Price forecast from 29 July to 2 August 2024

-

Energy market:

The Olympics started in Paris with cardboard beds for the athletes, and we now have a rate of 18%. Yeah, apparently, when the rate is 100%, the economy will go to zero. Well, in the meantime, we can still pump it up! We make a rationalization proposal: let the deposit rate be 20% and the loan 7%. The difference is 13%. Nobody works. Everybody’s happy.

That’s the way it’s going to be. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The level of 80.00 for Brent oil remains unbroken for now. Sellers will try to take it, but we see nothing but a short-term hit at 79.40 in the crystal ball. US GDP data came out better than expected, which supported the market. The fate of oil supplies from Russia will be in question in the long run, as we cannot say how rampant the US financial authorities will be. India and China may be advised to reduce purchases in one place and increase them in another. Or even Iran! Just not from the Russians. Such tricks can “shake” the market up.

US oil inventories continue to fall, which has already led to traders watching this indicator with much more attention every Wednesday. If it continues to fall, it will be to the advantage of the bulls, especially with the growth of domestic production and the increase in the number of active drilling rigs.

Grain market:

Everything is so good with the harvest that there is no need to invent anything. Including in Russia. Kuban has finished harvesting with the result of 10.2 million tons of wheat, which gives us a good head start for the entire sector. In August we are expecting figures in the region of 80 million tons of gross wheat harvest in the country. However, the FOB price is unlikely to be above 220.0 in the coming weeks.

At the time, the growth of grain consumption, and wheat in particular, is not stopping, i.e. we need more and more of it. So, we can say that wheat prices will not be low for a very long time. At the moment they may be pressed down by the gross harvest, then by a strong dollar, then by global détente. But! So far we don’t see the world economy getting up. No! It’s growing! People are working, which means more and more people want a croissant in the morning. And a beer (barley or wheat) and a pork sausage in the evening. So the demand for cereals will continue to grow.

We continue to wait for 450 cents a bushel on wheat, and 330 on corn. Deep? Yeah. Deep.

USD/RUB:

And here it is. A great event and a press conference. They raised the interest rate to 18% and said they will continue to raise it and at least keep it at a high level until the end of the year. After a rise above 20% we will be in the gray zone and after a rise above 25% we will be in the black zone.

I would like to call for a more restrained policy regarding “inflation targeting”. Still, we need some startups and expansion of production, if possible. It is unlikely that there will be enough soft loans for everyone. There will be no foreign money. Yes, the moment is not simple, and in many respects it is sad, but still we have to work somehow. We urge Elvira to cancel this horror and return to a rate around 14, maybe even 12% otherwise many people will feel bad, including borrowers who take loans at the current rate. Dear Central Bank, let’s look for a balance. As long as the country needs armor and tanks, you can do nothing about inflationary pressure. There is no need to go crazy.

The ruble exchange rate will most likely tend to strengthen in the next couple of weeks. Currency is no longer needed, you can’t buy anything with it, no one accepts payments. We will have to claw our partners for rubles. Well, that’s fine.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 35.5 th. contracts. Buyers were fleeing. Sellers have been sluggish in entering the market. Buyers are maintaining control.

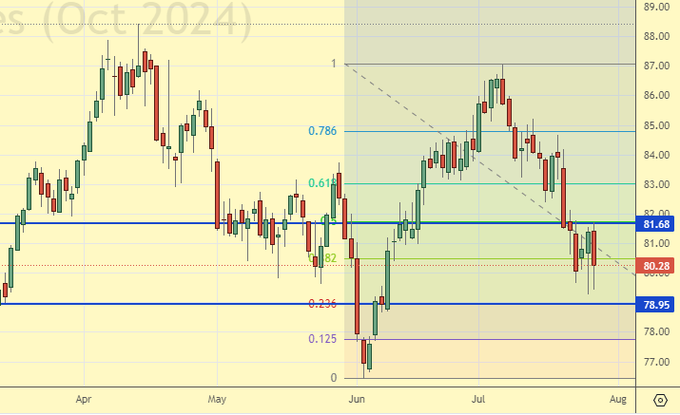

Growth scenario: we consider August futures, expiration date August 30. We bought at the bottom. Now we stand in longs. We have a lot of interesting targets at the top. As if in August the superpowers would not stand on their haunches like horses.

Downside scenario: the shorting target is fulfilled. Do not open new positions downwards yet.

Recommendations for the Brent oil market:

Buy: who is in position from 79.30 (taking into account the transition to a new contract), move the stop to 78.70. Target: 99.90.

Sale: no.

Support — 78.95. Resistance — 81.68.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 5 units to 482.

U.S. commercial oil inventories fell by -3.741 to 436.485 million barrels, with a forecast of -2.6 million barrels. Gasoline stocks fell by -5.572 to 227.422 million barrels. Distillate stocks fell -2.753 to 125.313 million barrels. Cushing storage stocks fell by -1.708 to 30.956 million barrels.

Oil production was unchanged at 13.3 million barrels per day. Oil imports fell by -0.166 to 6.871 million barrels per day. Oil exports rose by 0.222 to 4.186 million barrels per day. Thus, net oil imports fell -0.388 to 2.685 million barrels per day. Oil refining fell by -2.1 to 91.6 percent.

Gasoline demand increased by 0.673 to 9.456 million barrels per day. Gasoline production increased by 0.664 to 10.213 million barrels per day. Gasoline imports rose 0.05 to 0.778 million barrels per day. Gasoline exports increased by 0.064 to 0.915 million barrels per day.

Distillate demand rose by 0.276 to 3.861 million barrels. Distillate production fell by -0.292 to 4.937 million barrels. Distillate imports rose 0.004 to 0.112 million barrels. Distillate exports rose 0.322 to 1.581 million barrels per day.

Demand for petroleum products increased by 1.603 to 21.033 million barrels. Petroleum products production fell by -0.017 to 22.341 million barrels. Imports of refined petroleum products rose 0.209 to 1.976 million barrels. Exports of refined products increased by 0.314 to 6.437 million barrels per day.

Propane demand rose by 0.475 to 1.018 million barrels. Propane production fell -0.026 to 2.629 million barrels. Propane imports rose 0.003 to 0.084 million barrels. Propane exports fell -0.101 to 1.431 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 23.5 th. contracts. Buyers were fleeing. Sellers sluggishly entered the market. The bulls stepped up their control.

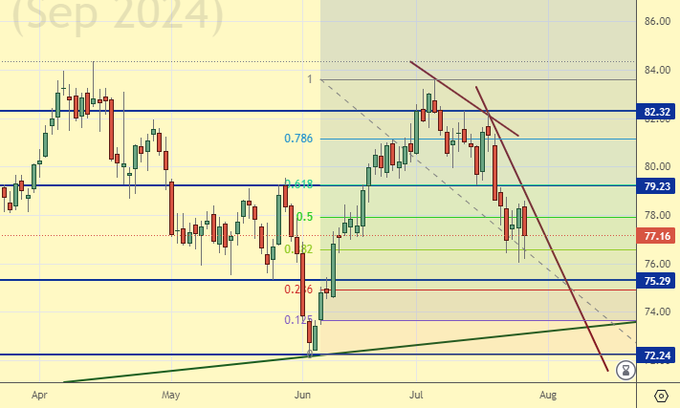

Growth scenario: moved to September futures, expiration date August 20. We got the expected pullback, we can buy. In case the market plunges deeper, you can add.

Downside scenario: we will continue to hold the short with downside targets at 75.30. At the same time we press the stop order.

Recommendations for WTI crude oil:

Buy: now (77.16) and when approaching 75.30. Stop: 74.70. Target: 95.00. Count the risks!

Sell: no. Those in position from 82.00 move stop to 78.10. Target: 75.30.

Support — 75.29. Resistance — 79.23.

Gas-Oil. ICE

Growth scenario: we consider the August futures, expiration date August 12. The market gave an opportunity to buy when approaching 735.0. Now we keep longing.

Downside scenario: keep shorting. A move below 700.0 cannot be ruled out.

Gasoil Recommendations:

Buy: No. Those in position from 737.00, move stop to 734.00. Target: 950.00.

Sell: No. Those in position from 807.50, move your stop to 770.00. Target: 650.00!

Support — 728.25. Resistance — 759.50.

Natural Gas. CME Group

Growth scenario: moved to September futures, expiration date August 28. Nothing new. You can buy. But you don’t want to. Colder weather in the US reduces the demand for energy for air conditioners.

Downside scenario: refrain from selling for now.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.995. Resistance — 2.260.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 64000. Target: 100000!

Sale: no.

Support — 69453. Resistance — 79707.

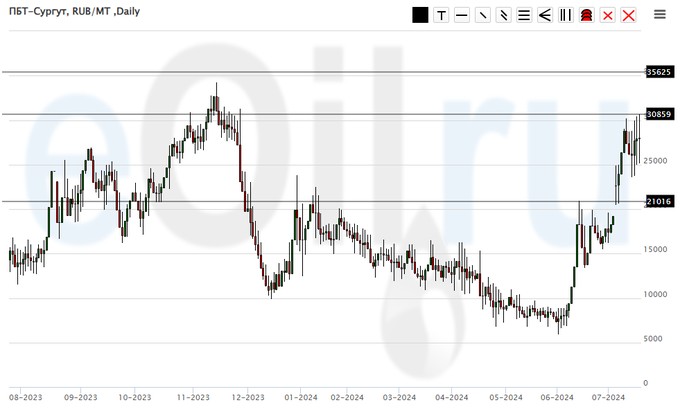

Propane butane (Surgut), ETP eOil.ru

Growth scenario: growing. We’ll continue to hold the long. We want 35000!

Downside scenario: 35000 mark may give a reason for shorting.

PBT Market Recommendations:

Buy: no. Those in position from 11000, move stop to 23000. Target: 35000.

Sale: no.

Support — 21016. Resistance — 30859.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1027. Resistance — 1525.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 0.3 th. contracts. Buyers were a bit more active than sellers on small volumes. Bears keep control.

Growth scenario: we consider the September futures, expiration date September 13. We want the mark of 455.0 for purchases.

Downside scenario: without upward correction, medium-term selling is not safe. Nevertheless, we don’t want to miss the move to 450.0. Let’s sell.

Recommendations for the wheat market:

Recommendations for the wheat market:Buy: when approaching 455.0. Stop: 425.0. Target: 650.0!

Sell: Now (523.4). Stop: 557.0. Target: 455.0. Also think when approaching 625.0.

Support — 520.4. Resistance — 556.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 18.9 th. contracts. Buyers were entering the market. Sellers were fleeing. Bears are maintaining control.

Growth scenario: we consider the September futures, expiration date September 13. The market continues to look heavy. We expect the decline to continue.

Downside scenario: and we go short again. We can be aggressive. We should put our five cents into this movement.

Recommendations for the corn market:

Buy: when approaching 335.0. Stop: 315.0. Target: 440.0.

Sell: now (394.4). Stop: 412.0. Target: 335.0.

Support — 389.2. Resistance — 409.4.

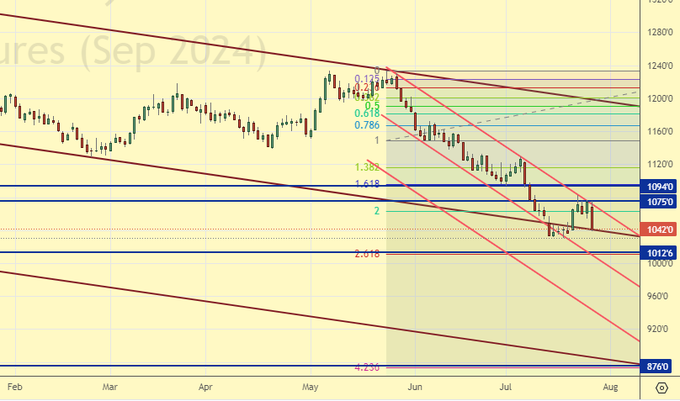

Soybeans No. 1. CME Group

Growth scenario: we consider September futures, expiration date September 13. We do not exclude the possibility of failure to 880.0. The recommendation to buy from 1015 is removed.

Downside scenario: let’s sell. Why not? What a beautiful Friday candle.

Recommendations for the soybean market:

Buy: at touching 880.0. Stop: 850.0. Target: 1090.0.

Sell: now (1042.0). Stop: 1080.0 Target: 880.0! Count the risks!!!

Support — 1012.6. Resistance — 1075.0.

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2120 will be interesting.

Downside scenario: a difficult and unpleasant picture for shorts. We can go down, but we don’t have to. Fed meeting on July 31st, there may not be any long moves down until then. From 2410 we can go short.

Gold Market Recommendations:

Buy: when approaching 2120. Stop: 2070. Target: 2650?!

Sell: on approach to 2410. Stop: 2427. Target: 2120.

Support — 2349. Resistance — 2433.

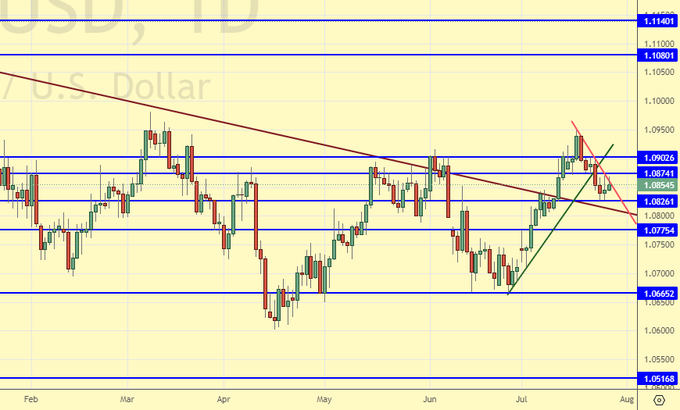

EUR/USD

Growth scenario: the situation is not interesting for purchases. Outside the market.

Downside scenario: US inflation is not slowing down, which gives a chance for a rate hike in September. Sell the pair.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.0854). Stop: 1.0957. Target: 1.0000.

Support — 1.0826. Resistance — 1.0874.

USD/RUB

Growth scenario: we consider the September futures, expiration date September 19. We reacted modestly to the rate hike, and not in the direction that is needed according to the classic. So far out of the market.

Downside scenario: the technique again does not deny further strengthening of the ruble. Selling from 91700 will still be interesting, and we will recommend it. It is better to short from current levels on “hours”. In general, the currency drama is getting bloodier. The yuan will be canceled. What will we do? We will guess, as before.

Recommendations on dollar/ruble pair:

Buy: when approaching 74000. Stop: 72000. Target: 100.00.

Sell: on approach to 91700. Stop: 92800. Target: 76000.

Support — 86019. Resistance — 87558.

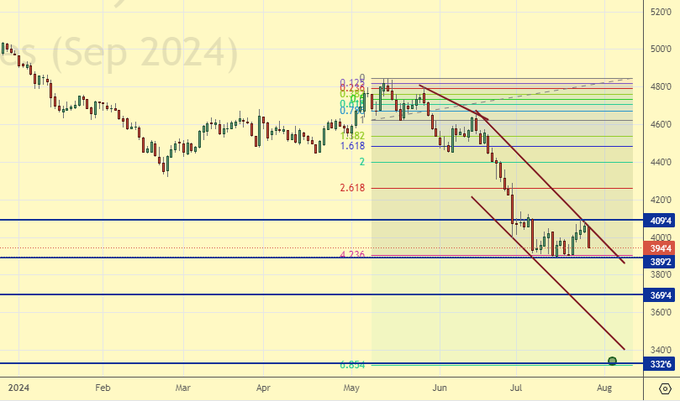

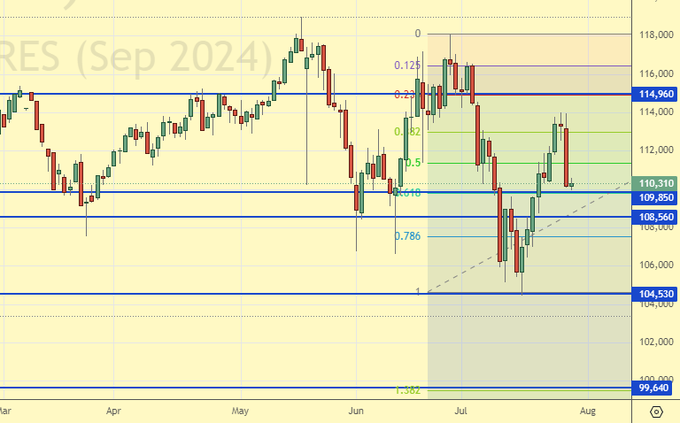

RTSI

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: we reached 114000. We see that people are determined to try the area of 110000, if we go below, we are waiting for 100000, 90000, 20000, zero?!

Recommendations on the RTS index:

Buy: no.

Sell: no. Who is in the position from 115200, move the stop to 114200. Target: 102000.

Support — 109850. Resistance — 114960.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.