Price forecast from 12 to 16 August 2024

-

Energy market:

In the French Olympics, one man beat another man in the finals… in women’s boxing. What a spectacle! And here we are looking for enlightenment ideas in the West, out of inertia, so to speak, starting from Walter and Diderot, and it all came to this.

For fair sport, comrades, for men and women! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The market is quickly recovering after a completely unnecessary move below 80.00. However, we have not gone higher yet, but we can, and this may become an extremely unpleasant story for sellers. US oil reserves continue to fall: -3.728, while we note the record production of 13.4 million barrels per day, which does not change much inside the US, but the efforts themselves are worth evaluating. We expect prices above 80.00 in the fall on the back of good global demand.

The Fed’s rate cut, which everyone is waiting for and cannot wait for, and which is still not happening, may support the commodity market in the future. However, more negative impact on the commodity group, including oil, may have a decline in growth rates in the United States. But! Even if it happens, we will learn about it, or rather it will be recognized at the level of politicians, only after the US presidential election (November 5), and until then they are unlikely to muddy the waters.

Grain market:

Globally, there are no preconditions for the wheat market to suddenly turn upward. August. The new harvest continues to put pressure on prices at the exchanges. At the same time there is some stabilization at FOB in Europe and the USA: $240 per ton of milling wheat 12.5% protein, in Novorossiysk we see $222 per ton. If on the physical market sellers will not be in a hurry to give up their volumes, it may lead to higher prices, and exchange quotations will have to, after a few weeks, agree with the situation on the ground.

On Monday, the USDA will release another gross harvest forecast. We are likely to see a slight drop in optimism for wheat, and the numbers will again fall below 800 million tons. There will be an attempt to break above 550.0, and if it fails, we are likely to see a drop to 450.0, where we should definitely buy. With soybeans and corn prone to continued declines, wheat alone is unlikely to show immunity to the depression. Only anticipated gross harvest volumes below 780 million tons could turn the wheat market upward.

USD/RUB:

Central Bank Deputy Chairman Zabotkin said the rate could rise to 20%, and higher levels are possible if inflation does not start to slow down, he said.

In the future we have barter, reduction of volumes on the interbank market when trading in any currency, which will lead us to a planned capitalist economy. Tourists should not panic: they will give you Turkish liras upon departure. And the dollar? The dollar will soon become a fairy tale, a tale of lost time.

«LUKOIL will import refrigerators and computers through commodity exchange, ROSNEFT diapers and pads. From Cuba we will receive cigars and rum, and cane sugar in rations.

Then all of these echelons of consumer goods, and we should not forget to include hairspray in the list, will be distributed to retail chains. The main thing is not to take too much of one product from the Chinese, or they will throw out shoes of size 35, ladies’, bordeaux color. And not everyone needs them.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 56.2 thousand contracts. The change is significant. Buyers significantly reduced positions. Sellers have been entering the market. Buyers may be losing control.

Growth scenario: we consider the August futures, expiration date August 30. We refrain from buying for now. Think after the growth above 80.00.

Downside scenario: you can sell. As long as we are below 80.00 it makes sense.

Recommendations for the Brent oil market:

Buy: no.

Sell: now (79.03). Stop: 80.15. Target: 70.80.

Support — 75.10. Resistance — 79.82.

WTI. CME Group

US fundamental data: the number of active drilling rigs rose by 3 units to 485.

U.S. commercial oil inventories fell by -3.728 to 429.321 million barrels, with -1.6 million barrels forecast. Gasoline inventories rose 1.34 to 225.097 million barrels. Distillate stocks rose 0.949 to 127.796 million barrels. Cushing storage stocks increased by 0.579 million barrels to 30.429 million barrels.

Oil production rose by 0.1 to 13.4 million barrels per day. Oil imports fell by -0.729 to 6.224 million barrels per day. Oil exports fell by -1.281 to 3.638 million barrels per day. Thus, net oil imports rose by 0.552 to 2.586 million barrels per day. Oil refining rose by 0.4 to 90.5 percent.

Gasoline demand fell -0.283 to 8.967 million barrels per day. Gasoline production rose by 0.032 to 10.04 million barrels per day. Gasoline imports fell -0.287 to 0.63 million barrels per day. Gasoline exports fell -0.108 to 0.899 million barrels per day.

Distillate demand fell by -0.256 to 3.469 million barrels. Distillate production rose by 0.056 to 5.036 million barrels. Distillate imports fell -0.025 to 0.115 million barrels. Distillate exports rose 0.371 to 1.546 million barrels per day.

Demand for petroleum products fell by -0.75 to 19.974 million barrels. Petroleum products production fell -0.63 to 22.024 million barrels. Imports of refined petroleum products fell -0.127 to 2.104 million barrels. Exports of refined products rose by 0.208 to 6.793 million barrels per day.

Propane demand rose 0.316 to 1.032 million barrels. Propane production fell -0.019 to 2.649 million barrels. Propane imports fell -0.003 to 0.105 million barrels. Propane exports rose 0.007 to 1.648 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 26.6 th. contracts. Buyers were retreating. Sellers were entering the market. Bulls are maintaining control.

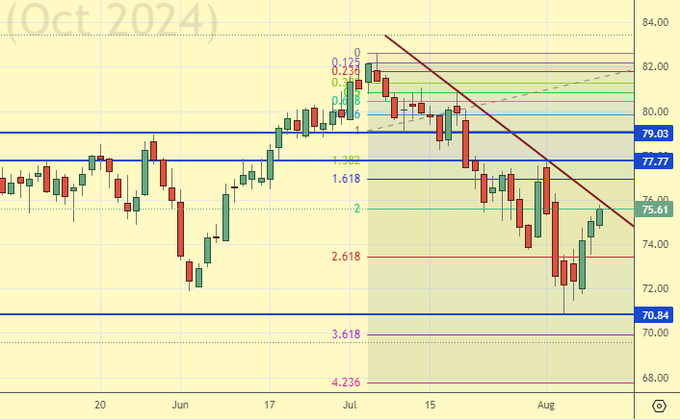

Growth scenario: we consider October futures, expiration date September 20. We refrain from buying for now. Think after the growth above 77.00.

Downside scenario: it’s okay to sell again.

Recommendations for WTI crude oil:

Buy: no.

Sell: now (75.61). Stop: 77.30. Target: 68.00. Count the risks!

Support — 70.84. Resistance — 77.77.

Gas-Oil. ICE

Growth scenario: we consider September futures, expiration date September 12. We remain out of the market for now.

Downside scenario: keep shorts. A move below 700.0 cannot be ruled out.

Gasoil Recommendations:

Buy: no.

Sell: No. Those in position from 807.50, move your stop to 752.00. Target: 650.00!

Support — 695.25. Resistance — 728.75.

Natural Gas. CME Group

Growth scenario: we consider October futures, expiration date September 26. We continue to refuse to buy.

Downside scenario: when approaching 2,600 you can enter short.

Natural Gas Recommendations:

Buy: no.

Sell: on approach to 2.600. Stop: 2.800. Target: 1.555.

Support — 1.987. Resistance — 2.431.

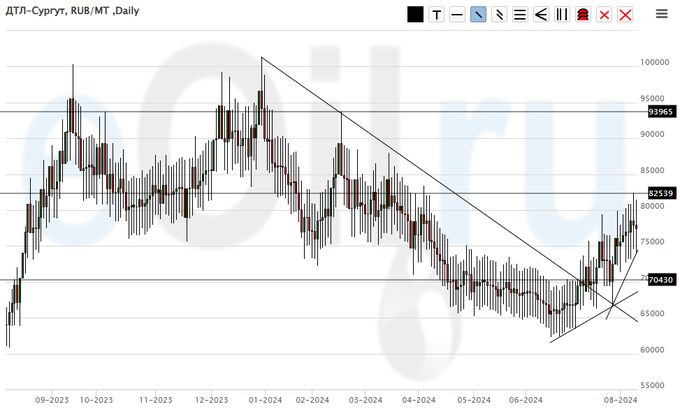

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell, as we can’t believe we don’t need diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 66000. Target: 100000!

Sale: no.

Support — 70430. Resistance — 82539.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 22969. Resistance — 35156.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1037. Resistance — 1535.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 5.2 th. contracts. Buyers and sellers were leaving the market. Sellers did it more actively. Bears are keeping control.

Growth scenario: we consider September futures, expiration date September 13. Nothing new. We want the 455.0 mark for purchases. The current upside is unlikely to lead to a market reversal. Until September 10, sellers will keep pushing.

Downside scenario: stay in sales. On Monday evening on the background of WASDE release the volatility growth is possible.

Recommendations for the wheat market:

Buy: at 455.0. Stop: 435.0. Target: 650.0!

Sell: no. Those in position from 523.4, keep stop at 557.0. Target: 455.0.

Support — 514.0. Resistance — 556.0.

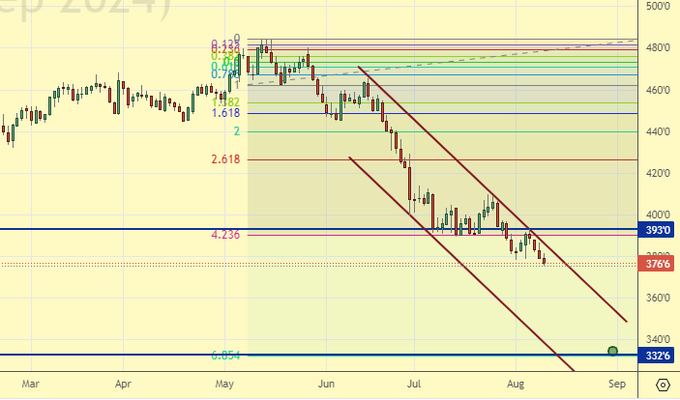

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 51.5 th. contracts. Buyers were entering the market. Sellers were reducing their positions. Bears keep control.

Growth scenario: we consider September futures, expiration date September 13. Falling. We need lower levels to buy.

Downside scenario: we’ll keep shorting. We’re at 390.0. The sellers’ position looks strong.

Recommendations for the corn market:

Buy: when approaching 335.0. Stop: 315.0. Target: 440.0.

Sell: no. Those in position from 394.4, move your stop to 403.0. Target: 335.0.

Support — 332.6. Resistance — 393.0.

Soybeans No. 1. CME Group

Growth scenario: we consider September futures, expiration date September 13. We are waiting for low prices. The market is able to go deeper on the background of the new harvest.

Downside scenario: you can keep shorts.

Recommendations for the soybean market:

Buy: at touching 880.0. Stop: 850.0. Target: 1090.0.

Sell: no. Those in position from 1042.0, move your stop to 1038.0. Target: 880.0!

Support — 927.4. Resistance — 1034.6.

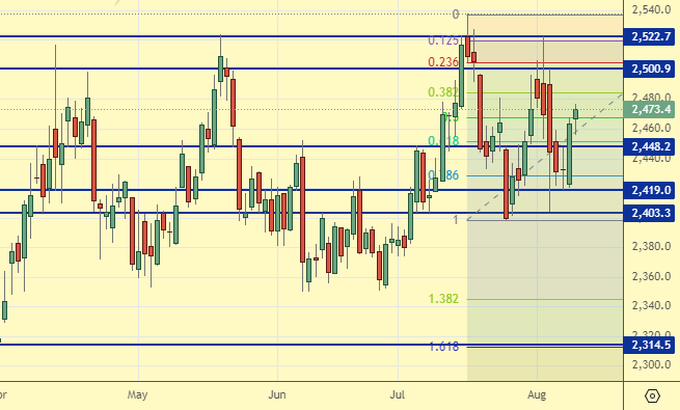

Growth scenario: we consider December futures, expiration date December 27. For purchases we continue to want a correction. Buying from 2180 will be interesting.

Downside scenario: we will continue to keep shorting. At the same time, we note that there are risks of continuing growth in the cost of gold on the background of falling confidence of Central Banks in reserve currencies. They are shooting at presidents. What a horror.

Gold Market Recommendations:

Buy: when approaching 2180. Stop: 2140. Target: 3000?!

Sale: now (2473). Stop: 2515. Target: 2180. Those who are in a position from 2500, move the stop to 2515. Target: 2180. Count the risks!

Support — 2448. Resistance — 2500.

EUR/USD

Growth scenario: we cannot miss this growth. Buy.

Downside scenario: there are still opportunities to strengthen the dollar. The Fed’s rate cut in September is not a fact yet. At the same time, we will refrain from selling the pair for the time being.

Recommendations on euro/dollar pair:

Buy: when approaching 1.0840. Stop: 1.0770. Target: 1.2000. Those who are in the position from 1.0908, keep the stop at 1.0770. Target: 1.2000. Consider the risks!

Sale: not yet.

Support — 1.0879. Resistance — 1.1010.

USD/RUB

Growth scenario: we consider the September futures, expiration date September 19. The market is able to go above 88000, if this happens, we will quickly go to 91700.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Who is in position from 85976, keep stop at 84900. Target: 100000.

Sale: no.

Support — 84906. Resistance — 87568.

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: we will keep shorting. The external and internal background is favorable for selling. One promise of the Central Bank Deputy Chairman to raise the interest rate above 20%, if necessary, is worth it.

Recommendations on the RTS index:

Buy: no.

Sell: no. Who is in position from 115200, keep stop at 111600. Target: 98000.

Support — 103890. Resistance — 108070.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.