17 February 2025, 10:19

Price forecast from 17 to 21 February 2025

-

Don’t you feel like we’re already on Mars? Yeah, you probably don’t. But we definitely have the feeling that we are flying to it. And everyone does it, i.e. “flies”, in his own way, trying to get some benefit, but the result will be common. While we were waving clubs in the meadows, it was fun. Now the world has become small for us.

May the Earth never become Mars! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

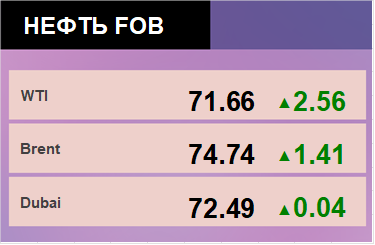

Energy market:

Oil prices will continue to wriggle around the 75.00 level like a gymnasium girl around a pole. Trump wants to pull Russia out of China’s embrace. If that happens, then the two major oil producers on the planet could be arguing together about how much oil should cost for Europe and China. Beautiful. Dreamy. But then there’s OPEC. And there are a lot of greedy people there. And should we trust Washington, where every four years there’s a programmed coup. There’s so many of them, they’re so far away, there’s so much… power in them.

EU leaders are shocked. You bet, Ukraine’s fertile land has long been described by German cartographers. And here suddenly everything goes wrong again. The hegemon is shoehorned into the air and left to its own devices, demanding to pay for its own wants on its own. For the oil market, this is actually an unpleasant story. Europe has to be rich, America has to be rich, otherwise who is going to sell something that costs $4 a barrel for $80. That kind of “twenty percent” is not on the road. That kind of business just doesn’t exist anymore. And many people, including Russia, even though our production costs are much higher than those of the Arabs, need business. China will switch to bicycles in two days, if something happens, just like that, at the snap of a finger; Europe will not, because they have pampered people.

Grain market:

The wheat market realizes that this year will not be easy, that is why we see a slight increase in prices. At the same time, no one is trying to push the market up, as there will be supply. Even if we will not be able to cross the cherished mark on gross harvest of 800 million tons, the world will still have enough 790 or even 750 million tons of wheat. But if, with very bad weather in spring and summer, we still get a forecast in early May, for example, 740 million tons, which is actually unlikely, but still possible, then we can expect the market to grow to the level of 800 cents per bushel.

It is time for Europeans to realize their identity. If it will be realized at the level of a principality or a district, then the fate of Europe is sad. At the level of a country — not enviable, at the level of a part of the Eurasian continent — then yes, then they can extend their unity. There is one nuance: there is no money. Washington is going to throw Brussels, and also because there is no money. There is simply no money. Not at all. Trump wants to force America to stop living in debt. He’s already taking lollipops away from everyone. The sharing of American taxpayers’ money between America itself and Europe may end in deep resentments. It should be emphasized that there are no significant threats to the agricultural market because of the US-EU rift, because Asia will eat it all up. They are there… no one even counted them. Just went and had a baby. Yeah. Simple as that.

USD/RUB:

Elvira left the bid. 21%. She was at the press conference in gray, not black. At the same time avoided the word SWO and in general… proceeds from what was, from what is and from what will be. That is: it’s hard to predict. If it’s “hard” for the head of the Central Bank, what’s it like for the rest of us. She didn’t know yet that Trump is ready to stick flags in the table for negotiations between Moscow and Kiev. Oh, there’s going to be pressure. There will be pressure on everyone. Bargaining, however, as well as the active phase of the SWO, apparently, will continue, for another six months. And since this is the case, it is very hard for us to believe in a strong ruble. We want to, it is true, but it is as hard as never before.

US inflation is not falling (3.3%), which may force the Fed to start a second round of rate hikes in 2 — 4 months.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 0.4 th. contracts. Buyers and sellers were not active. Bulls are controlling the situation.

Growth scenario: we consider February futures, expiration date is February 28. It makes sense to hold and buy for now. We are holding the long.

Downside scenario: we stay out of the market. It is possible to sell from 84.00.

Recommendations for the Brent oil market:

Buy: possible. Those who are in the position from 74.66, keep the stop at 73.70. Target: 94.00.

Sale: not yet.

Support — 73.89. Resistance — 77.35.

WTI. CME Group

US fundamental data: the number of active drilling rigs rose by 1 unit to 481.

U.S. commercial oil inventories rose 4.07 to 427.86 million barrels, with +2.4 million barrels forecast. Gasoline inventories fell by -3.035 to 248.053 million barrels. Distillate stocks rose 0.135 to 118.615 million barrels. Cushing storage stocks rose by 0.872 to 21.819 million barrels.

Oil production rose by 0.016 to 13.494 million barrels per day. Oil imports fell by -0.606 to 6.309 million barrels per day. Oil exports fell by -0.422 to 3.909 million barrels per day. Thus, net oil imports fell by -0.184 to 2.4 million barrels per day. Oil refining rose by 0.5 to 85 percent.

Gasoline demand increased by 0.248 to 8.576 million barrels per day. Gasoline production rose 0.18 to 9.346 million barrels per day. Gasoline imports fell -0.274 to 0.319 million barrels per day. Gasoline exports rose 0.11 to 0.97 million barrels per day.

Distillate demand fell by -0.914 to 3.685 million barrels. Distillate production fell by -0.009 to 4.543 million barrels. Distillate imports rose -0.086 to 0.245 million barrels. Distillate exports rose 0.191 to 1.084 million barrels per day.

Demand for petroleum products fell by -1.451 to 19.624 million barrels. Petroleum products production fell by -0.608 to 20.505 million barrels. Imports of refined petroleum products fell -0.246 to 1.46 million barrels. Exports of refined products rose by 0.142 to 6.443 million barrels per day.

Propane demand increased by 0.204 to 1.5 million barrels. Propane production increased by 0.017 to 2.609 million barrels. Propane imports rose 0.029 to 0.182 million barrels. Propane exports fell -0.478 to 1.659 million barrels per day.

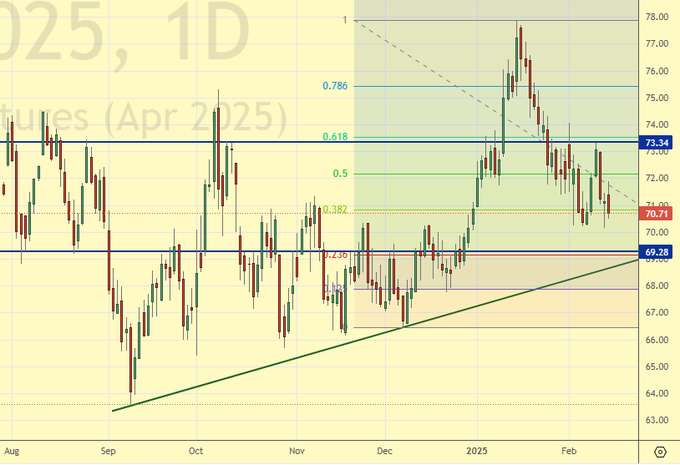

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 13.8 th. contracts. Buyers were fleeing. Sellers were arriving. The bulls are maintaining control.

Growth scenario: moved to April futures, expiration date March 20. Here you can buy.

Downside scenario: there is no sense to sell yet.

Recommendations for WTI crude oil:

Buy: possible. Those who are in the position from 70.50 and 72.33 (taking into account the transition to a new contract), move the stop to 68.80. Target: 90.00.

Sale: no.

Support — 69.28. Resistance — 73.34.

Gas-Oil. ICE

Growth scenario: we consider March futures, expiration date March 12. For new purchases we need a pullback to 680.0. Those who have longs, hold them.

Downside scenario: don’t sell yet.

Gasoil Recommendations:

Buy: when approaching 680.0. Stop: 670.0. Target: 900.0. Those who are in the position from 701.75, keep the stop at 670.0. Target: 900.0.

Sale: no.

Support — 685.00. Resistance — 732.00

Natural Gas. CME Group

Growth scenario: moved to April futures, expiration date March 27. We can hold positions. For now, we confirm that the US did not capture Europe to sell cheap gas to them. They can’t even move against Washington now, Russia is no more for them.

Downside scenario: we don’t think about sales yet.

Natural Gas Recommendations:

Buy: no. Who is in the position from 3.069 (taking into account the transition to a new contract), move the stop to 3.440. Target: 4.870

Sale: no.

Support — 3.587. Resistance — 3.960.

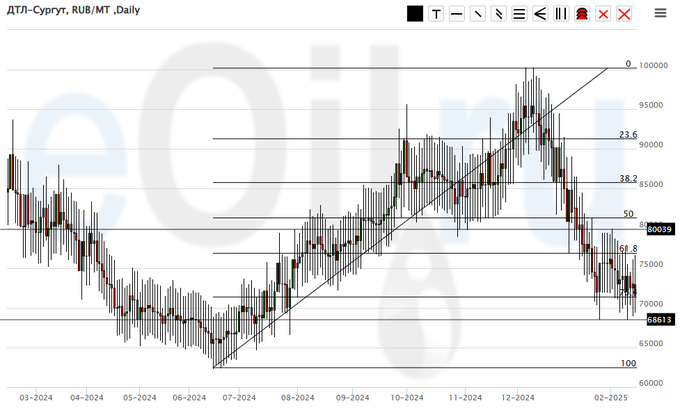

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we should buy here. Technically, the situation is favorable.

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: possible. Who is in position from 72000, keep stop at 68000. Target: 110000.

Sale: no.

Support — 68613. Resistance — 80039.

Helium (Orenburg), ETP eOil.ru

Growth scenario: it makes sense to buy here. It is unlikely that the company will release helium cheaper. This is most likely the bottom.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: possible. Those who are in position from 900, keep stop at 770. Target: 2000.

Sale: no.

Support — 813. Resistance is 986.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 7.9 th. contracts. Buyers were arriving. Sellers fled in insignificant volumes. Bears are maintaining control.

Growth scenario: we consider the March contract, expiration date is March 14. We will keep longing. We are going to 630.0, further is not clear.

Downside scenario: don’t sell yet.

Recommendations for the wheat market:

Buy: no. Those who are in position from 533.0, move the stop to 564.0. Target: 631.0.

Sale: no.

Support — 592.4. Resistance — 631.6.

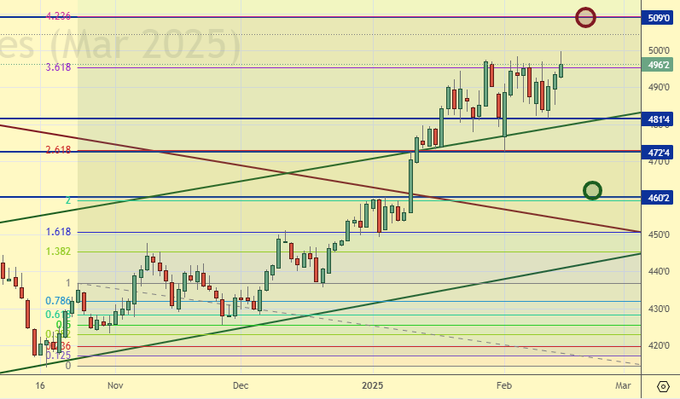

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 35.3 thnd contracts. Buyers ran away. Sellers’ volumes remained at the same level. Bulls strengthened their control once again.

Growth scenario: we consider the March contract, expiration date March 14. Nothing new. There is nowhere to buy. Out of the market. If we go to 440.0, then we will think about it.

Downside scenario: shorting from 509.0 remains the main idea.

Recommendations for the corn market:

Buy: no.

Sell: on approach to 509.0. Stop: 511.0. Target: 440.0.

Support — 460.2. Resistance — 509.0.

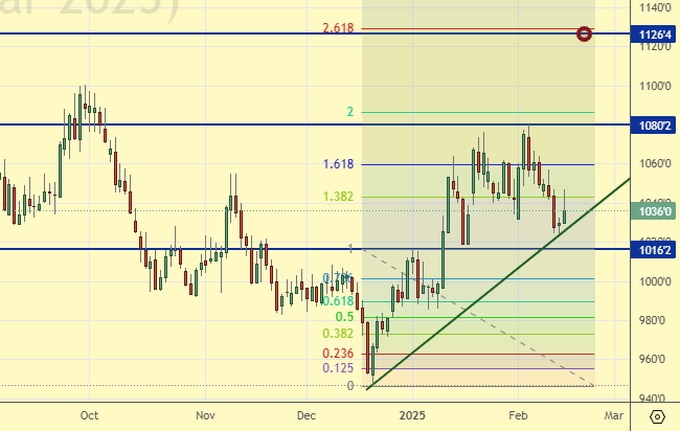

Soybeans No. 1. CME Group

Growth scenario: we consider March futures, expiration date March 14. We may reach 1125. Those who wish can buy at current levels with a stop order at 1010.0.

Downside scenario: refuse to sell for now.

Recommendations for the soybean market:

Buy: now (1036). Stop: 1010.0. Target: 1125.0.

Sell: on approach to 1125. Stop: 1135. Target: 830.0.

Support — 1016.2. Resistance — 1080.2.

Growth scenario: we consider February futures, expiration date February 26. To continue buying we need a pullback at least to 2760.

Downside scenario: it’s kind of suspicious, this market. Well, what war between the U.S. and Europe? Who is taking gold out of London where? Where is it going? To Greenland? Or burying it in the sands. If Europe gets flattened under Trump’s pressure, then everyone will be praying for the dollar.

Gold Market Recommendations:

Buy: think when approaching 2760.

Sale: now. Stop: 2970. Target: 2120.

Support — 2872. Resistance — 3021.

EUR/USD

Growth scenario: “the dollar will be under pressure due to the exuberant behavior of the new — old US president. It’s safe to buy.” That’s what we wrote last week. So far, yes, so far for the Euro what we will have to borrow (issue bonds) to produce weapons. But that optimism won’t last.

Downside scenario: we refrain from selling for now. But… who knows.

Recommendations on euro/dollar pair:

Buy: Those who are in positions from 1.0325 and 1.0356, move the stop to 1.0330. Target: 1.1000 (1.2000).

Sale: no.

Support — 1.0381. Resistance — 1.0530.

USD/RUB

Growth scenario: we consider the March futures, expiration date March 20. “Any hint of the completion of the SWO will strengthen the ruble by 5 rubles within one hour.” That was almost a correct assumption. We went lower, to 92,000. Buying. Words are not deeds.

Downside scenario: yes, we are down. A move to 88000 would be questionable.

Recommendations on dollar/ruble pair:

Buy: Now (94261). Stop: 93700. Target: 115000?!!!

Sell: no. Who is in position from 100100, move stop to 95300. Target: 88100.

Support — 91890. Resistance — 97563.

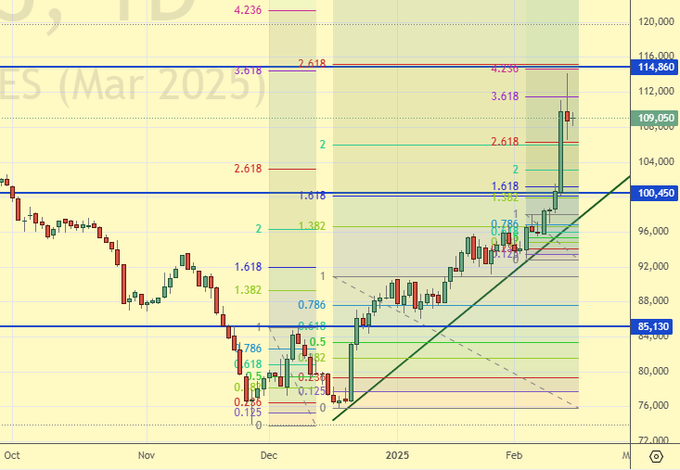

RTSI. MOEX

Growth scenario: we consider the March futures, expiration date March 20. Yes… yes… No one could have imagined this a week ago. Out of the market.

Downside scenario: out of the market. Save on tickets to the circus. We have it right in front of us.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 100450. Resistance — 114860.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.