Price forecast from 6 to 10 of February 2023

-

Energy market:

A Chinese balloon was shot down over American waters, which was simply blown away by the wind. But Washington did not believe this, and Secretary of State Blinken will not go to China now. Because there is nothing to inflate, it is not known what, and send it to a democratic country by air.

Favorable wind to you during flights and crossings. Hello everybody!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

The collective West has set marginal prices for Russian oil products transported by sea. Diesel cannot be sold above $100, fuel oil above $45 per barrel. The price level will be reviewed every two months.

This whole price thing is starting to look like anti-OPEC. Some limit production, others limit purchase prices. The only problem for former partners is that Europe will not be able to meet its diesel needs this year without Russia, so some things, such as turning Russian diesel into Indian or Qatari by transferring from one tanker to another, will be overlooked.

From today, February 5, an embargo on the supply of petroleum products from the Russian Federation to the West at a price above the designated price ceiling begins to operate. Yes, there will be a transitional period of 55 days for those contracts that were concluded before the current date, but in general the direction of thought is visible: strangle Russia economically.

Every German in 2022 paid 2,000 euros for Germany’s participation in the conflict in Ukraine. This year the amount will increase. So far, unfortunately, the parties are determined to continue to find out who has more margin of safety.

Reading our forecasts, you could make money on Brent oil futures taking the move up from 79.00 to 83.40 dollars per barrel. You could also make money on WTI oil by taking a move up from 74.00 to 76.30 dollars per barrel.

Grain market:

We see that the new crop of wheat coming to the market from Argentina and Australia is not able to bring down prices. All offered volumes are consistently chosen by importers, which keeps prices at fairly high levels compared to previous years.

Inflated grain prices will inevitably raise the cost of meat, which will keep food inflation at a high level. Therefore, it cannot be ruled out that the cycle of raising interest rates in the world will continue, and not just about finished, as many argue about it. Expensive loans will begin to have a negative impact on the economy, which will lead to a strong slowdown in economic activity, for example, this fall.

In 2023, the U.S. winter wheat planting area will increase by 11% compared to last year and will reach the highest levels in the last eight years. In Canada, the total area under wheat will increase by 2%. The expansion of crops is due to current attractive prices.

USD/RUB:

In February, the Ministry of Finance will increase sales of yuan for rubles on the stock exchange to cover the budget deficit. In the period from February 7 to March 6, foreign currency will be sold in the amount of 8.9 billion rubles, which is equivalent to (126.6 million dollars) per day. This is almost three times the volume of daily transactions compared to the previous month.

It is unlikely that the market reaction to these sales will be strong. Yes, the ruble has chances for a short-term strengthening to the level of 65.00, but in order to change the trend towards the weakening of the national currency, which began 7 months ago, there should be information that the situation with the receipt of oil and gas revenues is improving, not worsening. We have to admit that sanctions pressure is hurting the Russian economy.

The US Federal Reserve raised the rate by 0.25% to 4.75%. Against this backdrop, US securities will be attractive for purchases around the world, which will ensure stable demand for dollars.

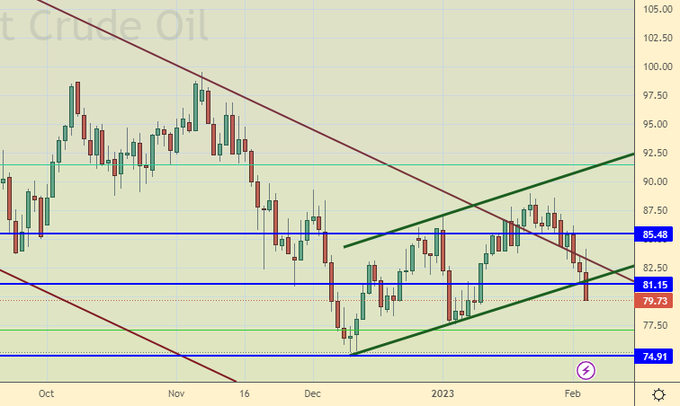

Brent. ICE

Growth scenario: consider the January futures, the expiration date is February 28. The bulls failed to take the market above the 90.00 level. Prices are falling. We remain out of the market.

Fall scenario: the bet on the fall justified itself. Let’s keep the shorts. For the time being, we will tentatively define the target at the level of 70.00. Perhaps a stronger immersion.

Recommendations for the Brent oil market:

Purchase: no.

Sale: no. Who is in position from 87.30, move the stop to 87.50. Target: 70.00 (55.00; 45.00?!!!) dollars per barrel.

Support — 74.91. Resistance — 81.15.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 10 units and now stands at 599 units.

Commercial oil reserves in the US increased by 4.14 to 452.688 million barrels, while the forecast was +0.376 million barrels. Inventories of gasoline rose by 2.576 to 234.598 million barrels. Distillate inventories rose by 2.32 to 117.59 million barrels. Inventories at Cushing rose by 2.315 million barrels to 38.009 million barrels.

Oil production has not changed and is 12.2 million barrels per day. Oil imports rose by 1.378 to 7.283 million barrels per day. Oil exports fell by -1.215 to 3.492 million barrels per day. Thus, net oil imports increased by 2.593 to 3.791 million barrels per day. Oil refining fell by -0.4 to 85.7 percent.

Gasoline demand rose by 0.349 to 8.491 million barrels per day. Gasoline production increased by 0.612 to 9.443 million barrels per day. Gasoline imports rose by 0.048 to 0.501 million barrels per day. Gasoline exports rose by 0.033 to 0.926 million barrels per day.

Demand for distillates fell by -0.186 to 3.692 million barrels. Distillate production increased by 0.1 to 4.692 million barrels. Distillate imports fell -0.007 to 0.313 million barrels. Exports of distillates rose by 979.894 to 981 million barrels per day.

Demand for petroleum products rose by 0.659 to 20.106 million barrels. Production of petroleum products increased by 0.46 to 21.282 million barrels. Imports of petroleum products fell by -0.202 to 2.022 million barrels. Exports of petroleum products fell by -0.009 to 5.778 million barrels per day.

Demand for propane rose by 0.43 to 1.482 million barrels. Propane production fell by -0.023 to 2.352 million barrels. Propane imports rose by 0.018 to 0.171 million barrels. Propane exports fell by -0.23 to 1.389 mb/d.

Growth scenario: we consider the March futures, the expiration date is February 21. Failed to go above 82.80. As predicted earlier, this failure caused the market to turn lower. We don’t buy.

Fall scenario: the bet on the short turned out to be correct. We will continue to hold short positions.

Recommendations for WTI oil:

Purchase: no.

Sale: no. Those in positions between 82.00 and 80.50 move the stop to 80.60. Target: 66.00 (40.00) dollars per barrel.

Support — 65.13. Resistance — 77.79.

Gas-Oil. ICE

Growth scenario: we consider the March futures, the expiration date is March 10. Our buying last week went nowhere as the market fell. We do not open positions.

Fall scenario: “in case of a fall below 900.0, we will sell. Shorting from current levels is also possible,” we wrote last week. Who entered, hold positions.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 900.0, move the stop to 910.0. Target: 700.0.

Support — 775.50. Resistance is 830.00.

Natural Gas. CME Group

Growth scenario: we consider the March futures, the expiration date is February 24th. Prices are extremely low. In case of a green daily candle, you can buy.

Fall scenario: it makes no sense to sell. Prices have dropped. We’ll be back to shorts soon.

Recommendations for natural gas:

Purchase: when a green daily candle appears. Stop: 2.380. Target: 3.500.

Sale: no.

Support — 2.312. Resistance is 2.974.

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: EU diesel price ceiling of $100/bbl can be correlated with $750/t price level. At the current exchange rate, this is 52,500 rubles per ton. We see that the market has the potential to fall. Until we buy.

Fall scenario: the 60000 level continues to be a good ambitious downside target. At current levels, you can add to existing shorts.

Diesel market recommendations:

Purchase: no.

Sale: now. Stop: 77,000. Target: 60,000 (55,000) rubles per ton. Those in positions between 84,000 and 74,000 move the stop to 77,000. Target: 60,000 (55,000) rubles per ton.

Support — 69844. Resistance — 75938.

Propane butane (Surgut), ETP eOil

Growth scenario: we will continue to recommend buys as prices are extremely low. Restoration to the level of 6500 rubles per ton is possible from the technical point of view.

Fall scenario: we will continue to refuse sales. Prices are extremely low.

Recommendations for the PBT market:

Purchase: now. Stop: 1200. Target: 4000 (6500). Those who are in positions from 1400, move the stop to 1200. Target: 4000 (6500) rubles per ton.

Sale: no.

Support — 830. Resistance — 6577.

Helium (Orenburg), ETP eOil

Growth scenario: last week was actively growing. We hold longs. We set the goal at the level of 2750 rubles per cubic meter.

Fall scenario: As we approach 2750, it will be possible to think about selling. While out of the market.

Recommendations for the helium market:

Purchase: no. Those who are in positions from 1800, 1900 and 2000, move the stop to 1920. Target: 2750 (3000) rubles per cubic meter.

Sale: no.

Support — 2170. Resistance — 2753.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. There is an exhausting struggle in the range. The bulls are not yet able to push prices above the 780.0 level, which should lead to a move to 840.0. Ideally, we need a pullback to 650.0 for buying, and in the worst case, an increase above 780.0 cents per bushel.

Fall scenario: bulls look weak so far. We will sell. A Friday candle with a long upper shadow suggests a fall for at least three days.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 630.0. Target: 800.0. Or in case of growth above 780.0. Stop: 735.0. Target: 1200.0?!!!

Sale: now. Stop: 780.0. Target: 650.0. Who is in position from 750.0, keep the stop at 780.0. Target: 650.0 cents per bushel.

Support — 711.2. Resistance — 777.6.

Growth scenario: we consider the March futures, the expiration date is March 14. Buying from current levels looks risky, but you can enter the market with a close stop order. In case of growth above 710.0, it will be possible to add to the longs.

Fall scenario: continue to recommend shorts. We cannot rise above 690.0, and this weakness creates the prerequisites for a move down.

Recommendations for the corn market:

Purchase: now. Stop: 667.0. Target: 800.0.

Sale: now. Stop: 698.0. Target: 590.0 (550.0). Who is in position from 688.0, keep the stop at 698.0. Target: 590.0 (550.0) cents per bushel

Support — 669.4. Resistance is 689.0.

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. We will continue to stop shopping. Bulls cannot take the level of 1550, showing weakness.

Fall scenario: we will continue to recommend sales. There are so many sunflowers in Europe that it refuses palm oil. With oils in the world, everything is in order. We must go down.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1557.0. Target: 1000.0.

Support — 1477.2. Resistance — 1548.2.

Gold. CME Group

Growth scenario: failed to rise above the level of 1960. Most likely, we are waiting for a rollback to 1790. After that, it will be possible to talk about purchases again.

Fall scenario: you should have been short from 1920. Now you need to hold positions until 1790.

Recommendations for the gold market:

Purchase: no.

Sale: no. For those in position from 1920, move the stop to 1923. Target: $1,790 a troy ounce.

Support — 1788. Resistance — 1901.

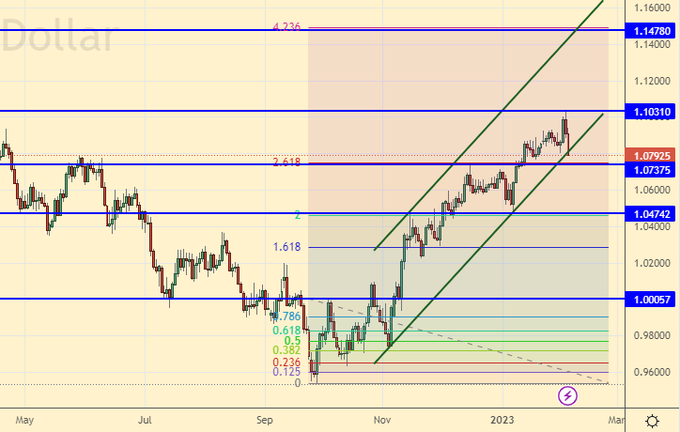

EUR/USD

Growth scenario: a strong US labor market could trigger a fall towards 1.0400, possibly lower. You need to be prepared for the fact that the long will be closed by a stop order at 1.0780.

Fall scenario: considering a short entry is possible only after the market drops below 1.0700. We do not open down positions yet.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position between 1.0800 and 1.0860, keep your stop at 1.0780. Target: 1.1500.

Sale: no.

Support — 1.0737. Resistance is 1.1031.

USD/RUB

Growth scenario: the ruble falls against the dollar, but this is happening slowly. Only one long green candle last Monday cannot form the prerequisites for continued growth. In order to believe in a move to 83.00, we need to see aggressive buying at the level of 70.00.

Fall scenario: continue to hold shorts from 72.50 with a target at 65.60. The chances of the dollar falling increased after it became clear that the Ministry of Finance would sell on the market at $126.6 million a day.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 65.00. Stop: 63.00. Target: 83.00. In case of growth above 71.50. Stop: 69.80. Target: 83.00 (88.00).

Sale: now. Stop: 71.60. Target: 65.60. Who is in position from 72.50, move the stop to 71.60. Target: 65.60 rubles per dollar.

Support — 69.21. Resistance — 73.02.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. It is extremely difficult to grow against the backdrop of the introduction of a price ceiling for petroleum products. There are few fundamental positive ideas. It is possible that the construction sector will show growth in government orders, but the data on this will be closer to the end of the year. Growth is possible in the production of medical devices and preparations, in the microelectronics sector. But these successes will be modest against the backdrop of problems in the oil and gas industry. There is only hope for a brighter future. We hold previously open longs. We do not open new positions up.

Fall scenario: nothing has changed for sellers in a week. As expected, the 98000 — 99000 area provided strong support. If the market goes below 98000, then this could lead to a fast move to 90000. It makes sense to add to the shorts if it falls below the 98000 level.

Recommendations for the RTS index:

Purchase: no. Who is in position from 100000, keep stop at 97000. Target: 112000.

Sale: no. Who is in position from 106000, 103000 and 101000, move the stop to 104000. Target: 80000 (50000, then 20000) points.

Support — 98120. Resistance — 101690.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.