|

13 February, 11:44Мировой рынок

В 2023 году цена на нефть может взлететь до 140 долларов, спрогнозировал в беседе с Financial Times один из крупнейших трейдеров в сфере энергетики, основатель хедж-фонда Andurand Capital Пьер Андюран. |

Архив за 13 февраля, 2023

|

13 February, 11:42Мировой рынок

Доход мировой нефтегазовой отрасли вырос до рекордных за последние несколько лет почти $4 трлн, заявил в Twitter исполнительный директор Международного энергетического агентства (МЭА) Фатих Бироль. |

13 February, 11:33Отчеты

|

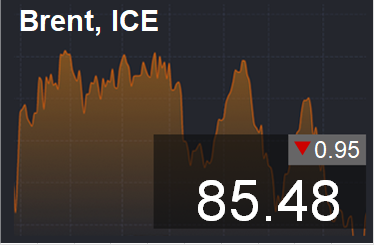

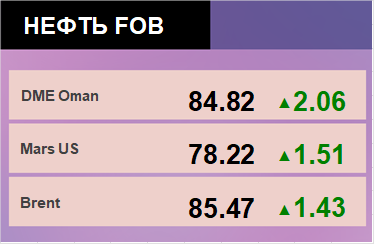

Energy market: Kurdistan strongly denied allegations of selling oil to Israel. Note that if he had done this not only decisively, but also loudly, it would still hardly have cost more than one line in the Bloomberg terminal. And if the Kurds wanted two lines in Bloomberg, they would have to pay extra. Let in your life every year there will be at least one event worthy of the news window of the trading terminal. Hello! This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given. Russia will reduce production by 500 thousand barrels per day from March. Most likely, the produced oil simply has nowhere to go because of the embargo, so production will have to be reduced. The disappearance of half a percent of world consumption from the market is significant. Over the week, oil rose by $7 per barrel. If Saudi Arabia takes a break and does not rush to increase production, then we will quickly go to the level of $100 per barrel. If there is no increase in supplies from OPEC countries at all, for example, for reasons of principle, then we can see oil at $120 per barrel. If energy prices start to rise again, then along with rising food prices, they will not allow inflation to slow down this year, which may lead to a continuation of the policy of raising rates in the EU and the US, and this will slow down the growth of the global economy by the end of 2023 year. About America. There are indirect data indicating that it was the United States that blew up the second branch of the Nord Stream. China has already asked Washington to explain its behavior, but, as expected, the Americans only express satisfaction that Nord Stream will not work, but they are in no hurry to take responsibility. At the moment, significant harm is being done to the economies of Russia and Germany. Joyful cries on this occasion are heard not only in France, but even in Spain. In Europe, many wish Berlin to dry up quickly, as the Germans are too hard-working, and this annoys the relaxed southerners. Apparently, this year there will not be enough oil and gas in the EU for everyone. Use solar panels. |

13 February, 08:55Пульс рынка

|

В 2023 году уровень спроса на нефть достигнет почти 102 млн баррелей в день (б/с), это превысит допандемийные показатели. Об этом заявил генсек ОПЕК Хайтам аль-Гайс. |

13 February, 08:38Отчеты

|

Россия сократит добычу нефти в марте на 500 тыс. баррелей в сутки. Основное предположение: нефть просто некуда девать из-за ввода эмбарго со стороны Запада. При этом в ОПЕК поспешили заявить, что не будут наращивать добычу и замещать уходящие с рынка российские баррели. Как долго картель сможет смело смотреть в глаза Вашингтону и демонстрировать свою сплоченность не ясно. Очевидно, что на данный момент рынок получил поддержку от сокращения добычи нефти со стороны России. Нельзя исключать продолжения роста цен. Наши отчеты и прогнозы можно найти здесь. |