27 September 2021, 12:33

Price forecast from 27 September to 1 October 2021

-

Energy market:

What Europe has done to itself, wishing to demonstrate the strength of its bureaucracy, first of all to the Kremlin, with its energy packages, laws and courts, cannot be called any decent word. Either we allow you to lay the pipe, then we do not.

Everything turned into a fourfold increase in the cost of natural gas in Europe on the eve of winter due to a drop in reserves in storage facilities. There were 200, now 800 dollars per thousand cubic meters. Yes, and who knew this spring and this summer that Asia would contract LNG at any price, taking almost everything from the market. Nobody except Alexey Miller.

The «greens» will now be quickly shoved into a wooden box and sprinkled with earth, the coal stations will be reactivated, and the sky will be smoked forward. They will even send their German, possibly British, Stakhanov to us in Kuzbass, if only coal is given to the top.

And most of all the king of Norway is happy. They are there out of happiness for their five million citizens will soon light up their personal sun, so that it would be easier to endure the dark winter, and what else to do with their money.

Iran again began to run around the table from the Americans not wanting to sign the papers on the nuclear deal. The Washingtonians are publicly complaining, urging the public to witness the fact that the negotiation process has been dragging out. And expensive oil is to blame. China, apparently, pours good enough for Tehran under direct contracts, so the Persians now have no need to rush.

Drilling activity is on the rise in America. The number of active drilling rigs reached 421. At the beginning of the year, there were only 240 working devices. The path is not close to the average for the last five years in the amount of 800 installs, but active growth, 10 installs in seven days, is going on for the second week in a row.

Grain market:

The fairy tale about cheap food does not want to become reality. Prosperity is being postponed all the time even under developed capitalism. Cereal prices are going up again, and this is at a record harvest in the world. If demand remains at a high level, and it will, as rulers around the world are afraid of the pandemic, it is scary to imagine what prices we will see in the event of a cold winter in Europe and Russia, when winter crops begin to freeze. It makes sense to keep a close eye on temperatures this winter.

Europe has harvested one of the worst grape harvests ever due to a disgusting summer. Good wine will not be enough. There will be nothing to calm the nerves. And against such a sad, one might even say not a rosy European background, elections to the Bundestag are being held. Let’s hope that the Germans will use their votes carefully. Following the results of the elections, new members of parliament must elect a new chancellor. Angela Merkel is leaving politics. The coming to power of a person who is too preoccupied with the environment may lead to an increase in the cost of agricultural products in the largest EU economy.

USD/RUB:

The ruble is still stable. The Americans are threatening with new sanctions. The question of a ban on the purchase of the secondary state debt of the Russian Federation has been raised. With high energy prices, the ruble is unlikely to experience problems. Another thing is that with a rollback in the oil and gas markets, anxiety about the state’s ability to cope with current challenges will intensify and the ruble will begin to weaken.

Note that Washington has more and more room for maneuver, since diplomatic contacts between Russia and America are practically frozen. If earlier it was possible to sit down at the table and discuss the accumulated questions, now it is impossible to do this. The FRS meeting on the 22nd gave an extremely weak reason for the dollar bulls to continue buying. If the American currency improves its position, it will not be for long. There remain many questions about inflation, the labor market, and the growth of US GDP, the forecast for which was reduced from 7.0 to 5.9%.

Brent. ICE

We’re looking at the volume of open interest of Brent. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 21.8 thousand contracts. Bulls were actively entering the market, sellers, on the contrary, retreated, which led to an increase in prices.

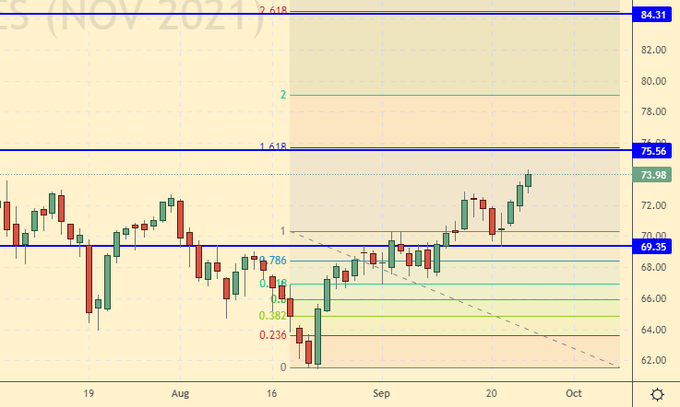

Growth scenario: October futures, the expiration date is October 29. The outlook for the oil market remains good due to high gas prices. Up to 1 million barrels per day will be burned this winter if Europe does not get enough natural gas from Russia and Norway. Let’s move the target from 80.00 to 88.00.

Falling scenario: do not sell. Strong energy demand and a weak dollar leave no room for a fall. Only when approaching 88.00 can you think about selling.

Recommendation:

Purchase: no. Whoever is in the position between 74.00 and 75.00, move the stop to 74.30. Target: 80.00.

Sale: on touch 88.00. Stop: 91.70. Target: 78.00. Support — 76.19. Resistance — 78.98.

WTI. CME Group

Fundamental data from the USA: the number of active drilling rigs increased by 10 units and is 421 units.

Commercial oil reserves in the US fell by -3.481 to 413.964 million barrels, while the forecast was -2.44 million barrels. Gasoline inventories rose by 3.474 to 221.616 million barrels. Distillate stocks fell -2.554 to 129.343 million barrels. Cushing’s stocks fell -1.476 to 33.84 million barrels.

Oil production increased by 0.5 to 10.6 million barrels per day. Oil imports rose 0.704 to 6.465 million barrels per day. Oil exports rose 0.185 to 2.809 million barrels per day. Thus, net oil imports rose by 0.519 to 3.656 million barrels per day. Refining increased by 5.4 to 87.5 percent.

Gasoline demand rose 0.004 to 8.896 million barrels per day. Gasoline production rose 0.372 to 9.643 million barrels per day. Gasoline imports rose 0.444 to 1.082 million barrels per day. Gasoline exports fell by -0.013 to 0.621 million barrels per day.

Distillate demand rose 0.629 to 4.424 million barrels. Distillate production rose 0.298 to 4.454 million barrels. Distillate imports rose 0.02 to 0.184 million barrels. Distillate exports fell by -0.188 to 0.579 million barrels per day.

The demand for petroleum products increased by 1.234 to 21.145 million barrels. Production of petroleum products increased by 0.573 to 21.191 million barrels. Imports of petroleum products rose by 0.483 to 2.481 million barrels. Exports of petroleum products fell by -0.206 to 4.287 million barrels per day.

Propane demand increased by 0.405 to 1.293 million barrels. Propane production fell by -0.054 to 2.163 million barrels. Propane imports rose 0.014 to 0.088 million barrels. Propane exports fell by -0.265 to 1.035 million barrels per day.

We’re looking at the volume of open interest of WTI. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 12.4 thousand contracts. Some of the bulls did not believe in the continuation of the growth and a bet was made to sell, however, prices continued to rise, which led to the disruption of stop orders and a sharp rise in the market.

Growth scenario: November futures, the expiration date is October 20. Considering the proximity of the resistance level at 75.56, there is no point in buying now. Who bought after rising above 73.00 — keep long with targets at 84.00.

Falling scenario: sellers should stay on the sidelines for now. It is possible that the market will pick up speed and continue to grow rapidly. Recommendation:

Purchase: no. Those who are in the position from 73.20, move the stop to 71.80. Target: 84.00.

Sale: thinking when approaching 84.00.

Support — 69.35. Resistance — 75.56.

Gas-Oil. ICE

Growth scenario: October futures, the expiration date is October 12. It is possible that the market will roll back from the level of 667.0. If this happens, then shopping opportunities can be considered. Out of the market so far.

Falling scenario: you can sell when you touch 665.0. We are counting not on a fall, but on a correction, so we set the target at 620.0.

Recommendation:

Purchase: on a rollback to 620.0. Stop: 590.0. Target: 665.0.

Sale: on touch 665.0. Stop: 680.0. Target: 620.00.

Support — 619.00. Resistance — 667.25.

Natural Gas. CME Group

Growth scenario: October futures, expiration date September 28. The gas market in Europe continues to remain at high, one might even say exorbitant levels. Buying now is extremely uncomfortable. For now, we will count on the normalization of the situation and a rollback to 4.220.

Falling scenario: selling here is extremely difficult, knowing that storage facilities in Europe are about a third full before winter starts. We do not enter the short.

Recommendation:

Purchase: on touch 4.220. Stop: 3.800. Target: 6.000. Sale: no.

Support — 4.720. Resistance — 5.650.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 0.3 thousand contracts. We see that speculators have temporarily lost interest in the market. Traders closed both buy and sell positions. In fact, in the thinner market that became after the departure of speculators, the price increased.

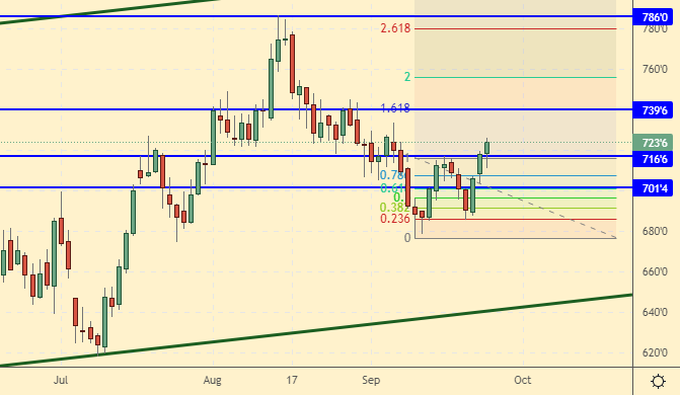

Growth scenario: December futures, expiration date December 14. Not a bad situation to keep the long open after rising above 715.0. The current levels are also good for buying, although they are not optimal.

Fall scenario: there is a possibility that we will go to the area of 780.0. We do not sell.

Recommendation:

Purchase: now. Stop: 701.0. Target: 779.0. Those who are in the position from 717.0, move the stop to 701.0. Target: 779.0.

Sale: now. Stop: 719.0. Target: 652.0.

Support — 716.6 (701.4). Resistance — 739.6.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 2.2 thousand contracts. The changes are not significant. Traders are out of ideas at the moment.

Growth scenario: December futures, the expiration date is December 14. Market uncertainty is dragging on. Let’s keep last week’s recommendation: if prices rise above 558.0, we will buy. The second option for buying is a drop in prices to 430.0.

Falling scenario: since nothing has changed, we continue to hold the short from 584.0. Much corn was harvested. Possible downward movement.

Recommendation:

Purchase: think after rising above 558.0.

Sale: no. Who is in positions between 570.0, 560.0 and 584.0, keep the stop at 558.0. Target: 430.0.

Support — 512.6. Resistance — 537.6.

Soybeans No. 1. CME Group

Growth scenario: considering November futures, expiration date November 12. We came out of consolidation down. Some cooling is ready. We do not open new buy positions.

Falling scenario: keep holding the shorts. Those interested can add at the current price levels.

Recommendation:

Purchase: no. Whoever is in the position from 1290, keep the stop at 1244.0. Target: 1880.0 ?!

Sale: no. Whoever is in the position between 1400.0 and 1350.0, keep the stop at 1343.0. Target: 1111.0.

Support — 1257.2. Resistance — 1308.0.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 28. If we rise above 21.00, it makes sense to buy. The current situation is in favor of sellers. Falling scenario: we designated the level of 20.40 as resistance. Let’s go in short.

Recommendation:

Purchase: think when approaching 18.20, also think after rising above 21.00.

Sale: now. Stop: 20.57. Target: 18.20. Anyone in the position from 19.50, keep the stop at 20.57. Target: 18.20.

Support — 19.26. Resistance — 20.43.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 20. Rise above 190.00 again, you can buy.

Falling scenario: most likely the bulls will be able to raise the market to 244.0. We do not sell.

Recommendation:

Purchase: now. Stop: 184.00. Target: 244.00.

Sale: no. Whoever is in the position from 190.00, keep the stop at 196.00. Target: 162.00.

Support — 181.15. Resistance — 202.25.

Gold. CME Group

Growth scenario: sellers cannot break below 1730 yet. Buy here, as the risk is small. The FRS meeting on the 22nd only intensified rumors about the strength of the dollar in the distant future, but it never came to concrete cases, in the form of curtailing the quantitative easing program.

Falling scenario: sellers will find it very difficult to push gold to 1650. We do not open new shorts.

Recommendations:

Purchase: now. Stop: 1730. Target: 2060.

Sale: no. Anyone in the position from 1790, move the stop to 1793. Target: 1650.

Support — 1736. Resistance — 1787.

EUR/USD

Growth scenario: the euro has a chance. Let’s look at the results of the elections to the Bundestag next week. Then the elections of the chancellor will follow. And a new leader always means new hopes. From a technical point of view, the bulls are also not lost.

Falling scenario: the Fed meeting failed to give impetus to the fall. We do not open new sell positions.

Recommendations:

Purchase: now. Stop: 1.1670. Target: 1.2100.

Sale: no. Those who are in the position from 1.1900, move the stop to 1.1870. Target: 1.1060.

Support — 1.1669. Resistance — 1.1902.

USD/RUB

Growth scenario: the situation is uncertain. If the market rises above 73.50 again, you can buy. Anyone in position from 73.00, keep longs.

Falling scenario: we will continue to hold the short opened five weeks ago from 73.90. We do not open new sell positions.

Recommendations:

Purchase: in case of growth above 73.50. Stop: 72.40. Target: 80.00. Anyone in the position from 73.00, keep the stop at 72.40. Target: 80.00.

Sale: no. Anyone in the position from 73.90, keep the stop at 73.67. Target: 67.60.

Support — 72.23. Resistance — 73.63.

RTSI

Growth scenario: expensive energy supplies support the Russian stock market. The external background also remains positive despite the forecasts for the reduction of the quantitative easing program and the strengthening of the dollar. We leave out new possible US sanctions for now, although in the long term they may affect the Russian economy. If the market goes above 178,000 you can buy.

Falling scenario: short from current levels is interesting primarily from a technical point of view. Let’s go on sale. Investor sentiment may change over the weekend. Suddenly from Monday everyone will start to believe in a strong dollar, then the stock market will have to correct. These are the rules of the game.

Recommendations:

Purchase: think after a rise above 178,000.

Sale: now. Stop: 178000. Target: 151000.

Support — 167030. Resistance — 176140.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.