Price forecast from 19 to 23 January 2024

-

Energy market:

This year of the Dragon will pass under the sign, or rather under the signs of payment for Russian oil. Everyone will be wondering in what Russia will be ready to accept payment for oil supplies. What are the options other than Arab dirhams in the face of sanctions? From India: bitcoins, bananas, baboon skins, buffalo, rams, sheep, lambs, bagels, holes from the same. From China: we can accept in dragons, in dragon eggs, in coins with dragons.

Yep, in times like these there’s nothing like bartering, you won’t get confused about the exchange rate, swapping rams for baboons and bananas for barrels. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

Clearly, the oil market is paying too much attention to the conflict between Israel and the Gaza Strip. There is nothing there, but the noise is there. OK, one dollar per barrel added for transporting oil around Africa instead of the Red Sea, but the speculation continues. If we pass to 85.00 on Brent, it will be a problem for sellers, as in this case we can talk about a move to 100, but how this all fits into the recession in Europe is not clear. Of course, we will obey the trend, but while there is no move to 85.00, we will look down. It’s more comfortable.

The Chinese will start working next week after a long holiday. Their markets will also start their work, and everyone will continue to look at the stock markets of the Celestial Empire, from which investors continue to flee. Since the beginning of 2024, China’s stock exchanges have lost $1.7 trillion. Businesses no longer believe in the rapid growth of China’s economy — forecasts sound more and more pessimistic. This means that the oil market is unlikely to show significant growth. No production, no spending of resources.

Grain market:

IGC forecasted the gross grain harvest to grow by 3 million tons to 2,310 million tons. Wheat production is projected at 788 million tons, corn production at 1,234 million tons. At the same time, it is noted that the world sown area will continue to increase due to the plowing of land in Asia and Africa.

So far in the world over the last month and a half there is a clear trend of falling FOB prices on the main bases. The last tender in Egypt ended at the level of 255 dollars per ton together with freight. At the same time prices for wheat inside the USA stabilized. Thus, EXW prices in Chicago are at $219 per ton, in St. Louis $226 per ton. It can be assumed that we are already close to strong support levels and the price drop, if it happens, will not exceed 5% of the current values.

There have been reports that some of the grain that Russia supplies to Africa is at risk of being lost due to natural causes, as there is simply nowhere to store it. Commissars should be assigned to the grain shipments to see how the charity is distributed in the countries. The main task is to make them eat everything. We’ll have to control the food stations. So that nothing goes to waste. Or maybe they should just build a grain elevator, but that’s just a matter of luck.

USD/RUB:

On Friday, the Central Bank of Russia left the interest rate at 16% and proudly announced its inflation target of 4% in 2024. This ambition has attracted the attention of all sensible people on the planet. We will not be surprised if soon there will be data on the growth of the Russian economy by 5% per year, as in China. 3.6% was found, why not a little more. 5.0% is beautiful.

Given the difficulties with which the convertible currency has to be chewed out for oil contracts, it can be assumed that the ruble will face a difficult next two years.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 42.2. th. contracts. Buyers were actively entering the market. Sellers were retreating. Bulls keep the advantage.

Growth scenario: we consider the February futures, expiration date February 29. Growth above 85.00 will be a surprise. We do not look up until it happens.

Downside scenario: the market is frozen in even more interesting position for shorting than a week ago. Sell. Buyers have not convinced us of their strength yet.

Recommendations for the Brent oil market:

Purchase: no.

Sell: now (83.40). Stop: 84.20. Target: 68.00.

Support — 81.16. Resistance — 83.80.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 2 units to 497.

U.S. commercial oil inventories rose by 12.018 to 439.45 million barrels, against a forecast of +3.3 million barrels. Gasoline inventories fell by -3.658 to 247.33 million barrels. Distillate stocks fell -1.915 to 125.659 million barrels. Cushing storage stocks rose 0.71 to 28.771 million barrels.

Oil production is unchanged at 13.3 million barrels per day. Oil imports fell by -0.437 to 6.47 million barrels per day. Oil exports rose by 0.751 to 4.347 million barrels per day. Thus, net oil imports fell -1.188 to 2.123 million barrels per day. Oil refining fell by -1.8 to 80.6 percent.

Gasoline demand fell -0.639 to 8.168 million barrels per day. Gasoline production rose by 0.164 to 9.175 million barrels per day. Gasoline imports fell -0.1 to 0.436 million barrels per day. Gasoline exports rose 0.221 to 0.968 million barrels per day.

Distillate demand fell by -0.303 to 3.514 million barrels. Distillate production fell by -0.281 to 4.076 million barrels. Distillate imports rose 0.009 to 0.135 million barrels. Distillate exports fell -0.155 to 0.971 million barrels per day.

Demand for petroleum products fell by -0.972 to 19.255 million barrels. Petroleum products production fell by -0.162 to 20.592 million barrels. Imports of refined petroleum products fell -0.552 to 1.527 million barrels. Exports of refined products fell -0.106 to 6.266 million barrels per day.

Propane demand rose 0.093 to 1.333 million barrels. Propane production fell -0.012 to 2.483 million barrels. Propane imports fell -0.025 to 0.122 million barrels. Propane exports fell -0.009 to 0.111 million barrels per day.

Let’s look at the WTI open interest volumes . You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 23.1 thousand contracts. Buyers increased the volume, sellers left the market in the same amount. Bulls keep control.

Growth scenario: switched to April futures, expiration date March 20. Out of the market for now. Washington’s new peace initiatives may be able to cool down the market.

Downside scenario: we’ll continue to push for selling, even though it’s already looking unsafe.

Recommendations for WTI crude oil:

Purchase: no.

Sell: now (78.46). Stop: 79.40. Target: 65.00. Count the risks!

Support — 75.50. Resistance — 79.13.

Gas-Oil. ICE

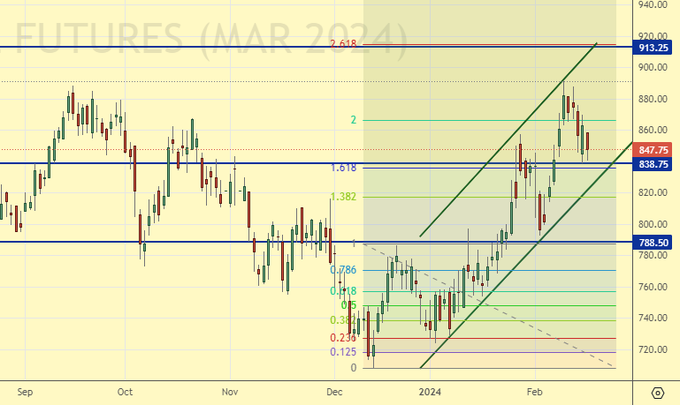

Growth scenario: we consider the March futures, expiration date March 12. A move to 913.00 cannot be ruled out. Let’s buy.

Downside scenario: we are not selling yet. Out of the market.

Gasoil Recommendations:

Purchase: Now (847.00). Stop: 833.00. Target: 913.00.

Sale: no.

Support — 838.75. Resistance — 913.25.

Natural Gas. CME Group

Growth scenario: we consider the March futures, expiration date is February 27. The market is still falling. We do not make attempts to buy yet.

Downside scenario: we will continue to hold the short, but we will tighten the stop order in order to protect some of what the market has already given us.

Natural Gas Recommendations:

Purchase: no.

Selling: no. Those in position from 2.570, move your stop to 1.709. Target: 1.000 (revised).

Support — 0.702. Resistance — 1.806.

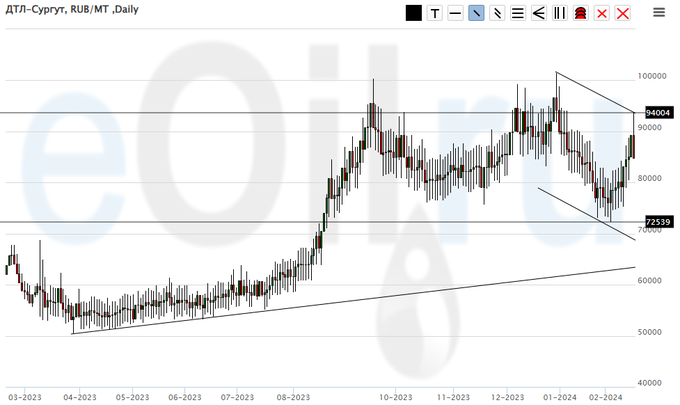

Diesel arctic fuel, ETP eOil.ru

Growth scenario: continue to stay out of the market. Prices are too high for interesting purchases.

Downside scenario: we were knocked out of the short with a small profit. We are out of the market for now. This upward surge is strange, it may be caused by drone attacks on refineries, among other things.

Diesel Market Recommendations:

Purchase: no.

Sale: no.

Support — 72539. Resistance — 94004.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we are back close to 10000. Let’s buy, inflation should support prices.

Downside scenario: no interesting ideas for sales. Out of the market.

PBT Market Recommendations:

Purchase: Now (13000). Stop: 11000. Target: 25000.

Sale: no.

Support — 10029. Resistance — 24004.

Helium (Orenburg), ETP eOil.ru

Growth scenario: like a week ago, we believe that when approaching 2100 we should definitely buy. In principle, this area is already interesting for buying. Therefore, it makes sense to open a position now and add after the move to 2100.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: now (2200), add when approaching 2100. Stop: 1900. Target: 5000.

Sale: no.

Support — 2133. Resistance — 2766.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 11.4 th. contracts. Buyers entered the market in insignificant volumes, sellers left the market. Bears keep control.

Growth scenario: we consider March futures, expiration date March 14. The bulls have fled. Out of the market.

Downside scenario: corn dragged the market down, as suggested earlier. If it returns to 585.0, it is possible to sell.

Recommendations for the wheat market:

Purchase: no.

Sell: on approach to 585.0. Stop: 595.0. Target: 530.0.

Support — 530.5. Resistance — 585.3.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 11.3 th. contracts. Both buyers and sellers entered the market. Sellers did it in big volumes. Bears strengthened their advantage.

Growth scenario: we consider the March futures, expiration date March 14. It would be interesting to buy from 382.0, but whether we will come to this mark is not clear. Therefore, we will buy from 410.0 and then from 382.00.

Downside scenario: we fell under 420.0, but, apparently, this is not the end of the story. A visit to the level of 382.0 is not excluded.

Recommendations for the corn market:

Purchase: when approaching 410.0. Stop: 406.0. Target: 500.0. Those who are in the position from 420.0, move the stop to 406.0. Target: 500.0.

Sale: no.

Support — 410.1. Resistance — 425.1.

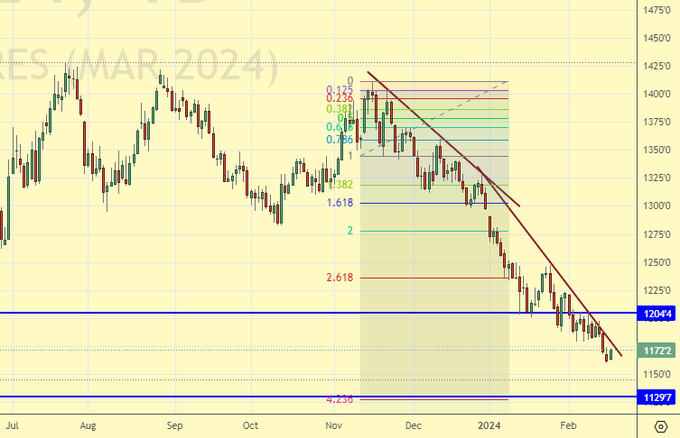

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, expiration date March 14. Soybeans can fall to 1130. When approaching this level, buying is possible.

Downside scenario: nothing has changed for us. We will continue to hold the short. The target at 1130 looks real.

Recommendations for the soybean market:

Purchase: when approaching 1130.0. Stop: 1110.0. Target: 1300.0.

Sell: no. Those who are in position from 1295.0, move the stop to 1196.0. Target: 1130.0.

Support — 1129.7. Resistance — 1204.4.

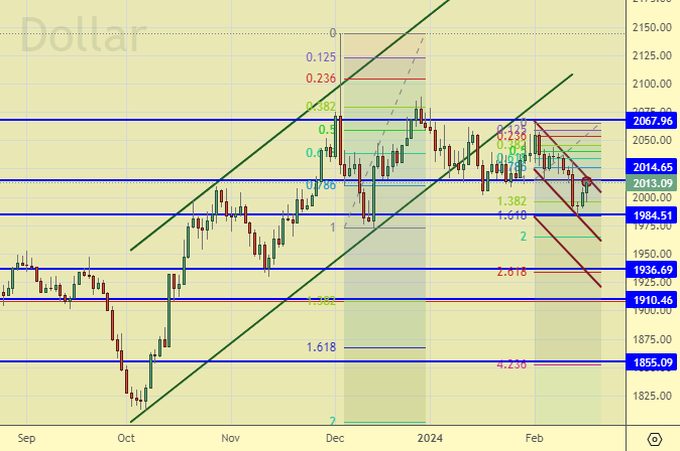

Growth scenario: the market sellers are pushing things up. As long as we are below 2050 it is better to look down. At the same time, we understand that the 2015 area is key.

Downside scenario: you can try to sell at current levels. Targets at the bottom may be interesting. Bulls can’t break through to 2100 for a long time. The market looks tired.

Gold Market Recommendations:

Purchase: no.

Sale: now (2013). Stop: 2023. Target: 1936 (1855).

Support — 1984. Resistance — 2013.

EUR/USD

Growth scenario: we went long from 1.0722. Let’s see if the bulls have enough strength to get back above 1.0800. If it happens, there will be a lot of interesting marks at the top.

Downside scenario: we continue to keep shorting. We came to 1.0720, but since we went below the lower boundary of the rising channel there are chances for the continuation of the fall. We want 1.0460.

Recommendations on euro/dollar pair:

Purchase: no. Who is in position from 1.0722, keep stop at 1.0690. Target: 1.2000.

Sell: no. Those in position from 1.1050, move stop to 1.0820. Target: 1.0460 (revised).

Support — 1.0627. Resistance — 1.0895.

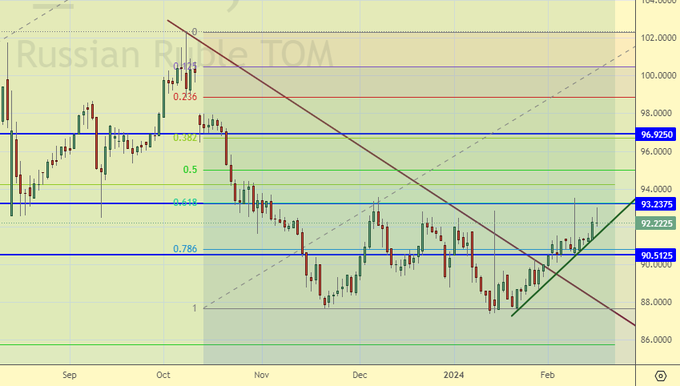

USD/RUB

Growth Scenario: salespeople have failed to scare us. They are weak. We continue to grow. The target at 97.00, in case the growth continues, looks natural.

Downside scenario: we continue to abandon shorts. The ruble could easily be strengthened by selling oil for rubles, but then what will happen to the budget? Yes, it will not come together. A strong ruble is not needed.

Recommendations on dollar/ruble pair:

Purchase: no. Those in position from 91.60, move stop to 90.40. Target: 97.00 (120.00?!).

Sale: no.

Support — 90.51. Resistance — 93.23.

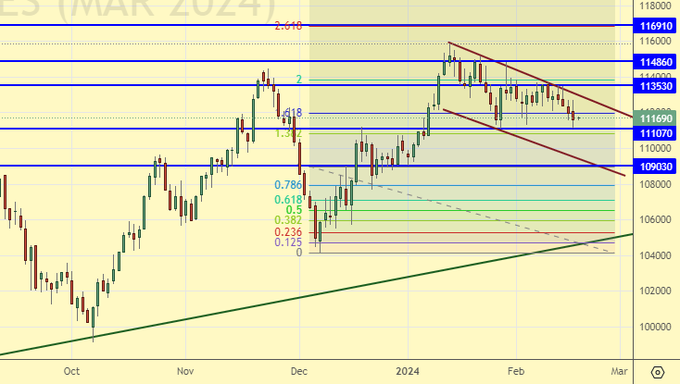

RTSI

Growth scenario: we consider the March futures, expiration date March 21. As long as we are below 115000, we will not consider buying. Out of the market.

Downside scenario: hold shorts. The potential for economic development is limited by sanctions. Domestic demand will slow down due to overcrediting.

Recommendations on the RTS index:

Purchase: think after rising above 115000.

Sell: no. Those who are in position from 113010, move the stop to 113750. Target: 100000 (revised). Can be added after falling below 110000.

Support — 111070. Resistance — 113530.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.