Price forecast from 12 to 16 of April 2021

-

Energy market:

There are no special news drivers on the market at the moment. We don’t even see any technical movement.

Next week we are waiting for the OPEC report, where, as always, the public repentance of the local analysts on the assessment of consumption for the current year is of interest. The inflated expectations of the beginning of the year faced consumption problems related to the pandemic in Europe. Let’s see if the OPEC forecast will be revised. Downgrading forecasts are always a breakage for an organization interested in increasing demand.

Among the long-term factors that can support the quotes, we note a decrease in investments in new production projects, which can create a certain tension in the market.

OPEC + countries will return to the market up to 5 million barrels per day without any problems, but a more serious excess of demand over supply can force prices to rise.

Grain market:

The USDA has published a report on gross yield and stocks for the 20/21 season. We see a fall in ending stocks by 1.88% for wheat and by 1.33% for corn. This fact will create additional support for prices until it is clear that harvest volumes for the 21/22 season will be excellent, if not record high. In the current environment, a drop in gross harvest compared to last season will lead to further price increases.

Recall that the next USDA report will already give a forecast for the season 21/22.

China is expected to continue replacing corn with wheat in 2021 as high corn prices continue to motivate local processors to seek cheaper feed alternatives amid signs of a recovery in the country’s pig population.

In March, domestic corn prices in China were $ 434 per tonne, while wheat prices were $ 390 per tonne. We see that prices are outrageous, and this situation can serve as a foundation for the continued growth of prices on the stock exchanges.

USD/RUB:

Donbass looms over the ruble. If events move to an active phase, or simply, a war breaks out in the DPR and LPR, then the consequences for the national currency will become extremely unpleasant. The Central Bank will be forced to burn some of its reserves in order to soften the fall, but we can hardly avoid visiting the 80.00 mark.

It is possible that inflationary pressure will force the Central Bank on April 23 (in 10 working days) to raise the rate again. This will partly increase interest in the ruble, but if the external background deteriorates, this will not help the national currency. Tomorrow is the Cosmonautics Day, we wish the ruble to stay on the ground, that is, around 77.00.

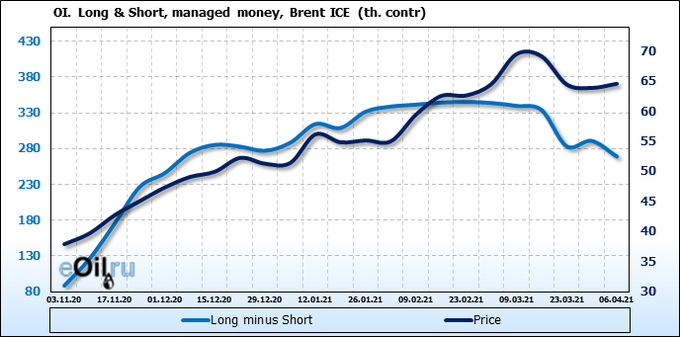

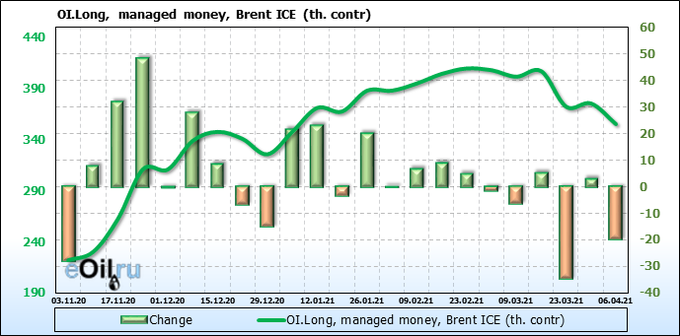

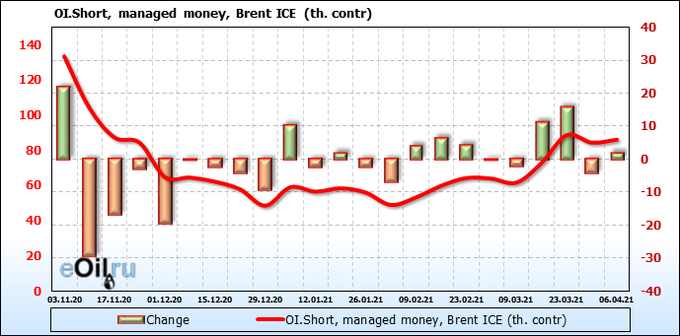

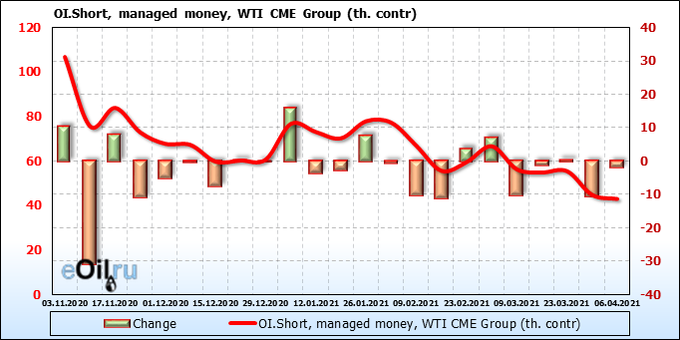

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

We see that the support from the buyers is fading away. Most likely, this should lead to a downward movement of prices next week. Small upward climbs will be considered a provocation.

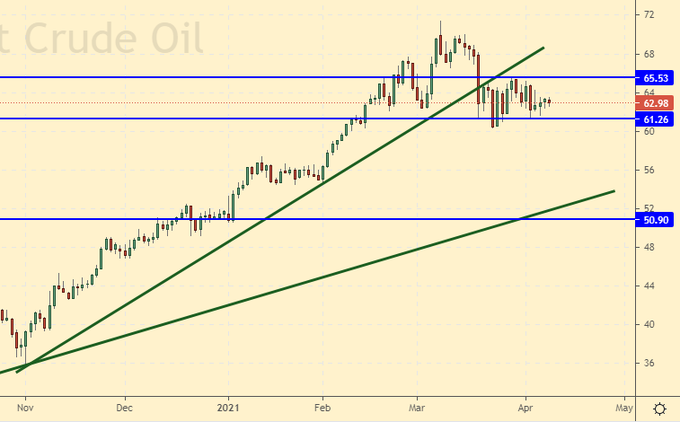

Growth scenario: April futures, expiration date April 30. We do not buy. We are waiting for the continued fall of the market.

Falling scenario: we will recommend selling. A sharp departure at 66.00 is possible, but it should not lead to growth.

Recommendation:

Purchase: no.

Sale: when approaching 66.00. Stop: 66.20. Target: 51.00. Whoever is in positions between 64.00 and 63.00, keep the stop at 66.20. Target: 51.00.

Support — 61.26. Resistance — 65.53.

WTI. CME Group

Fundamental US data: the number of active drilling rigs has not changed at 337 units.

US commercial oil reserves fell by -3.522 to 498.313 million barrels. Gasoline inventories rose by 4.044 to 234.588 million barrels. Distillate stocks rose by 1.452 to 145.547 million barrels. Stocks at Cushing’s storage fell 0.735 to 46.322 million barrels.

Oil production fell by -0.2 to 10.9 million barrels per day. Oil imports rose 0.119 to 6.264 million barrels per day. Oil exports rose 0.26 to 3.434 million barrels per day. Thus, net oil imports fell by -0.141 to 2.83 million barrels per day. Oil refining rose by 0.1 to 84 percent.

Gasoline demand fell by -0.11 to 8.781 million barrels per day. Gasoline production fell by -0.06 to 9.279 million barrels per day. Gasoline imports rose 0.678 to 1.297 million barrels per day. Gasoline exports rose 0.251 to 0.792 million barrels per day.

Distillate demand fell by -0.449 to 3.664 million barrels. Distillate production fell by -0.099 to 4.639 million barrels. Distillate imports fell by -0.116 to 0.325 million barrels. Distillate exports rose 0.389 to 1.092 million barrels per day.

The demand for petroleum products fell by -1.077 to 19.236 million barrels. Production of petroleum products fell by -0.809 to 19.929159 million barrels. Imports of petroleum products rose by 0.194 to 2.555 million barrels. Exports of petroleum products rose by 0.491 to 4.745 million barrels per day.

Propane demand fell by -0.017 to 1.659 million barrels. Propane production fell by -0.084 to 2.285 million barrels. Propane imports fell by -0.015 to 0.133 million barrels. Propane exports fell by -0.417 to 0.713 million barrels per day.

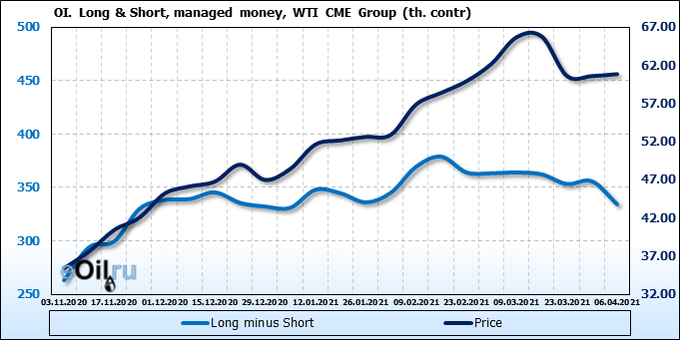

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Bulls are actively leaving WTI futures, which creates strong structural prerequisites for the continuation of the fall.

Growth scenario: May futures, the expiration date is April 20. The risk of passing by 46.00 remains. Let’s pause. We admit that in case of growth above 65.00 we will reconsider our approaches.

Falling scenario: if you jump to 64.00, you can sell. Bulls are leaving the market, which creates strong preconditions for a short.

Recommendation:

Purchase: no.

Sale: when approaching 64.00. Stop: 66.20. Target: 46.00. Those who are in positions between 61.00 and 61.50, move the stop to 66.20. Target: 46.00.

Support — 55.89. Resistance — 63.23.

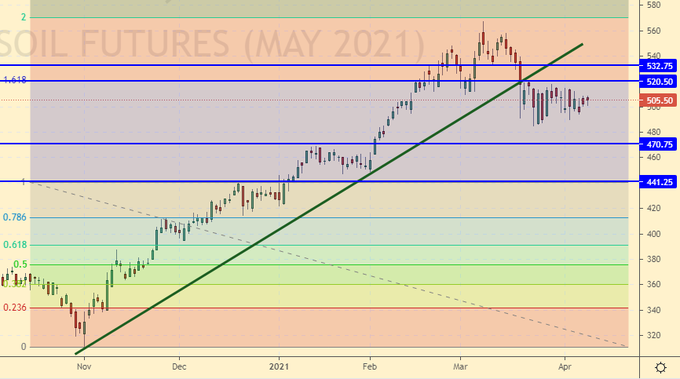

Gas-Oil. ICE

Growth scenario: May futures, the expiration date is May 12. We continue to wait for the market to fall. We do not buy.

Falling scenario: sell here. We can get to 530.0, but we’re unlikely to go higher.

Recommendation:

Purchase: no.

Sale: now and up to 536.0. Stop: 543.0. Target: 410.0. Whoever is in positions between 520.0, 515.0 and 510.0, keep the stop at 543.0. Target: 410.0.

Support — 470.75. Resistance — 520.50.

Natural Gas. CME Group

Growth scenario: May futures, expiration date April 28. Gas upsets us because it doesn’t want to grow. And we will buy anyway, since we have only «zero» below. True, even that sometimes is not the limit.

Falling scenario: do not sell. The prices are low.

Recommendation:

Purchase: now. Stop: 2.430. Target: 3.615.

Sale: no.

Support — 2.453. Resistance — 2.690.

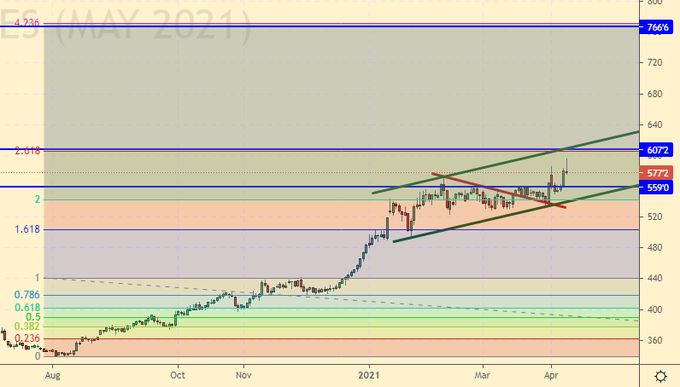

Wheat No. 2 Soft Red. CME Group

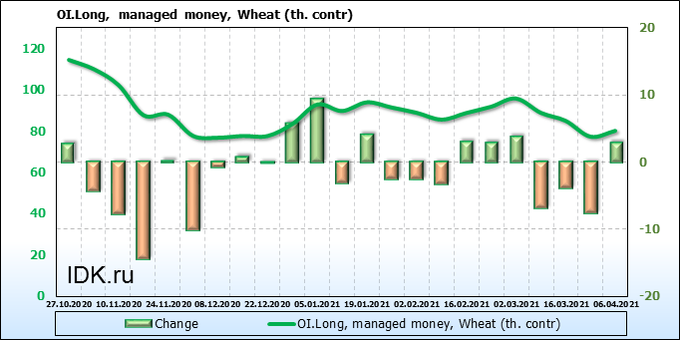

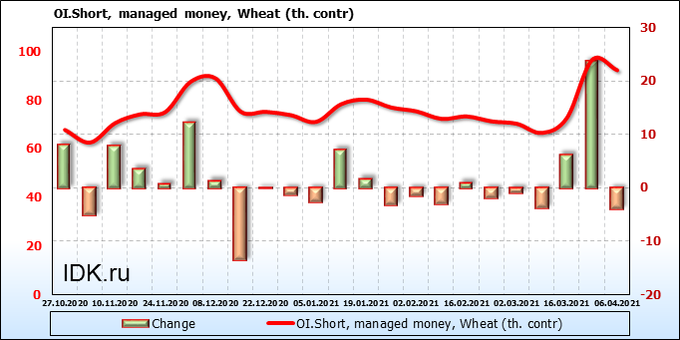

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

We observe some buyers interest and at the same time some loss of interest on the part of sellers. All this led to the formation of support in the 600.0 area, which may develop into a search for new ideas somewhere above.

Growth scenario: May futures, expiration date May 14. Unfortunately, the market did not give us the opportunity to buy from 580.0. The bounce of prices up on Friday makes us react to the movement. We will buy, but with a sour expression on our face.

Falling scenario: the market did not work normally. We took a movement from 660.0 to 633.0, but this is not what we expected. We are out of the market. No matter how we go to 770.0.

Recommendation:

Purchase: now. Stop: 614.0. Target: 770.0? !!!

Sale: no.

Support — 602.6. Resistance — 666.2.

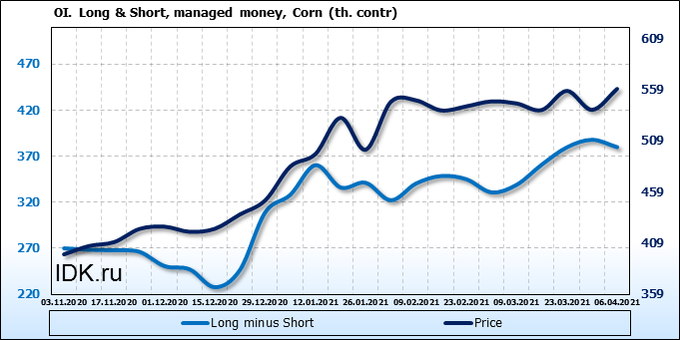

Смотрим на объемы открытого интереса управляющих. Вы должны учитывать, что это данные трехдневной давности (за вторник прошедшей недели), они же и самые последние из тех, что публикует биржа CME Group.

Speculators have lost interest in what is happening on the corn market, while prices continue to push towards 600.0.

Growth scenario: May futures, expiration date May 14. We do not open new positions. Note that a pass above 615.0 will force us to speculate about the 765.0 level.

Falling scenario: from the point of bears view, nothing has changed; when approaching 605.0, sell. It is possible that the corn will complete the fifth wave of impulse and turn down.

Recommendation:

Purchase: not yet.

Sale: on touch 604.0. Stop: 616.0. Target: 532.0.

Support — 559.0. Resistance — 607.2.

Soybeans No. 1. CME Group

Growth scenario: May futures, expiration date May 14. We will buy after the growth above 1470.0. There is a chance that soybeans will reach 1720.0. Falling scenario: after sharp movements you don’t want to sell. Let’s go short only after falling below 1380.0.

Recommendation:

Purchase: after rising above 1470.0. Stop: 1410. Target: 1720.0.

Sale: after falling below 1380.0. Stop: 1436.0. Target: 1180.0.

Support — 1362.0. Resistance — 1459.4.

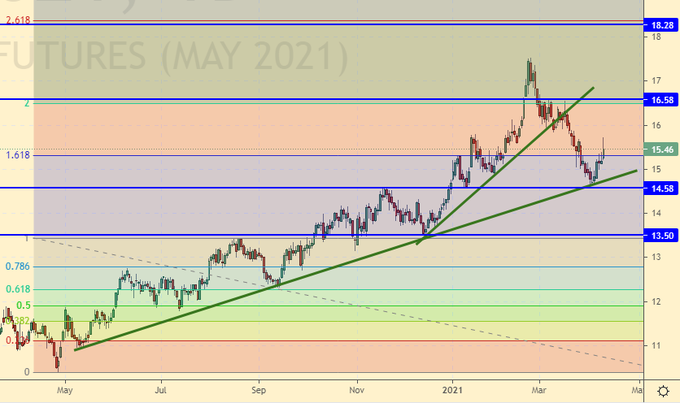

Sugar 11 white, ICE

Growth scenario: May futures, the expiration date is April 30. Withdrawn from support. We will keep the previously opened positions counting on continued growth.

Falling scenario: the short from 18.20 continues to be the main idea. We are waiting for the arrival of prices to this level. The short from the current levels does not look obligatory.

Recommendation:

Purchase: no. whoever is in position from 14.60, keep the stop at 14.40. Target: 18.20.

Sale: only when approaching the area at 18.20. Stop: 18.60. Target: 16.60.

Support — 14.58. Resistance — 16.58.

Сoffee С, ICE

Growth scenario: May futures, the expiration date is May 18. Long is not obvious. Only a return above 135.00 will make us buy.

Falling scenario: short is also not obvious, although the situation is tactically more attractive. You can sell, but the chances are not great.

Recommendation:

Purchase: on touch 115.20. Stop: 113.80. Target: 157.00. Or think after a rise above 135.00.

Sale: now. Stop: 129.70. Target: 115.00.

Support — 120.30. Resistance — 129.60.

Gold. CME Group

Growth scenario: only after the day closes above 1760, we will buy. The dollar is showing weakness due to the US programs to stimulate the economy, so growth by 1850 is possible.

Falling scenario: we do not open new sell positions. Prices exited the falling channel upwards and, in addition, we do not see signals for a downward reversal of the market.

Recommendations:

Purchase: after the day’s close above 1760. Stop: 1724. Target: 1850.

Sale: no.

Support — 1719. Resistance — 1756.

EUR/USD

Growth scenario: we too cheerfully bounced off the top from 1.1700 without reaching 1.1610, but meanwhile, we really wanted to. The current growth forces us to reconsider what is happening in the market. In case of a rise above 1.2020, we will buy. We took a move from 1.2050 to 1.1870. Few. Modestly.

Falling scenario: we went up two figures from the minimum, one might say from scratch. We will not sell any more yet. We take a break. Recommendations:

Purchase: after rising above 1.2020. Stop: 1.1870. Target: 1.3000 ?!

Sale: no.

Support — 1.1709. Resistance — 1.1989.

USD/RUB

Growth scenario: the ruble was unable to show anything worthwhile and limply lost ground under the pressure of political squabbles. We keep longs. Note that the ultimate targets may be above 80.00. We listen and read the news.

Falling scenario: we see nothing interesting except the red candle on Wednesday. Apparently the Central Bank tried, or the Ministry of Finance auctions played a role. No matter. We are above 77.00 and this is far from 75.00.

Purchase: now. Stop: 76.30. Target: 80.00. Those who are in the position from 75.10, move the stop to 75.90. Target: 80.00.

Sale: no.

Support — 76.60. Resistance — 79.56.

RTSI

Growth scenario: “only growth above 147,000 will force us to speculate cautiously about the possibility of moving to 160,000,” we wrote a week earlier. We see that there is no talk of any growth yet. We are out of the market.

Falling scenario: we entered a position on a breakdown of 141000 downwards. Not the best sell, but there is no particular choice here. Most likely, futures on the RTS index will continue to fall due to deteriorating investment sentiment, which is associated with the aggravation of the situation in eastern Ukraine.

Note that the SP500 approached its theoretical highs. From the current levels, which are 4100 — 4200 according to the American index, the little light show on the stock market can begin at any day and hour.

Recommendations:

Purchase: no.

Sale: no. Who is in the position from 141000, move the stop to 143600. Target: 100000.

Support — 130420. Resistance — 142490.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.