Price forecast from 4 to 8 November 2024

-

Energy market:

Elections, elections, American electors… will make a choice. And they explain to us in the media that the whole world is waiting for them and a lot depends on it… Who cares about them? Happy campaigning. How can one party be symbolized by an elephant and the other by a donkey? How? It turns out it can. Apparently, all party members are attracted to these species.

To beautiful animals. There’s a bear, what more do you need? Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Now we wait for Iran to hit Israel. They can’t do it right away. They’re saving up money. Then they’ll buy the components, make firecrackers and strike. The market on Friday didn’t want to even think about the Persians and fell. Yeah, not by much, but there’s no growth, nobody’s afraid of Iran because Israel has nothing. Iran will shoot in the desert. The oil is in Iran, everyone is afraid of Israel. That’s how messed up it is. So we need to worry about Tel Aviv’s response, to an attack by Tehran that hasn’t happened yet. Suddenly this time they’ll be hitting upstream and downstream. Rumor has it the Jews took out the air defenses in the first strike. Everything there is bare now.

Russia is thinking about independence. They will take taxes from the Urals price at FOB + $2 for transportation. A slight embarrassment so far is that the quotation for the domestic grade is at the sanctioned $60 and is not growing. But, nothing, it may become more expensive later.

It turns out that Venezuela has increased exports to 950 thousand barrels per day, almost a million. Then why do people in the country continue to work not for money, but for eggs, for chicken eggs? And five men with machetes guarding a refrigerator with Coca-Cola. From great satiety, I guess. There’s something wrong. It’s been a long time.

Looking at the US election results: if Trump comes in with his “drill as much as you can”, we will have Brent at 60.00. That could very well happen.

Grain market:

Until a Russian grain exchange or BRICS exchange has appeared, and interested parties themselves determine what the price is within the country and for export, we look at the Chicago market (an unfriendly state). But there it is, and has been for a very long time. So far, prices are in a range and only show us intentions to move to growth, but there is no real growth. Both wheat and corn have found a balance and are in no hurry to part with it. This is a sadness for the speculator.

If a president wins in the US, who is being smeared by hitmen, he can start “persuading” Moscow to stop the SWO by all means. He can start working with buyers of Russian grain… This is Biden-2 maturing before our eyes, no matter what party he belongs to. Ginkgo biloba won’t help. So he’s gonna try to deprive Moscow of export revenues. And he will explain to the people of Cairo that they should sit hungry in the name of democracy. If this begins, then we are in for some absolutely marvelous (wild) upward price spikes.

Domestically, prices are at a standstill. Last year’s overhang, i.e. there is grain, and the government’s desire to get $250 per ton for it, as well as the increased duties, are the factors.

USD/RUB:

“Give the rate 50%,” we wrote five weeks ago. Judging by the data on inflation, Elvira, at the end of her career, perhaps she will be removed in December or January, will charge 23%, and perhaps she will have time to put 25% on the table. We’ll only see 50% if she stays at the helm.

Under current conditions, to sterilize cash, it is necessary to start selling to the people glass beads charged with sorcerer’s beads for all diseases. Otherwise, we will not be able to get rid of the growing money supply. Lotteries should be promoted, all kinds of casinos, in which it is impossible to win, with state participation, of course, so that people just give, give and give. Promise islands, Solovetsky islands, for contribution to the development of the project to build a glass dome over Yakutia. Haven’t you heard? It’s going to happen. We’ll plow on elephants, it seems profitable, and colonize the Moon, and everyone will have a summer house on it. Just give me the money now. Don’t drive up the price of potatoes. He who eats too much is a criminal, spoils the statistics.

We’re also going to have an epic stock market run-up. Be careful. We are somewhere close to interesting levels (not tomorrow yet, but the bottom will come), we are coming. And then all our blue chips will be red, so high prices will rise. Sberbank will be at 5000 (five thousand) per share. Twenty times higher. And then? And then that’s it.

The dollar/ruble pair is stubbornly moving on the futures to 99500, then 104500.

November 7th Fed meeting in Moscow. Just kidding. Somewhere out there in America. The probability of a 0.25% rate cut, from 5% to 4.75%, is substantial. For the ruble, any decision by the Fed will not make any difference.

Brent. ICE

Growth scenario: we consider November futures, expiration date November 29. Some are bombing others and the market is falling. This is interesting. Everyone needs to know exactly where they hit (didn’t hit). Outside the market.

Downside scenario: out of the market. Waiting for the election results.

Recommendations for the Brent oil market:

Buy: no.

Sale: no.

Support — 70.31. Resistance — 75.04.

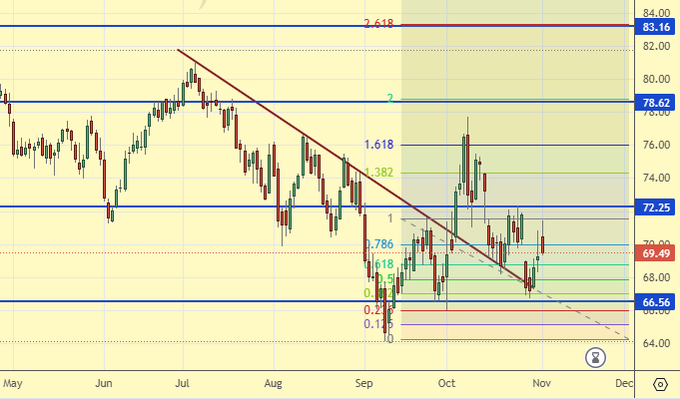

WTI. CME Group

Growth scenario: we consider December futures, expiration date November 20. Due to the gap down, our long did not survive. We’re watching the patient with the interest of a psychiatrist. Out of the market.

Downside scenario: we’re not going short right now.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 66.56. Resistance — 72.25.

Gas-Oil. ICE

Growth scenario: we consider November futures, expiration date November 12. Weird. Considering the US elections and the Fed meeting next week — out of the market.

Downside scenario: give time to the market to decide on the direction. Do not trade.

Gasoil Recommendations:

Buy: no. Those in position from 648.50, move stop to 645.00. Target: 830.00?!!!!

Sale: no.

Support — 648.00. Resistance — 714.75.

Natural Gas. CME Group

Growth scenario: we consider December futures, expiration date November 26. The market went extremely low and then rose slightly. Everything is good, keep longs.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: when approaching 2.467. Stop: 2.400. Target: 4.000?!!!

Sale: no.

Support — 2.467. Resistance — 3.021.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we consider December futures, expiration date December 13. We do nothing at the current price levels. We need deviations up or down.

Downside scenario: nothing interesting. Off-market.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 557.6. Resistance — 595.6.

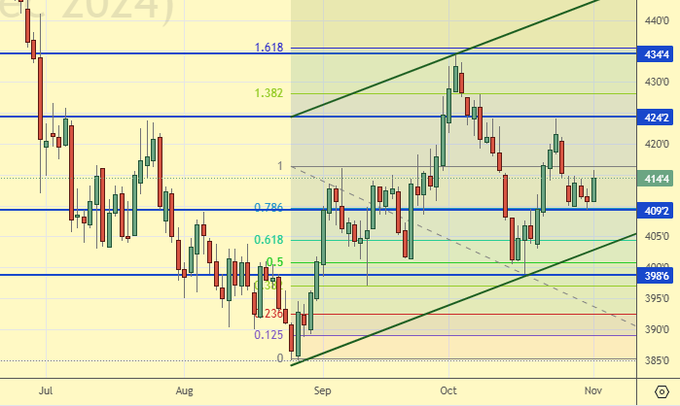

Corn No. 2 Yellow. CME Group

Growth scenario: we consider December futures, expiration date is December 13. Bulls need to accelerate the market, otherwise they will be forgotten at 370.0. Let’s hold the long.

Downside scenario: need higher levels to sell. For example: 465.0. Out of market.

Recommendations for the corn market:

Buy: no. Who is in position from 415.6, 410.0 and 400.0, move the stop to 402.0. Target: 465.0.

Sell: thinking when approaching 465.0.

Support — 409.2. Resistance — 424.2.

Soybeans No. 1. CME Group

Growth scenario: we switched to January futures, expiration date is January 14. We are not thinking about buying yet. There are a lot of soybeans.

Downside scenario: we will continue to keep open shorts. The target is shifted to 835.0.

Recommendations for the soybean market:

Buy: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: no. Who is in the position from 1049.0 (taking into account the transition to the January contract), move the stop to 1053.0. Target: 835.0.

Support — 947.6. Resistance — 1049.0.

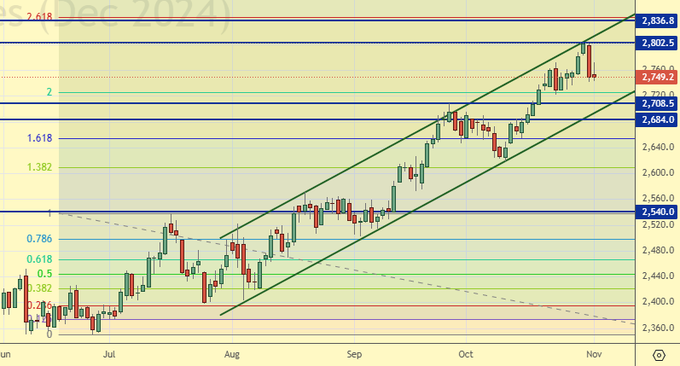

Growth scenario: we consider December futures, expiration date December 27. We continue to demand a pullback for purchases.

Downside scenario: at the top we have 2838, from this level we can sell. The current red candle appeared on the chart out of place.

Gold Market Recommendations:

Buy: no.

Sell: on approach to 2838. Stop: 2858. Target: 2550.

Support — 2708. Resistance — 2836.

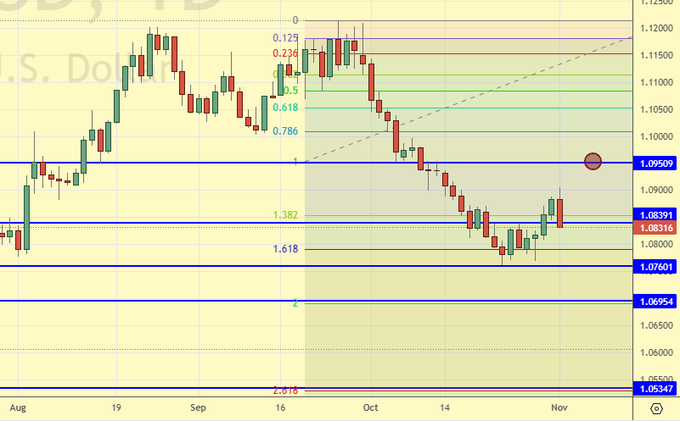

EUR/USD

Growth scenario: went under 1.0950. Forget about buying for now.

Downside scenario: “we are waiting for a rise to 1.0950 and continuation of the fall”, — we wrote last week. It will happen. We just need to wait.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Those in position from 1.0935, keep stop at 1.0970. Target: 1.0000.

Support — 1.0760. Resistance — 1.0950.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. On a pullback to 91000, it makes sense to buy again. “If only it ever does…”, it was written a week earlier. But there is simply nothing to add to that.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: when approaching 90000. Stop: 88800. Target: 104000. Who is in position from 96234, keep stop at 95900. Target: 150000, 200000?! (these are the benchmarks so far)

Sale: no.

Support — 94171. Resistance — 99982.

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. We slowed down, moreover, sharply passed below 90000, and we do not roll up. We’re not buying yet. Somehow it does not look good.

Downside scenario: nothing new. We’re low. Sell on “hourly” intervals. If there will be a pullback to 93000, you can try to sell on daily intervals.

Recommendations on the RTS index:

Buy: no.

Sell: on approach to 93000. Stop: 94800. Target: 70000 (further 0.0000 (zero) absolute, well, who is afraid, let it be 20000).

Support — 83420. Resistance — 93020.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.