18 October 2021, 12:17

Price forecast from 18 to 22 of October 2021

-

Energy market:

After it became clear that the oil sheiks and princes would not dance to the American tune, and Novak, by the way, would not either, oil prices continued to rise. We will most likely hit around $ 90.00 per barrel before the market makes its first attempt to cool off a bit.

At current price levels, US mining is becoming profitable. We see an increase in the number of active drilling rigs to 445 units and an increase in oil production to 11.4 million barrels per day. As soon as the freezing EU citizens step on their throats for European bureaucrats, or on something else, and they also give the green light to Nord Stream 2, it will immediately become easier for European wallets, as energy prices will be adjusted.

At the moment, the situation is such that some of the poor countries of Eastern Europe, let’s not point with the finger which ones, have become hostages of the European policy of determining a fair price for gas. Nobody can pay $ 800 per thousand cubic meters under long-term contracts, but no one wants to freeze in winter either.

Grain market:

Grain prices have remained stable since the October USDA report was released. Corn is more prone to weakness than wheat, but so far we have not seen sales.

It is worth noting that with oil prices close to $ 100 per barrel and the clear poverty of a large number of people as a result of the introduction of quarantine measures against COVID-19, the topic of bioethanol will flourish with renewed vigor, especially in Latin America and the United States, which will clearly affect the final stocks of corn by the summer of 2022. The growth in biofuel production will clearly support the grain market this season.

We expect moderate growth in the grain market due to expensive fuel and high prices for fertilizers, which are unlikely to fall, especially nitrogen ones, since fertilizer producers in Europe are forced to stop due to high gas prices.

The medium-term outlook for the wheat market remains strong, especially as the number of Chinese virus infections in Russia and the UK continues to rise. Ukraine and Romania also cannot boast with a good state of affairs, there is an increase in the number of COVID-19 cases, and these are wheat-producing and exporting countries.

USD/RUB:

The first rule: as soon as people from the West want to negotiate, it means that things do not go as they (the West) want it to go. Why did Nuland, who is Victoria, come? With such energy prices, the Kremlin could replace the US Federal Reserve as the center of influence. But it is necessary to pour a new philosophy into the ruble. But it remains under question whether they will do it or will not. It is already clear that the topic of «green energy» risks being shelved for 10 years. There is not enough wind and sun for everyone.

If you missed the revolution, do not get lost and lead it. It looks like this is what is happening now between banking groups and bitcoin. China has banned everything, and the US has approved the first ETF for Bitcoin.

Citizens! It is a sin to own gold! Buy zeros and ones on a flash card. Invest in the emptiness. There is a strong feeling that the bankers will take people in. Families and clans think in decades, not in quarters. We are waiting for Bitcoin at $ 100,000, $ 1 million, $ 2 million each. And then it is all over. The circus will assemble the tent and leave for the sunset. We live in an interesting time.

Brent. ICE

We are looking at the volumes of open interest in Brent. You should take into account that this is data from three days ago (for Tuesday of the past week), it is also the most recent of those published by the ICE.

Over the past week, the difference between long and short positions of managers decreased by 25.8 thousand contracts. Some of the bulls stop believing in the further growth of the market. We see an outflow of money from long positions and active opening of shorts. Thus, articles about hedge funds investing in oil and public forecasts of $ 100 per barrel are currently considered a provocation.

Growth scenario: considering the October futures, the expiration date is October 29. We will continue to hold the long, but upon reaching 88.00 we will close the position.

Fall scenario: sell when approaching 88.00. The market should correct at least to 80.00.

Recommendation:

Purchase: no. Those who are in positions between 74.00 and 75.00, move the stop to 82.10. Target: 87.80. You can close 25% of the position.

Sell: on touch 87.80. Stop: 92.30. Target: 78.00.

Support — 82.17. Resistance — 88.29.

WTI. CME Group

Fundamental data from the USA: the number of active drilling rigs increased by 12 units to 445 units.

US commercial oil reserves increased by 6.088 to 426.975 million barrels. Gasoline inventories fell by -1.958 to 223.107 million barrels. Distillate stocks fell by -0.024 to 129.307 million barrels. Stocks at Cushing’s storage fell by -1.968 to 33.551 million barrels.

Oil production increased by 0.1 to 11.4 million barrels per day. Oil imports fell by -1.041 to 5.994 million barrels per day. Oil exports rose by 0.4 to 2.514 million barrels per day. Thus, net oil imports fell by-1.441 to 3.48 million barrels per day. Refining fell by -2.9 percent to 86.7 percent.

Gasoline demand fell by -0.241 to 9.186 million barrels per day. Gasoline production rose by 0.239 to 9.605 million barrels per day. Gasoline imports fell by -0.545 to 0.543 million barrels per day. Gasoline exports rose by 0.295 to 0.699 million barrels per day.

Distillate demand fell by -0.433 to 3.932 million barrels. Distillate production fell by -0.072 to 4.706 million barrels. Distillate imports fell by -0.108 to 0.19 million barrels. Distillate exports rose by 0.2 to 0.968 million barrels per day.

The demand for petroleum products fell by -1.651 to 19.875 million barrels. Production of petroleum products fell by -0.315 to 20.829313 million barrels. Imports of petroleum products fell by -0.254 to 2.331 million barrels. Exports of petroleum products rose by 0.657 to 5.498 million barrels per day.

Propane demand fell by -0.165 to 1.116 million barrels. Propane production fell by -0.037 to 2.313 million barrels. Propane imports fell by -0.002 to 0.089 million barrels. Propane exports rose 0.12 to 1.37 million barrels per day.

We are looking at the volumes of open interest in WTI. You should take into account that this is data from three days ago (for Tuesday of the past week), it is also the most recent of those published by the ICE.

Over the past week, the difference between long and short positions of managers increased by 16 thousand contracts. Unlike Brent, bulls are still active for the American grade of oil. We assume that sentiment may change dramatically next week. The market will turn down by Friday.

Growth scenario: consider the December futures, expiration date November 19. As long as the market is growing, we will not interfere with it. We stand in longs until 84.00.

Fall scenario: we will sell when the market approaches 84.00. The market is close to its technical highs.

Recommendation:

Purchase: no. Anyone in the position from 73.20, move the stop to 79.80. Target: 84.00. You can close 25% of the position.

Sale: when approaching 84.00. Stop: 86.30. Target: 76.00.

Support — 78.96. Resistance — 84.07

Gas-Oil. ICE

Growth scenario: considering November futures, expiration date November 11. While there are doubts that we can go above 750.00. If this does happen, we will enter long with little capital risk.

Fall scenario: after the appearance of a long red daily candle, you can sell, provided that the market is below 750.00.

Recommendation:

Purchase: after rising above 770.00. Stop: 730.00. Target: 870.00. Reduce your standard risk of capital loss by three times.

Sell: after a long red candle appears. Stop above the high of such a candle. Target: 640.0.

Support — 726.25. Resistance — 871.75.

Natural Gas. CME Group

Growth scenario: consider the December futures, expiration date November 26. You can purchase here. Growth prospects remain. Winter will come to America too.

Fall scenario: we do not sell. The market is capable of reaching 8.777 on high gas demand.

Recommendation:

Purchase: on touch 5.100. Stop: 4.400. Target: 8.777. Or now. Stop: 5.400. Target: 8.777.

Sale: no.

Support — 5.429. Resistance — 6.191.

Wheat No. 2 Soft Red. CME Group

We are looking at the volumes of open interest of wheat managers. You should take into account that this is data from three days ago (for Tuesday of the past week), it is also the most recent one that is published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 14.6 thousand contracts, with more short positions than long ones. For now, speculators are betting on price reductions. The technical picture in the market remains bullish, but if selling pressure continues to rise, we will turn down.

Growth scenario: considering the December futures, the expiration date is December 14. For now, let’s put on a visit to the 780.0 level. We keep longs.

Fall scenario: we will sell only when we approach 780.0. We are out of the market.

Recommendation:

Purchase: no. Whoever is in positions between 717.0 and 720.0, keep the stop at 710.0. Target: 777.0 (840.0).

Selling: Thinking When Approaching 777.0.

Support — 712.4. Resistance — 764.0.

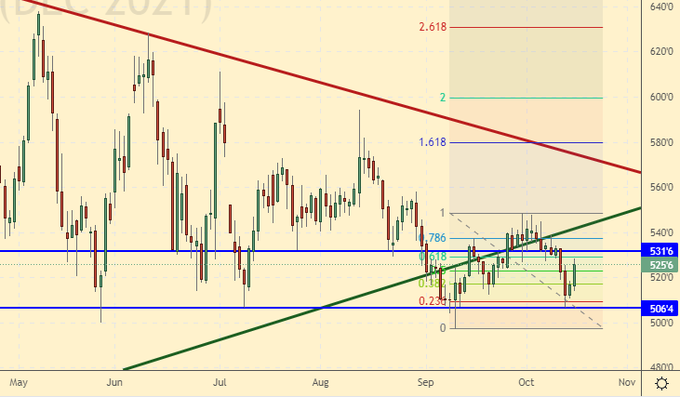

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 25.4 thousand contracts. Sellers appeared on the market, but they did not manage to achieve great success. Note that if the pressure increases, we will go below the 500.0 level, which will lead to a move to 430.0.

Growth scenario: considering the December futures, the expiration date is December 14. We will purchase in case of growth above 555.0. The situation at the moment looks balanced.

Fall scenario: it makes sense to keep the short open a week ago. In addition, those who wish can sell here at current prices.

Recommendation:

Purchase: after rising above 555.0. Stop: 522.0. Target: 600.0.

Sale: now. Stop: 548.0. Target: 430.0. Whoever is in positions between 540.0 and 530.0, keep the stop at 548.0. Target: 430.0.

Support — 506.4. Resistance — 531.6.

Soybeans No. 1. CME Group

Growth scenario: considering November futures, expiration date November 12. Soybeans are most likely to reach the level of 1100.0. We do not purchase.

Fall scenario: hold the shorts. The situation is completely on the side of the sellers.

Recommendation:

Purchase: no.

Sale: no. Those who are in positions between 1400.0 and 1350.0, move the stop to 1290.0. Target: 1111.0.

Support — 1094.2. Resistance — 1257.2.

Sugar 11 white, ICE

Growth scenario: considering the March futures, the expiration date is February 28. We will keep on to recommend to purchase. The situation is not unambiguous, but there are still chances for growth.

Fall scenario: we do not open new sell positions, we hold the old ones.

Recommendation:

Purchase: think when approaching 18.20. Or now. Stop: 19.30. Target: 23.20.

Sale: no. Whoever is in the position between 19.50 and 20.00, keep the stop at 20.67. Target: 18.20.

Support — 19.40. Resistance — 21.24.

Сoffee С, ICE

Growth scenario: considering the December futures, the expiration date is December 20. We keep longs and expect a move to 244.00.

Fall scenario: wait for the rise to 244.00 and sell.

Recommendation:

Purchase: no. Anyone in the position from 192.00, keep the stop at 190.00. Target: 244.00.

Selling: after falling below 190.00. Stop: 206.0. Target: 150.00.

Support — 190.65. Resistance — 218.35.

Gold. CME Group

Growth scenario: the bulls could not gain a foothold above 1800. Only after the growth above this level will we purchase.

Fall scenario: if the market falls below 1740.0, we will sell.

Recommendations:

Purchase: think after a rise above 1800.

Sell: after falling below 1740. Stop: 1770. Target: 1650.

Support — 1748. Resistance — 1810.

EUR/USD

Growth scenario: we will keep longs. We do not open new positions. In November, the dollar may strengthen its position.

Fall scenario: we are waiting for the rise to 1.1670, where you can add to the previously opened shorts. You can also open new positions who have not done so yet.

Recommendations:

Purchase: no. Those who are in the position from 1.1540, move the stop to 1.1530. Target: 1.2100 ?!

Sell: on touch 1.1670. Stop: 1.1720. Target: 1.1060. Those who are in the position from 1.1900, move the stop to 1.1730. Target: 1.1060.

Support — 1.1519. Resistance — 1.1644.

USD/RUB

Growth scenario: when approaching the level of 70.80, purchases are possible. However, the rise in energy prices could push the pair to 67.60. Let’s keep this in mind.

Fall scenario: we will continue to hold the short opened eight weeks ago from 73.90. We do not open new sell positions. Most likely next week we will reach the target at 70.80.

Recommendations:

Purchase: when approaching 70.80. Stop: 70.30. Target: 80.00 ?!

Sale: no. Anyone in the position from 73.90, keep the stop at 73.67. Target: 70.80 (67.60).

Support — 70.71. Resistance — 71.54.

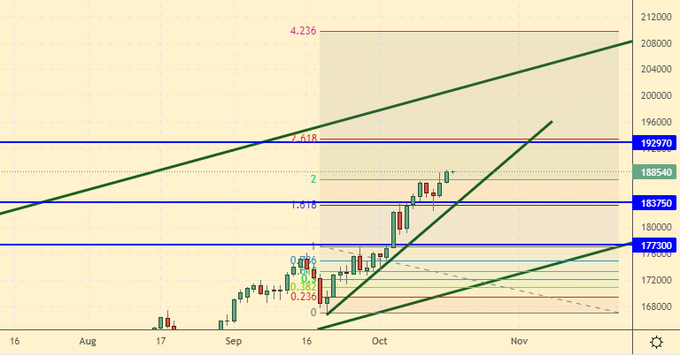

RTSI

Growth scenario: 193,000 target is close. If you have open purchase positions, then this level will be a strong resistance level. If we break it up, then the move to 209000 will become possible.

Fall scenario: those who wish can sell when they approach 193,000. It is advisable to follow the background that will develop in the markets. Consider risks and stay focused.

Recommendations:

Purchase: no.

Sell: when approaching 193000. Stop: 197000. Target: 150000?!

Support — 183750. Resistance — 192970.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.