03 June 2024, 13:15

Price forecast from 3 to 7 June 2024

-

Energy market:

The Chinese have landed a probe on the back side of the moon. They will look for aliens, or those from whom the Chinese themselves are descended, some blue bloods from Alpha Centauri, in the sense of blue blood. And by the year 36, we’ll have a base on the Moon with our nuclear reactor. And the other day the EU imposed prohibitive duties on Russian grain. Mankind must make up its mind: either the Moon or the duties.

To consent! Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

So, OPEC+ will meet today at the technical committee level. Most likely, the reduction will be prolonged, and possibly extended. The market exhibited before the meeting very unpleasantly for the bulls. We may not see a gap down on Monday night.

OPEC+ members are currently realizing production cuts totaling 5.86 million bpd, or about 5.7% of global demand. This figure includes 3.66 million bpd by OPEC+ members (agreed through the end of 2024) and 2.2 million bpd of voluntary cuts by some members — this arrangement expires at the end of June.

Reports that Chinese private refineries and mills are cutting back on their purchases of Russian oil have been replaced by cries that the Indians need a lot of Russian product again. We should take advantage of the situation and buy up the entire tea industry from the Yogi inventors for their own rupees, and embargo London. And they will no longer have tea with elephant.

So far, high Fed rates can’t crush the U.S. economy and lower inflation. This is not bad for the oil market. But the first reports about GDP decline in the US will be a reason for Brent to feel the strength of 70.00. Regardless of what OPEC+ is pumping.

Grain market:

Unexpectedly, for a number of analysts, summer has come. And it is warm. And since there was such a random event not predicted by anyone, the bulls will have to agree that the plants get enough light and heat for their development, which makes the harvest in July almost a matter of decision. If it grows, it should be harvested.

The grain market is going to have a hard time trying to grow. Everyone is used to the SWO, Palestine has been recognized (though not by everyone), China’s march on Taiwan is unlikely, and nothing new is on the horizon. As stress levels drop, grain prices will not be inclined to rise. Yes, they will make coffee and cocoa, but you can do without them and they can’t affect grain in any way.

The world is already starting: Germany for the Germans, China for the Chinese, and so on, and international projects must now be designed very carefully. Including flights to the Moon, Mars, and so on down the list.

USD/RUB:

We expect the rate to rise to 17% minimum on Friday, we may see 18% at once. We continue to note that the RGBI is falling, on some days it is just falling, which tells us that bankers do not see a way out of the situation. They are ready to give the money raised from the population to the state by buying bonds, but they want high rates, very high. And they see that these high rates will remain in the foreseeable future: a year, two, three.

You know… there is a feeling (from the higher spheres) that the ruble will not be helped by the rate and 25%. That is: inflation will remain, and the rate against the dollar will continue to fall. I would very much like to be wrong.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of asset managers increased by 4.6 th. contracts. Speculators refrained from active bets last week. Buyers are still controlling the situation.

Growth scenario: we consider July futures, expiration date June 28. It is possible to buy a small risk. If there will be a gap of more than 30 cents up or down, it makes sense to reduce the risk on the deal.

Downside scenario: came to the support line, it will be difficult to go below. Out of the market.

Recommendations for the Brent oil market:

Buy: now (81.11). Stop: 79.80. Target: 92.00.

Sale: no.

Support — 80.15. Resistance — 84.75.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 1 unit to 496.

U.S. commercial oil inventories fell by -4.156 to 454.689 million barrels, with a forecast of -1.6 million barrels. Gasoline inventories rose by 2.022 to 228.844 million barrels. Distillate stocks rose 2.544 to 119.288 million barrels. Cushing storage stocks fell by -1.766 to 34.554 million barrels.

Oil production remained unchanged at 13.1 million barrels per day. Oil imports rose by 0.106 to 6.769 million barrels per day. Oil exports fell by -0.505 to 4.225 million barrels per day. Thus, net oil imports rose by 0.611 to 2.544 million barrels per day. Oil refining rose by 2.6 to 94.3 percent.

Gasoline demand fell -0.167 to 9.148 million barrels per day. Gasoline production fell -0.038 to 10.011 million barrels per day. Gasoline imports rose 0.319 to 1.092 million barrels per day. Gasoline exports rose 0.184 to 0.954 million barrels per day.

Distillate demand fell -0.088 to 3.795 million barrels. Distillate production fell by -0.034 to 5.03 million barrels. Distillate imports rose -0.067 to 0.165 million barrels. Distillate exports fell -0.188 to 1.036 million barrels per day.

Demand for petroleum products fell by -0.647 to 19.383 million barrels. Petroleum products production fell by -0.443 to 21.702 million barrels. Petroleum product imports rose 0.131 to 2.21 million barrels. Exports of refined petroleum products fell -0.096 to 6.55 million barrels per day.

Propane demand fell -0.346 to 0.46 million barrels. Propane production fell -0.049 to 2.737 million barrels. Propane imports fell -0.044 to 0.066 million barrels. Propane exports rose 0.278 to 2.047 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 34.6 th. contracts. For the second week in a row, buyers entered the market, sellers fled. The bulls are maintaining control.

Growth scenario: we consider July futures, expiration date June 20. Chances for growth remain. We will keep longing.

Downside scenario: do nothing for now.

Recommendations for WTI crude oil:

Buy: no. Those in position from 77.72, move stop to 75.74. Target: 97.00.

Sale: no.

Support — 75.92. Resistance — 80.58.

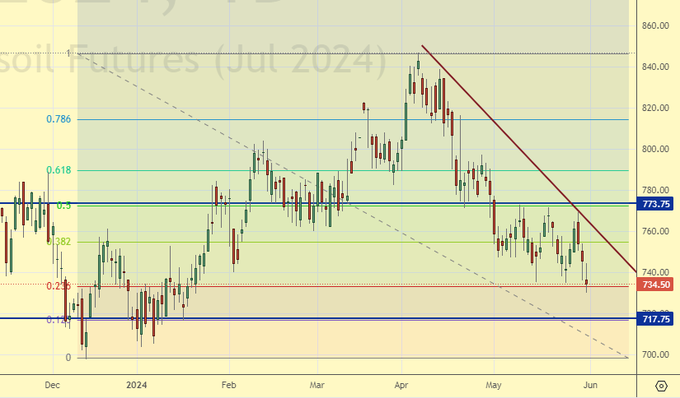

Gas-Oil. ICE

Growth scenario: we consider June futures, expiration date June 12. We fight for longs, buy at current levels.

Downside scenario: there are no interesting levels for selling.

Gasoil Recommendations:

Buy: Now (734.50). Stop: 727.00. Target: 880.00.

Sale: no.

Support — 717.75. Resistance — 773.75.

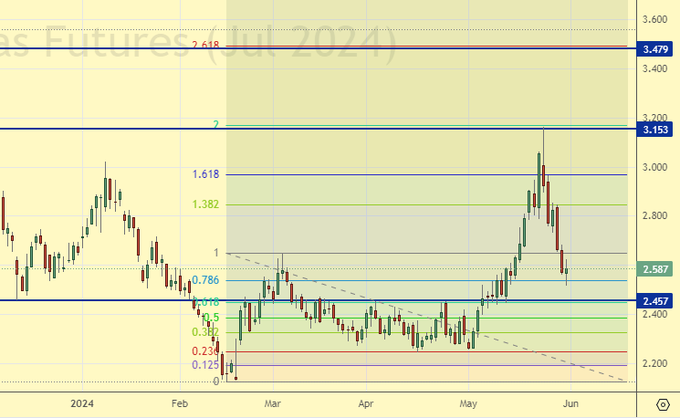

Natural Gas. CME Group

Growth scenario: we consider July futures, expiration date June 26. We hold long. Those who wish can buy, the levels are not bad.

Downside scenario: when approaching 3.500 we will think about selling. Out of the market for now.

Natural Gas Recommendations:

Buy: no. Who is in position from 2.300, keep stop at 2.400. Target: 3.400.

Sale: not yet.

Support — 2.457. Resistance — 3.153.

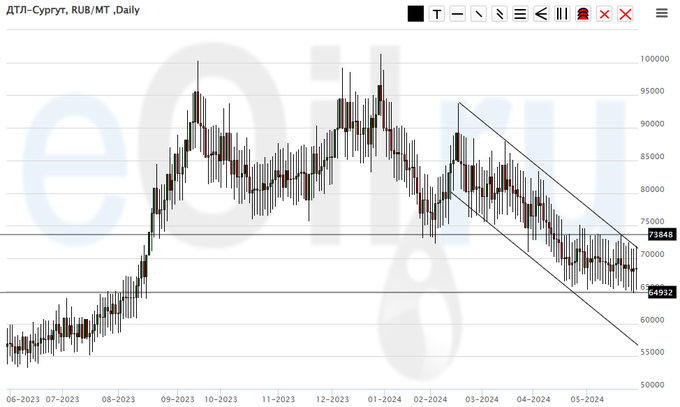

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 75000, we don’t think about buying. At the same time: purchases from 62000 are welcome.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: on approach to 62000. Stop: 58000. Target: 100000!

Sale: no.

Support — 64932. Resistance — 73848.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will buy, but only after growth above 11000.

Downside scenario: we stay out of the market. A move to 5000 is possible, but selling is risky now. It is better to be in commodities than in cash.

PBT Market Recommendations:

Buy: in case of growth above 11000. Stop: 8800. Target: 25000. You can be aggressive.

Sale: no.

Support — 6914. Resistance — 9990.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see growth from 1000. Nevertheless, still out of the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1027. Resistance — the area of 1545.

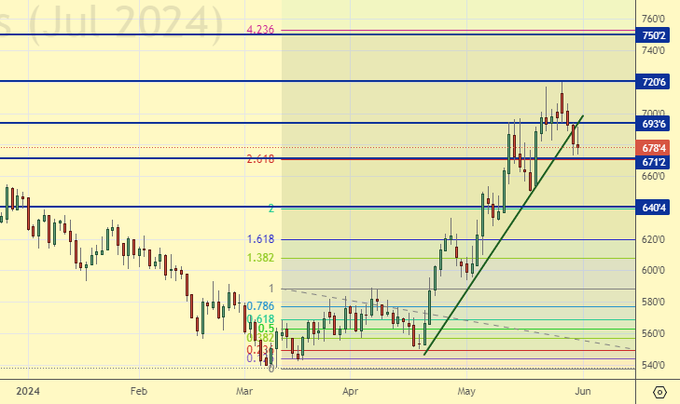

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 4.7 th. contracts. Buyers were losing interest in the market. Sellers were inactive. Bears are keeping control for the time being.

Growth scenario: we consider July futures, expiration date July 12. We refrain from buying. On “hours” it is possible to work out the idea of a move to 750.0.

Downside scenario: nothing new, shorting from 750.0 would be a good decision given that the current rise has weak fundamental support.

Recommendations for the wheat market:

Buy: no.

Sell: when approaching 750.0. Stop: 770.0 Target: 600.0.

Support — 671.2. Resistance — 693.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 16.2 thousand contracts. Sellers came in, buyers were inactive. Bears consolidated their control.

Growth scenario: we consider July futures, expiration date July 12. They won’t let us make money on longs. Out of the market.

Downside scenario: it would be interesting to sell from 550.0. It is also possible to sell on a pullback to 460.0.

Recommendations for the corn market:

Buy: no.

Sell: on approach to 460.0. Stop: 470.0. Target: 360.0. Or when approaching 550.0. Stop: 570.0. Target: 360.0?!

Support — 443.6. Resistance — 450.6.

Soybeans No. 1. CME Group

Growth scenario: we consider July futures, expiration date July 12. We got nothing on the upside. We are out of the market for now.

Downside scenario: we interpret the current picture as equilibrium. From 1310 we will definitely go short.

Recommendations for the soybean market:

Buy: no.

Sell: when approaching 1310.0. Stop: 1330.0. Target: 960.0.

Support — 1191.0. Resistance — 1258.

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2150 will be interesting.

Downside scenario: we will sell when approaching 2430.

Gold Market Recommendations:

Buy: when approaching 2150. Stop: 2120. Target: 2650?!

Sale: now (2345). Stop: 2400. Target: 2150.

Support — 2312. Resistance — 2387.

EUR/USD

Growth scenario: the bulls may reverse the situation, but until that happens we remain out of the market.

Downside scenario: we keep short, but we realize that there is a possibility of the market moving to 1.1000.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Who is in position from 1.0867, keep your stop at 1.0910. Target: 1.0000.

Support — 1.0788. Resistance — 1.0893.

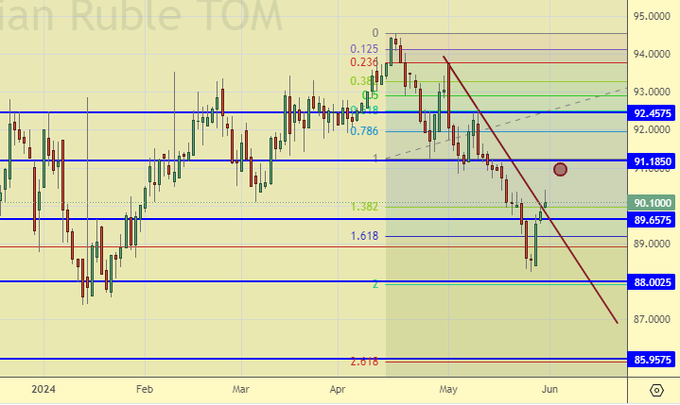

USD/RUB

Growth scenario: most likely, we will enter long from 86.00. Out of the market for now. We may get 18% rate on Friday, instead of 17%, and they promise to raise it further.

Downside scenario: it is possible to try to enter short from 91.20. We remain of the opinion that as long as the Central Bank has not raised the rate above 20%, the ruble will be looked at as a quite healthy creature.

Recommendations on dollar/ruble pair:

Buy: when approaching 86.00. Stop: 85.00. Target: 95.00?!

Sell: when approaching 91.20. Stop: 91.60. Target: 86.00.

Support — 89.65. Resistance — 91.18.

RTSI. MOEX

Growth scenario: we consider the June futures, expiration date June 20. There is nothing bullish in the picture. Everything is sad. The Central Bank of Russia will raise the interest rate on Friday. Out of the market.

Downside scenario: if there will be a rise to 116300, it will be possible to sell. Current levels are low.

Recommendations on the RTS index:

Buy: no.

Sell: on approach to 116300. Stop: 116800. Target: 103000.

Support — 109470. Resistance — 116410.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.