Price forecast from 1 to 5 of March 2021

-

Energy market:

Oil trading ended with a strong fall on Friday. Overbought on the market has long been formed, and now it, with a high chance of probability, will be destroyed and the situation will return to normal. It is likely that the market will retrace 10% from the highs. Further developments will depend on OPEC +. The meeting will take place on March 3rd.

If the parties to the transaction begin to rock the boat and demand an increase in quotas, then this can lead to negative consequences. The market is clearly not strong yet. There is no clarity about the ability of states to effectively confront a pandemic, even as vaccinations begin. For example, the Czech Republic, the center of Europe, is currently in an extremely difficult situation, the government has again tightened quarantine measures there since March 1. Any aggressive action to increase production can easily bring down the market and erase all the gains that have been made in recent months.

Grain market:

The European Commission has raised its forecast for soft wheat exports from the European Union for the 2020/21 season to 27 million tons from the 26 million it had forecast last month. Remains of soft wheat at the end of the season were revised downward to 9.5 million tons.

Net income for Canadian farmers in 2020 jumped 21.8% year-over-year to C $ 16.5 billion, driven by an increase in the value of staple crops. Net income is projected to rise another 6.8% this year to C $ 17.6 billion.

The grain market in March will be prone to correction. Positive spring expectations will temporarily ease the heat on wheat and corn.

Note that if in the near future the rates of vaccination are weak, then the horrors of last year in the form of logistical problems in ports and the desire of importing states to increase stocks for a rainy day may return, which will lead to another round of price increases.

USD/RUB:

Mr. Powell gave a very mild speech last week in the US Congress, reporting six months and outlining the prospects. According to him, the FRS expects inflation in a couple of years, but for now the process of pumping up the economy with money will be carried out, since it, they say, is still weak.

Weakness is true. Some initial applications for unemployment benefits at the level of 800 thousand are worth what. But the market did not believe that there would be no inflation and growth of rates.

Considering that the main task of financial tycoons is to deceive the crowd to the last moment at the moment of the global reversal of the market, the speech of Powell and any other official at this stage should be interpreted with the opposite sign. All this is done with only one purpose: to make you buy at the highs. At the same time, the guys from Wall Street will unload their long positions by giving shares to those in need, and those who know a little more, and there probably are, will go short.

The strengthening of the dollar against gold and the euro, as well as the fall in the SP500, give us a hint of the beginning of a reversal. If the first week of March is very red, it could be the beginning of what the enlightened citizens of the entire planet have been waiting for. And they are waiting for the popping of bursting bubbles.

The ruble will feel bad next week amid falling oil and the strengthening of the dollar. Perhaps we will gain a foothold above 75.00 and look at 80.00.

Brent. ICE

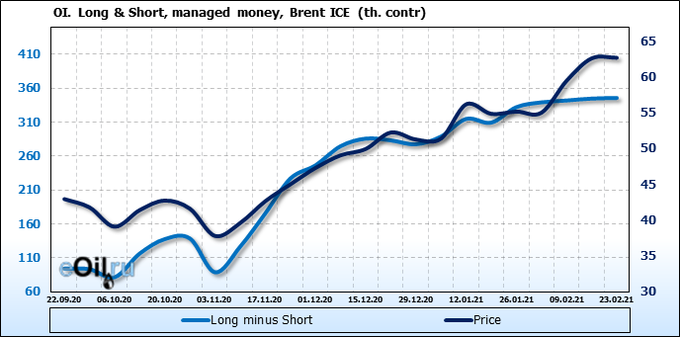

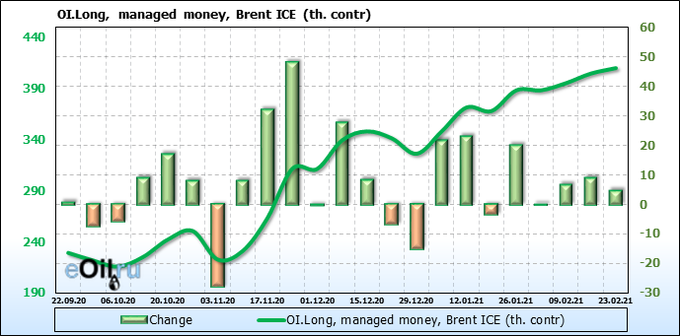

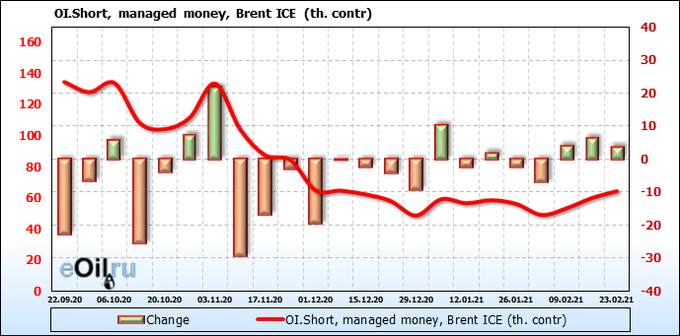

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Sellers and buyers bring money to the market for three weeks in a row. The sharp drop that took place on Friday can be explained by the fact that some of the bulls’ stop orders were triggered. We won’t be surprised if sellers come to the market next week.

Growth scenario: March futures, expiration date March 31. The rollback, which we have been writing about for so long, has begun. If the market goes to the 58.00 area, you can think about buying.

Falling scenario: if you did not sell on Friday, then you can do it at the market open on Monday. There are good prospects for the fall. If the OPEC + countries start talking about an increase in production, we can go to 50.00.

Recommendation:

Purchase: think when approaching 58.00.

Sale: now and when rolled back to 66.00.

Stop: 67.30. Target: 58.00 (51.00).

Support — 61.02. Resistance — 67.37.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 4 units to 309 units.

US commercial oil reserves increased by 1.285 to 463.042 million barrels. Gasoline inventories increased by 0.012 to 257.096 million barrels. Distillate stocks fell -4.969 to 152.715 million barrels. Cushing’s stocks rose by 2.807 to 47.823 million barrels.

Oil production fell -1.1 to 9.7 million barrels per day. Oil imports fell -1.299 to 4.599 million barrels per day. Oil exports fell -1.548 to 2.314 million barrels per day. Thus, net oil imports rose by 0.249 to 2.285 million barrels per day. Refining fell -14.5 to 68.6 percent.

Gasoline demand fell -1.2 to 7.207 million barrels per day. Gasoline production fell -1.295 to 7.736 million barrels per day. Gasoline imports fell by -0.139 to 0.531 million barrels per day. Gasoline exports fell by -0.059 to 0.517 million barrels per day.

Distillate demand fell by -0.522 to 3.932 million barrels. Distillate production fell by -0.953 to 3.621 million barrels. Distillate imports fell by -0.059 to 0.303 million barrels. Distillate exports fell by -0.27 to 0.701 million barrels per day.

The demand for petroleum products fell -1.98 to 18.688 million barrels. Production of petroleum products fell -1.393 to 19.212 million barrels. Imports of petroleum products fell by -0.283 to 1.75 million barrels. Exports of petroleum products fell by -0.271 to 4.431 million barrels per day.

Propane demand fell by -0.918 to 0.951 million barrels. Propane production fell by -0.938 to 1.406 million barrels. Propane imports fell by -0.026 to 0.135 million barrels. Propane exports rose 0.276 to 1.326 million barrels per day.

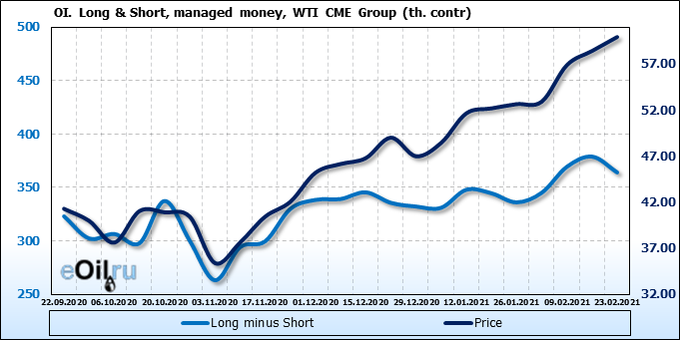

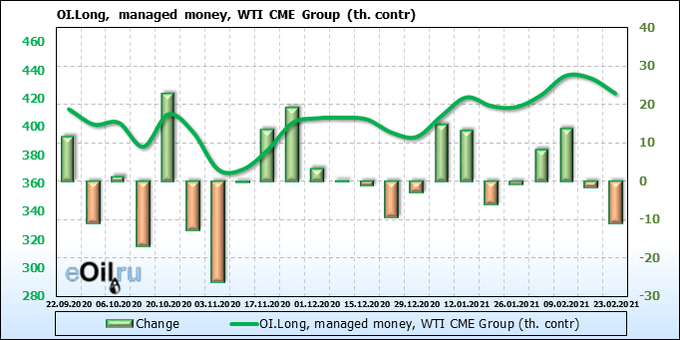

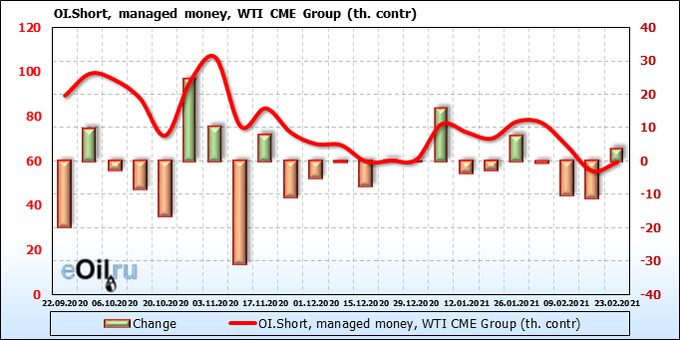

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

We see a change in market sentiment: buyers began to leave, sellers, on the contrary, began to increase their presence. It is highly likely that this trend will continue, as the market began to roll back.

Growth scenario: April futures, expiration date March 22. The correction began. The closest level to which prices may fall is 56.00. At the top, we have the target at 72.00, which we will keep in mind when we buy after the correction is completed.

Falling scenario: entered short. Let’s see what happens. We will count on the special positions of each of the participants in the OPEC + deal.

Recommendation:

Purchase: think when falling to 56.00.

Sale: now. Stop: 63.90. Target: 56.10 (51.60). Consider the risks! Those who are in the position from 62.70, move the stop to 63.90. Target: 56.10 (51.60).

Support — 55.96. Resistance — 63.86.

Gas-Oil. ICE

Growth scenario: March futures, expiration date March 11th. Judging by the behavior of oil, a correction awaits us. We closely follow the development of the plot, prepare money.

Falling scenario: sell here. On Monday, just to be sure, look at how Asia trades. If prices continue to fall, then this will be confirmation, if they correct upward, we can expect the market to fall below 520.0.

Recommendation:

Purchase: not yet.

Sale: now. Stop: 552.0. Target: 455.0 (416.0).

Support — 479.25. Resistance — 549.00.

Natural Gas. CME Group

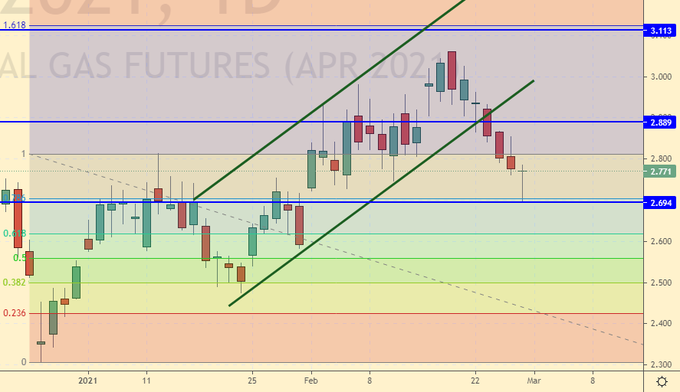

Growth scenario: April futures, expiration date March 29. The cold weather in the southern United States is over. Europe is also warming. Above-zero temperatures are everywhere. However, Europeans’ fear should remain after this winter. We do not expect a fall below 2.50. Prices exited the growing channel, but everything ended in an upward reversal candle. If Monday is green, you can buy.

Falling scenario: we don’t believe in extremely low gas prices. Do not sell.

Recommendation:

Purchase: after Green Monday. Stop: 2.630. Target: 3.615. Anyone in the position from 2.550, keep the stop at 2.630. Target: 3.615.

Sale: no.

Support — 2.694. Resistance — 2.889.

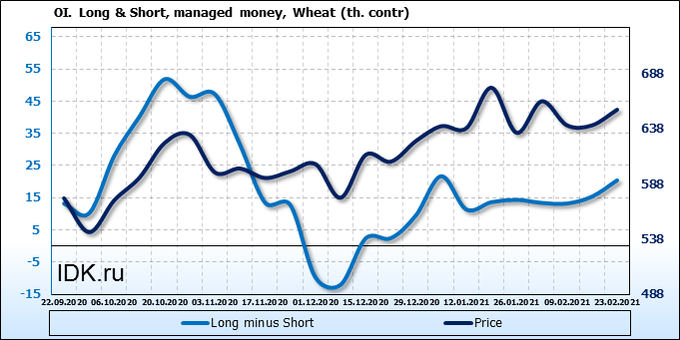

Wheat No. 2 Soft Red. CME Group

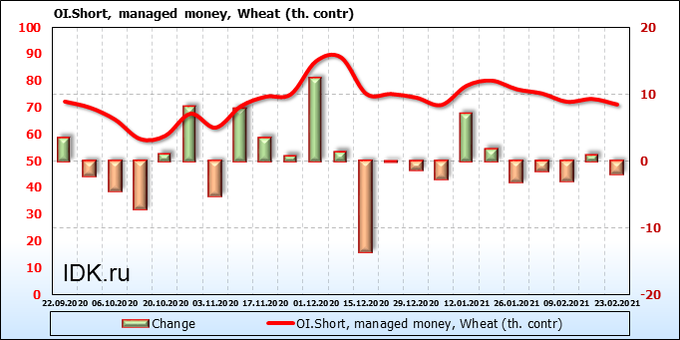

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Buyers sluggishly enter the market, sellers also sluggishly leave it. Trading in a wide range without any strong ideas will be present in the market for the next couple of months. We switched to May futures for wheat, corn, soybeans and sugar.

Growth scenario: May futures, expiration date May 14. “We regard the current situation as a correctional formation before the next round of decline,” we wrote last week. While we can consider ourselves right. We do not buy.

Falling scenario: wait for the market to fall below 650.0 and sell again. We are quite capable of going down to 600.0. Descent to 555.0 is also possible. Recommendation:

Purchase: no.

Sale: after falling below 650.0. Stop: 676.0. Target: 555.0.

Support — 618.2. Resistance — 692.6.

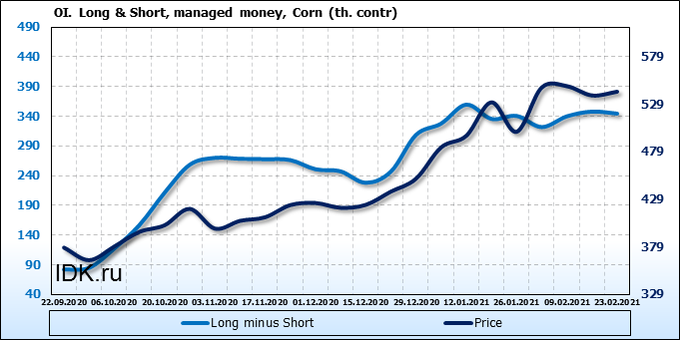

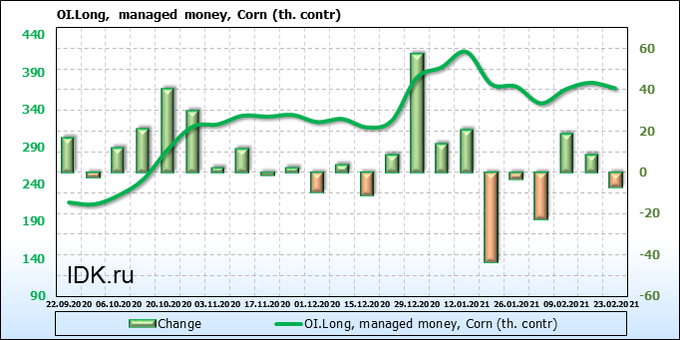

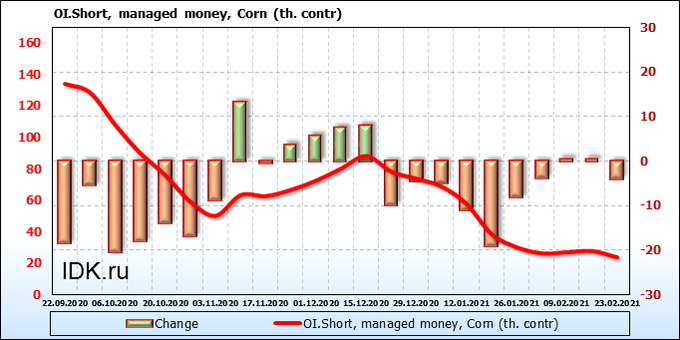

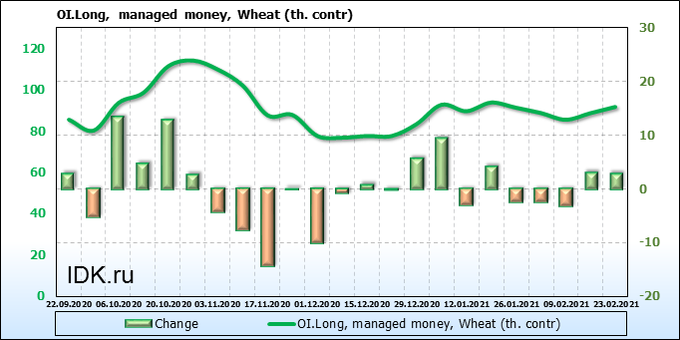

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

We see a small outflow of speculators from the market. The crowd doesn’t see new ideas. Open interest is not our help today.

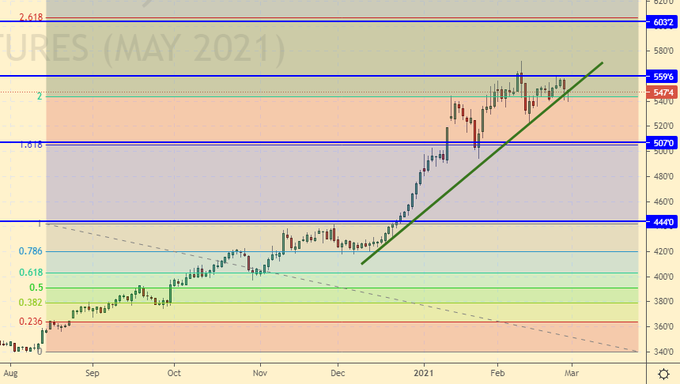

Growth scenario: May futures, expiration date May 14. We continue to wait for the correction. A fall in the area of 485.0 is possible. For a stronger fall, it is necessary that the fears of a pandemic become less. Falling scenario: after the next market fall below 540.0, you can either sell or add to the previously opened shorts.

Recommendation:

Purchase: not yet.

Sale: after falling below 540.0. Stop: 563.0. Target: 486.0. Anyone in the position from 570.0, move the stop to 563.0. Target: 486.0 (445.0).

Support — 507.0. Resistance — 559.6.

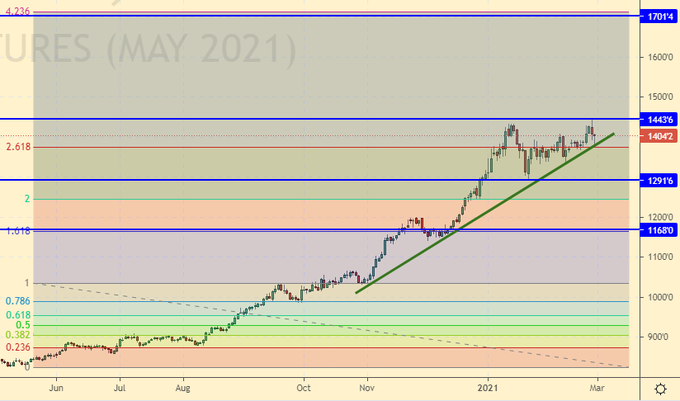

Soybeans No. 1. CME Group

Growth scenario: May futures, expiration date May 14. We continue to wait for a rollback to the area 1200.0 — 1250.0. However, if there is a rise above 1450.0, you will have to buy.

Falling scenario: as before, we recommend selling. You can aggressively. Before the summer months, we may well visit the area 1200.0.

Recommendation:

Purchase: in case of growth above 1452.0. Stop: 1390.0. Target: 1700.0.

Sale: now. Stop: 1452.0. Target: 1180.0.

Support — 1291.6. Resistance — 1443.6.

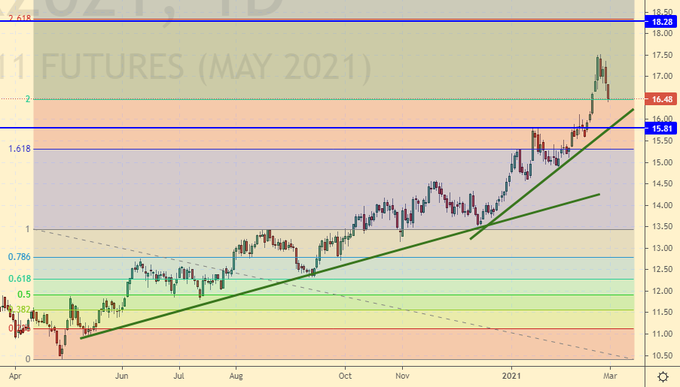

Sugar 11 white, ICE

Growth scenario: May futures, expiration date April 30. We take a break. There are no convenient entry points in the market. The uncertainty is too great.

Falling scenario: a short from 18.20 is quite possible. We will not sell at the current levels. Recommendation:

Purchase: no.

Sale: think when approaching the area at 18.20.

Support — 15.81. Resistance — 18.28.

Сoffee С, ICE

Growth scenario: March futures, expiration date March 19. The market looks aggressive. During pullbacks, you can buy and add to positions.

Falling scenario: flew up. We retreat with respect. We are waiting for the approach to 157.00, we think there. Recommendation:

Purchase: no. Those who are in the position from 128.0, move the stop to 129.0. Target: 157.0 (revised).

Sale: no.

Support — 135.20 (126.95). Resistance — 157.80.

Gold. CME Group

Growth scenario: when approaching 1700, after reversal signals appear, you can buy. It cannot be ruled out that the dollar will be aggressively strengthening. Therefore, take care when shopping.

Falling scenario: basically, we have already earned from 1920, however, there is a chance for an aggressive fall below 1700, therefore, part of the position open down can be left in order to see what will happen next.

Recommendations:

Purchase: on touch 1707. Stop: 1687. Target: 2260. Sale: no. Anyone in the position from 1920, move the stop to 1763. Target: 1707.

Support — 1704. Resistance — 1760.

EUR/USD

Growth scenario: we are witnessing the second Friday horror. It is highly likely that the euro will continue to fall against the dollar. Prices came out of the growing channel, we are not buying.

Falling scenario: we were knocked out of shorts last week. Sell again. I would not like to miss the phase of dollar strengthening.

Recommendations:

Purchase: no. Whoever is in the position from 1.2140, keep the stop at 1.2020. Target: 1.2760.

Sale: now. Stop: 1.2190. Target: 1.1460.

Support — 1.1711. Resistance — 1.2242.

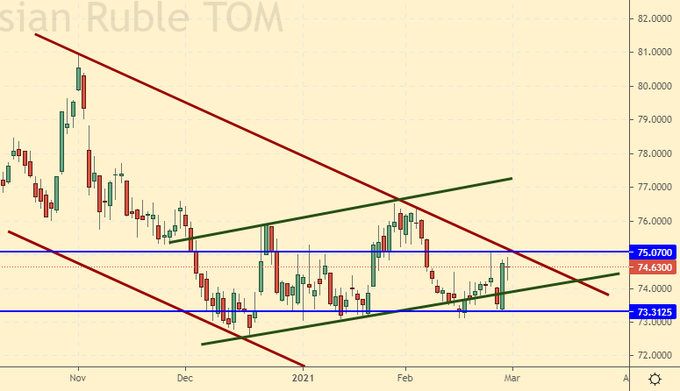

USD/RUB

Growth scenario: the long green candlestick on Thursday looks very attractive. But let’s not rush. Only if the market goes above 75.10 will we enter long. Falling scenario: given that oil fell heavily on Friday, we will not recommend selling. We keep the previously opened shorts.

Purchase: after rising above 75.10. Stop: 74.10. Target: 80.00.

Sale: no. Those who are in the position from 74.60, move the stop to 75.10. Target: 70.00 (68.00).

Support — 73.31. Resistance — 75.07.

RTSI

Growth scenario: March futures, expiration date March 18. Prices went down from the growing channel. If we fall below 140,000, the bulls will have no chance of growth. We are not buying in the current situation.

Falling scenario: after the market falls below 140,000, you need to sell. It is very likely that the ruble will fall next week, which will lead to a fall in the RTS index. If the mood on the US stock market deteriorates, and there are prerequisites for this, then the fall in the Russian market may become aggressive. Recommendations:

Purchase: no.

Sale: after falling below 140,000. Stop: 146,000. Target: 100,000. Consider the risks!

Support — 134940. Resistance — 143280.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.