03 October 2022, 13:38

Price forecast from 3 to 7 of October 2022

-

Energy market:

According to some signs, humanity has decided to return to the Stone Age. Not everyone will see it, but there is weak hope, that there will be neither borders nor politicians. And those who will call for something incomprehensible will be blamed at the beginning, and then struck in their rights. You can call for only one thing: to eat delicious food.

Hello! Stay healthy!

OPEC+ on the 5th at a face-to-face meeting, which has not been held since March 2020, will discuss a plan that should prevent the collapse of oil prices if the global economy starts to fall at an accelerated pace. A production cut of 500,000 barrels per day in November seems highly likely. And maintaining prices around $100 per barrel is one of the main tasks of the organization, since the budgets of exporting countries are heavily dependent on oil revenues.

The fight against inflation in the US and Europe may lead to the fact that it will not be easy to maintain current business processes and develop new ones. Rising rates will stifle inflation, but will also hurt a number of sectors, leading to a protracted recession.

Chicago business activity index for the first time since June 20, went below the level of 50. The people do not see prospects for development. Note that the US stock market is falling, which is a leading indicator on a 6-month horizon. We are waiting for very sad statistics after the 1st quarter of 2023.

By reading our forecasts, you could make money in the wheat market by taking a move up from 840.0 to 945.0 cents per bushel.

Grain market:

It is possible that Russia will ban operations with its grain to «unfriendly» countries.

Food is a strategic resource and must be treated wisely. Obstacles to enrichment of foreigners in the current situation look natural, however, it is necessary to assess the losses for our agriculture from the shortfall in revenue here and now.

By removing large Western grain traders from Russian grain, you can be left without orders for some time, which will lead to an even stronger drop in prices within the country against the backdrop of overstocking on the domestic market. At the same time, in the future, when building up our own ties, the gain from conducting independent trade will be higher. You just need to live to see this beautiful tomorrow.

Domestic grain prices have risen somewhat, but remain at low levels. So grain of the 3rd class is traded at the level of 13,000 rubles per ton in the middle lane and up to 15,000 rubles in the south, grain of the 4th class is traded at the level of 11,000 rubles in the middle lane and 13,000 rubles in the south. This is already not bad, but there is potential for growth by 20 percent, provided that exports from the country continue.

USD/RUB:

In the event of an increase in the costs of the special operation and a simultaneous reduction in profits from the sale of oil and gas, the ruble has very little chance of remaining at current levels in 2023.

So far, the ruble is looking good: there are punctures down and attempts to gain a foothold in the 50.00 region, but it smells false from what is happening, as the scale of events in Ukraine is growing day by day. Workers and intellectuals are pulled out of the economic processes, which creates problems for companies.

If Europe does impose an embargo on Russian oil in early December, this could push the dollar up to 80.00. Further, it will be possible to analyze what kind of money alternative buyers will bring, and if it turns out to be less than what is coming now, then we cannot avoid rising inflation with a reduction in revenues and an increase in expenses.

We assume that the current CBR rate of 7.5% may be the lowest in the next three years.

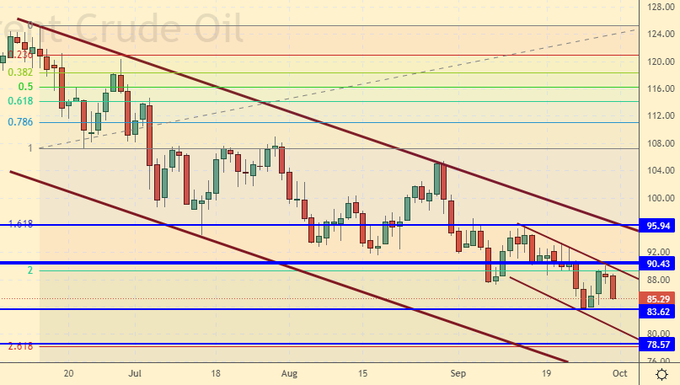

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers has decreased by 8.6 thousand contracts. Buyers left the market, sellers opened new positions. The spread between long and short positions is narrowing, however, the bulls continue to control the market.

Growth scenario: consider the October futures, the expiration date is October 31. The bulls failed to go above $90.00 per barrel. Until we buy.

Fall scenario: sellers step up pressure. We can count on the fact that we will reach the level of 78.00.

Recommendations for the Brent oil market:

Purchase: when approaching the level of 79.00 dollars per barrel. Stop: 77.00. Target: 150.00!!! dollars per barrel.

Sale: no. Who is in position from 86.00, keep the stop at 91.20. Target: $78.60 per barrel.

Support — 83.62. Resistance is 90.43.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 2 units and now stands at 604 units.

Commercial oil reserves in the US fell by -0.215 to 430.559 million barrels, while the forecast was +0.433 million barrels. Inventories of gasoline fell -2.422 to 212.188 million barrels. Distillate inventories fell -2.891 to 114.359 million barrels. Inventories at Cushing rose by 0.692 to 25.683 million barrels.

Oil production fell by -0.1 to 12 million barrels per day. Oil imports fell by -0.498 to 6.449 million barrels per day. Oil exports rose by 1.106 to 4.646 million barrels per day. Thus, net oil imports fell by -1.604 to 1.803 million barrels per day. Oil refining fell by -3 to 90.6 percent.

Gasoline demand rose by 0.503 to 8.825 million barrels per day. Gasoline production increased by 0.166 to 9.625 million barrels per day. Gasoline imports fell by -0.25 to 0.525 million barrels per day. Gasoline exports fell -0.204 to 0.985 million bpd.

Demand for distillates rose by 0.769 to 4.178 million barrels. Distillate production fell -0.278 to 4.958 million barrels. Distillate imports fell -0.013 to 0.094 million barrels. Distillate exports fell -0.471 to 1.287 million barrels per day.

Demand for petroleum products rose by 1.832 to 20.77 million barrels. Oil products production fell by -0.53 to 21.805 million barrels. Imports of petroleum products fell by -0.194 to 1.841 million barrels. Exports of petroleum products fell by -0.318 to 6.338 million barrels per day.

Propane demand rose 0.066 to 0.918 million barrels. Propane production increased by 0.073 to 2.515 million barrels. Propane imports rose by 0.039 to 0.112 million barrels. Propane exports rose by 0.285 to 1.475 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 25.9 thousand contracts. The change is significant. Buyers left the market, sellers entered positions. The spread between long and short positions is narrowing, the advantage of the bulls is fading.

Growth scenario: we are considering the November futures, the expiration date is October 20. We will buy only when approaching 68.00. The market has every chance to continue falling.

Fall scenario: most likely we will reach the area of 70.00 dollars per barrel. Further fall is not visible.

Recommendations for WTI oil:

Purchase: when approaching 68.00. Stop: 66.40. Target: 90.00.

Sale: no. Who entered from 83.00, move the stop to 84.30. Target: $68.60 per barrel.

Support — 68.35. Resistance — 83.05.

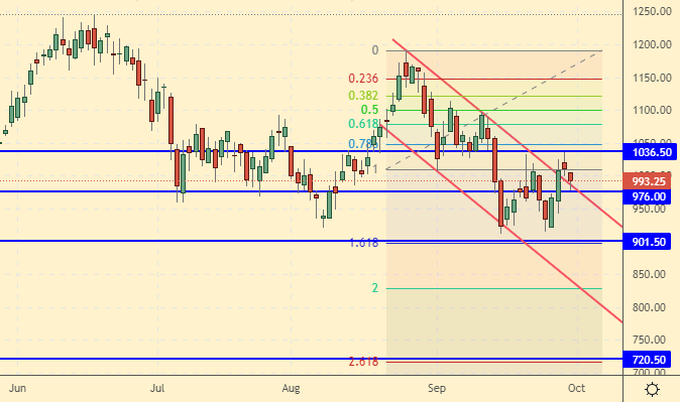

Gas-Oil. ICE

Growth scenario: consider the October futures, the expiration date is October 12. Until we buy. Fuel should be enough for everyone during the crisis.

Fall scenario: it is worth continuing to hold positions from 1115.0. Americans will draw on the market lower prices than the current ones on the eve of the elections.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 1115.00, keep the stop at 1055.00. Target: 720.00!!! dollars per ton.

Support — 976.00. Resistance is 1036.50.

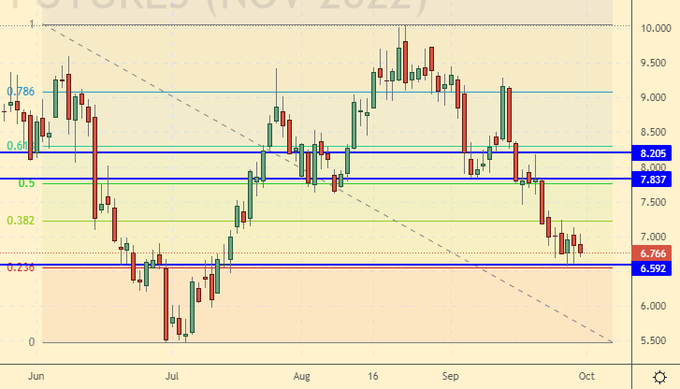

Natural Gas. CME Group

Growth scenario: switched to the November futures, the expiration date is October 27th. We have fallen extremely low. The approaching winter will bring a lot of problems to the West. We buy.

Fall scenario: there are no opportunities to enter shorts. Out of the market.

Recommendations for natural gas:

Purchase: now. Stop: 6.200. Target: 15.000!!!

Sale: no.

Support — 6.592. Resistance is 7.837.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 1.8 thousand contracts. At the same time, both sellers and buyers left the market. The spread between long and short positions is narrowing, the uncertainty in the market is growing.

Growth scenario: consider the December futures, the expiration date is December 14th. Buyers hit the target at 945.0. All with a profit. Now we are taking a break for a week.

Fall scenario: you can sell here. If there are good chances that the market will correct to the level of 826.0 cents per bushel.

Recommendations for the wheat market:

Purchase: no.

Sale: now. Stop: 956.0. Target: 826.0 cents per bushel. Count the risks.

Support — 887.6. Resistance is 948.0.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 11.8 thousand contracts. Both sellers and buyers left the market. Buyers closed their positions more actively. The spread between long and short positions is narrowing, the advantage of the bulls is fading.

Growth scenario: consider the December futures, the expiration date is December 14th. There are many bulls on the market. Friday gives us a chance to go long at a good price. Let’s buy.

Fall scenario: while the bulls are strong. Let’s wait for a drop below the level of 660.0 in order to recommend selling.

Recommendations for the corn market:

Purchase: now. Stop: 660.0. Target: 750.0. Who is in position from 680.0, keep the stop at 660.0. Target: 750.0 cents per bushel.

Sale: after falling below 660.0. Stop: 680.0. Target: 550.0 cents per bushel.

Support — 661.4. Resistance — 708.0.

Soybeans No. 1. CME Group

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 11.8 thousand contracts. Both sellers and buyers left the market. Buyers closed their positions more actively. The spread between long and short positions is narrowing, the advantage of the bulls is fading.

Growth scenario: consider the December futures, the expiration date is December 14th. There are many bulls on the market. Friday gives us a chance to go long at a good price. Let’s buy.

Fall scenario: while the bulls are strong. Let’s wait for a drop below the level of 660.0 in order to recommend selling.

Recommendations for the corn market:

Purchase: now. Stop: 660.0. Target: 750.0. Who is in position from 680.0, keep the stop at 660.0. Target: 750.0 cents per bushel.

Sale: after falling below 660.0. Stop: 680.0. Target: 550.0 cents per bushel.

Support — 661.4. Resistance — 708.0.

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. The struggle is in the range, but the bulls have a slight advantage due to the move up the week before last. We buy.

Fall scenario: we are in a falling channel. We continue to keep the previously opened short, we do not open new positions.

Recommendations for the sugar market:

Purchase: now. Stop: 17.42. Target: 21.00 cents per pound.

Sale: no. Who is in position from 17.80, keep the stop at 18.10. Target: 15.20 cents a pound.

Support — 17.60. Resistance — 18.54.

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. The bulls may lose the initiative here. We hold old positions, we do not open new ones.

Fall scenario: if last week the probability of falling was small, then after another five trading days it increased. We will sell.

Recommendations for the coffee market:

Purchase: no. Those in positions from 210.0, 221.00 and 235.00, move the stop to 212.00.

Target: 350.00 cents per pound.

Sale: now. Stop: 228.00. Target: 150.00 cents per pound.

Support — 217.35. Resistance is 232.45.

Gold. CME Group

Growth scenario: the market was leaving by 1610. If you didn’t buy, it’s okay. We will continue to count on a fall, now for a stronger one, to the area of 1480. And we will buy there. If there is no fall, we will go long above 1710.

Fall scenario: keep short. Our target level is 1600. We have every chance to achieve our target set a few weeks ago.

Recommendations for the gold market:

Purchase: think after rising above 1710.

Sale: no. For those in position from 1802, keep your stop at 1718. Target: $1,480 a troy ounce.

Support — 1602. Resistance — 1674.

EUR/USD

Growth scenario: the pair is in a falling channel. We don’t buy.

Fall scenario: good levels for short entry. Let’s sell here with the target at 0.8600.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: now. Stop: 0.9970. Target: 0.8600.

Support is 0.9530. Resistance is 0.9859.

USD/RUB

Growth scenario: extremely high volatility on Friday resulted in many traders suffering significant losses in a short time. We continue to remain outside the market, and only if there is an increase above the level of 61.00, it will be possible to think about entering a long position.

Fall scenario: we saw an attempt to pass by 50.00, but it ended in failure. Most likely we have a speculative game with the target at 74.00 above. We do not sell.

Recommendations for the dollar/ruble pair:

Purchase: think after rising above 61.00.

Sale: no.

Support — 56.58. Resistance — 62.65.

RTSI

Growth scenario: consider the December futures, the expiration date is December 15th. We observe extremely strong changes in quotes in a short time. It is difficult to come up with a reason for growth now. The situation is nervous. The forecasts are not positive. We don’t buy.

Fall scenario: we will continue to keep shorts from 118000. Targets at 80000 and 50000 points remain. We note that the approved dividend payments on GAZPROM shares did not impress the market. Quotes failed to gain a foothold above 100,000.

Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 118000, move the stop to 114000. Target: 80000 (50000).

Support — 95150. Resistance — 109220.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.