01 February 2021, 11:25

Price forecast from 1 to 5 of February 2021

-

Energy market:

Oil cannot break through due to the problems in the European economy associated with the coronavirus. Fuel demand remains low.

The bulls can, of course, rely on the fact that Biden is a fan of green technologies, and the procedure for obtaining oil production licenses in a couple of months will be complicated, however, in Saudi Arabia there are no problems with obtaining oil production licenses. The states of the Arabian Peninsula will gladly reimburse potential 3-4 million barrels per day, which Washington will voluntarily give up. Everything will be the same as it was under Obama: the proceeds from oil will be directed by the Arabs to buy weapons in the United States.

Realizing that there will be no global deficit, traders are in no hurry to accelerate the market to 60.00.

Grain market:

Importers are not ready to pay more than three hundred dollars for a ton of wheat. This is clear because of the positions of Turkey and Egypt. Attempts to tender bids above $ 300 are simply rejected by buyers.

Considering that the vaccination process has started, the situation is normalizing in most countries by the summer. This means that we will meet the autumn harvest in a normal environment, which will reduce the panic to nothing, and with it the threat of a logistical collapse.

We expect a drop in the rush demand for grain, although in the long term, the global trend to create deeper food reserves will continue in many countries.

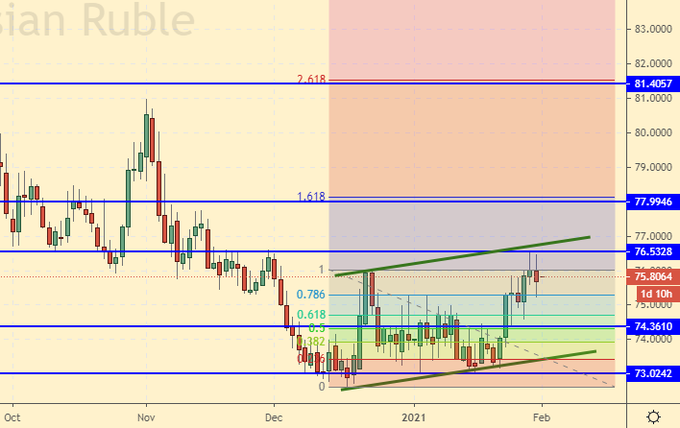

USD/RUB:

The US Federal Reserve meeting passed without any excesses. Powell confirmed the preservation of the program to buy out government bonds for $ 120 billion per month. Main goal: improving the situation on the labor market. Inflation is monitored, it is not accelerating and is below 2%. Thus, there is no reason to raise rates.

The preliminary US GDP falls by 3.5%. It is not clear how they thought, only New York and Los Angeles, who were «killed» by quarantine, lost about 2 million jobs. Initial applications for unemployment benefits are at around 900 thousand.

If oil goes down, then the ruble will have nothing to rely on, since oil and gas budget revenues sank 34% last year compared to 2019, to 5.235 trillion rubles, and the index of Russian debt securities, RGBI, continues to be in a downward trend.

Brent. ICE

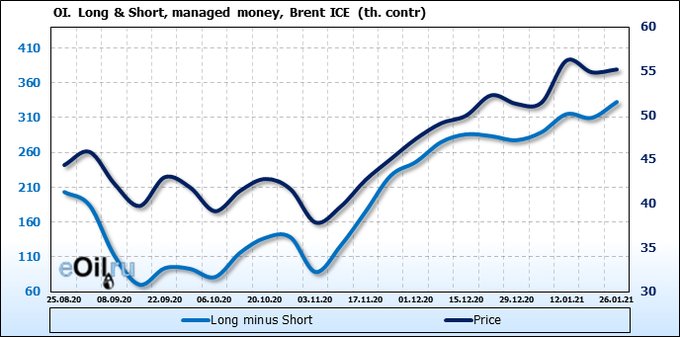

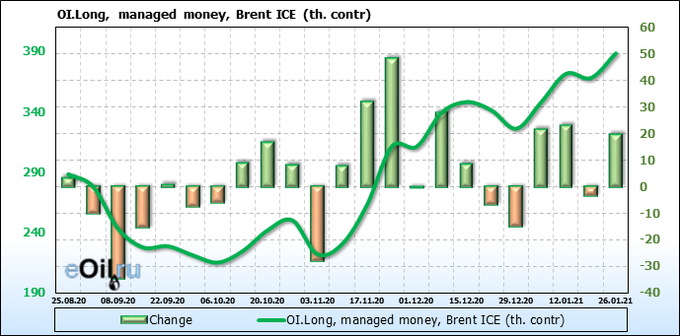

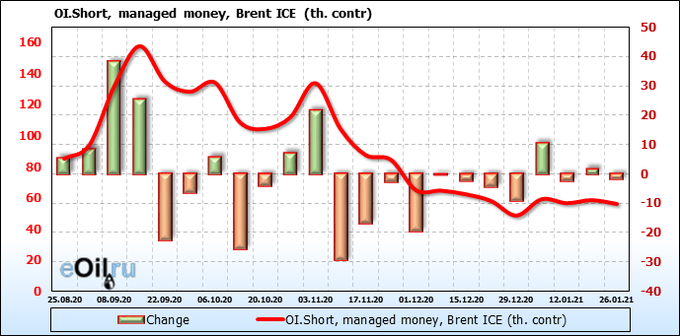

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

The bulls don’t want to leave. They are gradually being squeezed out, but so far they have money left, which they pour into the market in order to maintain their positions. Considering that prices did go down, we can expect to close long positions by stops next week, which will lead to a sharp move to the 50.00 area.

Growth scenario: February futures, expiration date February 26. For the buyer, nothing has changed in the market. We need a rollback to enter the long. We do not buy.

Falling scenario: keep holding the shorts. Those who have not logged in earlier can do so now. Recommendation:

Purchase: look for opportunities in the fall to 46.00. Sale: now. Stop: 56.70. Target: 46.00. Anyone in the position between 54.80 and 55.00, keep the stop at 56.70. Target: 46.00.

Support — 52.54. Resistance — 56.56.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 6 units to 295 units.

US commercial oil reserves fell by -9.91 to 476.653 million barrels. Gasoline stocks rose by 2.469 to 247.686 million barrels. Distillate stocks fell by -0.815 to 162.847 million barrels. Stocks at the Cushing storage facility fell -2.281 to 50.219 million barrels.

Oil production fell by -0.1 to 10.9 million barrels per day. Oil imports fell by -0.981 to 5.064 million barrels per day. Oil exports rose by 1.104 to 3.355 million barrels per day. Thus, net oil imports fell by -2.085 to 1.709 million barrels per day. Refining fell by -0.8 to 81.7 percent.

Gasoline demand fell by -0.279 to 7.833 million barrels per day. Gasoline production fell by -0.212 to 8.673 million barrels per day. Gasoline imports fell by -0.039 to 0.465 million barrels per day. Gasoline exports rose 0.073 to 0.804 million barrels per day.

Distillate demand rose 0.479 to 4.3 million barrels. Distillate production fell by -0.011 to 4.518 million barrels. Distillate imports rose 0.014 to 0.474 million barrels. Distillate exports fell by -0.294 to 0.808 million barrels per day.

The demand for oil products rose by 0.039 to 19.681 million barrels. Production of petroleum products fell by -0.164 to 20.292231 million barrels. Imports of petroleum products rose by 0.01 to 2.147 million barrels. Exports of petroleum products fell by -0.545 to 4.859 million barrels per day.

Propane demand fell by -0.291 to 1.588 million barrels. Propane production rose 0.094 to 2.389 million barrels. Propane imports fell by -0.03 to 0.144 million barrels. Propane exports fell by -0.219 to 1.261 million barrels per day.

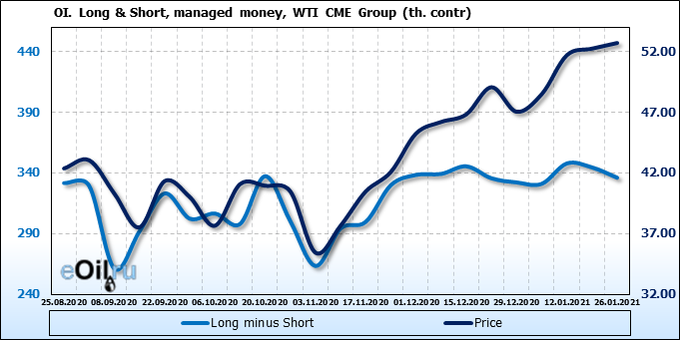

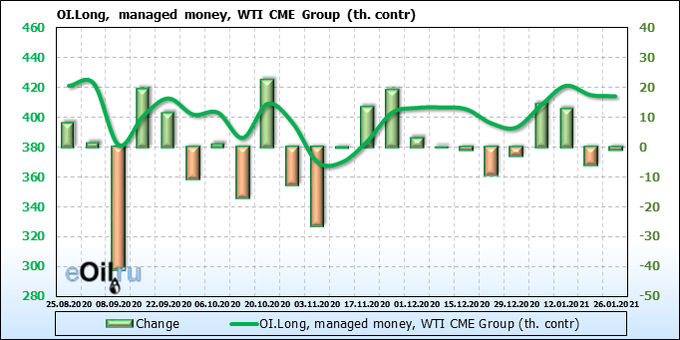

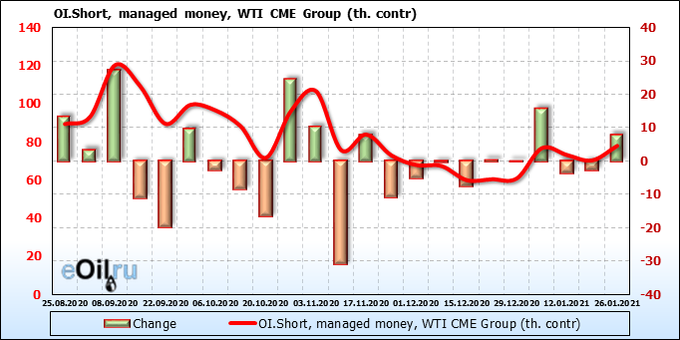

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

WTI has caught the eyes of sellers. We see an increase in the number of short positions, which can lead to a fall. Note that nobody pays attention to Biden’s words about the prohibition of issuing licenses for two months using hydraulic fracturing.

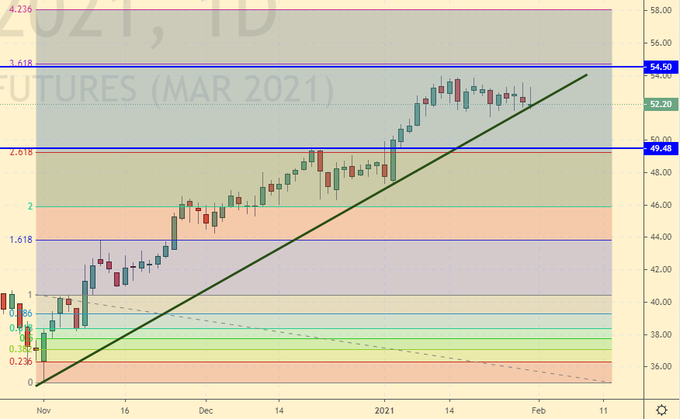

Growth scenario: March futures, expiration date February 22. We continue to pretend to break the long-term support line. We need a rollback. Preferably by 46.00. We are not buying yet.

Falling scenario: sell here. So far, the market has not managed to gain a foothold below 52.00, which is unnerving, but there are prerequisites for this. Those who are already in shorts, hold positions.

Recommendation:

Purchase: no. A correction is needed, at least to the area of 46.00.

Sale: after falling below 52.00. Stop: 53.86. Target: 46.00. Those who are already in positions between 52.40 and 51.90 keep the stop at 53.86. Target: 46.00.

Support — 49.48. Resistance — 54.50.

Gas-Oil. ICE

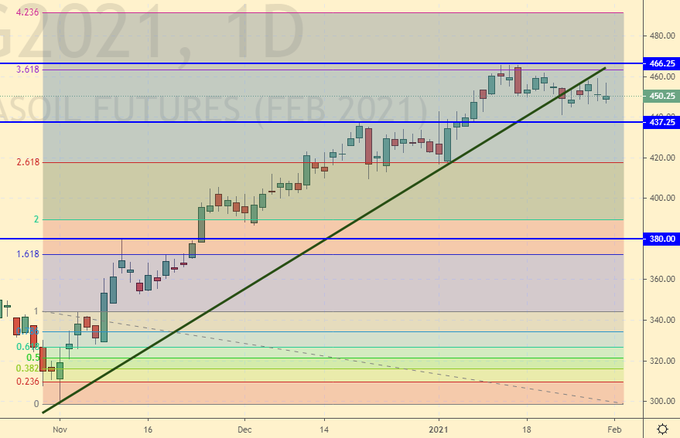

Growth scenario: February futures, expiration date February 11th. We have broken through the support line, but we are in no hurry to fall. We are not waiting for a rollback. The surprise will be the growth without retracement above 470.0.

Falling scenario: we still believe that if the market falls below 440.0, we can sell. I would like to see a long red candle down.

Recommendation:

Purchase: no. Wait for a rollback to 380.0.

Sale: on touch 435.0. Stop: 465.0. Target: 380.0.

Support — 437.75. Resistance — 466.25.

Natural Gas. CME Group

Growth scenario: March futures, expiration date February 24. It should be admitted that gas is not very satisfying. There is no power in the market. Friday’s red candle can drive the bulls away.

Falling scenario: the market may go down to 2.300, but such things are better to work out on 1H intervals. We do not sell.

Recommendation:

Purchase: no. Anyone in the position from 2.550, move the stop to 2.440. Target: 3.150.

Sale: no.

Support — 2.408. Resistance — 2.831.

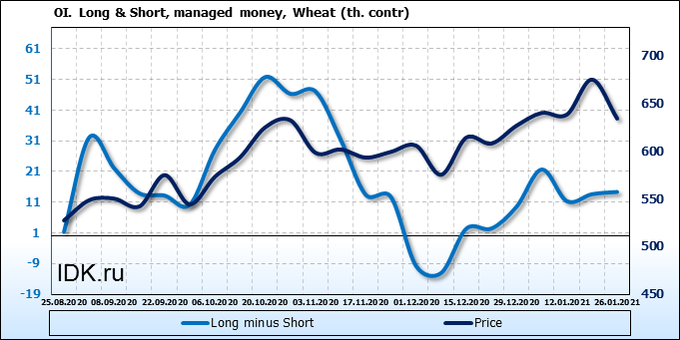

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

In the absence of ideas, speculators’ money leaves the market. This makes the situation more subtle. There is a feeling that both sides are disappointed, as some of them fail to reach their target at the top at 710.0, while others cannot force the market to fall amid the start of vaccination programs.

Growth scenario: March futures, expiration date March 12. If the market manages to return above 680.0, it will have to buy. In the current situation, we the give preference to sellers.

Falling scenario: we continue to recommend selling. Even if you are closed by a stop order, enter again. The situation is not bad, given the testing from below the previously broken support level.

Recommendation:

Purchase: think after rising above 680.0. In the meantime, we are waiting for a fall to 560.0.

Sale: now. Stop: 674.0. Target: 560.0.

Support — 624.0. Resistance — 672.4.

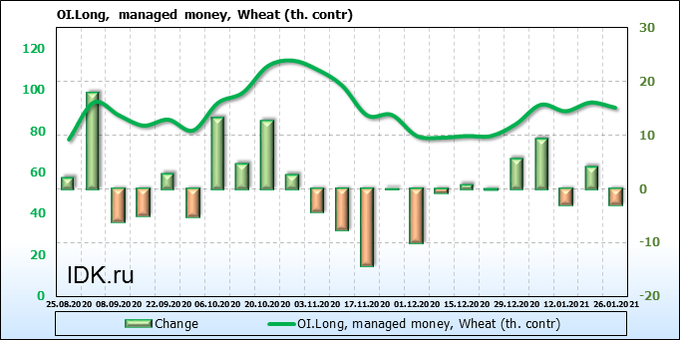

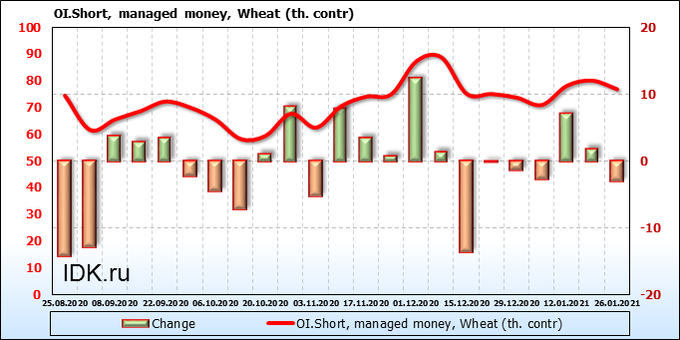

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Note that speculators’ money leaves the market. Meanwhile, prices are approaching their main Fibonacci target, the 670.0 area. Buyers there will take profits. But sellers should increase their activity. So far we do not see this, but next week there is a possibility that a rollback will begin after visiting the indicated level.

Growth scenario: March futures, expiration date March 12. We will not buy anything at the offered prices. We are waiting for a rollback.

Falling scenario: set a new maximum. Considering our layout with Fibonacci levels, we do not believe in growth above 570.0. We will sell from 560.0 to 580.0. Recommendation:

Purchase: no. Need a rollback.

Sale: on touching 560.0 and up to 580.0. Stop: 590.0. Target: 470.0.

Support — 495.2. Resistance — 566.0.

Soybeans No. 1. CME Group

Growth scenario: March futures, expiration date March 12. The rollback is hardly complete. We need one more branch down to 1250.0. We will count on this. We do not buy.

Falling scenario: we recommend selling. The market has been actively growing for several months. The probability of a corrective move to 1250.0 is high. Recommendation:

Purchase: no. Need to rollback to 1250.0.

Sale: now. Stop: 1390.0. Target: 1250.0.

Support — 1295.6. Resistance — 1437.6.

Sugar 11 white, ICE

Growth scenario: March futures, expiration date February 26. The market is overheated. A rollback is needed, at least to the lower border of the growing channel. We do not buy.

Falling scenario: keep the previous recommendation — if there is a rollback to 16.30 — sell. By 15.00 we are quite capable of getting off without any problems. Recommendation:

Purchase: no. A rollback is needed, at least by 15.00. Sale: on touch 16.30. Stop: 16.67. Target: 13.90.

Support — 15.52. Resistance — 17.18.

Сoffee С, ICE

Growth scenario: March futures, expiration date March 19. The market is able to return to 115.0. The situation is ripe for a breakdown of support. We do not buy. If there is a rise above 128.00, think about buying.

Falling scenario: we continue to consider the short in the current situation as appropriate. Those who are already in position — stop. We are quite capable of taking our 10 cents per pound of coffee. Recommendation:

Purchase: a rollback to 115.0 is needed. Think when it rises above 128.00.

Sale: now. Stop: 128.10. Target: 108.60. Whoever is in positions between 124.00 and 123.80, keep the stop at 128.10. Target: 108.60.

Support — 118.50. Resistance — 126.95.

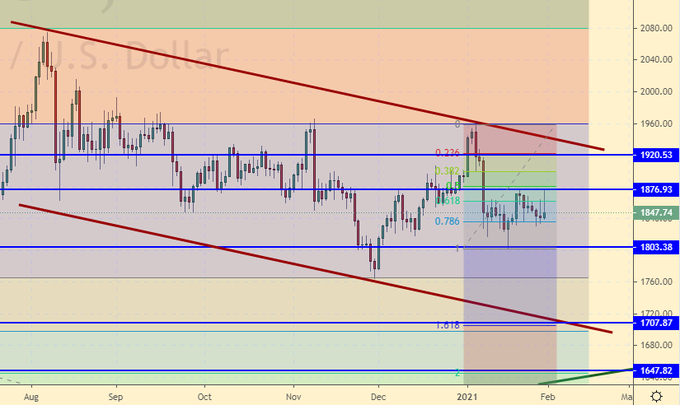

Gold. CME Group

Growth scenario: the FED meeting passed, but nothing happened. But on the silver market, users of the American network Reddit took to hooliganism on a large scale, hoping to swing «gold for the poor» to … yes, in fact, to heaven. This act by small investors may affect the gold market as well. We will buy, however, like a week earlier.

Falling scenario: whoever sold three weeks ago is holding shorts. Considering the story from Reddit, let’s tighten our stop orders. People against hedge funds — this will be a confrontation! We have a bearish picture, but it can be broken.

Recommendations:

Purchase: now. Stop: 1790. Target: 2260 (5000 ?!). Who is in the position from 1860, move the stop to 1790. Target: 2260 (5000 ?!).

Sale: no. Anyone in the position from 1920, move the stop to 1880. Target: 1660.

Support — 1803. Resistance — 1876.

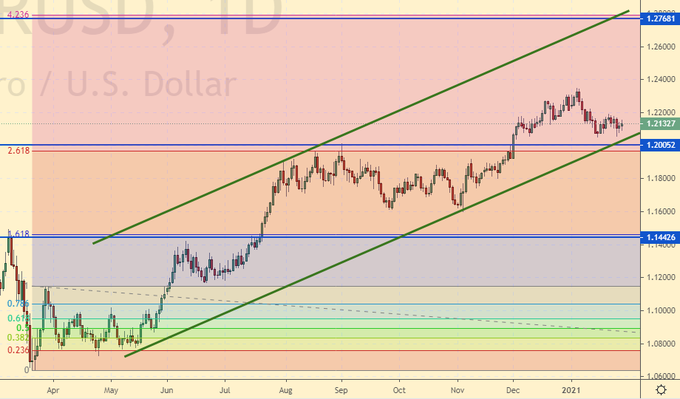

EUR/USD

Growth scenario: someone unknown defends the level 1.2100 and so far successfully. Even if we go to 1.2700, which is not a fact, the euro will fall. The eurozone did not grow last year and is unlikely to show anything more than 2 percent this year. America will recover faster, it’s worth realizing.

Falling scenario: hold the shorts. Stop near: at 1.2210. If the market goes higher and the position is closed by a stop, we do not open new sales until it falls below 1.2000 or up to 1.2700.

Recommendation:

Purchase: now. Stop: 1.2080. Target: 1.2700.

Sale: no. Whoever is in the position from 1.2220, keep the stop at 1.2210. Target: 1.1460.

Support — 1.2005. Resistance — 1.2768.

USD/RUB

Growth scenario: painted a full-fledged upward impulse. Now, provided that we are not facing a correction to the previous strengthening of the ruble, we will see a rollback to the area of 75.00 and continued growth to 81.40. We keep longs.

Falling scenario: if Friday’s candlestick was not only red, but also long, then we could talk about a test sale for a small volume. But so far sellers have not shown a desire to take control of the market. We can only recommend thinking about selling if the market goes below 74.30.

Purchase: on a rollback to 74.60. Stop: 74.20. Target: 81.40. Anyone in the position from 73.30, keep the stop at 74.20. Target: 81.40.

Sale: think if it falls below 74.30.

Support — 74.36. Resistance — 76.53.

RTSI

Growth scenario: March futures, expiration date March 18. The RTS index took offense at everyone and fell. Note that the Russian stock market is falling in rubles as well. Red candles look extremely menacing.

We did not stop at the 2.618% Fibonacci level and went below the 137000 level without a pullback. The 130,000 target doesn’t seem far off now. But now we will not buy even for 130,000 or even for 100,000. Let’s see how events will develop.

Perhaps by May, those who wish will buy a share of Sberbank at 30 rubles 13 kopecks, instead of the current 260 rubles per share. Falling scenario: if not everything happened, then a lot. Prices are on the way to 130,000, any upward pullbacks are used to build up shorts. Do not discount the possibility of falling to 100,000.

Recommendation:

Purchase: no.

Sale: on touch, 140,000. Stop: 144,000. Target: 130,000 (100,000). Anyone in the position from 147000, move the stop to 144000. Target: 130,000 (100000).

Support — 128950. Resistance — 143210.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.