11 January 2021, 11:35

PRICE FORECAST from 11 to 15 of January 2021. A year in advance

-

Energy market:

Let’s try to list the main fears for 2021 for the oil market:

The virus is mutating and will not be defeated. As a result, China will rise, then Europe, then total quarantine on Earth. So far, we regard the scenario of such horror as unlikely. Yes, 1 — 2% of the population is under the threat, but this is not a reason to stop buying oil.

The stock market will start falling. In fact, it’s high time. We are waiting for the FED to change tune about signs of accelerating inflation in the United States. And this moment will be a landmark for the entire 2021 year. We will closely monitor him on an ongoing basis. As soon as the stock indexes go down due to the growth prospects of the dollar, the oil market will collapse.

OPEC + will disintegrate and a price war will begin. This scenario is slightly more likely than the likelihood of a new killer virus emerging. For this year, the parties had to get used to it. A bath of vodka was drunk out, albeit remotely, and a mountain of sherbet was eaten during the bargaining process. Who will scuttle these efforts? We are embarrassed, but we believe that politicians still have nuggets of wisdom. Otherwise, we will again see -40 dollars per barrel for the nearest futures.

The fourth fear in the series is both laughter and sin. Biden, not having time to come, will leave the post for health. We have to admit that the market will fall by ten percent on such news, but then everything will be fine. They will change for him, for her, for someone else. In general, everything will be changed.

The fifth fear, the most coveted by some Russians. Just like that, that’s what you want and that’s it. The dollar will collapse. The only question is how, because the world debt is 270 trillion dollars and all run into debt in the American currency, and it must be taken somewhere in order to give it away. But, here it is worth recognizing that if the Democrats in the United States continue to distribute money, then the dollar index will have a chance for weakening. In this case, the entire commodity market will receive support from a gradual decline in the American currency. We do not believe that the dollar will collapse. However, if in Washington, people with horns on their heads take a congress every week, then anything is possible.

Grain market:

Let’s list what we can expect in 2021 and how this will affect the cost of cereals.

The spread of the virus and widespread quarantine measures such as those currently being taken in Europe are capable of keeping grain prices from falling during the summer months. The greater the fear is, the greater the desire to create more substantial food supplies. The grain market will only benefit from the pandemic, sadly.

Low yield in season 21/22. The likelihood of such a scenario is very high, given the La Niña phenomenon and record gross collection rates over the past ten years. Sooner or later there will be a breakdown. It is likely that this will happen this year. If this happens, then prices by the end of the year may be at levels that are 25 — 30% higher than the current ones. Wheat will trade at 800 cents and corn at 650 cents a bushel.

The crisis in the stock market can become a bearish factor in the grain market, provided that there are no new global sites of infection. It will provoke its growth in the value of the American currency in the event that there is a prospect of growth in interest rates in the United States. With an expensive dollar, it is not customary to talk about high prices for goods. In this case, the rise in grain prices can only cause a physical shortage.

USD/RUB:

What will happen to the ruble?

Rather, no bones will be broken. By «bad» we mean the growth of the dollar / ruble pair above 90.00. Such a weakening requires tough sanctions and oil below $ 30.00 per barrel. It is unlikely that we will see something like that.

The Americans will only arrange for the first quarter of the person and take matters, they will not have time for Russia. Then, in Berlin and Paris, together with Beijing, they probably appreciated the expression of American democracy during the New Year holidays, and therefore, conservative Russia, regularly supplying resources, is much better than the old, feeble cowboy with slurred speech.

While the West is recovering from the pandemic, getting vaccinated and counting losses, the ruble has a chance to go to the region of 65.00. Further strengthening is not yet visible.

Today we are looking at large pictures built on weekly candles. We look forward three to six months.

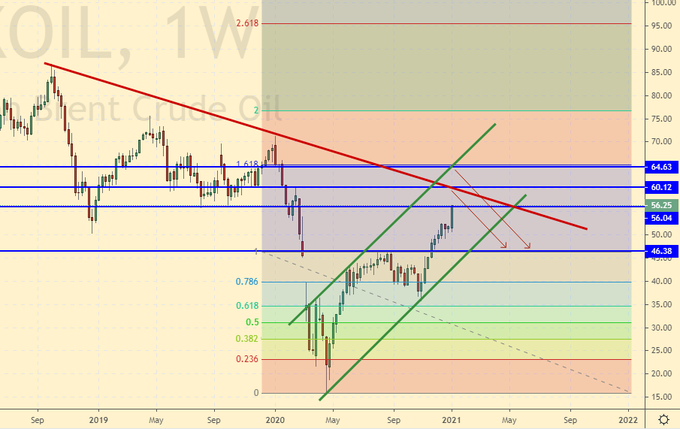

Brent. ICE

Growth scenario: oil is capable of reaching 60.00. Growth to 65.00 is unlikely. After a positive reaction to Biden’s approval by the US President, a correction is ripe for the market.

Falling scenario: you can sell after the appearance of a red daily candle with a long body. For now, the Arabs are voluntarily reducing production, which supports the market, but they will not give in for a long time.

Recommendation:

Purchase: look for opportunities on the falling to 47.00.

Sale: when a long red daily candle appears, provided that the market is below 60.00. Stop: 61.00. Target: 47.00.

Support — 46.38. Resistance — 60.12.

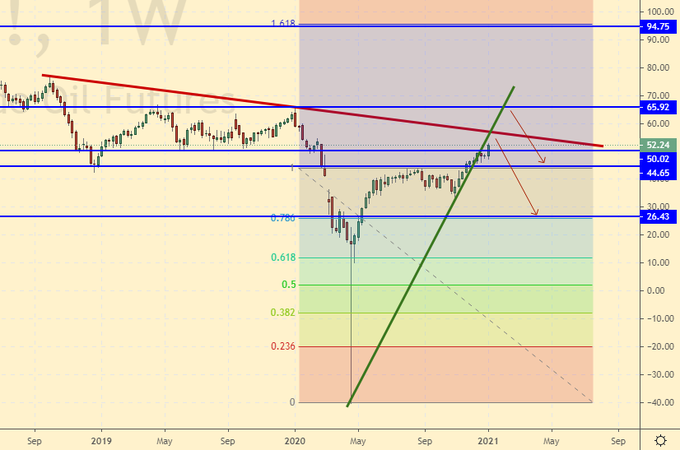

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 8 units to 275 units.

US commercial oil reserves fell by -8.01 to 485.459 million barrels. Gasoline inventories rose by 4.519 to 241.081 million barrels. Distillate stocks rose by 6.39 to 158.419 million barrels. Inventories at the Cushing storage facility increased by 0.792 to 59.202 million barrels.

Oil production has not changed at 11 million barrels per day. Oil imports rose 0.043 to 5.369 million barrels per day. Oil exports rose 0.007 to 3.632 million barrels per day. Thus, net oil imports rose by 0.036 to 1.737 million barrels per day. Oil refining rose by 1.3 to 80.7 percent.

Gasoline demand fell by -0.687 to 7.441 million barrels per day. Gasoline production fell -1.181 to 8.01 million barrels per day. Gasoline imports fell by -0.156 to 0.445 million barrels per day. Gasoline exports fell by -0.028 to 0.883 million barrels per day.

Distillate demand fell by -0.653 to 2.941 million barrels. Distillate production rose 0.146 to 4.785 million barrels. Distillate imports fell by -0.317 to 0.302 million barrels. Distillate exports rose 0.01 to 1.232 million barrels per day.

The demand for petroleum products fell by -2.263 to 17.054 million barrels. Production of petroleum products fell -1.569 to 19.089 million barrels. Imports of petroleum products fell by -0.5 to 1.533 million barrels. Exports of petroleum products fell by -0.789 to 4.867 million barrels per day.

Propane demand fell by -0.053 to 1.702 million barrels. Propane production fell by -0.072 to 2.257 million barrels. Propane imports rose 0.043 to 0.181 million barrels. Propane exports fell by -0.559 to 1.075 million barrels per day.

Growth scenario: if the market can pass the 55.00 area, we can go to 65.00. Purchases from current levels look extremely late. We need a correction.

Falling scenario: if a struggle starts around 55.00, then you can look for opportunities for sales. While there are no daily red candles, we are out of the market.

Recommendation:

Purchase: no. A correction is needed, at least to the 40.00 area.

Sale: no. We are waiting for a red long daily candle.

Support — 44.65. Resistance — 65.92.

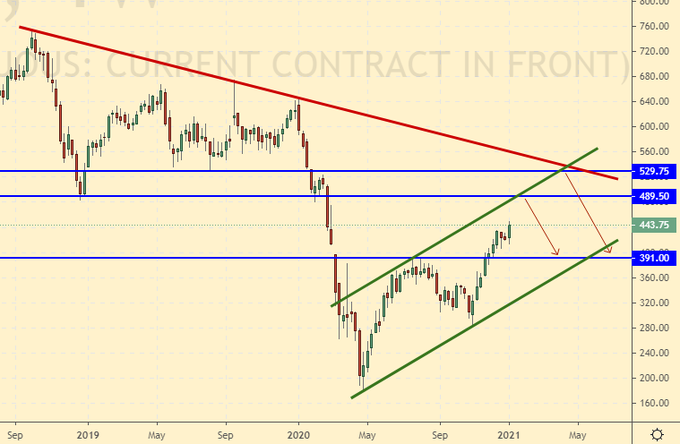

Gas-Oil. ICE

Growth scenario: we see that the market really wants to reach 500.0. Growth to 530.0 is also possible. For purchases, we need a rollback to the 400.0 area.

Falling scenario: from 500.0 and 530.0, you can look for opportunities for short. Out of the market so far. Recommendation:

Purchase: no. Wait for a rollback to 400.0.

Sale: no. Think when approaching 500.0 and 530.0.

Support — 391.00. Resistance — 489.50.

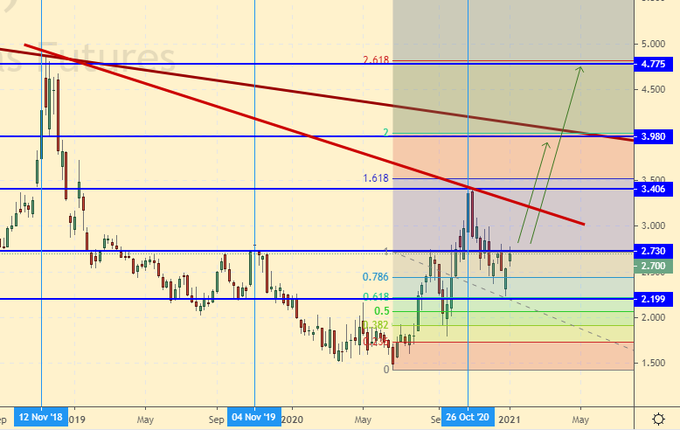

Natural Gas. CME Group

Growth scenario: it is possible that cold weather in Europe will help quotes. You can buy here.

Falling scenario: we did not believe in a fall in the middle of winter, and we still do not believe. Recommendation:

Purchase: now. Stop: 2.210. Target: 4.775.

Sale: no.

Support — 2.199. Resistance — 3.406.

Wheat No. 2 Soft Red. CME Group

Growth scenario: the five-wave structure is clearly visible. The upward pulse is complete. A rollback to the area of 550.0 is likely. You can buy there.

Falling scenario: seductive short entry candle, small body, long shadow up. You can sell. Consider the risks carefully.

Recommendation:

Purchase: no. We look forward to a fall to 550.0. Sale: now. Stop: 680.0. Target: 555.0.

Support — 592.2. Resistance — 675.2.

Growth scenario: a rollback is about to happen. If it does not exist, and we go higher, then a move to 620.0 is possible.

Falling scenario: here you can sell when reversal signals appear, for example, a long red daily candle, the market is overbought.

Recommendation:

Purchase: no. Need a rollback, or a pass above 530.0. Sale: possible when a long red daily candle appears.

Support — 412.2. Resistance — 522.6.

Soybeans No. 1. CME Group

Growth scenario: speculative upward ideas will appear only after falling to the 1200 area. The market is able to go to 1450.0 — 1550.0, but it is unlikely to be able to go higher.

Falling scenario: the market is clearly overheated. We are waiting for a long red candlestick down and sell. When touching 1500.0, you can sell without additional downward reversal signals. Recommendation:

Purchase: no. Need to rollback to 1200.

Sale: no. When a long red daily candle appears down. Or by touching 1500.0.

Support — 1210.0. Resistance — 1467.0.

Sugar 11 white, ICE

Growth scenario: growth to 17.70 is visible. However, the current levels are perceived to be too high. We are waiting for a rollback.

Falling scenario: when touching 17.70, selling is mandatory. A rollback to 132.0 is possible from the current levels, we work it out at small intervals. Recommendation:

Purchase: no. We need a rollback to 13.20.

Sale: possible. Stop: 16.30. Target: 13.20.

Support — 14.26. Resistance — 17.74.

Сoffee С, ICE

Growth scenario: market in range. A slight advantage for the bulls. You can buy with a near stop order. The second attempt to enter the long can be made by fall to 104.60.

Falling scenario: don’t sell yet. There is a chance for a reversal, but for confirmation we need a fall below 120.0.

Recommendation:

Purchase: now. Stop: 119.0. Target: 175.0.

Sale: after falling below 120.0. Stop: 126.10. Target: 104.60.

Support — 104.40. Resistance — 132.75.

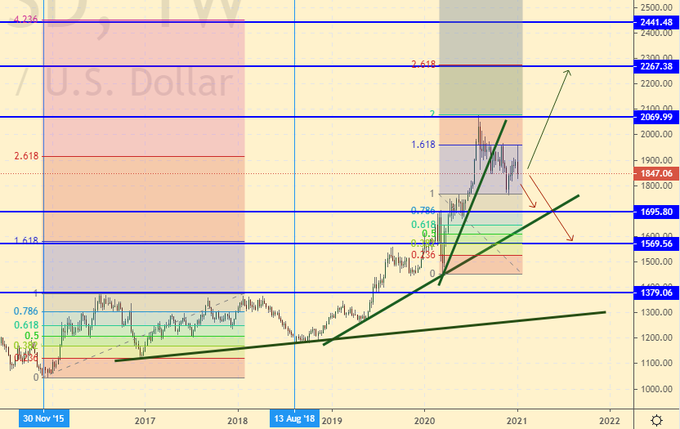

Gold. CME Group

Growth scenario: pullbacks to 1700 and 1600 can be used for purchases, but only if the US futures interest rate remains near zero.

Falling scenario: Biden was approved, the gold market sank. The further development of events will depend on what the democrats will do after gaining power. A short from 2260 looks natural. Selling from current levels is possible, but the chances of success are slim.

Recommendation:

Purchase: no. We need a rollback to 1700 (1600). Sale: on touch 2260 required. Or now. Stop: 1930. Target: 1600.

Support — 1695. Resistance — 2069.

EUR/USD

Growth scenario: the pair is able to reach 1.2700, then we will see a rollback to 1.2000. A fall from current levels may lead to a move to 1.1460. You can enter a long with a near stop order.

Falling scenario: sell here. The move to 1.1400 is visible.

Recommendation:

Purchase: now. Stop: 1.2070. Target: 1.2700.

Sale: now. Stop: 1.2330. Target: 1.1460.

Support — 1.1923. Resistance — 1.2727.

USD/RUB

Growth scenario: there is little fundamental negative for the ruble. Nevertheless, the growth of the dollar on the wave of Biden’s accession and his inauguration is possible. Long is possible.

Falling scenario: corrections to 70.0 and 65.00 will not be surprised. The Americans have lost political points due to the dirty presidential race, which gives the currencies of developing countries a chance to strengthen.

Purchase: now. Stop: 72.30. Target: 82.00.

Sale: now. Stop: 75.60. Target: 65.00.

Support — 70.57. Resistance — 75.26.

RTSI

Growth scenario: key level 150,000. In case of growth above it, the index will go to 165,000, possibly 175,000. Thus, in case of a breakdown up to 150,000, we are looking for opportunities to enter a long.

Falling scenario: want to sell here. If a long red daily candle appears, you can do it.

Recommendation:

Purchase: think after rising above 150,000.

Sale: if a long red daily candle appears, provided the market remains below 150,000. Stop: 151,000. Target: 100,000.

Support — 133380. Resistance — 165480.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.