15 April 2024, 10:36

Price forecast from 15 to 19 April 2024

-

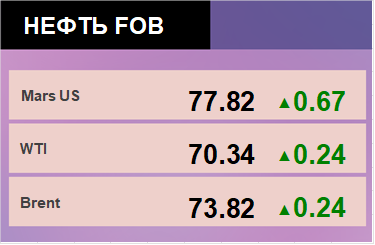

Energy market:

Now in order to predict price fluctuations you need to know about missiles and air defense systems, P/E ratios and other multiples are a thing of the past, and so is a CFA degree.

I should have studied tourism. I’d know where to get away from it all. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

Well… the Persians sent their fiery greetings to the Jews. And they said no way, we’ll ship you something soon. And so on and so forth. And it should be like before, people go out with clubs into the field and there, locally, without traumatizing the civilian population to find out all the issues.

OPEC in its report cheerfully wrote that we are going to see an increase in fuel demand. Of course we are. I bet everyone’s rushing to build up their strategic reserves. And what to do? In fact, the forecast of demand growth up to 107.3 million barrels per day in the 4th quarter of 2025 is a bit ambitious, but perhaps it will happen, but not due to the development of economies, but due to the growing horror on a planetary scale. And then all the excitement will die down. We will ride horses, if not two-headed ones.

People are seriously speculating about the price of oil per barrel at 100 dollars. Of course, it will continue to rise if you take Iran and Russia out of the market. You’ll get 150, you’ll get 200. And this will lead to higher inflation in the West, higher interest rates, cooler economies, higher unemployment. Only the collapse will happen a year after we reach, for example, 150 dollars per barrel. At the same time, somewhere in Tyumen, the same barrel will be available for 10 dollars. And with such a difference, the demand for small tankers and for desperate guys will increase.

Grain market:

The USDA report confirmed good gross harvest volumes for wheat, corn and soybeans. The data did not have a big effect on the market, but in general it is clear that there is no strong fundamental support for price growth at the moment. We can expect a 5 — 10% increase by mid-May, no more than that.

The prospect of developing exchange trading of grain in Russia may stumble upon the necessity of dumping to conclude as many contracts as possible in conditions of shortage of reserve currencies already this fall. Yes, it will be possible to get some quotations inside the country, but they will all rest on a certain price bar in order to be able to carry out export operations in a large volume. However, this is only a theory for now. All of a sudden, all the BRICS countries will trade for rubles.

If the frenzy in the Middle East intensifies, it threatens to shift even more trade routes out of the region. And no airplanes will fly there. And that’s all outright harm.

USD/RUB:

Supplies of non-ferrous metals from Russia for trading on the London Stock Exchange will be stopped from April 14. This means that Russian companies will be selling their products at a discount, and in an unknown currency. No «pounds and sterlets» for you.

If the problem with payments for the supplied resources intensifies, it will lead to the fact that the balance of foreign trade will become negative, and this would be very unfortunate, because then the last of the money will have to be taken out of the pants to maintain the current exchange rate. It would be possible to somehow digest this situation with sanctions without the SWO, but with huge expenditures on defense, the prospects are bleak.

We are waiting for a slow, smooth weakening of the ruble during the year. For now we need to visit 95.50, then 97.00. Further on, it’s foggy.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 2.5 thousand contracts. Bulls and bears entered the market in approximately equal volumes. Buyers control the situation.

Growth scenario: we consider April futures, expiration date April 30. We do not buy. We are waiting for a pullback to 84.00.

Downside scenario: shorts from 92.70 are possible. Selling from current levels is also possible, considering the fact that we have been drawn a «pincer».

Recommendations for the Brent oil market:

Buy: when approaching 84.00, as well as 82.40, 80.40. Stop: 79.00. Target: 110.00. Count the risks!

Sell: now(90.13) and when touching 92.70. Stop: 93.06. Target: 84.00 (82.40). Count the risks!

Support — 88.68. Resistance — 92.70.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 2 units to 506.

US commercial oil inventories rose by 5.841 to 457.258 mln barrels, with +0.9 mln barrels forecast. Gasoline inventories rose by 0.715 to 228.531 million barrels. Distillate stocks rose 1.659 to 117.728 million barrels. Cushing storage inventories fell -0.17 to 32.993 million barrels.

Oil production is unchanged at 13.1 million barrels per day. Oil imports fell by -0.184 to 6.434 million barrels per day. Oil exports fell by -1.314 to 2.708 million barrels per day. Thus, net oil imports rose by 1.13 to 3.726 million barrels per day. Oil refining fell by -0.3 to 88.3 percent.

Gasoline demand fell -0.624 to 8.612 million barrels per day. Gasoline production fell -0.538 to 9.442 million barrels per day. Gasoline imports rose 0.242 to 0.73 million barrels per day. Gasoline exports rose 0.115 to 0.978 million barrels per day.

Distillate demand fell by -0.51 to 2.985 million barrels. Distillate production rose by 0.033 to 4.639 million barrels. Distillate imports rose 0.059 to 0.163 million barrels. Distillate exports rose 0.184 to 1.58 million barrels per day.

Demand for petroleum products fell by -2.056 to 19.236 mln barrels. Petroleum products production fell by -1.195 to 21.397 mln barrels. Imports of refined petroleum products rose 0.701 to 2.367 million barrels. Exports of refined products rose by 0.915 to 6.853 million barrels per day.

Propane demand fell -0.124 to 1.305 million barrels. Propane production was unchanged at 0 remaining at 2.673 million barrels. Propane imports fell -0.017 to 0.108 million barrels. Propane exports rose 0.072 to 1.491 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 6.3 th. contracts. Buyers and sellers arrived on the market, but buyers came more. Bulls keep control.

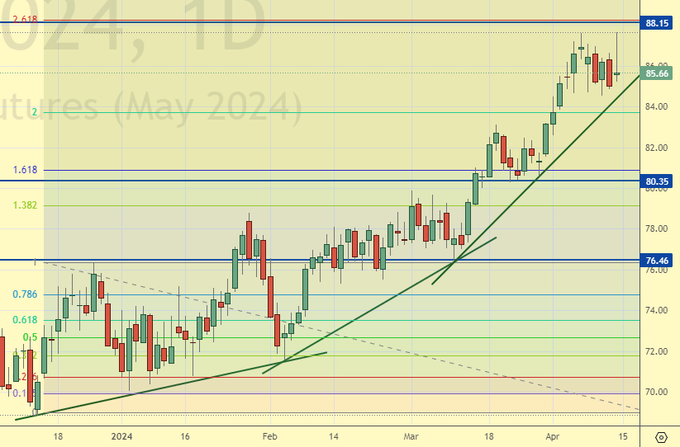

Growth scenario: we consider May futures, expiration date April 22. The market is high. For new purchases we need a correction, at least to 80.00, better to 76.70.

Downside scenario: shorting from 88.10 area will be reasonable. Current levels can also be considered for selling.

Recommendations for WTI crude oil:

Buy: ideal on a pullback to 76.70. Stop: 75.70. Target: 100.00.

Sell: now (85.66) and at touching 88.10. Stop: 88.60. Target: 80.00. Count the risks!

Support — 80.35. Resistance — 88.15.

Gas-Oil. ICE

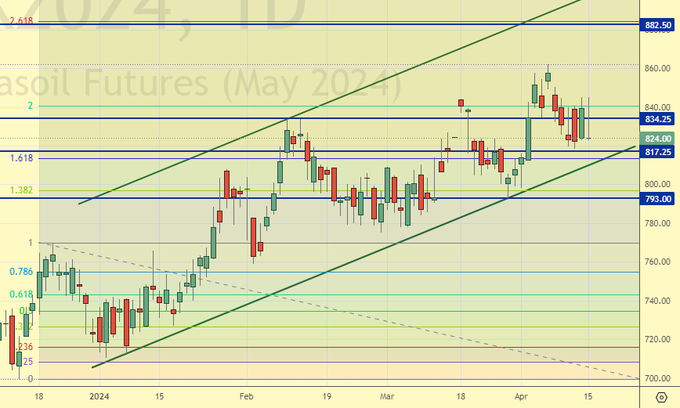

Growth scenario: we consider May futures, expiration date May 10. It is possible to try to buy. Ideally from 770.0, but these levels the market may not give.

Downside scenario: when approaching 882.50 it is possible to sell. At the moment the market has not built all the units up (wave theory), so our current expectation of growth is justified. If we pass above 880.00 without correction, we will go to 980.00.

Gasoil Recommendations:

Buy: Now (824.00). Stop: 810.00. Target: 980.00.

Sell: on approach to 882.50. Stop: 892.50. Target: 800.00.

Support — 817.25. Resistance — 834.25.

Natural Gas. CME Group

Growth scenario: we consider May futures, expiration date April 26. We hold longs. We will continue to count on growth.

Downside scenario: refrain from selling, market is low.

Natural Gas Recommendations:

Buy: no. Who is in position from 1.7630, keep your stop at 1.6900. Target: 2.770?!

Sale: no.

Support — 1.682. Resistance — 1.945.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we get above 85000, we don’t think about buying. Out of the market.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 61602. Resistance — 77051.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: let’s be persistent in buying. Moreover, the situation is technically favorable for it.

Downside scenario: we stay out of the market. Movement to 5000 is possible, but selling is risky now.

PBT Market Recommendations:

Buy: Now. Stop: 9800. Target: 25000.

Sale: no.

Support — 10078. Resistance — 16719.

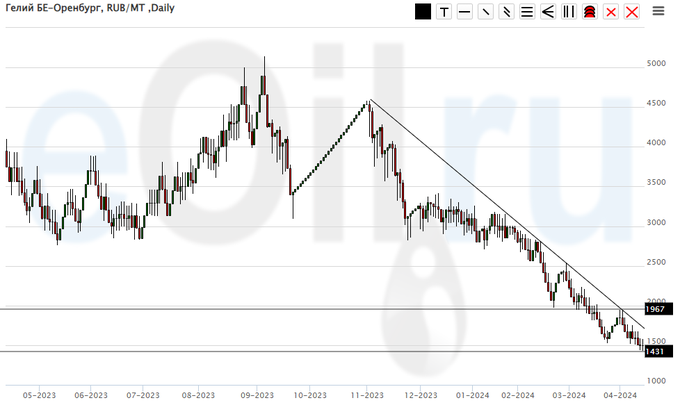

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market gives us a chance to take it at a low price. And we will take that chance.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: Now (1500). Stop: 1300. Target: 3500. Who is in position from 1600, move the stop to 1300. Target: 3500.

Sale: no.

Support — 1431. Resistance — the area of 1967.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 5.2 th. contracts. Both buyers and sellers left the market in insignificant volumes. Bears keep control.

Growth scenario: we consider May futures, expiration date May 14. We continue to want the market at 515.0. it is possible to buy at current levels, but the chances of survival of the position are small.

Downside scenario: the market continues to look down. The movement target at 516.0 looks natural. A deeper dive is unlikely to take place.

Recommendations for the wheat market:

Buy: now. Stop: 547.0. Target: 650.0. On approach to 516.0. Stop: 502.0. Target: 650.0.

Sell: no. Who is in position from 565.0, keep stop at 577.0. Target: 515.0.

Support — 548.2. Resistance — 574.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 5.7 thousand contracts. Both buyers and sellers were leaving the market, buyers did it more actively. Bears keep control.

Growth scenario: we consider the May futures, expiration date May 14. The green candle of Friday gives hope for the continuation of the upward movement. We hold long.

Downside scenario: do not sell. There are doubts in continuation of the fall.

Recommendations for the corn market:

Buy: no. Who is in position from 432.0, keep stop at 423.0. Target: 500.0.

Sale: no.

Support — 424.4. Resistance — 438.4.

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date is May 14. Not a bad situation for the bulls. There will be buyers here. And we’ll buy, too.

Downside scenario: out of the market for now.

Recommendations for the soybean market:

Buy: now (1174.0). Stop: 1148.0. Target: 1300.0.

Sale: no.

Support — 1151.0. Resistance — 1225.4.

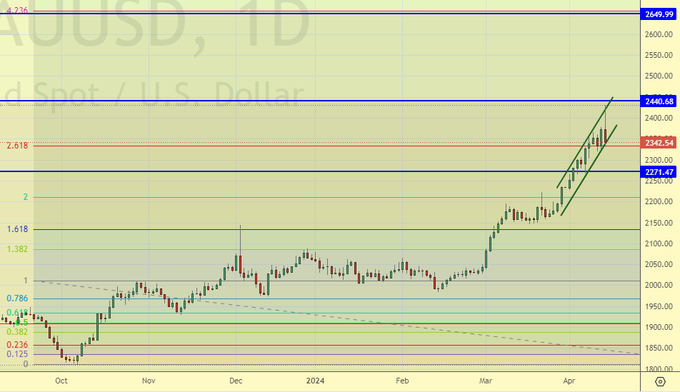

Growth scenario: strong overbought in this market is embarrassing. Don’t buy.

Downside scenario: we see an excessively strong growth and a strong pullback for the day, which is inconvenient for selling. We can look for opportunities when the price returns to the area of 2420.

Gold Market Recommendations:

Buy: not yet.

Sell: on approach to 2420. Stop: 2450. Target: 2100.

Support — 2271. Resistance — 2440.

EUR/USD

Growth scenario: you should definitely not buy now. Most likely, the dollar will continue its strengthening for the next two weeks.

Downside scenario: it is possible to short from 1.0700. Given the lack of slowdown in inflation in the U.S., we can assume that the Fed will keep rates at 5.5% for a long time. However, they may not have to raise them even more.

Recommendations on euro/dollar pair:

Buy: no.

Sell: when approaching 1.0700. Stop: 1.0830. Target: 1.0360 (1.0000).

Support — 1.0447. Resistance — 1.0721.

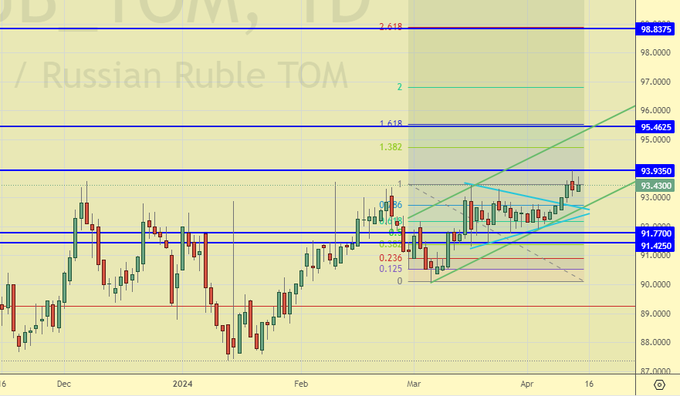

USD/RUB

Growth scenario: hold longs. Talks that we are not being paid for the supply of resources are getting stronger. Also, the legalization of mining and cryptocurrencies in general raises questions, i.e. there is nothing to pay with, nothing to accept payments with. Talks about negotiations with Ukraine from our side are frankly alarming.

Downside scenario: we will not sell. None of the experts are seriously talking about the ruble strengthening.

Recommendations on dollar/ruble pair:

Buy: no. Who is in position from 92.79 and 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 91.77. Resistance — 93.93.

RTSI

Growth scenario: we consider the June futures, expiration date is June 20. We are waiting for 116000 to be taken in order to consider buying. In our view, the economic environment is unhealthy because of the dim outlook.

Downside scenario: we keep short, slightly move the stop up, luckily it didn’t work, the 116000 area can be very viscous for the bulls to take.

Recommendations on the RTS index:

Buy: no.

Sell: No. Who is in position from 114900, move your stop to 115700. Target: 100000?!!!!

Support — 112430. Resistance — 119190.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.