Price forecast from 4 to 8 of April 2022

-

Energy market:

Don Pedro will not go to rest this weekend from his castle on the coast — it’s too cold. And the German von Bobock will not be able to drive to the Alps, there are 30 centimeters of snow on the roads. Europe is cold again. Again, you have to pay for gas, gasoline, coal. We need to look for rubles.

Hello!

OPEC+ is sticking to the plan so far. An increase in production by 400 thousand barrels per day is planned for May. Moscow would hate to see its market share replaced by other countries, but this can happen even if Saudi Arabia plays for the Kremlin in the oil field.

American Democrats will save their ratings, not only will 1 million barrels of oil per day be supplied to the market from reserves for 6 months, but also a set of cookies will be prepared for the Venezuelan government. Heavy oil from comrade Maduro interests Biden very much. If it does not exist, then a part of the inhabitants of the United States, whose lives matter, may rudely knock on the door of the White House and ask:

— «What’s with the gasoline prices, bro?»

In addition to Venezuela, other, not so significant, but significant players in the oil market can increase their supply: Kazakhstan and Azerbaijan, for example. And if the West finally strangles in its arms Iran, which is now so beloved and needed by everyone, and allows it to sell oil not only to China, then prices may go down to the region of $80 per barrel.

By reading our forecasts, you could make money on the gas oil market by taking a move up from 1090.00 to 1140.00 dollars per ton. You could also make money in the sugar market by taking a move up from 17.80 to 19.10 cents per pound. In addition, you could make money on the EUR/USD pair by taking a move down from 1.1370 to 1.1160.

Grain market:

It is not yet a fact that food supplies to Europe from Ukraine and Russia will be disrupted this autumn, but such a fear exists, and a shortage in a number of positions is real. EU citizens are trying to stock up on flour and sunflower oil for future use, which creates a stir when the shelves are empty.

This week, the hope for the end of the conflict in Ukraine did not come true, prices went down, then quickly recovered. At the moment, we see that against the backdrop of the sowing campaign, prices on the Chicago Stock Exchange for wheat and corn are prone to falling. We believe that there will be no deep correction, however, a 10% rollback from current levels is real.

The forecast for wheat yields in Europe for mid-March is at the level of last year’s excellent and is 58 centners per hectare. In addition, additional lands will be plowed up, which will provide a small increase in the gross harvest.

US farmers are switching from corn to soybeans because soybeans do not require a lot of fertilizer. As a result, soybean prices could correct by 15% to 1,300 cents per bushel.

USD/RUB:

There is no normal dollar trading on the MICEX. Non-residents are not allowed to trade. The current exchange rate of the dollar against the ruble is artificial. A cash dollar is quoted from 140 to 160 rubles, which is more than 1.5 times higher than the exchange rate.

The West cut off economic ties with Moscow for more than one month. Now it makes no sense to talk about an early normalization of the situation, since there are many unknowns in the equation. Until the situation normalizes, we consider the exchange rate to be indicative.

Most likely, the US dollar will continue to strengthen against other currencies this year on the back of forecasts for a multiple rate hike by the US Federal Reserve. It seems interesting that at the moment gold is in no hurry to fall against the US currency, and without strengthening against gold, the strengthening of the dollar will be perceived as a far-fetched thing. Note that the fiat currency market is rapidly beginning to resemble the crypto market, as it loses its fundamental content. The printing of money does not stop.

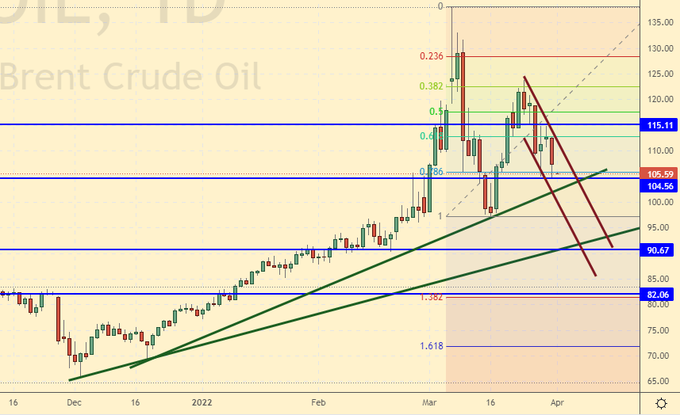

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 5.1 thousand contracts. The change is minor. The number of buyers in the market exceeds the number of sellers by 142,000 contracts.

Growth scenario: we are considering the April futures, the expiration date is April 29. As long as Russia has not asked to pay for oil in rubles, the market has a chance for a correction towards 90.00.

Falling scenario: sales are possible. The Biden administration will try to lower prices. In addition, there may not be any growth in global GDP this year.

Recommendation:

Purchase: not yet.

Sale: now. Stop: 116.00. Target: 92.00.

Support — 104.56. Resistance is 115.11.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 2 units and now stands at 533 units.

US commercial oil inventories fell by -3.449 to 409.95 million barrels, while the forecast was -1.022 million barrels. Inventories of gasoline rose by 0.785 to 238.828 million barrels. Distillate inventories rose by 1.395 to 113.53 million barrels. Inventories at Cushing fell -1.009 to 24.233 million barrels.

Oil production increased by 0.1 to 11.7 million barrels per day. Oil imports fell by -0.227 to 6.259 million bpd. Oil exports fell -0.856 to 2.988 million barrels per day. Thus, net oil imports rose by 0.629 to 3.271 million barrels per day. Oil refining increased by 1 to 92.1 percent.

Gasoline demand fell by -0.138 to 8.499 million barrels per day. Gasoline production fell by -0.75 to 9.054 million barrels per day. Gasoline imports fell by -0.065 to 0.656 million barrels per day. Gasoline exports fell -0.45 to 0.608 million barrels per day.

Demand for distillates fell -0.712 to 3.804 million barrels. Distillate production increased by 0.12 to 5.099 million barrels. Distillate imports fell -0.017 to 0.155 million barrels. Exports of distillates rose by 0.32 to 1.251 million barrels per day.

Demand for oil products fell by -1.25 to 19.874 million barrels. Oil products production fell by -0.507 to 21.432 million barrels. Imports of petroleum products fell by -0.003 to 2.119 million barrels. Exports of petroleum products fell by -0.075 to 5.61 million barrels per day.

Propane demand rose by 0.061 to 1.401 million barrels. Propane production increased by 0.006 to 2.366 million barrels. Propane imports fell -0.021 to 0.126 million barrels. Propane exports fell by -0.059 to 1.071 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Over the past week, the difference between long and short positions of managers has slightly decreased, by only 4.6 thousand contracts. Traders were waiting for the OPEC meeting and did not take active steps.

Growth scenario: we are considering the May futures, the expiration date is April 20. Until we buy. It makes sense to wait for the fall to the 80.00 area.

Falling scenario: we will keep the shorts opened a week earlier. We do not open new positions. Recommendation:

Purchase: no.

Sale: no. Who is in position from 114.00, move the stop to 112.00. Target: 80.00.

Support — 95.66. Resistance is 108.56.

Gas-Oil. ICE

Growth scenario: we are considering the April futures, the expiration date is April 12. Due to the actions of OPEC and the US to increase supply, prices may decrease, do not buy.

Falling scenario: it is worth holding the previously open shorts in the expectation of a fall to the 700.00 area.

Recommendation:

Purchase: no.

Sale: no. Who is in position from 1200.00, move the stop to 1210.00. Target: 700.00?!

Support — 1003.00. Resistance is 1260.75.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 27. The Americans intend to take patronage over Europe in the field of natural gas. They will liquefy it and carry it to the EU. Market demand will remain high.

Falling scenario: we will not sell. Most likely in the USA, and in the EU for sure, new giant gas storage facilities will be built. There will be no surplus in this market.

Recommendation:

Purchase: no. Who is in position from 3.875, move the stop to 4.670. Target: 8.777.

Sale: no.

Support — 5.103. Resistance — 6.134.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers has decreased by 3,000 contracts. Most likely, the bulls will retreat against the backdrop of a favorable spring. We do not expect a strong fall, but we will clearly see a rollback.

Growth scenario: we are considering the May futures, the expiration date is May 13. While we do not buy, we wait for lower price levels.

Falling scenario: We will keep the shorts open last week. It is possible that we will reach not only the level of 900.0, but also 800.0.

Recommendation:

Purchase: not yet.

Sale: no. Who is in position from 1100.0, move the stop to 1090.0. Target: 900.0 (800.0).

Support — 971.4. Resistance — 1077.0.

Let’s look at the volumes of open interest of corn managers. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Last week the difference between long and short positions of managers decreased by 30.3 thousand contracts. The positions of the bulls were shaken. It is possible that we will see the flight of buyers next week.

Growth scenario: we are considering the May futures, the expiration date is May 13. Shopping here is not comfortable. We take a break.

Falling scenario: we will sell. The market is able to pass to 650.0, a stronger fall is not in sight. Recommendation:

Purchase: not yet.

Sale: now. Stop: 758.0. Target: 650.0.

Support — 713.2. Resistance — 770.4.

Soybeans No. 1. CME Group

Growth scenario: we are considering the May futures, the expiration date is May 13. The market decided to go down. Refrain from shopping.

Falling scenario: you can go short. The levels are somewhat understated, but given the prospect of a move to 1300.0, the deal looks good. Recommendation:

Purchase: no.

Sale: now. Stop: 1680.0. Target: 1300.0.

Support — 1440.4. Resistance — 1622.4.

Sugar 11 white, ICE

Growth scenario: we are considering the May futures, the expiration date is April 29. It is possible to enter long again despite the demolition of the stop order.

Falling scenario: sell. The entire commodity group tends to correct.

Recommendation:

Purchase: now. Stop: 19.10. Target: 23.00.

Sale: now. Stop: 19.77. Target: 18.30.

Support — 18.83. Resistance — 19.88.

Сoffee С, ICE

Growth scenario: we are considering the May futures, the expiration date is May 18. Coffee behaves extremely suspiciously. Let’s buy.

Falling scenario: nothing has changed. Short will continue to hold. When approaching 200.0 you can take profit.

Recommendation:

Purchase: now. Stop: 217.00. Target: 300.00?!

Sale: no. Who is in position from 250.00, keep the stop at 237.00. Target: 186.00.

Support — 212.65. Resistance is 245.35.

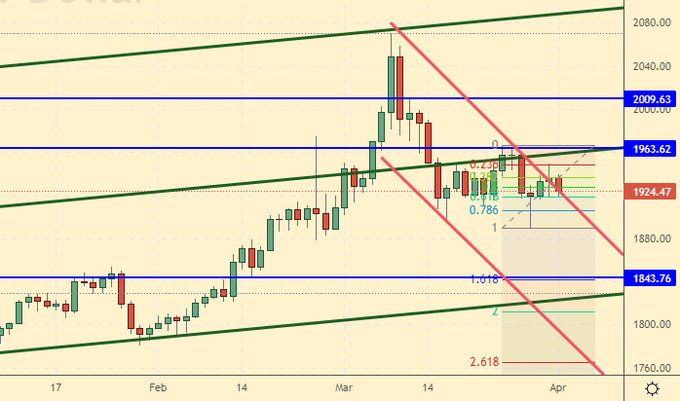

Gold. CME Group

Growth scenario: we see the struggle. You can return to buying if the day closes above 2000.0 or after a rollback to 1850.

Falling scenario: here you can sell. Like a week earlier, the picture is attractive for entering shorts. Recommendations:

Purchase: not yet.

Sale: now. Stop: 1970. Target: 1850 (1770). Who is in position from 1960, move the stop to 1970. Target: 1850 (1780).

Support — 1843. Resistance — 1963.

EUR/USD

Growth scenario: despite the surge to 1.1200, let’s not rush to buy. We are waiting for 1.0600.

Falling scenario: despite the failure of the stop order, we sell again.

Recommendations:

Purchase: when approaching 1.0600. Stop: 1.0400. Target: 1.2100 (1.5000?!)

Sale: now. Stop: 1.1190. Target: 1.0600.

Support — 1.1000. Resistance is 1.1185.

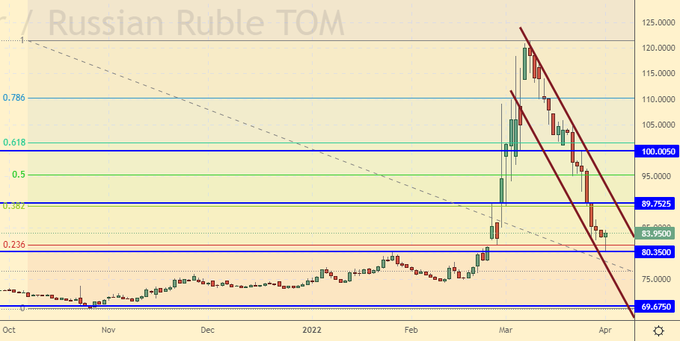

USD/RUB

Growth scenario: after the repayment of interest on loans to foreign investors on Monday, the pair’s growth is possible already on Tuesday.

Falling scenario: we perceive the current level as somewhat underestimated for sales. While out of the market. After returning to the 100.00 area, you will need to re-evaluate the situation. Recommendations:

Purchase: now. Stop: 76.00. Target: 120.00 (150.00?!).

Sale: no.

Support — 80.35. Resistance is 89.75.

RTSI

Growth scenario: some of the securities are in demand from investors, but Sberbank and Gazprom do not shine. The situation is extremely tense, as long as there is no understanding of how and to what extent companies will generate profits. It is difficult to push quotes up without realizing this.

Falling scenario: we perceive the current levels as extremely optimistic. The option of normalizing the situation is not ruled out, but this will not happen tomorrow. While there is no political and macroeconomic stability, it is impossible to talk about the growth of the stock market. Recommendations:

Purchase: think when approaching 50,000. Count the risks. Meditate. Read news.

Sale: no.

Support — 87080. Resistance — 106720.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.