Price forecast from 21 to 25 October 2024

-

Energy market:

Look, look, look! I have nothing, I spent it all on all sorts of entertainment and perversions, and you, you, look, you have everything. Right? Right. Let’s split it in half so I can have it all again and issue a new vanilla fiat currency. And then we can go around telling everyone how clever we are, how resourceful and shrewd we are. What’s the holdup? Open the basement, let’s go count your gold.

And that’s when our trusty comrade suspected something wrong. To lucky combinations! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Despite market fears about shortages and about possible Israeli bombardment of Iranian oil fields, the oil market is capable of going into a corkscrew amid a decline in GDP growth of the leading economies. Statistical bureaus close to the government can embellish the situation in any country, but it is impossible to hide foreign trade statistics, which sooner or later will come out.

Step by step, we are dragging ourselves into a destructive spiral, which instead of a quiet crisis promises us new trials that will not be able to avoid the oil market. Growth should be supported by real demand, not by fears. Fears will sooner or later disappear, or people will get used to them, but demand, it may disappear against the background of the destruction of economic models of states, or under the influence of trade restrictions or because of the hot phase.

While the Middle East is farting and there have already turned to personalities, that is, they are engaged in assassination attempts directly on politicians, heads, leaders and authorities, in the United States a new record in production: 13.5 million barrels per day.

Grain market:

IGC reports that cereal production remains unchanged at 2,315 million tons. Note that carryover stocks are forecast to rise in the 24/25 season, which should curb bullishness in the grain market. In the background, soybeans continue to break previous records, putting pressure on feed grains and feed corn.

Note that if the Chinese economy continues to slow down, this could lead to a skew in consumption towards cheap food: rice instead of wheat, if wheat, then of lower quality, vegetable oils instead of animal fats. Chicken instead of beef. Thus, a possible crisis will put pressure on quality products. The price gap between quality food and cheap food will become smaller.

The prospect of imposing our will on the market by announcing that we will not sell wheat below some threshold will be negative in the long run. Why wouldn’t our dictates write a price of $250 per ton? We could, of course. Only if the market will be below this level for a long time, and you will not sell anything, then there may be a problem with the next year’s crop: there will simply be nowhere to store it, because you have not sold what you harvested this summer and fall. Why, you were waiting for a better price.

USD/RUB:

“Give the rate 50%,” we wrote three weeks ago. And while this “slogan” makes sense to publish. On October 25, the Central Bank of Russia may raise the rate by 2% at once. And we will have 21, the number known as “point”. If this act is carried out, we will find ourselves in a band of instability, which will increase as the rate rises in the future, as there will be no talk of any economic development. And nothing, they dance and dance in Argentina with any inflation. They may well introduce the American dollar officially. We’ve got snowballs, snowmen and snowmen. Ice slides. And vodka at the store to wash down expensive credit. But dollars… we won’t have dollars. It’s evil.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 27.9 th. contracts. Buyers were leaving the market, sellers came in small volumes. Bulls are still controlling the market.

Growth scenario: we consider December futures, expiration date October 31. Technically, buying is justified at this point. Yes, we will buy. And we’ll wait for Israel to start bombing Iran. Nothing personal, just business.

Downside scenario: there is no point in selling.

Recommendations for the Brent oil market:

Buy: now (73.06). Stop: 72.40. Target: 90.00.

Sale: no.

Support — 71.49. Resistance — 75.13.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 1 to 482.

U.S. commercial oil inventories fell -2.191 to 420.55 million barrels, with a forecast of +1.8 million barrels. Gasoline inventories fell -2.201 to 212.697 million barrels. Distillate stocks fell by -3.534 to 114.979 million barrels. Cushing storage stocks rose by 0.108 to 25.022 million barrels.

Oil production increased by 0.1 to 13.5 million barrels per day. Oil imports fell by -0.71 to 5.529 million barrels per day. Oil exports rose by 0.329 to 4.123 million barrels per day. Thus, net oil imports fell -1.039 to 1.406 million barrels per day. Oil refining rose by 1 to 87.7 percent.

Gasoline demand fell -1.034 to 8.62 million barrels per day. Gasoline production fell -0.941 to 9.288 million barrels per day. Gasoline imports rose 0.098 to 0.526 million barrels per day. Gasoline exports fell -0.043 to 0.899 million barrels per day.

Distillate demand rose by 0.181 to 4.212 million barrels. Distillate production fell by -0.234 to 4.754 million barrels. Distillate imports rose 0.028 to 0.132 million barrels. Distillate exports fell -0.328 to 1.179 million barrels per day.

Demand for petroleum products fell by -0.488 to 20.697 million barrels. Petroleum products production fell by -0.782 to 21.807 million barrels. Imports of refined petroleum products rose 0.276 to 1.613 million barrels. Exports of refined products fell by -0.366 to 6.431 million barrels per day.

Propane demand fell -0.213 to 0.783 million barrels. Propane production fell -0.018 to 2.683 million barrels. Propane imports fell -0.001 to 0.114 million barrels. Propane exports fell -0.009 to 1.533 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 12.5 th. contracts. Buyers and sellers were leaving the market again, as well as a week ago. Buyers did it more actively. Bulls keep control.

Growth scenario: we switched to December futures, expiration date November 20. As for Brent, we were waiting for a pullback. And here it is. Deep, good. Let’s buy.

Downside scenario: prices are low. Off-market.

Recommendations for WTI crude oil:

Buy: now (68.69). Stop: 67.67. Target: 85.00.

Sale: no.

Support — 66.05. Resistance — 71.58.

Gas-Oil. ICE

Growth scenario: we are looking at the November futures, expiration date November 12. We didn’t just pullback, we fell. All right. Let’s buy.

Downside scenario: levels are low for short entry. Out of the market.

Gasoil Recommendations:

Buy: now (648.50). Stop: 630.0. Target: 765.0.

Sale: no.

Support — 638.50. Resistance — 679.25.

Natural Gas. CME Group

Growth scenario: we consider December futures, expiration date November 26. The market has gone extremely low. Let’s continue buying.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: now (2.765). Stop: 2.745. Target: 4.000?!

Sale: no.

Support — 2.499. Resistance — 2.969.

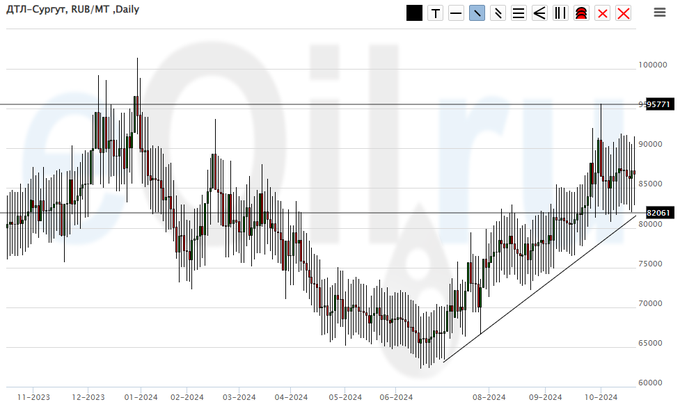

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth remain.

Downside scenario: we won’t sell, as we can’t believe we don’t need diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 77000. Target: 100000!

Sale: no.

Support — 82061. Resistance — 95771.

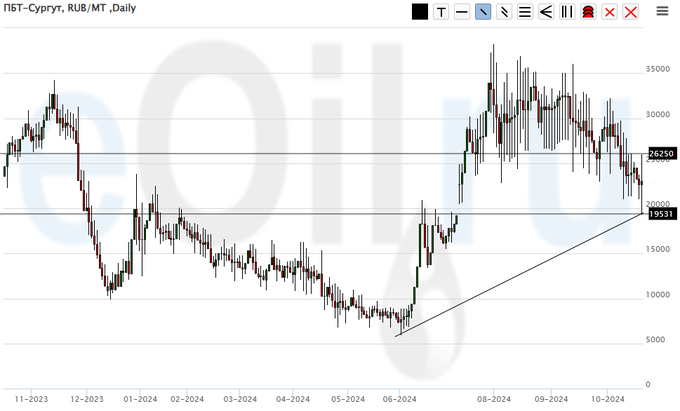

Propane butane (Surgut), ETP eOil.ru

Growth scenario: bought from 23800 and from 20000. Now we need to hold.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: no. Who is in position from 20000 and 23800, keep stop at 17000. Target: 40000.

Sale: no.

Support — 19531. Resistance — 26250.

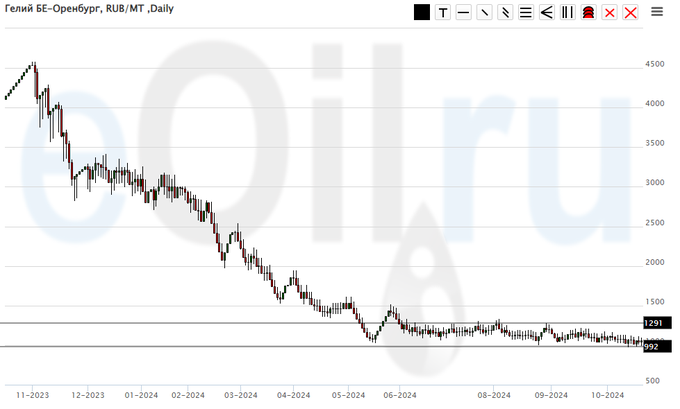

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 992. Resistance — 1291.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 0.8 th. contracts. Buyers and sellers left the market in minimal volumes. Bears keep control.

Growth scenario: we consider December futures, expiration date December 13. The risk of falling to 500.0 has increased. Grain is plentiful and there is likely to be no stress in this market.

Downside scenario: for selling we need levels much higher than the current ones. We want 656.0.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 563.6. Resistance — 595.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 72.6 thousand contracts. The change is significant. Buyers were fleeing. Sellers entered the market aggressively. Bears stepped up their control.

Growth scenario: we consider December futures, expiration date December 13. We went long on the previous recommendation. Those who wish can buy here. The pullback is very deep, which is somewhat embarrassing.

Downside scenario: need higher levels to sell. For example: 465.0.

Recommendations for the corn market:

Buy: no. Who is in position from 415.6, 410.0 and 400.0, move the stop to 397.0. Target: 465.0.

Sell: thinking when approaching 465.0.

Support — 399.2. Resistance — 416.2.

Soybeans No. 1. CME Group

Growth scenario: we consider November futures, expiration date November 14. We are not thinking about buying yet. There are a lot of soybeans.

Downside scenario: nothing new. We will keep open shorts. There is a risk of falling to 895.0.

Recommendations for the soybean market:

Buy: when approaching 893.0. Stop: 883.0. Target: 1100.0.

Sell: no. Those who are in position from 1037.6, move the stop to 1042.0. Target: 895.0.

Support — 953.6. Resistance — 1011.0.

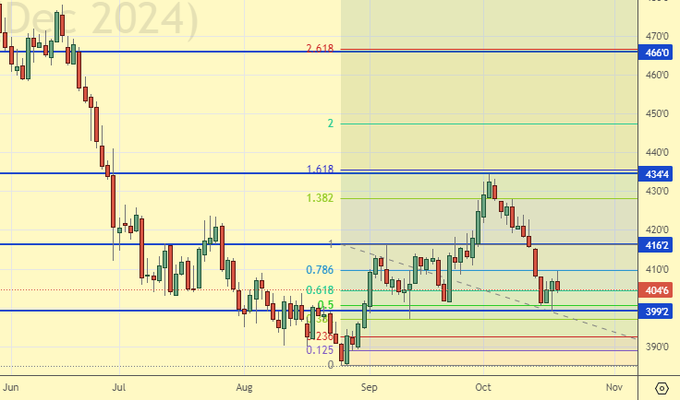

Growth scenario: we consider the December futures, expiration date December 27. We’re very high. There’s nowhere to buy. We need a pullback.

Downside scenario: “shorting from 2720 will be interesting”, — we wrote a week earlier. And we sold it. But it did not turn out to be very interesting. Bulls are extremely aggressive. At the top we have 2838, from this level we can also look for selling opportunities.

Gold Market Recommendations:

Buy: no.

Sell: No. Those in position from 2720, move your stop to 2744. Target: 2200?!

Support — 2707. Resistance — 2838.

EUR/USD

Growth scenario: we went under 1.0950. Forget about buying for now.

Downside scenario: who would have thought… the euro is a jackass. We are waiting for a rise to 1.0950 and the continuation of the fall.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Those in position from 1.0935, keep stop at 1.0970. Target: 1.0000.

Support — 1.0794. Resistance — 1.0955.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. With a pullback to 90000, it makes sense to buy again.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: when approaching 90000. Stop: 88800. Target: 104000.

Sale: no.

Support — 94164. Resistance — 97155.

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. Nothing new. It’s dreary. Waiting for 90600. Failure under this level will lead to panic dumping of shares.

Downside scenario: standing, not rolling up. We need at least 100000 to enter short. 105000 is better.

Recommendations on the RTS index:

Buy: when approaching 90600. Stop: 90300. Target: 105000.

Sell: on approach to 100000. Stop: 101300. Target: 90600.

Support — 93130. Resistance — 99180.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.