Price forecast from 31 July to 4 August 2023

-

Energy market:

Well … ministers came to us from different African states. They drank, ate, received forgiveness of debts, a lot of wheat, a bright future for their entire already sunny African “continent”. In general, the summit. In cloudy St. Petersburg.

Oh, why are we not Africans. And the banks would have written off all our debts, because we are so radiant. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Oil has fixed above 80.00 and claims to go to 86.00. So far, KSA has managed to maintain prices by reducing production. The Kingdom voluntarily agreed to cut by 1 million barrels in July and extended it into August.

In addition, behind the bulls US GDP figures in the second quarter. Predictions that we would see a slowdown did not come true. We see growth of 2.4% per annum against the forecast of +1.8%, and growth of 2.0% in the first quarter. That is, the economy is accelerating, not slowing down. This leads us to speculate about another 0.25% rate hike in the future. There are few such believers, at the moment on the market, only 30%, but their number may grow. Powell announced that he wants inflation at 2%, so he can continue to raise rates if the economy does not go into recession.

Russia is starting to slowly sell oil above the $60 sanctions threshold. It is possible that the West will shut up, as Moscow may further reduce supplies to the foreign market, which will lead to the fact that gas station prices in Europe will continue to rise.

Reading our forecasts, you could take a move down the euro/dollar pair from 1.1245 to 1.0960.

Grain market:

The grain market is cooling down after Russia’s withdrawal from the grain deal, but so far the chances for price growth remain even against the background of new crop volumes.

Both the Turkish President and the Pope and the UN Secretary General (representing Washington) are all urging Moscow to continue to spit on its own interests and allow Ukraine to export by sea without receiving anything in return. So far, Putin does not want to listen to anyone, and he has every reason to do so.

Russia continues to supply grain in large volumes: exports for July are estimated at 4.2. million tons, which smooths out the current situation. The main thing is that there should be no interference on delivery routes.

There are forecasts that in the season 23/24 we can see grain exports from Russia at the level of 60 million tons. The number can indeed be reached.

Note that the Russian economy is in good shape, taking into account all kinds of sanctions.

USD/RUB:

We do not have a rollback either to 85.00, or at least to 87.00. The market looks up to the level of 100.00. The 1% increase in the rate did not lead to the strengthening of the national currency, which makes forecasts for the strengthening of the exchange rate a thankless task at least until the end of August.

There is reason to believe that the influx of dollars and euros into the country will sharply decrease and they will not be enough to make purchases abroad. And not everyone needs yuan and rupee. This may lead to the fact that the ruble will gradually continue to fall against the dollar and further.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 0.4 thousand contracts. Both buyers and sellers entered the market in extremely small volumes. The spread between long and short positions has barely widened, the bulls continue to control the situation.

Growth scenario: consider the August futures, the expiration date is August 31. Since there was no correction to 77.00, we missed this opportunity to go long. Now out of the market.

Fall scenario: we will enter short from 86.30. The market is aggressive enough to go up another $2.

Recommendations for the Brent oil market:

Purchase: no.

Sale: when approaching 86.30. Stop: 86.90. Target: 76.00.

Support — 82.81. Resistance — 86.36.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 1 to 529 units.

Commercial oil reserves in the US fell by -0.6 to 456.82 million barrels, while the forecast was -2.348 million barrels. Inventories of gasoline fell by -0.786 to 217.6 million barrels. Distillate inventories fell -0.245 to 117.949 million barrels. Inventories at Cushing fell -2.609 to 35.739 million barrels.

Oil production fell by -0.1 to 12.2 million barrels per day. Oil imports fell by -0.807 to 6.367 million bpd. Oil exports rose by 0.777 to 4.591 million barrels per day. Thus, net oil imports fell by -1.584 to 1.776 million barrels per day. Oil refining fell by -0.9 to 93.4 percent.

Gasoline demand rose by 0.084 to 8.939 million barrels per day. Gasoline production fell by -0.035 to 9.488 million barrels per day. Gasoline imports rose by 0.037 to 0.754 million barrels per day. Gasoline exports fell -0.078 to 0.995 million bpd.

Demand for distillates rose by 0.049 to 3.718 million barrels. Distillate production fell -0.251 to 4.781 million barrels. Distillate imports rose by 0.097 to 0.16 million barrels. Distillate exports fell -0.011 to 0.189 million barrels per day.

Demand for petroleum products increased by 0.509 to 21.276 million barrels. Production of petroleum products fell by -0.053 to 22.648 million barrels. Imports of petroleum products increased by 0.278 to 2.152 million barrels. Exports of petroleum products fell by -0.221 to 6.34 million barrels per day.

Propane demand fell by -0.082 to 0.834 million barrels. Propane production increased by 0.041 to 2.554 million barrels. Propane imports fell -0.028 to 0.066 million barrels. Propane exports rose by 0.108 to 0.23 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers increased by 20.9 thousand contracts. Vendors left the market. Buyers were practically inert to what was happening. The advantage in the market remains with the bulls.

Growth scenario: consider the September futures, the expiration date is August 22. There was no rollback to 70.00. We missed the opportunity to go long. Out of the market.

Fall scenario: the market looks strong. There is overbought. A rollback is requested. However, we will sell only when we approach 86.00.

Recommendations for WTI oil:

Purchase: think when pulling back to 70.00.

Sale: when approaching 86.00. Stop: 87.60. Target: 70.00.

Support — 75.04. Resistance is 81.83.

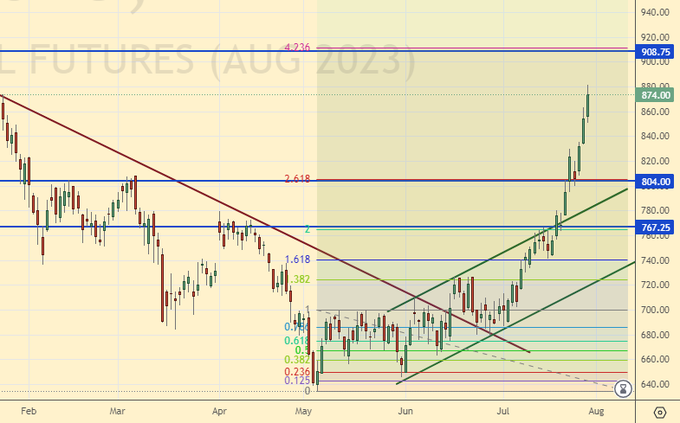

Gas-Oil. ICE

Growth scenario: consider the August futures, the expiration date is August 10. There is no point in shopping. Out of the market.

Fall scenario: we will sell when we approach 910.0. The market is overbought, but we are likely to reach the theoretical target.

Gasoil recommendations:

Purchase: no.

Sale: when approaching 910.0. Stop: 920.0. Target: 730.0.

Support — 804.00. Resistance is 908.75.

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. Let’s continue to stand in the longs. So far there is no panic, but by autumn it may begin to appear. Nobody knows what the winter will be like.

Downfall scenario: nothing has changed for sellers. Only when approaching 4,000, you can think about entering the short.

Recommendations for natural gas:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep a stop at 2.400. Target: 4.000.

Sale: no.

Support — 2.476. Resistance is 2.759.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: The market may give birth to growth after a long stagnation. We keep long.

Fall scenario: do not sell. At the moment, there are no prerequisites for lowering fuel prices.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, keep stop at 54000. Target: 70000 (80000).

Sale: no.

Support — 55322. Resistance — 65098.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: continue to pause. The situation is not certain.

Fall scenario: we also do not make sales. The fall in energy prices in the current situation looks extremely unlikely.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support — 11201. Resistance — 16943.

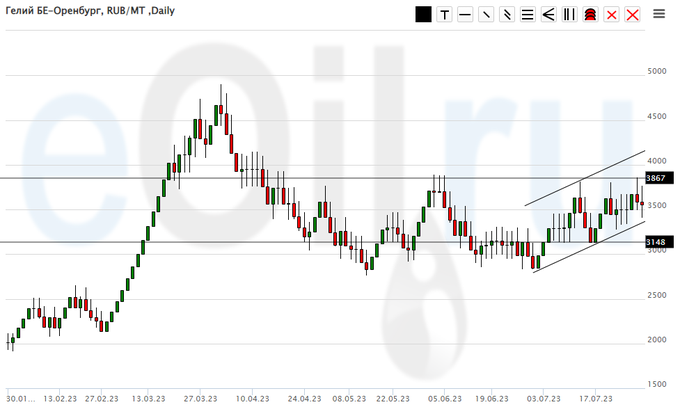

Helium (Orenburg), ETP eOil.ru

Growth scenario: keep longs. It is possible that next week we will see a new high.

Fall scenario: do not sell. The market is forming a bullish trend.

Recommendations for the helium market:

Purchase: no. If you are in position between 2900 and 3200, keep your stop at 2700. Target: 6000.

Sale: not yet.

Support — 3148. Resistance — 3867.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers decreased by 14.9 thousand contracts. Sellers left the market, buyers remained indifferent to what was happening. The spread between short and long positions narrowed. Sellers hold the edge.

Growth scenario: consider the September futures, the expiration date is September 14th. Let’s continue to wait for the move to 660.0 in order to increase the long. The volatility is great. The scenario of the move to 870.0 remains.

Fall scenario: if we go below 650.0, then there will be prerequisites for the market to fall. It should be noted that the international situation remains extremely tense and a reduction in quotes is not an obvious option now.

Recommendations for the wheat market:

Purchase: on rollback to 660.0. Stop: 635.0. Target: 880.0. Those who remain in positions from 632.0 and 640.0 keep the stop at 635.0. Target: 880.0.

Sale: no.

Support — 689.3. Resistance — 769.5.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open long positions than short ones. Last week the difference between long and short positions of managers increased by 71.2 thousand contracts. The change is gigantic. Sellers fled, buyers entered the market. Buyers have regained control.

Growth scenario: consider the September futures, the expiration date is September 14th. Rollback. But he didn’t fundamentally change anything. Let’s keep going long. When approaching 500.0, you can add.

Fall scenario: refrain from selling. The market is still nostalgic for Ukrainian corn floating in the Black Sea.

Recommendations for the corn market:

Purchase: when approaching 500.0. Stop: 480.0. Target: 590.0. Who is in position from 490.0, keep the stop at 480.0. Target: 590.0 (revised).

Sale: no.

Support — 509.4. Resistance — 565.1.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We will continue to stop shopping. Out of the market.

Fall scenario: they broke through the growing trend. Sell after any daily candle that closes below 1380. If after that there will be a rollback to 1430 — add.

Recommendations for the soybean market:

Purchase: no.

Sell: after day close below 1380. Add at 1430. Stop: 1460. Target: 1000?! Count the risks!!!

Support — 1256.4. Resistance — 1391.3 (1435.2).

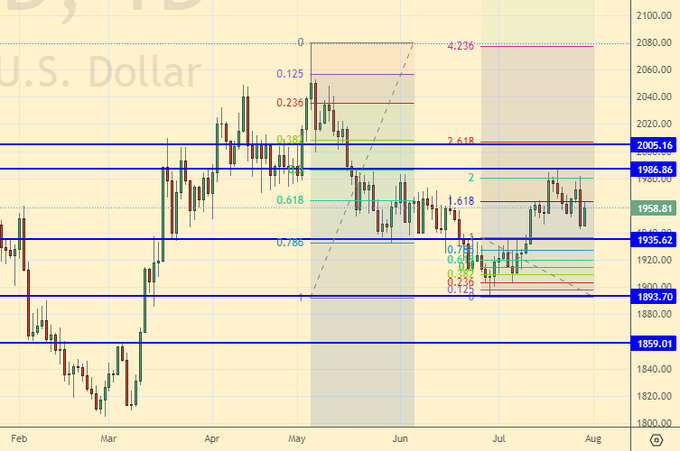

Growth scenario: for now we will refuse purchases. Still, the increase in the rate in the US should somehow manifest itself. At the same time, we are mentally prepared to resume purchases in case of growth above 2010.

Fall scenario: we can still go to 2000. If this happens, then we will talk about sales there.

Recommendations for the gold market:

Purchase: think after rising above 2010.

Sale: think about approaching 2000.

Support — 1935. Resistance — 1986.

EUR/USD

Growth scenario: if you went long, then good, if not, we are waiting for a slightly deeper dive to 1.0900. You can buy there.

Fall scenario: we took a short from 1.1245 to 1.0960. There are no more interesting opportunities for sales. Out of the market.

Recommendations for the EUR/USD pair:

Purchase: on touch 1.0930. Stop: 1.0870. Target: 1.2000?!

Sale: no.

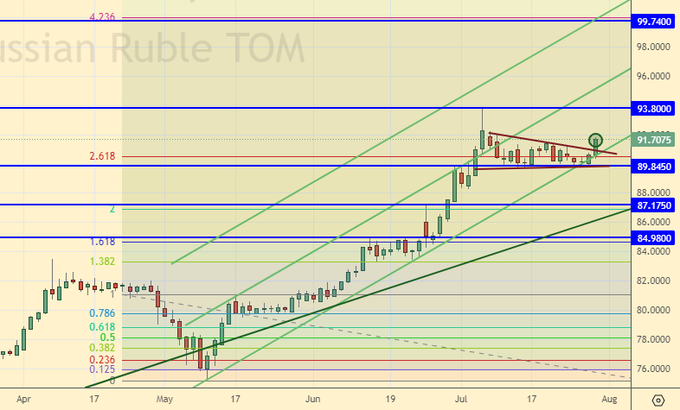

Support — 1.0900. Resistance is 1.1013.

USD/RUB

Growth scenario: and we took it and grew. Fine. We keep long. Our goal is 100.00. It will be necessary to look at the rate of price growth, it is possible that we will start talking about the level of 115.00.

Fall scenario: we continue to stay out of the market. Note that selling from 100.00 is not a good idea, as panic is possible if it rises above this level.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 86.00, move the stop to 89.40. Target: 100.00 (115.00?!).

Sale: no.

Support — 89.84. Resistance is 93.80.

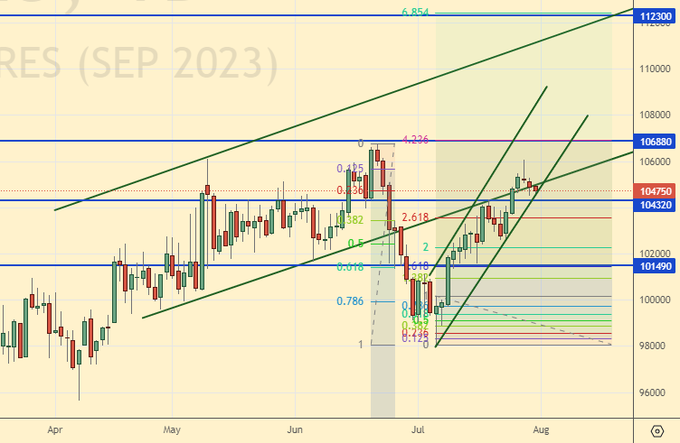

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. Buying from current levels does not look optimal. Out of the market.

Fall scenario: stop at 106000. Let’s enter again. Sellers may break the market due to the weakening ruble and overbought Russian stocks. At any moment we can get a long candle down.

Recommendations for the RTS index:

Purchase: no.

Sale: now. Stop: 106100. Target: 90000 (50000; 20000?!!!).

Support — 104320. Resistance — 106880.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.