Price forecast from 26 to 30 of December 2022

-

Energy market:

In Poland, in order to keep warm, they began to heat stoves with oats. For many who live in the countryside, this is cheaper than heating their homes with coal or gas. And then there is fish oil, overcooked butter from restaurants, old furniture, rags and waste paper. We see the beginning of the cleansing of Europe.

All gifts! Happy New Year.

Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

The market is nervous and growing. On Monday or Tuesday, a decree on Russia’s response to the embargo will see the light of day. Novak has already said that energy supplies to countries that have set a price ceiling, as well as to countries that are subject to this decision, will not be carried out. Moreover, we are talking not only about oil, but also about oil products.

In addition, a unilateral reduction in oil production by 500-700 thousand barrels per day was announced. This is not a very strong blow for the global market, but here it is important that none of the major exporters open their mouths in this situation, on the topic that we can replace the dropped volumes, redirect, strengthen and stuff like that. Then you can count on the return of prices for Brent oil above the level of 90.00.

The Americans and the British are working with tanker owners. At the moment, it is already clear that Russia will not have enough of its existing capacity to transport oil to Asia. Therefore, in a hurry, an enterprise is being created with India, the task of which will be to ensure the uninterrupted transportation of resources. There will be no quick effect, but now we need brave captains, and no less brave financiers. However, a huge discount for India should cover all the risks.

On the eOil.ru electronic trading platform, quotations for diesel fuel approached the level of 85,000 rubles per ton, but so far they have not been able to take it. Europe’s refusal of Russian energy carriers from February 5 may significantly increase the supply of diesel fuel on the domestic market, which will lead to a drop in prices within the country.

Reading our forecasts, you could take a move up the dollar / ruble pair from the level of 60.00 to the level of 72.00 rubles per dollar.

Grain market:

The grain market refused to fall and chose for itself not a movement to the south, which was visible, but another trip to the north. It will not be easy to grow, as there is a lot of grain. However, if the bulls gain strength, they will be able to push the market up 5% from current levels, it is unlikely that they will be able to grow even stronger.

Realizing the danger of disrupting the export company due to Western sanctions, grain traders are already thinking about buying and building their own ships. It is unlikely that the pleasure will be cheap, but there will be no need to worry about shipowners who may turn their backs on Russia under the pressure of sanctions. The process of creating your own fleet is not fast, and can take 8-10 years, but in our case this is the only reliable way out of the situation.

The Turks paid an introductory visit to the Grain Quality Assessment Center. Considering the volumes of food that the country buys from us, the visit can be considered a working one. The main thing is that the Turkish comrades have something to pay next year. The Turkish lira is doing badly and could get even worse. There are prerequisites that speculators will break the Turkish Central Bank, which may lead to a strong fall of the lira against the dollar as early as next year.

USD/RUB:

The American economy continues to be in good shape. The increase in the interest rate does not exert strong pressure on the business of companies. The labor market remains strong, inflation is slowing down. There is a slight drawdown in building permits for new homes, but it is not yet clear whether the downturn in real estate will spill over to other sectors. At the end of the year, the US economy is likely to grow by 2.8% and for the first time in a couple of decades will overtake the Chinese economy in terms of growth.

At the end of the year, Russia is expecting a 3% fall in GDP and an increase in the budget deficit despite comfortable energy prices. Such a prospect cannot help the ruble exchange rate, which began to weaken rapidly last week. In theory, some positive factors, primarily responsible for reducing tensions with the West, could give the ruble an opportunity to return to the 65.00 level, but we should not expect a stronger strengthening even if there is a slight warming in the current confrontation with Washington and its vassals.

Next week, we will test the strength of the level of 73.00 with the prospect of moving to the level of 88 rubles per dollar. It is too early to talk about other scenarios for the development of events.

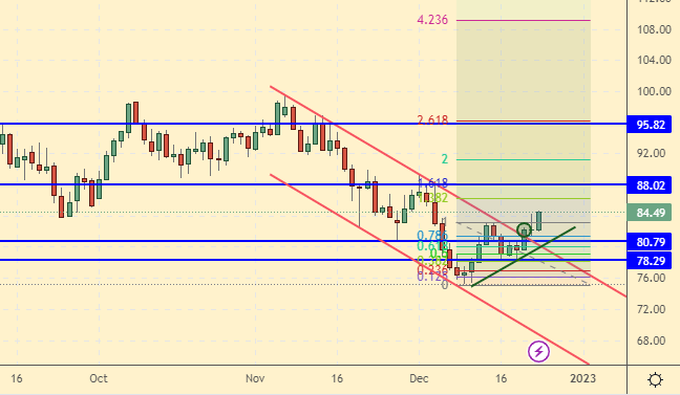

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 12.4 thousand contracts. Sellers left the market, buyers entered it in small numbers. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: consider the December futures, the expiration date is December 30th. There is growing concern about Russia’s response to the oil embargo. Prices may continue to rise. We hold longs.

Downfall scenario: abandon the idea of selling now. Friday’s green candle is too long. We can go up to the level of 88.00.

Recommendations for the Brent oil market:

Purchase: no. Who is in position from 78.40, move the stop to 78.45. Target: 109.00 (130.0).

Sale: no.

Support — 80.79. Resistance — 88.02.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 2 units and now stands at 622 units.

US commercial oil inventories fell by -5.895 to 418.234 million barrels, while the forecast was -1.657 million barrels. Inventories of gasoline rose by 2.53 to 226.113 million barrels. Distillate inventories fell -0.242 to 119.929 million barrels. Inventories at Cushing rose 0.853 to 25.221 million barrels.

Oil production has not changed and is 12.1 million barrels per day. Oil imports fell by -1.048 to 5.819 million barrels per day. Oil exports rose by 0.044 to 4.36 million barrels per day. Thus, net oil imports fell by -1.092 to 1.459 million barrels per day. Oil refining fell by -1.3 to 90.9 percent.

Gasoline demand rose by 0.459 to 8.714 million barrels per day. Gasoline production increased by 0.358 to 9.552 million barrels per day. Gasoline imports fell -0.239 to 0.551 million barrels per day. Gasoline exports fell -0.316 to 0.887 million bpd.

Demand for distillates rose by 0.247 to 4.015 million barrels. Distillate production fell -0.066 to 5.102 million barrels. Distillate imports fell -0.089 to 0.188 million barrels. Distillate exports fell -0.173 to 1.31 million barrels per day.

Demand for petroleum products increased by 0.968 to 20.924 million barrels. Production of petroleum products increased by 0.023 to 22.067 million barrels. Imports of petroleum products fell by -0.348 to 1.885 million barrels. Exports of petroleum products fell by -0.164 to 6.344 million barrels per day.

Demand for propane rose by 0.61 to 1.727 million barrels. Propane production increased by 0.045 to 2.626 million barrels. Propane imports rose by 0.05 to 0.174 million barrels. Propane exports fell by -0.004 to 1.49 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 18.2 thousand contracts. The change is significant. Sellers left the market, buyers entered it uncertainly. The spread between long and short positions has increased, the bulls continue to control the situation.

Growth scenario: we consider the February futures, the expiration date is January 20. We hold longs. There is a possibility that a large number of bulls will enter the market due to the confrontation between Russia and the West.

Fall scenario: sellers are less likely to turn the situation in their favor. If the market rises above the 84.00 level, then there will be no chance of a downward movement in the coming weeks.

Recommendations for WTI oil:

Purchase: no. Who is in position from 74.60, move the stop to 74.40, Target: 100.00 (120.00).

Sale: no. Who is in position from 86.80, move the stop to 80.30. Target: $67.00 per barrel.

Support — 73.17. Resistance is 83.46.

Gas-Oil. ICE

Growth scenario: consider the January futures, the expiration date is January 12. It is possible that the market growth will continue next week. We buy from current levels.

Fall scenario: we refuse to sell. The bulls turned out to be stronger than previously thought.

Gasoil recommendations:

Purchase: now. Stop: 864.0. Target: 1200. When approaching 750.0. Stop: 720.0. Target: 1200.0.

Sale: no.

Support — 866.75. Resistance is 967.00.

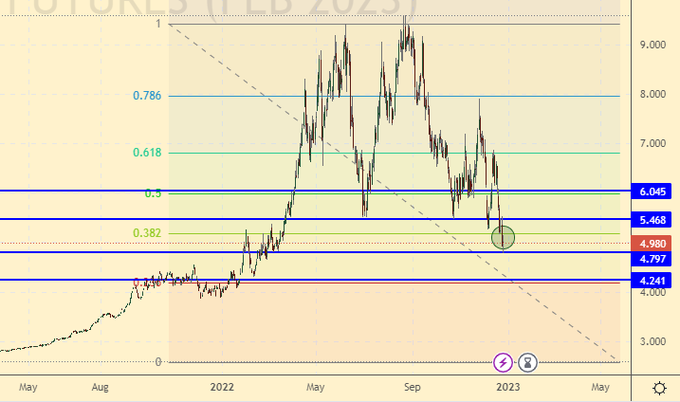

Natural Gas. CME Group

Growth scenario: switched to the February futures, the expiration date is January 27th. Despite everything, we will fight for purchases for now. However, now we will go long only after rising above 5.550.

Fall scenario: it is possible that the sellers in the market have already ended. Anyone who wanted to could go short much earlier. We do not sell.

Recommendations for natural gas:

Purchase: in case of growth above 5.550. Stop: 5.400. Target: 15.000. Those who are in position from 5.500 move the stop to 5.600. Target: 15.000 per 1 million BTUs.

Sale: no.

Support — 4.797. Resistance is 5.468.

Summer diesel (Surgut), ETP eOil.ru

Growth scenario: the market is high. We don’t go shopping. We will reach a maximum of 90,000, the market is not visible above this level without a significant weakening of the ruble.

Fall scenario: Like the week before, it makes sense to look for options to sell. Even if prices rise higher, to the level of 90,000, it is still necessary to sell after a slight downward turn of the market.

Diesel market recommendations:

Purchase: no.

Sale: now. Stop: 85600. Target: 60000. Or when approaching 90000. Stop: 93000. Target: 70000 (60000) rubles per ton. Who is in position from 82000, keep stop at 85600. Target: 70000 (60000).

Support — 74844. Resistance — 84141.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we continue to recommend purchases. In case of growth above the level of 5000, longs can be increased.

Fall scenario: we refuse to sell. Prices at the lowest levels. There are no prospects for making money on the downward movement.

Recommendations for the PBT market:

Purchase: now. Stop: 2700. Target: 9800 rubles per ton.

Sale: no.

Support — 2461. Resistance — 7930.

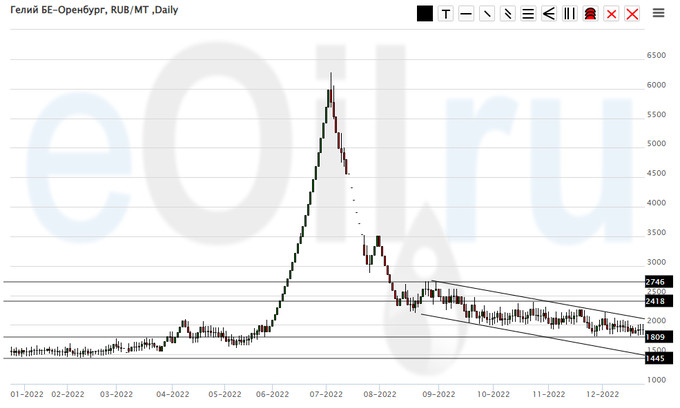

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market is in a range. You can buy, as we are at low levels. A fall to 1400 is not ruled out. If it happens, then you can aggressively go long.

Fall scenario: short from current levels with a short stop order is possible. Target 1460.

Recommendations for the helium market:

Purchase: now. Stop: 1790. Target: 2900 rubles per cubic meter. Also from 1400. Stop: 1200. Target: 2900.

Sale: now. Stop: 2100. Target: 1460.

Support — 1809. Resistance — 2418.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 3.3 thousand contracts. The change is minor. Both buyers and sellers left the market, but sellers did it more actively. The spread between short and long positions has narrowed, sellers retain the advantage.

Growth scenario: we consider the March futures, the expiration date is March 14. It is necessary to keep previously open longs. A break to 840.0 is not ruled out. We do not expect a stronger rise.

Fall scenario: we refuse to sell for now. Only when approaching the level of 840.0 will we go short.

Recommendations for the wheat market:

Purchase: no. Who is in position from 750.0, move the stop to 740.0. Target: 840.0.

Sale: when approaching 840.0. Stop: 855.0. Target: 650.0 cents per bushel.

Support — 739.6. Resistance — 803.6.

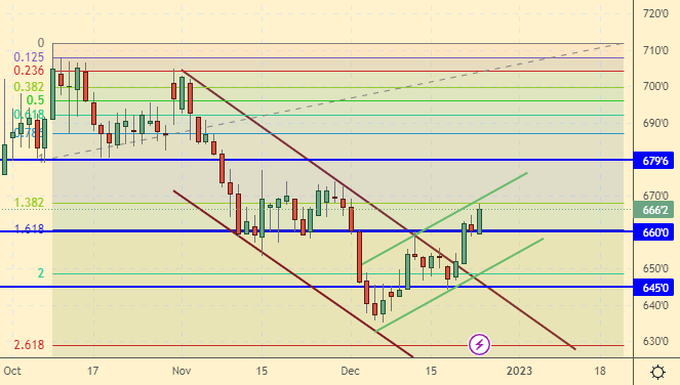

Corn No. 2 Yellow. CME Group

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 14.1 thousand contracts. Buyers left the market, sellers reluctantly entered it. The spread between long and short positions has narrowed, however, the advantage of the bulls remains significant.

Growth scenario: we consider the March futures, the expiration date is March 14. It is possible that we will go to 680.0, but we are unlikely to rise above. We are not included in the purchase.

Fall scenario: We are up above 660.0, making further gains possible. We do not open new positions for sale, we keep the old ones.

Recommendations for the corn market:

Purchase: no.

Sale: no. Who is in position between 670.0 and 650.0, keep the stop at 678.0. Target: 500.0 cents per bushel.

Support — 660.0. Resistance — 679.6.

Soybeans No. 1. CME Group

Growth scenario: consider the January futures, the expiration date is January 13th. We will continue to hold longs from 1425.0. It is impossible to exclude an upward exit from the consolidation.

Fall scenario: The chances of a reversal and a fall are noticeably lower. It is worth adjusting the position size, but still, you can keep short for now.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1425.0, keep a stop at 1438.0. Target: 1600.0.

Sale: no. Who is in position from 1460.0, keep the stop at 1497.0. Target: 1000.0.

Support — 1457.6. Resistance — 1489.4.

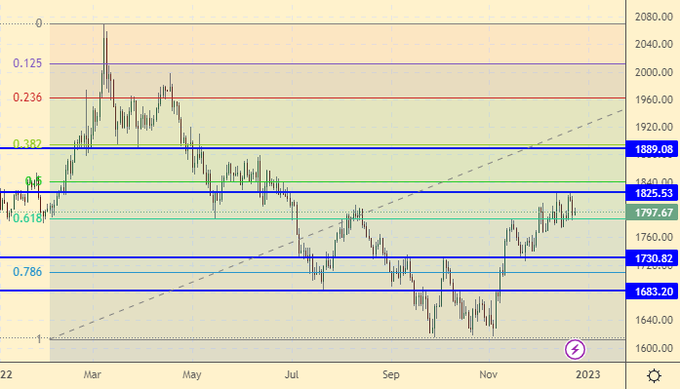

Gold. CME Group

Growth scenario: speculators continue to buy gold. There are more bulls on the market now. The market below 1730 is not visible. You have to keep longs.

Fall scenario: sell again, although the chances of a fall are small.

Recommendations for the gold market:

Purchase: no. For those in positions between 1675 and 1780, keep your stop at 1759. Target: $2,350 a troy ounce.

Sale: now. Stop: 1827. Target: 1480.

Support — 1730. Resistance — 1825.

EUR/USD

Growth scenario: the pair does not want to fall, which could lead to another growth branch next week. In case of growth above 1.0700 – buy.

Fall scenario: refrain from opening new shorts. We hold the previously opened positions.

Recommendations for the EUR/USD pair:

Purchase: in case of growth above 1.0700. Stop: 1.0600. Target: 1.1500.

Sale: no. Who is in position from 1.0630, keep the stop at 1.0670. Target: 0.8700.

Support — 1.0500. Resistance is 1.0738.

USD/RUB

Growth scenario: fixed profit at 72.00. A rollback to 65.00 is possible. If it happens, then you can buy again. If there is a breakdown above 74.00, we will have to buy, since the move to 88.00 should not be missed. We leave the entrance to the long from the current levels at your discretion.

Fall scenario: an increase in budget spending and a very likely reduction in revenue from the sale of resources in 2023 do not give us a reason to bet on the ruble. We do not sell.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 65.50. Stop: 63.00. Target: 88.00. Or in case of growth above 74.00. Stop: 68.00. Target: 88.00. Count the risks!!!

Sale: no.

Support — 64.87. Resistance — 73.51.

RTSI. MOEX

Growth scenario: we consider the March futures, the expiration date is March 16. Nothing encouraging can be said about our stock market. The economy has fallen this year and will fall next. The raw materials and processing sectors will lose a significant part of the sales market as a result of sanctions, it is possible that up to 20% by the end of next year. We don’t buy.

Fall scenario: holding shorts. The fall is likely to continue. In the event of a move below the level of 90,000, the bulls, who did not understand what they believed in all autumn, will start to panic. Or just margin calls will start to work. No panic. And there will be a little bit of money left in the accounts. Only enough for the New Year’s table.

Recommendations for the RTS index:

Purchase: no.

Sale: when approaching 105000. Stop: 107300. Target: 80000 (50000). Who is in position from 106000, move the stop to 107300. Target: 80000 (50000) points.

Support — 96390. Resistance — 102570.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.