18 December 2023, 12:45

Price forecast from 18 to 22 December 2023

-

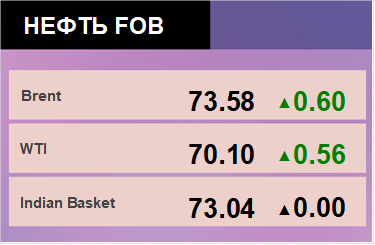

Energy market:

Our eggs’ prices are already exhausted without us. We won’t write about them. It’s better about the coming to power of right-wing politicians in Europe. There is a feeling that rainbow flags will soon come to an end, and people will begin to look at each other through the prism of practicality. Look, in Europe it will be like in Iran: they will start asking for gold to rent an apartment. Just a few grams. In such a situation, you can’t wave a flag anymore. Everyone gets to work! The euro will remain for now, but who knows, who knows…

And the ruble will remain for now. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Judging by the behavior of asset managers, bets on falling oil prices continue to rise despite the announced cuts by OPEC. It will be extremely difficult for Brent to overcome the 80.00 level and go higher.

Based on the OPEC report, the cartel is optimistic about the future. There will be demand. However, it is worth noting that resource extraction continues to develop in ordinary countries (not superpowers): Kuwait, Libya, Venezuela, these are all members of the cartel, among other things, to say nothing of other states. Do you think the war is over the Gaza Strip? No, just for gas, reserves of which were found opposite this territory.

Russia produces 9.66 million barrels per day in the 4th quarter. For the 24th year they write to us 10.62 (as it was at the beginning of the 23rd year), but it is possible that 1 million barrels per day will go to the needs of the Ministry of Defense, and this additional volume, as it were, does not count toward the overall agreement with the cartel will do. Let us note that it will be impossible to maintain production at the level of 10 million barrels per day without additional exploration and drilling, that is, oil workers will have to leave something to maintain production and development. True, it is unlikely that they will do this in the extremely difficult year 24.

By reading our forecasts, you could take a move up in gold from 1840 to 1976 dollars per troy ounce. It was also possible to take a move up the dollar/ruble pair from 88.00 to 90.80.

Grain market:

Chinese purchases supported the wheat market. Demand continues to remain at a good level. Following Egypt, which regularly holds tenders, Saudi Arabia wanted to buy almost three quarters of a million tons.

Over the past 10 years, we have seen a constant, albeit slow, increase in wheat production. All the best, but according to the theory of probability, we should already have some kind of strong incident. Most likely drought. So far the troubles have been overcome. Somewhere in Europe they took advantage of the opportunity to clean up river beds this summer. But if there is no water next year, this could cause serious problems, since the level of groundwater and the supply of moisture in river basins will decrease.

In Russia, the situation with the new harvest is quite good. 153 million tons of grain have been collected (Patrushev), of which 95 million tons of wheat (USDA 90 million tons), which gives us the opportunity to consistently export 7 million tons of wheat per month right up to next August. We most likely do not have such capacities, but since now everything (almost everything) collected beyond the Urals will be taken by China under a 12-year contract for the supply of 70 million tons of grain, it should become a little easier for the southern ports.

USD/RUB:

Elvira Sakhipzadovna raised the rate to 16% per annum. This is already scary, since after growth above 20%, processes in the economy may become poorly controlled. You don’t have to look far for examples. Look what happened to Turkey in two years. This is a thriller. It’s too early for us to talk about this, but the trend is extremely unpleasant at the moment. At this rate, the ruble is in no hurry to go to 80.00, and the stock market is not depleting, which indicates continued fears of inflation.

Note that at the moment the price of Urals has dropped below 60 dollars per barrel, which may cause the ruble to move towards 100.00. Current budget parameters for the 24th year: 71 dollars — oil and 90 rubles per 1 dollar.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 50.1 thousand contracts. The difference is significant. Short rates rose sharply. It is possible that the bulls will soon lose their advantage.

Growth scenario: we are considering December futures, expiration date is December 29. In case of failure by 65.00 you can buy. Considering the interest of speculators in shorts, we are not going long yet.

Fall scenario: shorts from current levels and from 81.00 are possible. The fall at 65.00 is visible.

Recommendations for the Brent oil market:

Purchase: think when approaching 65.00.

Sale: now. Stop: 77.60. Goal: 65.00. Or from 81.40. Stop: 83.00. Goal: 65.00.

Support – 72.27. Resistance – 77.24.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and amounts to 501 units.

Commercial oil reserves in the United States fell by -4.258 to 440.773 million barrels, with the forecast of -0.65 million barrels. Gasoline inventories increased by 0.409 to 224.013 million barrels. Distillate inventories increased by 1.494 to 113.539 million barrels. Inventories at the Cushing storage facility rose by 1.228 to 30.779 million barrels.

Oil production remained unchanged at 13.1 million barrels per day. Oil imports fell by -0.991 to 6.517 million barrels per day. Oil exports fell by -0.568 to 3.771 million barrels per day. Thus, net oil imports fell by -0.423 to 2.746 million barrels per day. Oil refining fell by -0.3 to 90.2 percent.

Demand for gasoline increased by 0.393 to 8.859 million barrels per day. Gasoline production increased by 0.025 to 9.542 million barrels per day. Gasoline imports increased by 0.026 to 0.715 million barrels per day. Gasoline exports increased by 0.183 to 1.131 million barrels per day.

Demand for distillates increased by 0.014 to 3.77 million barrels. Distillate production fell by -0.083 to 4.987 million barrels. Imports of distillates increased by 0.123 to 0.205 million barrels. Exports of distillates fell by -0.007 to 1.208 million barrels per day.

Demand for petroleum products increased by 1.468 to 21.079 million barrels. Production of petroleum products increased by 0.378 to 22.563 million barrels. Imports of petroleum products increased by 0.086 to 1.976 million barrels. Exports of petroleum products fell by -0.05 to 6.553 million barrels per day.

Propane demand increased by 0.202 to 1.2 million barrels. Propane production fell -0.001 to 2.632 million barrels. Propane imports increased by 0.012 to 0.13 million barrels. Propane exports increased by 0.043 to 0.1 million barrels per day.

Let’s look at the volumes of open interest in WTI. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 16.9 thousand contracts. The bulls are leaving the market. Buyers may lose control in the coming weeks.

Growth scenario: we are considering the February futures, expiration date is January 22. Nothing new, as before, we will return to discussions about longs after growth above 75.00. From 61.50 a must buy.

Fall scenario: there is nothing interesting below. Off the market.

Recommendations for WTI oil:

Purchase: when approaching 61.50. Stop: 58.50. Goal: 120.00. Think after rising above 75.00.

Sale: now. Stop: 73.30. Target: 61.50.

Support – 67.87. Resistance – 72.80.

Gas-Oil. ICE

Growth scenario: we are considering January futures, expiration date is January 11. Considering the prospects for a further fall in oil prices, we are not buying.

Fall scenario: it is possible that we will be able to go below 700.0. Let’s shift the short target to 650.0.

Recommendations for Gasoil:

Purchase: think when approaching 650.00.

Sale: no. Those who sold from 850.00, keep the stop at 780.00. Goal: 650.00 (revised).

Support – 716.50. Resistance – 788.00.

Natural Gas. CME Group

Growth scenario: we are considering the February futures, expiration date is January 29. From 1.600 it makes sense to buy. The decline is extremely aggressive and we expect it to continue.

Fall scenario: outside the market. Prices are low.

Natural gas recommendations:

Purchase: when approaching 1.600. Stop: 1.400. Goal: 3,000.

Sale: no.

Support – 1.557. Resistance – 2.465.

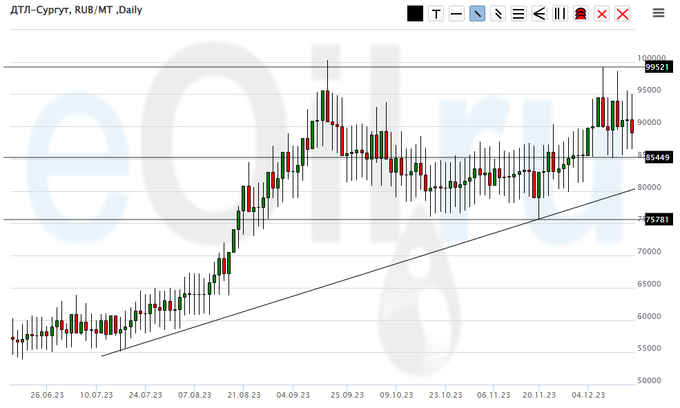

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to remain outside the market. Prices are too high for interesting purchases.

Fall scenario: we will not recommend sales directly. The area is, in principle, interesting for entering shorts, but we are not completely confident in the need to open a down position.

Recommendations for the diesel market:

Purchase: no.

Sale: no.

Support – 85449. Resistance – 99521.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we are unlikely to reach zero like last year… We are taking a break for another week, but the levels for purchases are already attractive.

Fall scenario: prices are low. We don’t sell.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support – 9766. Resistance – 16533

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will remain long. It is unlikely that the market will go below 2700 in the near future.

Fall scenario: we continue to remain outside the market, prices are low.

Helium Market Recommendations:

Purchase: no. If you are in a position from 3200, keep your stop at 2700. Target: 5000.

Sale: no.

Support – 2822. Resistance – 3426.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 29.4 thousand contracts. The sellers continue to flee. Buyers closed some positions. Bears risk losing control of the market.

Growth scenario: we are considering March futures, expiration date is March 14. You could take it from 600.0, although we obviously didn’t write about such a deal. We need a rollback to 580.0. If it is not there, you will have to buy at 645.0, which cannot be called a good idea.

Fall scenario: a move to 580.0 is possible, but it is more convenient to work it out at hourly intervals.

Recommendations for the wheat market:

Purchase: on a rollback to 580.0. Stop: 566.0. Goal: 700.0. Think in case of growth above 645.0.

Sale: no.

Support – 602.1. Resistance – 649.6.

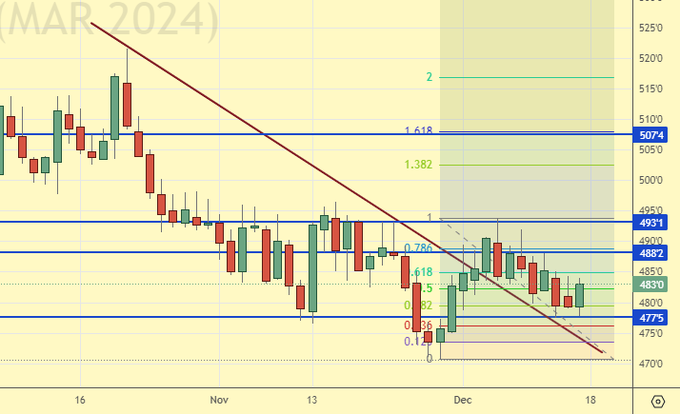

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 7.2 thousand contracts. Sellers and buyers left the market, but sellers did it more actively. The bears continue to control the situation.

Growth scenario: switched to March futures, expiration date March 14. We entered long from 479.0. Let’s pull up the stop. Let’s see if there is growth.

Fall scenario: we refuse to sell. The market is building something for us that could take us to 507.0, maybe 550.0.

Recommendations for the corn market:

Purchase: no. Anyone in position from 479.0, move the stop to 477.0. Goal: 600.0.

Sale: no.

Support – 477.5. Resistance – 488.2.

Soybeans No. 1. CME Group

Growth scenario: we are considering March futures, expiration date is March 14. There is a range in the market without any advantage on one side. Off the market.

Fall scenario: if you look at the foundation, you can sell, but technology does not yet provide such a reason.

Recommendations for the soybean market:

Purchase: not yet.

Sale: think when falling below 1300.

Support – 1281.2. Resistance – 1362.1.

Growth scenario: the Fed’s decision to leave rates unchanged led to two days of dollar weakness. In other matters, on Friday the dollar began to gain strength again. We are looking at the upside for gold in the long term, however, we do not deny corrections.

Fall scenario: you can short here. If Monday is red, it will attract a large number of sellers.

Recommendations for the gold market:

Purchase: not yet.

Sale: now. Stop: 2053. Goal: 1800?!

Support – 1974. Resistance – 2047.

EUR/USD

Growth scenario: the dollar weakened after the Fed meeting. However, the rate in the US is 1% higher than in Europe. Yes, the dollar will most likely fall, but this will not happen in one direction.

Fall scenario: we will not sell. The dollar’s movement towards parity is unlikely at the moment.

Recommendations for the euro/dollar pair:

Purchase: no. If you are in a position from 1.0750, move your stop to 1.0760. Target: 1.1250 (1.2000).

Sale: no.

Support – 1.0706. Resistance – 1.1015.

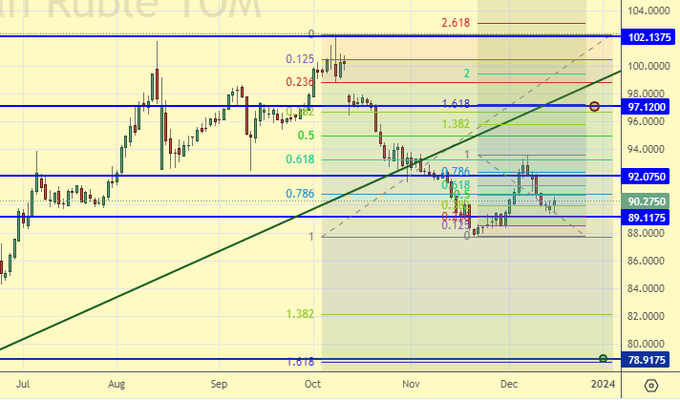

USD/RUB

Growth scenario: can be bought at current levels. A move to 97.00 is possible. The rate increase to 16% did not strengthen the position of the ruble.

Fall scenario: shorting from 97.00 is not a bad idea, but it must be supported by expensive, or at least rising oil prices. Not on the market yet.

Recommendations for the dollar/ruble pair:

Purchase: Now. Stop: 88.80. Goal: 100.00 (120.00; 200.00; 1000.00).

Sale: no.

Support – 89.11. Resistance – 92.07.

RTSI

Growth scenario: we are considering March futures, expiration date is March 21. We will keep the long position from 105,000. At the same time, we understand that the risks for the market to continue to fall are high.

Fall scenario: we are short from 114,000. Somehow we don’t really believe in the New Year’s rally, so we won’t press our stop yet.

Recommendations for the RTS Index:

Purchase: no. Who is in a position from 105000, move the stop to 104200. Target: 125000?!

Sale: no. Who is in a position from 114000, keep a stop at 112000. Target: 50000?!

Support – 104310. Resistance – 109720.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.