulls can still count on something. Let’s buy. Stop is near.

Downside scenario: we were given an opportunity to sell from 116700, we were going down all week. For a good short entry we need a pullback up to 113000.

Recommendations on the RTS index:

Buy: Now. Stop: 108000. Target: 120000?!!!

Sell: on a move to 113000. Stop: 114300. Target: 100000.

Support — 107620. Resistance — 111700.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.