30 December 2024, 06:13

Forecast of stock exchange prices for the year 2025. New Year issue.

-

Happy New Year 2025 to all investors and traders!

Within the framework of this article we will try to give benchmarks for the next year on the main markets we track. Unlike the schizophrenics of various large offices, who try to make clickable forecasts breaking all sorts of bottoms, we will not write anything like that. We could. For example: “Everyone will die on April 13th.” Why April 13th? That’s the number. Why April? Spring flare-up. Why 2025? Yes, it’s a year. It’s just that kind of year.

In fact, one should realize that there are only a few fundamental values in the world: access to clean air, clean water, a piece of bread, and a tolerable roof over your head. If people can afford this minimum, they breed. If not, the individual state ends. Just like that, by itself. Yeah, they just lived and lived, and then that’s it. They left to a place where they can get all this within one human life. The statues are still there, and archaeologists will work there. They’ll be asking themselves: “Why didn’t they have a life?” Brains. They didn’t have the brains to allocate resources properly, that’s all. Nothing more.

Here’s to equitable access to mainstream resources! Hello!

Energy market:

Can politicians control the oil market? Yes. Journalists are actively scaring the public with this. But! How long can you maintain the influence of one person on another? A year, two years? Yes, a strong America can put pressure on the UAE and KSA, but if you do it strongly, you can get an enemy instead of an ally. Everyone counts money. And for Russia, in its current particular, that’s fine.

Most likely, in 2025, the oil market will not fall without fundamental reasons. We see that the level of 75 dollars per barrel of Brent oil suits everyone and we do not have overproduction yet. Maybe, according to a number of forecasts, we will get 0.4 million bpd surplus by the middle of the year, but such “overhang” is unlikely to send the market to 50.00. Let’s not confuse falling demand with falling demand growth. They are far from the same thing. Oil demand continues to grow, it will increase by 1.4 million bpd and will reach 106.9 million bpd in Q4 2025.

In fact, it is not the growth in demand for oil that is frightening, but the growth in demand for black gold against the backdrop of growing supply in the gas market and the development of alternative methods of energy extraction. Civilization continues to devour energy in colossal amounts, while most countries cannot even remotely come close to China and the United States, including per capita consumption of fossil and any other fuel, as well as electricity. The current situation is far from the peak.

Yes, China is the one to watch. It buys more oil on the foreign market every day than anyone else in the world. Total demand is 17.1 million barrels and is expected to grow by 1.8% y/y 24. At the same time, 11 million barrels per day are imported into the country from outside.

Oil production in Russia has fallen from 9.5 to 9 million bpd since the beginning of the year. If the OPEC+ deal remains in place, the current level will be enough to cover most of the expenditures, but it will be impossible to avoid a budget deficit, even at the current price level.

The U.S. is unlikely to be able to bring down oil prices by increasing production at home or by bribing China with duties. A significant drop in prices will be possible only in case of either the collapse of the OPEC+ deal, which is unlikely, or after a drop in economic activity in the West, which is more likely. If the market bets on the stagnation of Western economies, then it will be 50.00 on Brent.

Grain market:

At the end of December 24, there is no indication that cereals will suffer significant damage. Failure, which is very likely in Russian agriculture, with the gross wheat harvest dropping to 78 million tons in the 24/25 season, will be offset by other exporting countries. Including the EU, where the grain situation is better than last year. Thus, we do not see any fundamental reason for a strong rise in grain prices at the moment. It should be noted, however, that if China remains interested in buying grain from the US and there is no halt in mutual trade between the two countries, this could swing the US market upwards.

A trend that we write about from time to time, namely the trend of increasing local food production, including in countries that have not had the most fertile land, will gain momentum. Hydroponics, drones, multi-level farms, all of these can cover the needs of the states in a number of food products. Experiments on cereals, when not 80, but 180 quintals (world record) are harvested per hectare, will soon be replicated. In addition, there are experimental sites with several harvests, up to five per year. Will you say it is expensive? But how much does it cost for the country’s food security?

A slowdown in global population growth from 2.3% in the 1960s to 0.8% in MY2014 will contribute to saturation and create a surplus in the cereal market on a horizon of less than 10 years, under current climatic conditions.

A rise in FOB prices to $280 per tonne of 12.5% protein milling wheat by May is possible. But a move above 300 now looks like an unlikely event.

USD/RUB:

Economic construction at the rate of 20 per annum is impossible. Complex technological chains and long-term projects require long cheap money. As long as we are in a situation of not just substantial, but large expenditures on defense, and the corresponding products are needed immediately, even now, we will not see a reduction in inflation due to the constant injection of unsecured rubles into the furnace of the military-industrial complex.

The Russian ruble will lose its purchasing power at a rate of 20% per year. We now have 100 rubles per dollar by the end of the year. This is quite a bearable achievement, while the outlook at the beginning of the 24th year looked much bleaker. Next, we should model a move to 120, at least until there are signs of the end of the conflict in Ukraine. At the moment, there are no de facto signs.

If the current volumes of resource sales on the foreign market (oil, gas, coal, metals) are maintained, the country will be able to resist the West for many more years. At the same time, the fundamental long-term development of all institutions will be suspended.

The main risk is the possibility of hyperinflation. But it is unlikely to be possible as long as the shelves in grocery stores are full. A well-fed citizen is a calm member of society. Price growth of 2% per month can be tolerated for a long time.

For the purposes of this review, we are looking at charts where one candle equals one week.

Brent. ICE

Growth scenario: As in the previous year, the level of 75.00 will be of special importance. As long as we are below it, we will try to fall. If we go higher, then we can think about buying.

Downside scenario: any red candle under 75.00 is a reason to sell. We may reach 60.00. We consider cries about 40.00 to be premature. Especially on this topic paid grandfathers on one video hosting are trying.

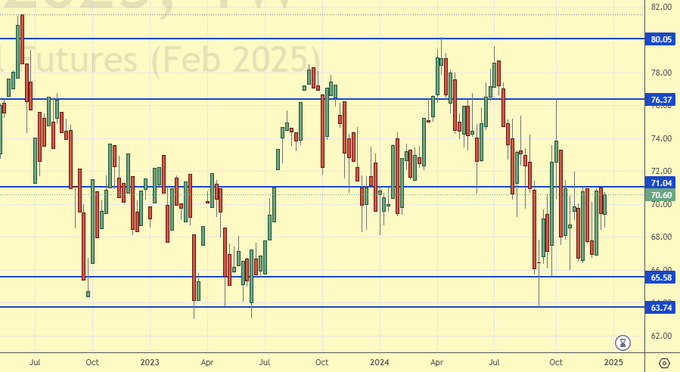

WTI. CME Group

Growth scenario: not too comfortable position. Protracted range. As long as we are below 80.00, buying will be risky. With a possible fall to 55.00, it is possible to buy, but only if no fundamental explanation for this fall can be found.

Downside scenario: as long as we are below 72.00 we can try to sell with a target at 55.00.

Gas-Oil. ICE

Growth scenario: only a rise above 800.0 or a fall to 550.0 will be a reason to enter longing.

Downside scenario: there is some current weakness. A red candle fully submerged under 700.0 is a reason to consider selling.

Natural Gas. CME Group

Growth scenario: closing of any weekly candle above 3.500 will attract bulls to the market, but there will be no strong growth. 4.800 is most likely the ceiling.

Downside scenario: given the development of LNG projects, it would not be surprising if we stay in the 2,500 — 4,500 range for a long time.

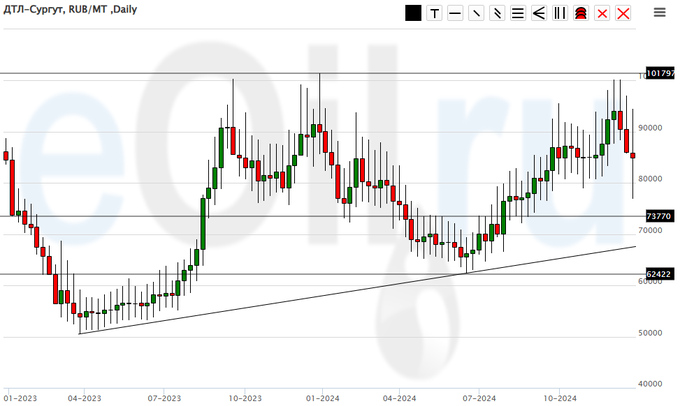

Diesel arctic fuel, ETP eOil.ru

Growth scenario: from the area of 70000 we can try to buy. At the same time we see that buying from 62000 would be much more interesting. But who will give such prices?

Downside scenario: sales are asking for it, but it is better not to seek adventure for yourself in this direction.

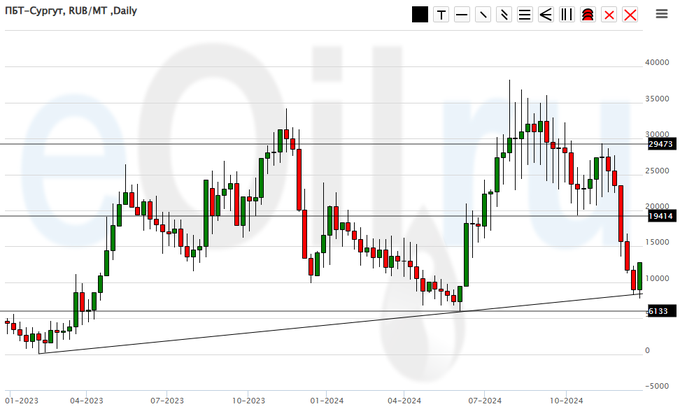

Propane butane (Surgut), ETP eOil.ru

Growth scenario: “when approaching 6000, buy definitely”, we wrote in our regular forecast. Indeed, the current area is interesting for long entry.

Downside scenario: we do not recommend selling PBT. We are low.

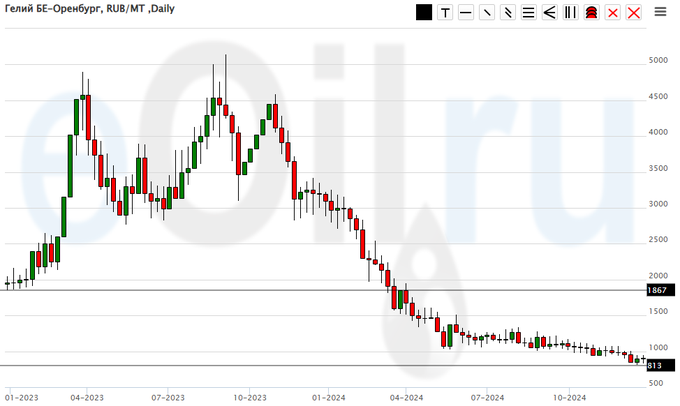

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market is dead for the year. It will be interesting if the manufacturer finds sales. We could launch balloons. For reference, 1 cubic meter of helium has a lifting force of 1 kilogram, near the surface of the Earth. Maybe someone needs to fly somewhere. Now would be a good time to get it.

Downside scenario: we don’t sell. Do not sell at all.

Wheat No. 2 Soft Red. CME Group

Growth scenario: A significant increase in the wheat market is unlikely. That said, in the event of a fall to 430.0, buying opportunities could be considered. If we can get up to 700.0 in the 25yr, it will be a success for the bulls.

Downside scenario: as long as we are below 570.0 it makes sense to expect the decline to continue.

Corn No. 2 Yellow. CME Group

Growth scenario: the current rise looks unnecessary given the fundamental data. As long as we are below 460.0 it is better not to enter long on small intervals. Buying from 380.00, if the market allows, would be a good decision.

Downside scenario: if there will be an approach to 500.0 (and it is probable) sell. Current levels are also interesting for selling.

Soybeans No. 1. CME Group

Growth scenario: Given the large yields, soybeans are fundamentally weak. Buying from 830.0 is a good decision. In case of a rise above 1050.0, you can buy on shallow intervals with modest prospects.

Downside scenario: as long as we are under 1000.0 it is only reasonable to look down with a target at 830.0.

Growth scenario: taking into account excessive “nervousness” of elite elitists it is worth keeping in mind that some amount of gold should be in the portfolio. As a whole, for the next year it can be considered a successful purchase to enter long from 2100 (2000!). The target is 3100.

Downside scenario: in case of a move below 2600 we can easily go to 2500 and also to 2100. Below 2100 the market is not visible. Yes, the dollar is strong, but it also has a limit of strength against gold.

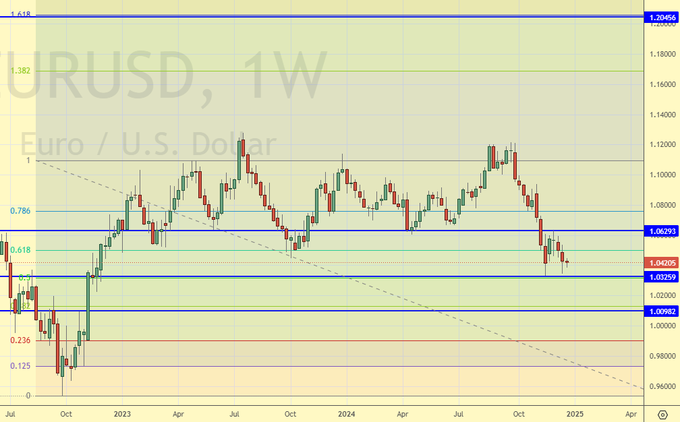

EUR/USD

Growth scenario: structurally we have finished the market cycle: momentum + correction. The picture is looking towards 1.2000. Only a fall below 0.9800 will deal a serious blow to the euro. Buying while we are above 0.9800 will be interesting.

Downside scenario: a move below parity is unlikely. This is not the time for the Fed and ECB to play strong imbalances between the two major economies.

USD/RUB

Growth scenario: all expectations of inflation slowdown are canceled for the time being. And since this is the case, after a pullback to 92.50, it is worth buying the dollar against the ruble. The scenario when the rate will be at 20% and inflation of the poor (let’s say) will be at 20% is much more probable. And nobody will do anything about it. We need to support the real sector in such a difficult period. Yes, developers without favorable mortgages will start to hang themselves, but not in the 25th year. Rather, in the 27th. But all at once.

Downside scenario: we are unlikely to go anywhere near 80.00. The budget will not come together. But! If suddenly oil will be 100 dollars per barrel, then, yes, such strengthening of the pair will be possible. Only it is not clear yet how oil will be 100 dollars per barrel. OPEC+ will immediately open the tap in case of market growth above 80.00.

RTSI

Growth scenario: the growth of the Russian market in US dollars, or, if you want, in Chinese yuan, is an extremely doubtful thing in the current situation. The economy is sinking deeper and deeper every month into a swamp isolated from the rest of the world. Full-fledged development on a separate planet with a population of 140 (120?) million people is hardly possible. Only lagging behind (but not degradation, as the paid heralds write) is visible. At the same time, in rubles Russian equity securities are able to show growth against the background of high inflation. And you say that they promise us 6.6% per annum by the end of the 25th year! Yes! It will be a new economic miracle, if it happens. Believing in miracles is good. But sometimes you have to look at the facts.

Growth to 105000 is possible, further ascent is questionable. Only if a new round of love with the West begins. And it is impossible against the background of expropriation of Russian money (de facto it has already happened), and against the background of expropriation by Russia of assets of companies from unfriendly countries.

Downside scenario: sales from 95000 and 105000 look reasonable.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.