Price forecast from 28 October to 1 November 2024

-

Energy market:

It’s good to be an Iran-trading president, and it’s good to be an Israel-trading president. Look: I attack you, and I take a long position in oil in advance. Oops, you’ve got three holes in the ground, and in the meantime the futures have gone $5 up. Let’s take the profit. Now it’s your turn. You attack me. Again, three holes and again oil is 3 dollars higher. For a successful and sustained play on the terror of the Western consumer, it is necessary for oil to constantly roll back down, after another round of bombing, just like now. That is, everyone should expect that there will be a little bit of oil in excess, but if suddenly everything is bad in the Middle East, then everyone will not have enough, and having rolled back prices will rise again.

Here’s to finding a balance between supply and demand. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

So, the Jews did their job and hit Iran. Keep it up. We’re making money off your wounded pride. Tonight, Sunday through Monday, we’re gonna get a gap up. Iran’s already said we’re going to retaliate. We will. Well, well, well, come on, come on.

At that time, the United States, sensing that the matter did not smell of kerosene at all, intensified production. And Canada has already received a call, probably about their pipeline, which was supposed to run through ecologically clean lands there. And it will. “Have no doubt,” citizens. And so, yes, soon we’ll all be using gas. There will be plenty of gas, but not tomorrow. LNG projects will continue to develop. And coal and oil will go underground. In general, Europe won’t freeze. China won’t get cold, everyone will reformat somehow. And if artificial intelligence begins to control traffic in cities, and the car’s steering wheel disappears, the savings will be 10 percent, just on the driving mode of the car.

And in the 30s, you bought yourself a capsule, charged it, it took you where you needed to go, if you needed to go, of course, and took you back. And no one behind the wheel.

From the global risks, the next assumption is that Moscow may decide to stop exporting hydrocarbons in response to bombardment with long-range Western weapons. That would be a new phase of the conflict. (We are analysts here, we don’t just drink coffee for nothing). And the West will close food export opportunities in response, and close everything in general, even the cracks under the baseboard. It will be quite a story. And you write in the comments why the Kremlin won’t do it.

Grain market:

In general, the fall is proceeding within expectations. The market is neither growing nor falling. Some light fears and ideas from the series are being worked out: here it is very wet — here it is very dry, but all this does not impress traders, because if in one place it worsens, in another it improves. Here, Brazil, well done. Plus 10% over last year. And all the problems of winter sowing in Russia, comrades from South America beat off in one fell swoop, we can say.

So where is the BRICS grain exchange? Where is it? Let’s turn on the flashlight, look for it. We’ve been talking about it for 10 years. And there is no exchange. Who, a Turk, should we give a stock exchange to? We gave them tourists, we buy tomatoes, we give them gas, we give them a gas hub, we give them oil, we give them nuclear power, they buy grain without a stock exchange. What else should we give them? Intelligence, perhaps. That’s a lot. Yes, it’s clear, they need the straits there. Why such an unhealthy passion to take everything out of Russia somewhere?

We should make airships for 1 million tons and airlift the raw materials. That’s it and we win. No need for English insurance companies and ships, along with their maritime law. Trade with whoever you want.

USD/RUB:

“Give the rate 50%,” we wrote a month ago. Elvira does not let us down. Already 21% on the scoreboard. Probably soon she will be kicked out for this, and then other invited luminaries will come, sit around, eat seeds, and continue to raise the rate further. And she, Elvira, had been asking to leave for a long time. It was clear to an economist two years ago where all this would go. They will leave now. Well, she can’t stabilize what can’t be stabilized.

Let us keep a close eye on the gold reserve of 2,000 tons. It should be divided and issued in 5000 ruble bills with a gold ribbon, thus distributing the gold to the people and prohibiting the export of these bills from the country (there is such a practice in the world). Otherwise everything will settle in England. Ask yourself why Western monarchies are rich. Because Europe has no gold of its own.

And no electronic rubles! That’s poop. Ew, get it out of your head now! Young bitcoin addicts.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 1.6 th. contracts. Buyers and sellers left the market in microscopic volumes. There is calm on the market. Bulls control the market.

Growth scenario: moved to November futures, expiration date November 29. “…we will buy. And we will wait for Israel to start bombing Iran,” we wrote a week ago. Many thanks to comrades from Tel Aviv. Our long will live, not excluded, for a very long time.

Downside scenario: there is no point in selling.

Recommendations for the Brent oil market:

Buy: no. Who is in the position from 72.63 (taking into account the transition to a new contract), move the stop to 73.00. Target: 96.00.

Sale: no.

Support — 72.07. Resistance — 76.12.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 2 to 480.

US commercial oil inventories rose by 5.474 to 426.024 million barrels, with +0.8 million barrels forecast. Gasoline stocks rose 0.878 to 213.575 million barrels. Distillate stocks fell -1.14 to 113.839 million barrels. Cushing storage stocks fell by -0.346 to 24.676 million barrels.

Oil production remained unchanged at 13.5 million barrels per day. Oil imports increased by 0.902 to 6.431 million barrels per day. Oil exports fell by -0.011 to 4.112 million barrels per day. Thus, net oil imports rose by 0.913 to 2.319 million barrels per day. Oil refining rose by 1.8 to 89.5 percent.

Gasoline demand increased by 0.218 to 8.838 million barrels per day. Gasoline production rose 0.666 to 9.954 million barrels per day. Gasoline imports fell -0.012 to 0.514 million barrels per day. Gasoline exports fell -0.013 to 0.886 million barrels per day.

Distillate demand fell by -0.081 to 4.131 million barrels. Distillate production rose by 0.257 to 5.011 million barrels. Distillate imports fell -0.027 to 0.105 million barrels. Distillate exports fell -0.031 to 1.148 million barrels per day.

Demand for petroleum products fell by -0.446 to 20.251 million barrels. Petroleum products production rose by 0.208 to 22.015 million barrels. Petroleum product imports fell -0.029 to 1.584 million barrels. Exports of refined products fell by -0.002 to 6.429 million barrels per day.

Propane demand increased by 0.306 to 1.089 million barrels. Propane production rose 0.02 to 2.703 million barrels. Propane imports fell -0.002 to 0.112 million barrels. Propane exports rose 0.389 to 1.922 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 16.6 th. contracts. Buyers were leaving and sellers were entering the market. Bulls are keeping control.

Growth scenario: we consider December futures, expiration date November 20. Hold long. The market is likely to continue to grow amid the growing conflict between Israel and Iran.

Downside scenario: we’re not going short right now.

Recommendations for WTI crude oil:

Buy: no. Those in position from 68.69, move stop to 68.67. Target: 83.00.

Sale: no.

Support — 68.07. Resistance — 78.62.

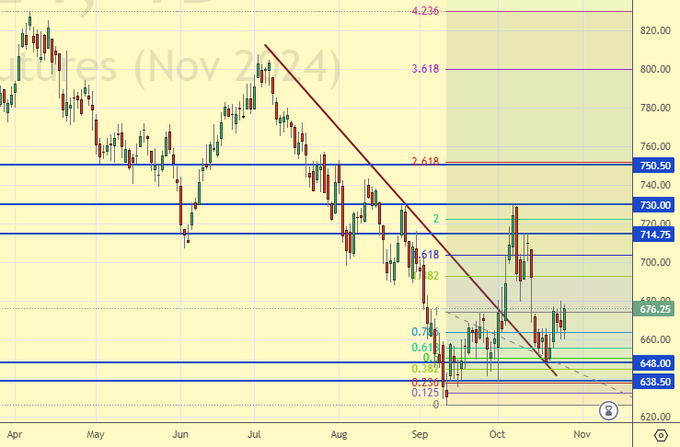

Gas-Oil. ICE

Growth scenario: we consider November futures, expiration date November 12. The oil market will pull the fuel market up. Hold long.

Downside scenario: levels are low for short entry. Out of the market.

Gasoil Recommendations:

Buy: no. Those in position from 648.50, move stop to 645.00. Target: 830.00?!!!!

Sale: no.

Support — 648.00. Resistance — 714.75.

Natural Gas. CME Group

Growth scenario: we consider December futures, expiration date November 26. The market went extremely low and then rose slightly. Everything is good, keep longs.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: no. Those in position from 2.765, move your stop to 2.775. Target: 4.000?!

Sale: no.

Support — 2.969. Resistance — 3.213.

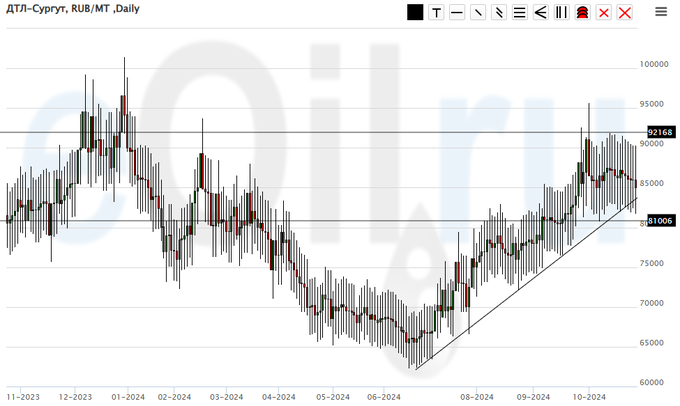

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth remain.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 78000. Target: 100000!

Sale: no.

Support — 81006. Resistance — 92168.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: scary, but we will hold longs from 23800 and from 20000.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: no. Who is in position from 20000 and 23800, keep stop at 17000. Target: 40000.

Sale: no.

Support — 19453. Resistance — 26172.

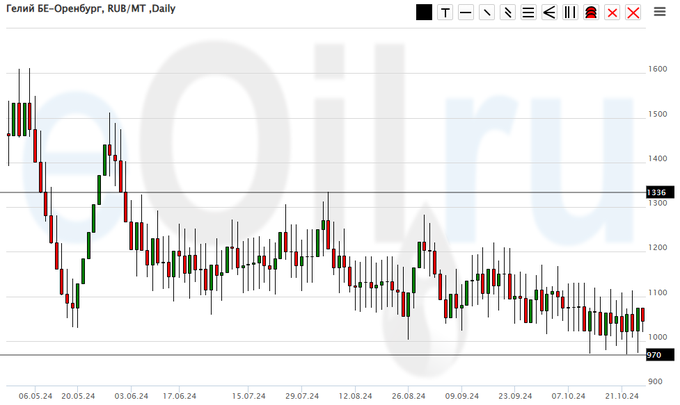

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Out of the market. Somehow everything is dead and does not move.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 970. Resistance — 1336.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 4.3 thousand contracts. Buyers left, sellers came in small volumes. Bears maintain control.

Growth scenario: we consider December futures, expiration date December 13. There’s a kind of helplessness. Nobody wants anything. Everyone has eaten pies and is sitting. And we are sitting on the sidelines.

Downside scenario: for selling we need levels much higher than the current ones. We want 656.0.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 565.6. Resistance — 595.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 19.6 th. contracts. Buyers were aggressively entering the market. Sellers were also arriving, but in smaller volumes. Bears are still keeping control.

Growth scenario: we consider December futures, expiration date December 13. Somehow we entered the long, somehow we are standing, but there is no great optimism in the market. The bulls are trying to draw us an upward impulse, but whether it will be or not is still a question. A move above 425.0 is needed to confirm the growth.

Downside scenario: need higher levels to sell. For example: 465.0.

Recommendations for the corn market:

Buy: no. Those who are in position from 415.6, 410.0 and 400.0, move stop to 401.0. Target: 465.0.

Sell: thinking when approaching 465.0.

Support — 409.2. Resistance — 424.2.

Soybeans No. 1. CME Group

Growth scenario: we consider November futures, expiration date November 14. We are not thinking about buying yet. There are a lot of soybeans.

Downside scenario: nothing new. We will keep open shorts. There is a risk of falling to 895.0.

Recommendations for the soybean market:

Buy: when approaching 893.0. Stop: 883.0. Target: 1100.0.

Sell: no. Those who are in position from 1037.6, move the stop to 1044.0. Target: 895.0.

Support — 953.6. Resistance — 1013.0.

Growth scenario: we consider the December futures, expiration date December 27. We’re very high. There’s nowhere to buy. We continue to call for a pullback.

Downside scenario: we have 2838 at the top, from this level we can also look for selling opportunities.

Gold Market Recommendations:

Buy: no.

Sell: on approach to 2838. Stop: 2858. Target: 2550.

Support — 2706. Resistance — 2838.

EUR/USD

Growth scenario: went under 1.0950. Forget about buying for now.

Downside scenario: we are waiting for a rise to 1.0950 and continuation of the fall. If it happens, it will be possible to add to shorts.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Those in position from 1.0935, keep stop at 1.0970. Target: 1.0000.

Support — 1.0760. Resistance — 1.0871.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. On a pullback to 90000, it makes sense to buy again. If it will only ever…

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: when approaching 90000. Stop: 88800. Target: 104000. Or now (96234). Stop: 95900. Target: 150000, 200000! (benchmarks so far)

Sale: no.

Support — 94309. Resistance — 97155.

RTSI

Growth scenario: we consider December futures, expiration date December 19. We’re losing too much. Don’t buy. It is not clear at all when the reversal will take place, whether it will be….

Downside scenario: terribly we are low, which is terribly inconvenient. Sell on “hourly” intervals. If there will be a pullback to 93000 you can try to sell on daily intervals as well.

Recommendations on the RTS index:

Buy: when approaching 90600. Stop: 90300. Target: 105000.

Sell: on approach to 93200. Stop: 94800. Target: 70000 (further 0.0000 (zero) absolute, well, who is afraid, let it be 20000).

Support — 77870. Resistance — 93130.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.