01 April 2024, 10:29

Price forecast from 1 to 5 April 2024

-

Energy market:

High-tech stocks are at highs. Artificial intelligence will soon replace all of us. It’s a shock. The economy is separate and the people are separate. The machine will give «humans» food, and will make sure everyone gets eight hours of sleep, doesn’t drink or get high. It will appoint a mother-in-law. One mother-in-law for life. Not a new one every year.

It is worth noting here that our report is still being written by human brains and is being transmitted to the web via keyboard for review. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

If fresh rumors are to be believed, we are in for a continuation of the OPEC+ oil production cut regime, which is very likely to last throughout FY24, and possibly flow smoothly into FY25.

Western democratic regimes are considering lowering the price ceiling for Russian oil, rumored to be as low as $30. Let them consider it. Who will honor it?

At the same time, we have to consider that in case of sabotage of payments for oil already supplied by the «friendly» countries, we will see a situation when OPEC countries, without Russia, will have to increase production rather than reduce it in order to prevent a strong price increase. We already see that no one will ruin relations with the US for the sake of Russia.

Refineries in the European part of the country are in a highly vulnerable position and could continue to be subject to UAV attacks, which is very likely to make for a nervous 2024. That said, domestic gasoline prices can remain within reasonable limits as long as the damage is minimized. So far, it is 7% of gasoline output.

Grain market:

A 4% drop in U.S. acreage for 2024 for wheat and 5% for corn has shaken up the Chicago Stock Exchange. Farmers are cutting back on acreage in crops that produce little economic return. Bulls on the eve of Good Friday pulled quotes up, and thus set the stage for a subsequent rise in prices. Thursday’s surge could lead to a small, within 10%, price recovery until the May 10 USDA report with the 24/25 season forecast is released.

With the erection of trade barriers and tougher competition for export markets, Africa is becoming a natural destination for Russia. There is no need for illusions: in 2024 we will not be selling grain to Europe, but the dry south and the black continent will provide demand, which Moscow will be happy to satisfy. The main thing is not logistics, which we were worried about yesterday, but the passage of payments. However, barter is also a tool when partners are in tight conditions.

USD/RUB:

It is unlikely that we should seriously count on the strengthening of the national currency. After all, defense orders are seriously undermining the ruble. For such large-scale injections, already measured in tens of trillions over the past two years, we need a corresponding GDP growth without taking into account the growth in the military-industrial complex, and it is not there.

From July, we are expecting tax reform, which is not for the better for business. In addition, if non-payments for supplied resources, no matter for what reason, become chronic, this could severely deplete the national welfare fund, which will be used to fill the budget. Experts sadly note that the remaining 3 trillion in the liquid part of this fund is nothing compared to the current needs and will be quickly squandered. Russia cannot afford to drag out the SWO for more than 2 years. The ruble can’t sustain that.

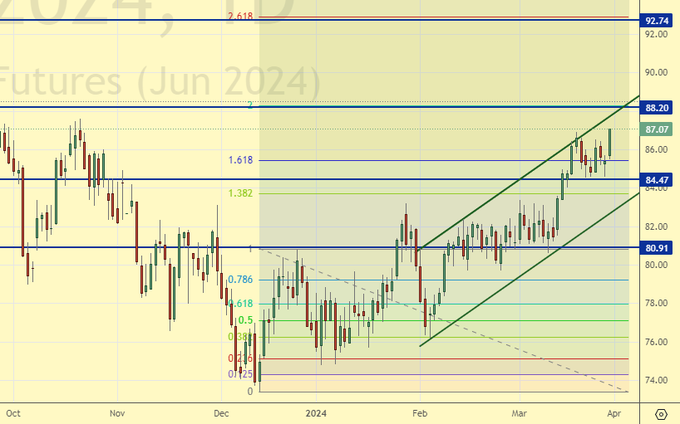

Brent. ICE

Growth scenario: we consider April futures, expiration date is April 30. It makes sense to keep buying. A move to the 93.00 area is possible.

Downside scenario: we continue to reject sales. Bulls have taken control of the market.

Recommendations for the Brent oil market:

Buy: no. Who is in position from 82.68, move the stop to 84.30. Target: 92.70.

Sale: no.

Support — 84.47. Resistance — 88.20.

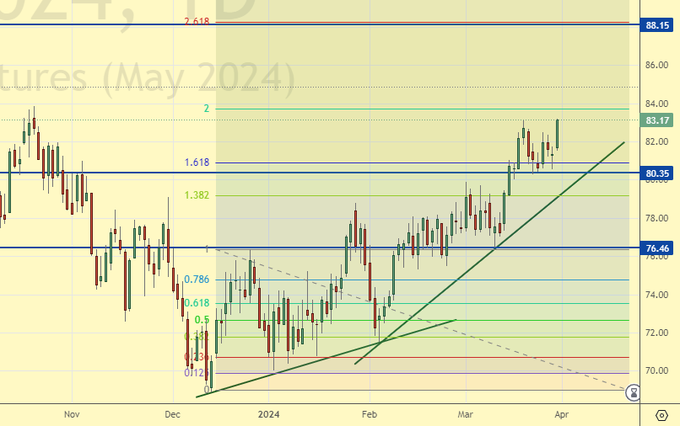

WTI. CME Group

US fundamental data: the number of active rigs decreased by 3 units to 506.

U.S. commercial oil inventories rose 3.165 to 448.207 million barrels, with a forecast of -0.7 million barrels. Gasoline stocks rose 1.299 to 232.072 million barrels. Distillate stocks fell -1.185 to 117.337 million barrels. Cushing storage stocks rose by 2.107 to 33.54 million barrels.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 0.1 thousand contracts. Market participants made bets on both growth and fall in the same volumes. Bulls keep control.

Growth scenario: we consider May futures, expiration date April 22. We keep buying. A move to 88.00 looks natural.

Downside scenario: we refuse to sell. We see acceleration of price growth. Short from 88.00 can be considered in the future.

Recommendations for WTI crude oil:

Buy: no. Those in position from 79.97, move stop to 80.20. Target: 87.90.

Sale: no.

Support — 80.35. Resistance — 88.15.

Gas-Oil. ICE

Growth scenario: we consider April futures, expiration date is April 11. It was knocked out of the long. We do not make any more attempts to buy.

Downside scenario: shorting on the background of growing oil looks like a completely unnecessary endeavor. Outside the market.

Gasoil Recommendations:

Buy: no.

Sale: no.

Support — 789.00. Resistance — 842.00.

Natural Gas. CME Group

Growth scenario: we consider the May futures, expiration date April 26. It is possible to buy, although there is a risk of an even stronger plunge.

Downside scenario: refrain from selling.

Natural Gas Recommendations:

Buy: now (1.7630). Stop: 1.690. Target: 2.770!

Sale: no.

Support — 1.692. Resistance — 2.152.

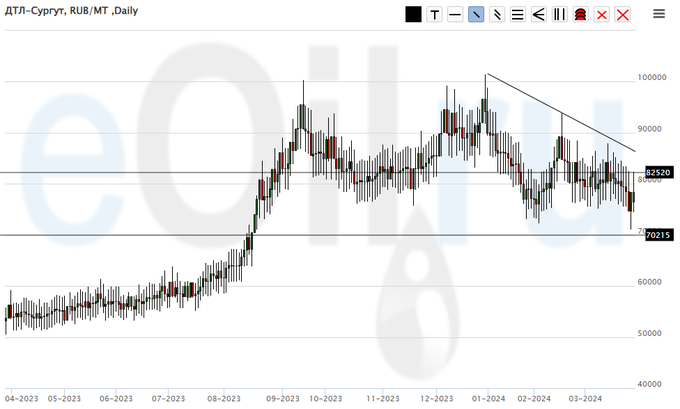

Diesel arctic fuel, ETP eOil.ru

Growth scenario: nothing new. As long as we don’t go above 90000, we don’t think about buying. Out of the market.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 70215. Resistance — 82520.

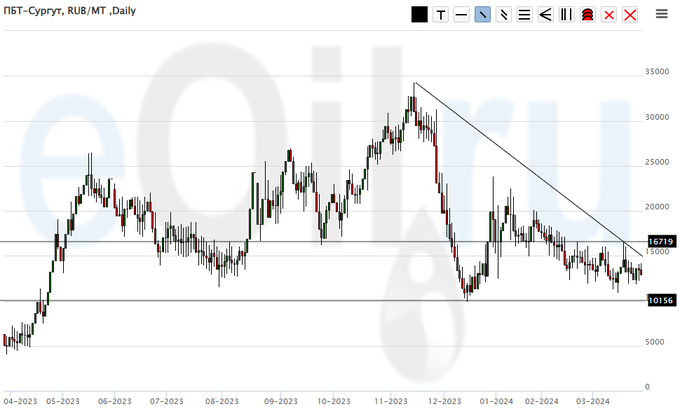

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will continue to keep longing. If the market goes below 10000, it may lead us to 5000. And there we will definitely need to buy.

Downside scenario: we stay out of the market. Movement to 5000 is possible, but selling is risky now.

PBT Market Recommendations:

Buy: no. Those in position from 13000, keep stop at 10700. Target: 25000.

Sale: no.

Support — 10156. Resistance — 16719.

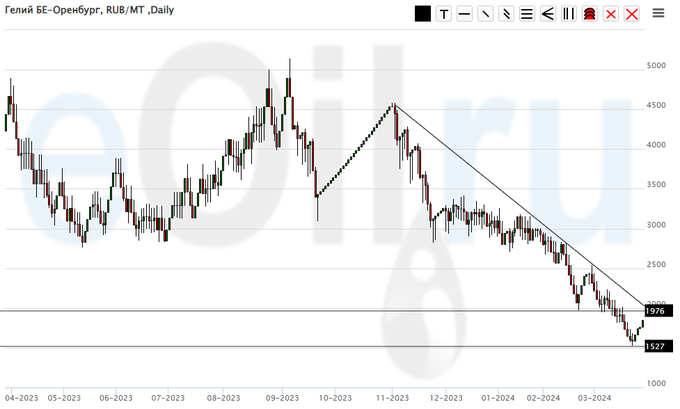

Helium (Orenburg), ETP eOil.ru

Growth scenario: we wait for growth above 2000. Then it will be possible to buy.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: in case of growth above 2000. Stop: 1800. Target: 3500?

Sale: no.

Support — 1527. Resistance — the area of 1976.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 10.4 th. contracts. Sellers entered the market in insignificant volumes, buyers left the market. Bears keep control.

Growth scenario: we consider May futures, expiration date May 14. We continue to want the market at 515.0, but there are doubts about the probability of such an event. We will not buy from current levels.

Downside scenario: the market continues to look down. The movement target at 516.0 looks natural. A deeper dive is unlikely to take place now. It is interesting to sell from 565.0.

Recommendations for the wheat market:

Buy: when approaching 516.0. Stop: 502.0. Target: 650.0.

Sell: no. Who is in position from 565.0, keep stop at 575.0. Target: 515.0.

Support — 539.1. Resistance — 568.5.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 1.3 th. contracts. Both buyers and sellers entered the market in microscopic volumes. Bears keep the control.

Growth scenario: we consider the May futures, expiration date May 14. We see a strong bullish candle of Thursday, which can develop the upward movement.

Downside scenario: do not sell. There are prerequisites for growth continuation.

Recommendations for the corn market:

Buy: on a pullback to 432.0. Stop: 424.0. Target: 500.0.

Sale: no.

Support — 425.1. Resistance — 447.7.

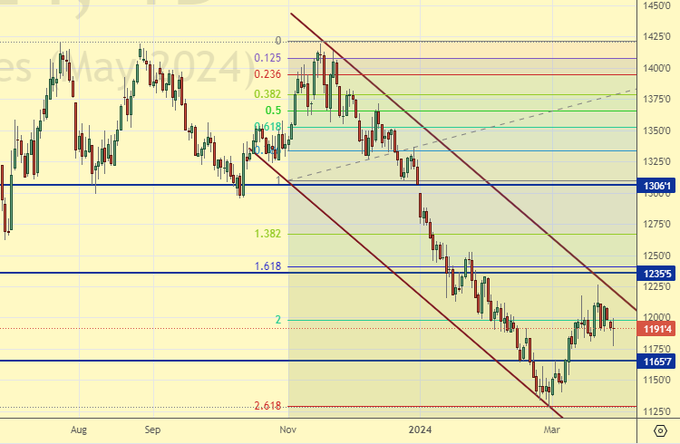

Soybeans No. 1. CME Group

Growth scenario: we consider May futures, expiration date May 14. It makes sense to bet on the growth continuation. Most likely, the market will not stop at 1235, as we supposed earlier, and will go higher.

Downside scenario: out of the market for now.

Recommendations for the soybean market:

Buy: no. Who is in position from 1141.6, keep stop at 1153.0. Target: 1300.0.

Sale: no.

Support — 1165.7. Resistance — 1235.5.

Growth scenario: microscopic hope of a pullback remains for those who are not yet in the market and who want to buy as cheaply as possible. We want to do the same.

Downside scenario: sales won’t do anything here anymore. Too aggressive growth. Off-market.

Gold Market Recommendations:

Buy: on a pullback to 2100. Stop: 2000. Target: 2390. Consider the risks!

Sale: no.

Support — 2158. Resistance — 2392.

EUR/USD

Growth scenario: the euro frankly disappointed. What about our dream of 1.2000? Judging by the fact that inflation is slowing down in the EU, they will start cutting rates there soon. Don’t buy.

Downside scenario: there are doubts on the short. There will be no ideas on this pair this week.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.0744. Resistance — 1.0863.

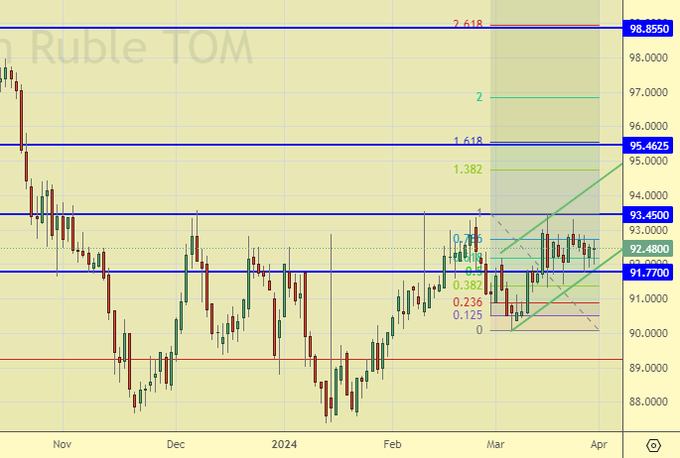

USD/RUB

Growth scenario: nothing new. It is necessary to keep longing. Strengthening to 90.00 on the background of accumulating negativity will be an unexpected revelation.

Downside scenario: we will not sell. None of the experts are seriously talking about the ruble strengthening.

Recommendations on dollar/ruble pair:

Buy: on a pullback to 91.00. Stop: 90.00. Those who are in position from 92.79 and 92.90, keep stop at 90.00. Target: 97.00 (103.00, 112.00, 155.00).

Sale: no.

Support — 91.77. Resistance — 93.45.

RTSI

Growth scenario: we consider June futures, expiration date June 20. On the background of dividend payments we went up. Nevertheless, the growth story is unlikely to be long. Off-market.

Downside scenario: we will take a pause for a week, but will sell again when new opportunities arise.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 107940. Resistance — 113630.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.