24 April 2023, 11:43

Price forecast from 24 to 28 of April 2023

-

Energy market:

May holidays are ahead. The main thing is to spend them wisely. You need to drive as many kilometers as possible, and eat as much meat as possible. By doing this, you will help the energy and agricultural sectors.

Let’s make a profit for a domestic manufacturer! Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

At the end of the week there will be a report on US GDP for the first quarter. Most likely, the figures will show a slowdown in growth from 2.6 to 2% per annum, which will cast doubt on the growth in energy demand that OPEC and the IEA dream about.

It is highly likely that OPEC will go for another cut in production if the price of a barrel of Brent oil falls below $75 per barrel.

Stories appeared on the net that Russian oil costs India only slightly cheaper than Iranian and American. Perhaps just then they increased imports by as much as 25 times compared to last year. Most likely there was a discount. And a lot.

If the G7 countries implement a plan to phase out the production of new ICE cars by 2035, then the oil market in its current form will come to an end. $20 per barrel. That’s what will happen then. Russia and the Arabs and Persians do not have much time (12 years or less) to diversify the economy.

Reading our forecasts, you could make money on Brent oil by taking a move up from 70.10 to 84.40.

Grain market:

Forecasts for the grain harvest in Europe are very positive. They expect an increase of 22.3 million tons compared to last season to 287.9 million tons. Therefore, one should not be surprised at the almost simultaneous closure of Ukrainian grain access to the markets of Eastern Europe. His will have nowhere to go.

Wheat, against our expectations, failed to pass to the level of 770.0 cents per bushel. Maybe it will be in the future, but for such a scenario, the USDA May report would be bad. It is worth realizing that large carry-over stocks in Russia for wheat, plus uncertainty about how and where Ukraine will sell grain this year, and whether it will be able to sell at least something, all these factors will put pressure on prices.

It is worth writing about Kazakhstan. The country is increasing its own grain production and is not interested in competitors. Closing the border can create problems for exports this year.

All hope is in Egypt, which wants to turn itself into a gateway for Russian grain to Africa, Pakistan (he just woke up) and Turkey. The latter will not go anywhere, but how it will behave there after the elections on May 14 is not yet clear.

USD/RUB:

We continue to disciplinedly wait for a pullback to 78.00. And he is not. It is now obvious that technical factors are not enough to strengthen the national currency. We need a fundamental positive, and in the near future.

In case of delaying the NWO, we will pass the way to 88.00 quickly. If not in May, then during the summer. There is a feeling that we have not yet realized the amount of spending on the military-industrial complex. Yes, it is possible that the GDP will grow, but it will be guns, not butter, and if it will have an effect in case of success for the economy, then only in 10-15 years.

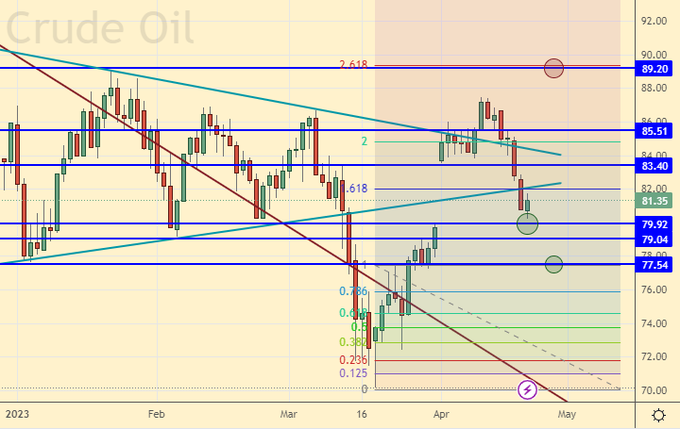

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 7,000 contracts. Buyers and sellers entered the market in very modest volumes. The spread between long and short positions widened. Buyers continue to control the situation.

Growth scenario: we are considering the April futures, the expiration date is April 28. The absence of touching 89.20 is an unpleasant surprise. However, prices dropped enough for the week to buy again.

Fall scenario: The market behaved outside of our analysis. We were only able to sell from 86.50. We will keep the shorts counting on the continuation of the fall.

Recommendations for the Brent oil market:

Purchase: now and when approaching 78.00. Stop: 77.00. Target: 110.00.

Sale: no. Who is in position from 86.50, move the stop to 85.60. Target: $66.64 per barrel.

Support — 79.92. Resistance — 83.40.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 3 units and now stands at 591 units.

US commercial oil inventories fell by -4.581 to 465.968 million barrels, while the forecast was -1.088 million barrels. Inventories of gasoline rose by 1.299 to 223.544 million barrels. Distillate inventories fell -0.355 to 112.09 million barrels. Inventories at Cushing fell -1.088 to 32.75 million barrels.

Oil production has not changed and stands at 12.3 million barrels per day. Oil imports rose by 0.101 to 6.294 million barrels per day. Oil exports rose by 1.844 to 4.571 million barrels per day. Thus, net oil imports fell by -1.743 to 1.723 million barrels per day. Oil refining increased by 1.7 to 91 percent.

Gasoline demand fell by -0.417 to 8.519 million bpd. Gasoline production fell by -0.343 to 9.475 million barrels per day. Gasoline imports fell by -0.113 to 0.7 million barrels per day. Gasoline exports rose by 0.158 to 0.943 million barrels per day.

Demand for distillates rose by 0.002 to 3.765 million barrels. Distillate production increased by 0.167 to 4.75 million barrels. Distillate imports fell -0.12 to 0.113 million barrels. Distillate exports rose by 0.009 to 1.149 million barrels per day.

Demand for oil products increased by 0.262 to 19.317 million barrels. Production of petroleum products increased by 0.536 to 21.397 million barrels. Imports of petroleum products fell by -0.031 to 2.244 million barrels. The export of oil products increased by 0.569 to 6.513 million barrels per day.

Propane demand fell -0.106 to 0.869 million barrels. Propane production increased by 0.116 to 2.511 million barrels. Propane imports rose by 0.002 to 0.106 million barrels. Propane exports rose by 0.394 to 1.851 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week, the difference between long and short positions of managers increased by 3.4 thousand contracts. Buyers and sellers entered the market. Buyers did it a little more actively. The spread between long and short positions widened. Bulls continue to control the situation.

Growth scenario: we are considering the June futures, the expiration date is May 22. We close the gap. We must buy. The target at 88.00 remains relevant.

Fall scenario: we could not enter short from 84.00. Out of the market. Current levels for sale are not interesting.

Recommendations for WTI oil:

Purchase: now and when approaching 74.00. Target: 88.00. Count the risks.

Sale: think when approaching 88.00.

Support — 75.88. Resistance — 79.17.

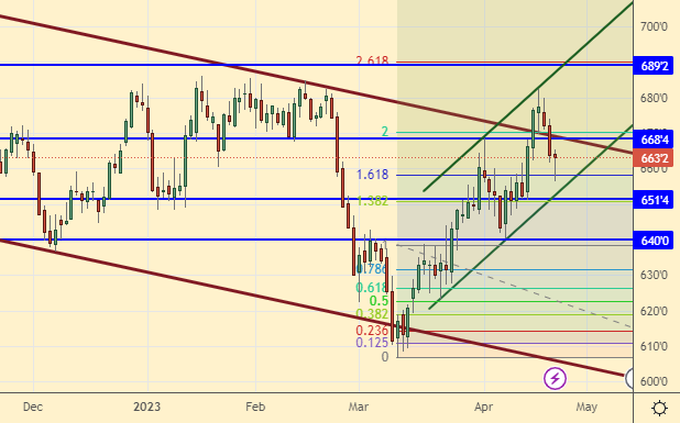

Gas-Oil. ICE

Growth scenario: we are considering the May futures, the expiration date is May 11. Marvelous. We will fall at the beginning of the season. Nobody needs fuel. While out of the market.

Fall scenario: our sales are already showing epic profits. Interesting. Let’s keep holding on. And let’s move the target down a bit: 660.0.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 900.0, move the stop to 770.0. Target: 660.0.

Support — 703.25. Resistance is 760.00.

Natural Gas. CME Group

Growth scenario: we are considering the June futures, the expiration date is May 26. We are trying to grow. Let’s buy based on growth to 3.340.

Fall scenario: there is no point in selling. Out of the market.

Recommendations for natural gas:

Purchase: now. Stop: 2.23. Target: 3.340.

Sale: no.

Support — 2.137. Resistance is 2.546.

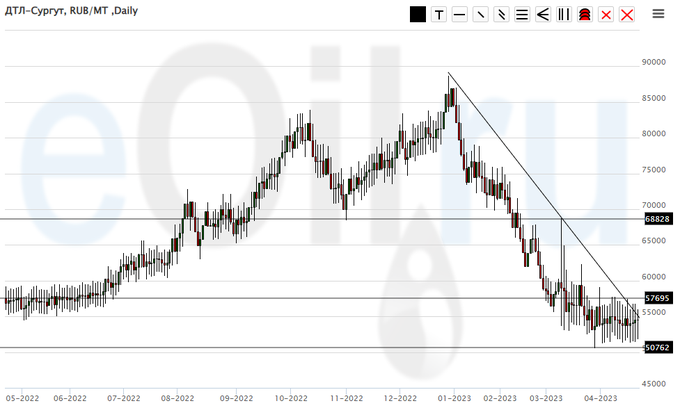

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: Buy recommendation. A fall below 50,000 is not visible. Buyers choose the entire offer at current levels.

Fall scenario: sales continue to be uninteresting. Need a lift. For example, in the region of 70,000.

Diesel market recommendations:

Purchase: now. Stop: 49000. Target: 65000 (70000). Count the risks. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 50762. Resistance — 57695.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we are trying to go above 11000. With such enthusiasm, 15000 is definitely waiting for us. We keep longs.

Fall scenario: shorts from 15000 are possible. Sales from lower levels will not be considered yet.

Recommendations for the PBT market:

Purchase: no. Those in positions between 5000 and 5200 move the stop to 7400. Target: 15000 (20000).

Sale: no.

Support — 7544. Resistance — 15278.

Helium (Orenburg), ETP eOil.ru

Growth scenario: The market has cooled down a bit. We continue to believe that if prices go to the 2700 area, then it will be possible to buy. Buying from current levels is premature.

Fall scenario: you can continue to keep an open short from 4500. It makes sense to move the stop along the trend. The target for 2800 remains.

Recommendations for the helium market:

Purchase: when approaching 2700. Stop: 2400. Target: 5000.

Sale: no. Who is in position from 4500, move the stop to 4100. Target: 2800.

Support — 2664. Resistance — 3953.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 1.1 thousand contracts. Buyers and sellers entered the market. Buyers did it a little more actively. The spread between short and long positions narrowed. Sellers hold the edge.

Growth scenario: consider the May futures, the expiration date is May 12. We are forced to abandon our claims to 765.0. It is possible that we went to 600.0. Out of the market.

Fall scenario: sales from current levels are of no interest. Out of the market.

Recommendations for the wheat market:

Purchase: no.

Sale: no.

Support — 654.2 (600.0). Resistance — 707.0.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers keep the edge. Last week the difference between long and short positions of managers increased by 28.8 thousand contracts. Buyers entered the market, sellers left it. The bulls have strengthened their advantage.

Growth scenario: consider the May futures, the expiration date is May 12. There is nothing special to do. We will wait for the arrival at 688.0. We hold longs.

Fall scenario: we will sell when we approach 689.0. The current levels for sales are underestimated.

Recommendations for the corn market:

Purchase: no. Who is in position from 640.0, keep the stop at 648.0. Target: 688.0.

Sale: when approaching 689.0. Stop: 697.0. Target: 550.0.

Support — 651.4. Resistance — 668.4.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We see a drop in soybeans. Out of the market. We continue to be confused by any ideas to buy this crop.

Fall scenario: keep holding shorts. Friday’s new low keeps us going.

Recommendations for the soybean market:

Purchase: think when approaching 1360.0. Stop: 1340.0. Target: 1420.0.

Sale: no. Who is in positions between 1520.0 and 1510.0, move the stop to 1522.0. Target: 1360.0 (1000.0) cents per bushel.

Support — 1405.0. Resistance — 1521.2.

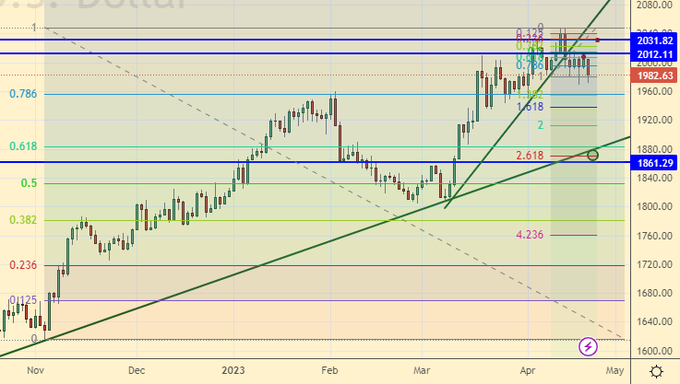

Growth Scenario: While there are prospects for growth rates in the US, gold will be under pressure. We don’t buy.

Fall scenario: It is possible to sell from current levels, although this is not the most convenient situation. Our target is 1863.

Recommendations for the gold market:

Purchase: not yet.

Sale: now. Stop: 2012. Target: 1860 (1600).

Support — 1861. Resistance — 2012.

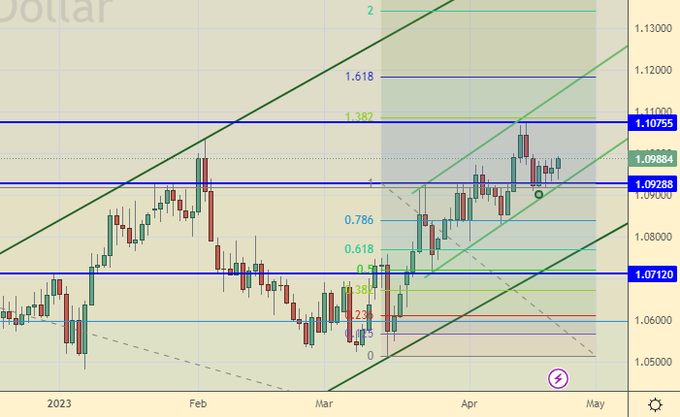

EUR/USD

Growth scenario: let’s fight for long. We were knocked out of position. We will buy again.

Fall scenario: for now we will refrain from going short, but if there is a red long candle down, you can sell.

Recommendations for the EUR/USD pair:

Purchase: now. Stop: 1.0890. Target: 1.1930.

Sale: after a long red daily candle. Stop above its maximum. Target: 1.0600?!

Support — 1.0928. Resistance is 1.1075.

USD/RUB

Growth scenario: nothing has changed. We continue to wait for a rollback to 78.00 for a new round of purchases. Growth from current levels to 88.00 should be recognized as possible, but in itself it will be inconvenient for speculation. It’s good that there are previously open longs.

Fall scenario: we cannot sell the pair. As before, we need positive fundamental, including political, successes.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 78.00. Stop: 77.40. Target: 88.70. Who is in position from 76.70, keep the stop at 77.40. Target: 88.70.

Sale: think when approaching 88.70.

Support — 77.96. Resistance — 83.76.

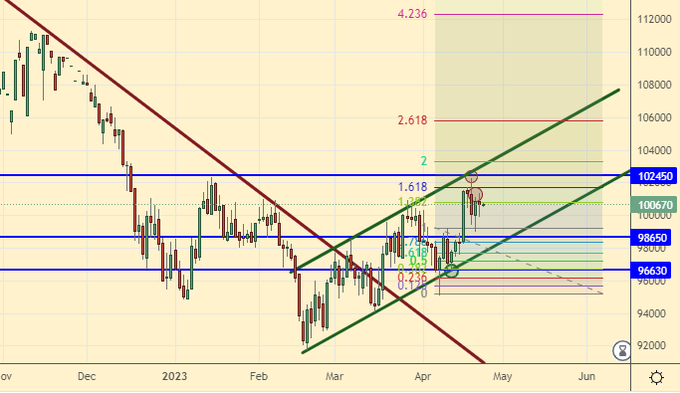

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. We can continue to grow further, as Sberbank’s paper may cost 1 million. Why not? There will be a rollback to 97500 buy.

Fall scenario: our stop was too low. If Monday is “red”, we will sell again.

Recommendations for the RTS index:

Purchase: on pullback to 97500. Stop: 94500. Target: 112000.

Sale: if Monday is «red». Stop above the high of the candle. Target: 80,000 (50,000, then 20,000) points.

Support — 98650. Resistance — 102450.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.