15 January 2024, 13:24

Price forecast from 15 to 19 January 2024

-

Energy market:

The problem is that the disease becomes chronic and everyone gets used to it as if it were something ordinary. The trend towards redividing the world is gaining momentum. The appropriation of Russian assets is not so bad, what will happen when they also appropriate Chinese ones.

A military engineer is also now a prestigious profession, and not some kind of currency trader. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The US hit the Yemeni Houthis. The whole of Yemen is on its hind legs, as it should happen in a normal country. If Washington needed tension in full, then he got it. We are waiting for terrorist attacks. Sunk tankers, downed planes and the like. Trading in such conditions, without access to news, is extremely difficult. However, we can say that the oil market is unlikely to face simpler times.

The scenario with a fall to 65.00 in Brent, which could have been discussed at the end of December, has become unlikely. If Monday closes with a long green candle, then it’s worth looking at 120.00 for oil.

Let’s look a little further: receiving currencies of unknown origin from China and India for sold oil, Russia will sooner or later be forced to sell it for rubles. Yes, in this case we will have problems with the budget, since the ruble will strengthen, and we will have to go through several extremely difficult months, but getting “nothing” or cryptocurrency for oil is not the way. This is madness. Yes, this will be a breakdown of the entire established model, but judging by the visits of the Englishman and the Frenchman to Kyiv, the West no longer exists for us in the current realities. And no one will watch the French Olympics. And a tower with a bunch of rivets in your Paris is of no interest to anyone.

Reading our forecasts, you could take a downward move in RTS index futures from 114,000 to 112,000 points.

Grain market:

Grain market:

USDA reported positive outlook for the 23/24 crop. We see an increase in forecasts for the gross harvest of wheat and corn. The growth for wheat was 0.24%, for corn 1.12%.

According to USDA estimates, Russia collected 91 million tons of wheat; after the previous report, the collection was increased by 1 million tons. This gives us an export potential of 65 million tons. We continue to note that in the current circumstances, such a surplus guarantees the country’s food security no matter how much eggs cost.

Let us note the fall in the cost of corn both in Argentina, where favorable conditions prevailed, but also in Brazil and the USA. The FOB price for this crop fell by $7 per month to $210–220, depending on the port of shipment. Also note that there is a lot of corn. Ending inventories are growing by 3.17% month on month, which has led to the current drop in prices in Chicago.

Shipowners are forced to send bulk carriers from Europe to Asia and back, bypassing Africa instead of allowing ships to pass through the Suez Canal and the Bab El-Mandeb Strait, which has already increased the cost of freight. These costs, ranging from $10 to $20 per ton, will be borne by buyers, which will negatively impact prices and inflation. European countries will have to significantly increase their storage capacity to supply their own population with goods, which, as is known, are produced in Asia.

USD/RUB:

The high rate began to influence minds and people took money to the bank. The problem for bankers is that they were able to attract capital at 16%, but it is extremely difficult to issue loans at a rate above 20%. A thinking person, who is also an earning borrower, will not take on too much at an exorbitant interest rate.

The ruble can go not only to 85.00, but also to 80.00, provided that the pressure from external factors does not increase.

Note that the “fiscal rule” has returned. Psychologically, this is a strong move, which should show that the country is coping with all current tasks and the period of severe stress is over.

A strong economic connection with China will not allow prices to rise very quickly, more than 15% per year. This will continue as long as everything is in order in China itself.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 40.7 thousand contracts. The difference is significant. Buyers entered the market, sellers fled. The bulls strengthened their lead.

Growth scenario: we are considering January futures, expiration date is January 31. We will buy if it rises above 81.60. There are still doubts about the ability of the bulls to reverse the trend upward.

Fall scenario: shorts from current levels is interesting from a technical point of view. A fall to 65.00 remains the main idea.

Recommendations for the Brent oil market:

Purchase: think when approaching 65.00. In case of growth above 81.60. Stop: 77.70. Goal: 120.00. Consider the risks!

Sale: now (78.75). Stop: 80.90. Goal: 65.00. Anyone in position from 76.10, keep a stop at 80.90. Goal: 65.00.

Support – 74.77. Resistance – 80.69.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and amounts to 499 units.

Commercial oil reserves in the United States increased by 1.338 to 432.403 million barrels, with a forecast of -0.675 million barrels. Gasoline inventories increased by 8.028 to 244.982 million barrels. Distillate inventories increased by 6.528 to 132.383 million barrels. Inventories at the Cushing storage facility fell by -0.506 to 34.173 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports fell by -0.654 to 6.241 million barrels per day. Oil exports fell by -1.97 to 3.322 million barrels per day. Thus, net oil imports increased by 1.316 to 2.919 million barrels per day. Oil refining fell by -0.6 to 92.9 percent.

Demand for gasoline increased by 0.371 to 8.325 million barrels per day. Gasoline production increased by 0.901 to 9.656 million barrels per day. Gasoline imports fell by -0.159 to 0.5 million barrels per day. Gasoline exports fell by -0.088 to 0.823 million barrels per day.

Demand for distillates increased by 0.774 to 3.432 million barrels. Distillate production fell by -0.064 to 5.167 million barrels. Imports of distillates increased by 0.08 to 0.274 million barrels. Exports of distillates fell by -0.249 to 1.076 million barrels per day.

Demand for petroleum products increased by 0.546 to 19.605 million barrels. Production of petroleum products increased by 0.288 to 22.346 million barrels. Imports of petroleum products fell by -0.176 to 1.916 million barrels. Exports of petroleum products fell by -0.333 to 6.238 million barrels per day.

Demand for propane increased by 0.233 to 1.591 million barrels. Propane production fell by -0.004 to 2.637 million barrels. Propane imports fell -0.035 to 0.111 million barrels. Propane exports increased by 0.029 to 0.102 million barrels per day.

Let’s look at the volumes of open interest in WTI. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 24.4 thousand contracts. Sellers have fled, while buyers are reluctant to enter the market. The bulls are in control.

Growth scenario: we are considering the February futures, expiration date is January 22. If there is a rise above 76.30, you can think about buying.

Fall scenario: while we are in a falling channel, we will look down.

Recommendations for WTI oil:

Purchase: when approaching 61.50. Stop: 58.50. Goal: 120.00. After rising above 76.60. Stop: 72.70. Goal: 110.00.

Sale: now. Stop: 75.80. Target: 61.50. If you are in a position from 73.90, keep your stop at 75.80. Target: 61.50.

Support – 69.33. Resistance – 76.30.

Gas-Oil. ICE

Growth scenario: we are considering the February futures, expiration date is February 12. While the bulls are unconvinced, they now have a psychological advantage due to events in the Red Sea.

Fall scenario: we will continue to hold shorts in anticipation of a dive to 600.00.

Recommendations for Gasoil:

Purchase: think when approaching 600.00. After rising above 830.00. Stop: 770.00. Goal: 1200.00.

Sale: now. Stop: 830.00. Goal: 600.00 (revised).

Support – 731.75. Resistance – 815.75.

Natural Gas. CME Group

Growth scenario: we are considering the February futures, expiration date is January 29. The levels are inconvenient for shopping. Off the market.

Fall scenario: selling is possible, however, tensions in the Red Sea may continue to push prices higher.

Natural gas recommendations:

Purchase: no.

Sale: now. Stop: 3.600. Goal: 2.600. Reduce the risk on the transaction by 2 times from the standard one.

Support – 2.600. Resistance – 3.403.

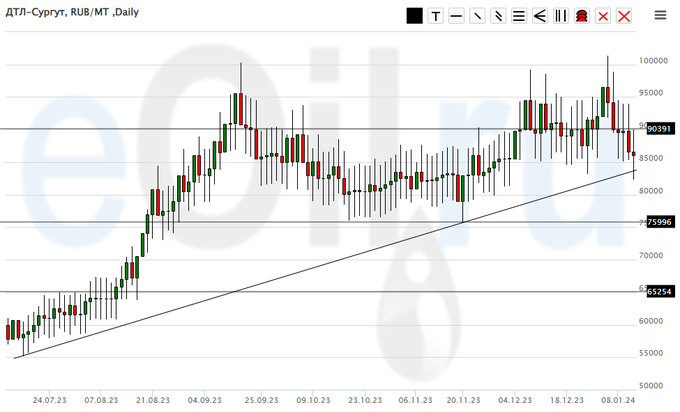

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to remain outside the market. Prices are too high for interesting purchases.

Fall scenario: we will continue to hold shorts. There may be some reduction in case of a move below 80,000.

Recommendations for the diesel market:

Purchase: no.

Sale: no. If you are in a position from 90300, move your stop to 96000. Target: 65000.

Support – 75996. Resistance – 90391.

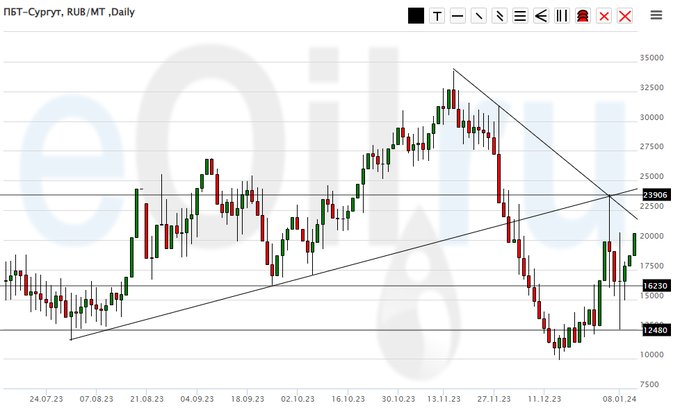

Propane butane (Surgut), ETP eOil.ru

Growth scenario: buying from current levels is not interesting. Off the market.

Fall scenario: you can sell at current prices, but the situation is not the most comfortable. Volatility is too high. A short of 23,000 would look better.

Recommendations for the PBT market:

Purchase: no.

Sale: when approaching 23,000. Stop: 26,000. Target: 15,000. Consider the risks!

Support – 16230. Resistance – 23906.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will remain long. We continue to hope that the market will not go below 2700.

Fall scenario: we remain outside the market, prices are low.

Helium Market Recommendations:

Purchase: no. If you are in a position from 3200, keep your stop at 2700. Target: 5000.

Sale: no.

Support – 2758. Resistance – 3426.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers decreased by 2.3 thousand contracts. A small number of buyers entered the market, sellers retreated. The bears still control the market.

Growth scenario: we are considering March futures, expiration date is March 14. We have almost reached 580.0. Question: buy now or wait? Let’s choose to wait.

Fall scenario: corn is falling. She is dragging wheat down, but it will be difficult for her to go below 570.0.

Recommendations for the wheat market:

Purchase: on a rollback to 580.0. Stop: 560.0. Goal: 700.0. Think in case of growth above 625.0.

Sale: no.

Support – 579.5. Resistance – 614.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should keep in mind that this is data from three days ago (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open asset manager short positions than long positions. Over the past week, the difference between long and short positions of managers increased by 36.3 thousand contracts. A sharp influx of sellers and a retreat of buyers. The Bears strengthened their advantage.

Growth scenario: we are considering March futures, expiration date is March 14. We are waiting for prices to arrive in the area of 420.0. We’ll buy there.

Fall scenario: the probability of a move to 420.0 increased with the red close on Friday. We keep short.

Recommendations for the corn market:

Purchase: when approaching 420.0. Stop: 407.0. Goal: 600.0.

Sale: no. If you are in a position from 470.0, move your stop to 467.0. Target: 422.0 (revised).

Support – 421.0. Resistance – 468.3.

Soybeans No. 1. CME Group

Growth scenario: we are considering March futures, expiration date is March 14. Rebound after an aggressive fall. But we’ll hold off on shopping for now.

Fall scenario: we will continue to hold shorts. Overall we reached 1200.0. Lower levels are also possible. If it falls below 1190, you can increase your position.

Recommendations for the soybean market:

Purchase: not yet.

Sale: no. If you are in a position from 1295.0, move your stop to 1284.0. Goal: 1000.0?!

Support – 1201.7. Resistance – 1281.2.

Gold. CME Group

Growth scenario: the threat of a fall by 1910 (1810) has become less due to events around Yemen, but it is still relevant. We are holding off on shopping for now.

Fall scenario: the threat of a downward breakdown of the growing channel remains. The dollar may continue to strengthen its position.

Recommendations for the gold market:

Purchase: no.

Sale: no. Those who are selling from 2090, move the stop to 2084. Target: 1910 (1810).

Support – 2012. Resistance – 2063.

EUR/USD

Growth scenario: let’s take a break for a week, although we do not deny the potential weakness of the dollar in the future.

Fall scenario: keep short. There is a prospect of a move to 1.0720.

Recommendations for the euro/dollar pair:

Purchase: no.

Sale: no. If you are in a position from 1.1050, move your stop to 1.1060. Target: 1.0720 (1.0000?!).

Support – 1.0876. Resistance – 1.0998.

USD/RUB

Growth scenario: It is possible that the bulls will be broken next week. Off the market.

Fall scenario: shorts from current levels look incorrect. Selling if it rises to 90.00 is possible.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: when approaching 90.00. Stop: 91.00. Goal: 75.00?!!!

Support – 87.71. Resistance – 92.83.

RTSI

Growth scenario: we are considering March futures, expiration date is March 21. We are growing due to companies’ announcements of dividends, as well as due to the strengthening of the ruble. A correction is imminent, so let’s aggressively tighten the stop order.

Fall scenario: most likely we will reach 117,000, further growth is unlikely to be possible without some kind of doping. For example, from rising oil prices. A downward rollback is possible from this level.

Recommendations for the RTS Index:

Purchase: no. If you are in a position from 105000, move your stop to 114400. Target: 124500.

Sale: think as you approach 117,000.

Support – 112130. Resistance – 116760.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.