Price forecast from 26 to 30 July 2021

-

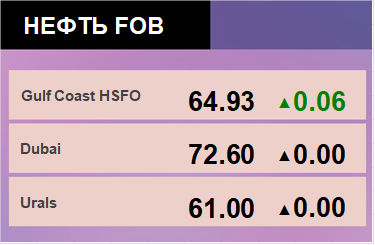

Energy market:

The oil market last week demonstrated the ability to fall by $ 4 per day and recover by the same amount in a day. Summer. Apparently not all rich people are in the workplace, hence the volatility.

Drilling is gaining momentum in the United States. The increase in the number of rigs has been observed for 5 consecutive weeks. Prices are not bad for producers who can hedge sales and start mining.

On the other hand, the demand for gasoline in the US is not falling, which supports the market. Also, do not forget about the possibility of hurricanes, which can stop production in the Gulf of Mexico for several days in August-September.

In the current situation, the move at 80.00 cannot be denied, but this rise will be an outright bluff against the backdrop of the OPEC + agreement reached and monstrous downpours around the world. If growth occurs, then it is worth increasing the rates on the market falling when reversal signals appear.

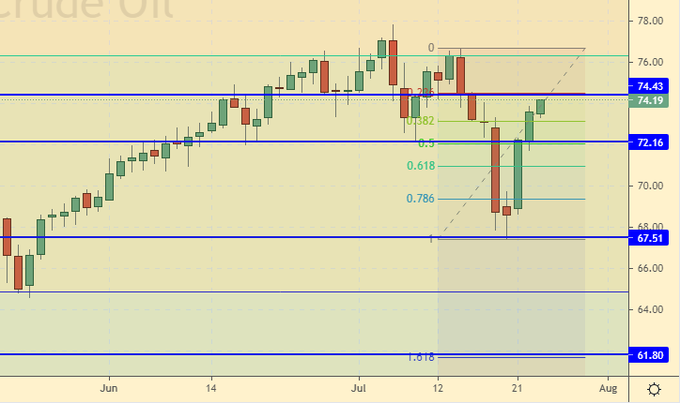

Reading our predictions, you could have made money on Brent by taking a move down from 76.00 to 69.00, as well as on WTI by taking a move down from 74.00 to 66.60. In addition, you could have made money in the coffee market by moving up from 153.0 to 194.0 cents per pound.

Grain market:

The prospect of cooler weather in August with a higher likelihood of rain in the US Midwest has created conditions for sales. Cooler, wetter weather will benefit both quality and yield. On Thursday and Friday, corn prices fell 3% and wheat prices fell 2%.

In Europe, on flat areas, experts do not note major problems with grain after heavy rainfall. Thus, we can talk about a more positive than a negative effect on the harvest of additional moisture. Water supply in the soil and restoration of good weather will allow plants to quickly recover from lodging.

The new crop in August should begin to put pressure on prices. Therefore, it is most reasonable to expect a decline in the grain market, which may last until the first ten days of September.

Reading our predictions, you could have made money on Brent by taking a move down from 76.00 to 69.00, as well as on WTI by taking a move down from 74.00 to 66.60. In addition, you could have made money in the coffee market by moving up from 153.0 to 194.0 cents per pound.

USD/RUB:

The Central Bank of the Russian Federation immediately raised the rate by a percentage to 6.5%, which increased the attractiveness of the national currency and ruble bonds. The RGBI index started to rise. Investors, apparently, really believe in the fading of inflation in Russia and in the possibility of obtaining net yields from debt securities.

The central event on the next week is the US Federal Reserve meeting on the 28th. It is unlikely that at the press conference after him, we will hear something extraordinary from the lips of Mr. Powell. The song about the weak labor market and the need for incentives will continue. This could force the dollar to decline slightly against other currencies on the day of the announcement of the decision on the rate, which will remain at 0.25%.

Another thing is that the market is already waiting for a symposium in Jackson Hall on August 27th. At a major annual bankers meeting, Powell is expected to announce the curtailment of the quantitative easing program, which will create preconditions for the growth of the dollar throughout the 22nd year. It cannot be ruled out that large investors will stake on this event. They may start buying the US currency intensively in August, which could strengthen the dollar’s bullish trend. But there is a question, and if there is no reduction in the asset buyback program this fall, what then?

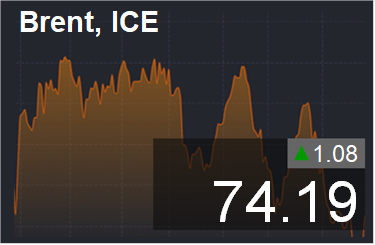

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 34.2 thousand contracts. At the same time, the price dropped by $ 2.48. Speculators — buyers quickly leave the market. Most likely, the rise in prices in the second half of the week is false.

Growth scenario: July futures, expiration date July 30. The moment to buy was when we were at 69.00. We wrote about him a week ago. At the moment, the levels are high, we do not enter long.

Falling scenario: we will fight for the short at the current levels, as the idea of a passage to 63.00 looks attractive.

Recommendation:

Purchase: no. Those who are in the position from 69.00, move the stop to 70.40. Target: 80.00.

Sale: now. Stop: 76.30. Target: 63.00.

Support — 72.16. Resistance — 74.43.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 7 units and is 387 units.

Commercial oil reserves in the US increased by 2.107 to 439.687 million barrels, while the forecast was -4.466 million barrels. Gasoline inventories fell by -0.121 to 236.414 million barrels. Distillate stocks fell -1.349 to 141 million barrels. Stocks at Cushing’s storage fell -1.347 to 36.711 million barrels.

Oil production has not changed at 11.4 million barrels per day. Oil imports rose 0.876 to 7.097 million barrels per day. Oil exports fell -1.562 to 2.463 million barrels per day. Thus, net oil imports increased by 2.438 about 4.634 million barrels per day. Refining fell by -0.4 to 91.4 percent.

Gasoline demand rose 0.012 to 9.295 million barrels per day. Gasoline production fell 0.728 to 9.13 million barrels per day. Gasoline imports rose 0.33 to 1.374 million barrels per day. Gasoline exports rose 0.119 to 0.866 million barrels per day.

Distillate demand rose 0.761 to 3.925 million barrels. Distillate production fell by -0.024 to 4.902 million barrels. Distillate imports rose 0.01 to 0.087 million barrels. Distillate exports fell by -0.059 to 1.257 million barrels per day.

The demand for petroleum products increased by 1.278 to 20.581 million barrels. Production of petroleum products fell by -0.06 to 21.205 million barrels. Imports of petroleum products rose by 0.154 to 2.591 million barrels. Exports of petroleum products fell by -0.073 to 5.522 million barrels per day.

Propane demand fell by -0.332 to 0.784 million barrels. Propane production fell by -0.017 to 2.316 million barrels. Propane imports rose 0.015 to 0.096 million barrels. Propane exports rose 0.115 to 1.186 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 48.6 thousand contracts. At the same time, the price dropped by $ 2.7. The sharp exodus of buyers should raise doubts about the strength of the bullish trend in oil.

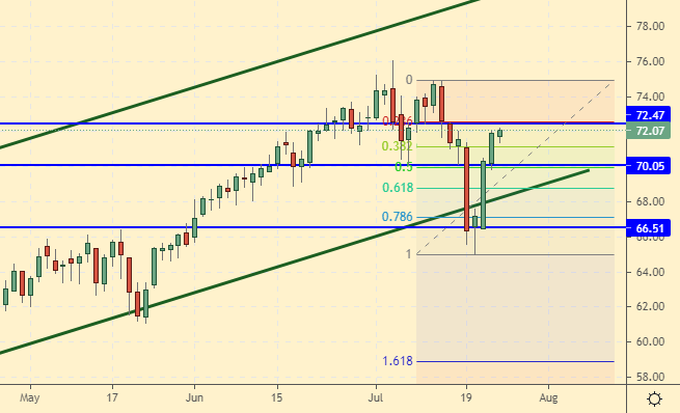

Growth scenario: September futures, the expiration date is August 20. Who bought from the area 66.50 — 67.50 keep longs. The current levels are no longer of any interest for entering a long.

Fall scenario: we will fight for the short here. We do not deny the move to 80.00, but the eyes are afraid, but the hands do. I would like to see 59.00.

Recommendation:

Purchase: no. Anyone in the position from 67.50, move the stop to 69.50. Target: 80.00.

Sale: now. Stop: 74.30. Target: 59.00.

Support — 70.05. Resistance — 72.47.

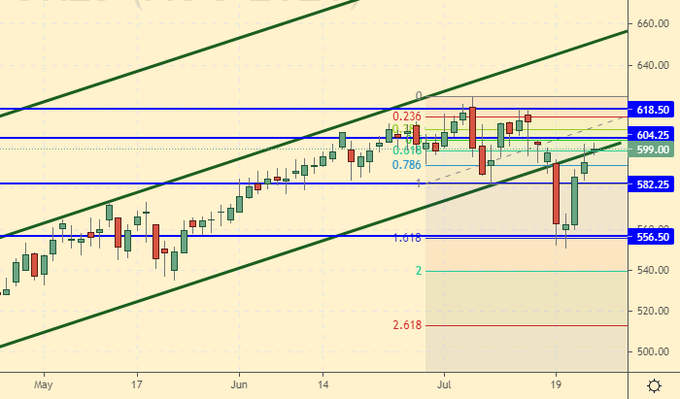

Gas-Oil. ICE

Growth scenario: August futures, the expiration date is August 12th. We see no reason for growth. The car season is coming to an end. Demand will inevitably fall. We do not buy.

Falling scenario: despite strong fluctuations, our short is alive. We will fight for a position with targets at 510.0.

Recommendation:

Purchase: no.

Sale: now. Stop: 623.0. Target: 510.0. Anyone in the position from 578.00, move the stop to 623.00. Target: 510.00.

Support — 582.25. Resistance — 604.25.

Natural Gas. CME Group

Growth scenario: September futures, expiration date August 27. We should get to 4.540 amid empty warehouses in Europe and strong demand. We keep longs.

Falling scenario: let’s think about shorts from 4.500. Nord Stream 2 should cool the market. Recommendation:

Purchase: no. Anyone in the position from 3.650, move the stop to 3.700. Target: 4.540.

Sale: when approaching 4.500. Stop: 4.700. Target: 3.700.

Support — 3.498. Resistance — 4.540.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 20.7 thousand contracts and came close to zero. Equilibrium in the market. Nevertheless, we will bet on sales. We are counting on seasonality.

Growth scenario: September futures, expiration date September 14. So far, the expectation of a rollback down from the 700.00 area is justified. We do not buy.

Falling scenario: here you can go short. It is unlikely that the market will fall below 560.0, but this movement will be enough for us.

Recommendation:

Purchase: on touch 566.0. Stop: 557.0. Target: 700.0.

Sale: now. Stop: 714.0. Target: 566.0. Those who are in the position from 692.0, move the stop to 714.0. Target: 566.0.

Support — 646.0. Resistance — 693.6 (718.2).

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 13.7 thousand contracts. There are a little more bulls on the market. Position change is insignificant. We are waiting for the seasonality to prevail. We will sell.

Growth scenario: September futures, expiration date September 14. Nothing has changed since last week. We will continue to refrain from buying, as the long-term support line is under the threat of breaking.

Falling scenario: when trying to close the gap at 587.0, shorts are required. Sales from current levels are also possible. I wish we had dropped to 425.0.

Recommendation:

Purchase: on touch 425.0. Stop: 392.0. Target: 540.0. Sale: now and at touch 584.0. Stop: 620.0. Target: 425.0 !!! Whoever is in the position from 570.0, keep the stop at 620.0. Target: 425.0 !!!

Support — 520.2. Resistance — 571.2.

Soybeans No. 1. CME Group

Growth scenario: September futures, expiration date September 14. Against the background of the improvement of the weather situation in the USA, we can expect a rollback to the 1100.0 area. We do not buy.

Falling scenario: continue to hold the previously opened shorts. To open new positions, prices are understated.

Recommendation:

Purchase: on touch 1111.0. Stop: 1083.0. Target: 1300.0.

Sale: no. Those who are in the position from 1400.0, move the stop to 1440. Target: 1111.0.

Support — 1250.0. Resistance — 1438.2.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. We will continue to long with targets at 19.50.

Falling scenario: from 19.50 we will definitely sell. Most likely, the rise in prices will be limited by this level.

Recommendation:

Purchase: no. Those who are in positions between 17.50 and 17.00, move the stop to 17.10. Target: 19.50. Sale: on touch 19.50. Stop: 20.50. Target: 16.50.

Support — 16.71. Resistance — 18.51.

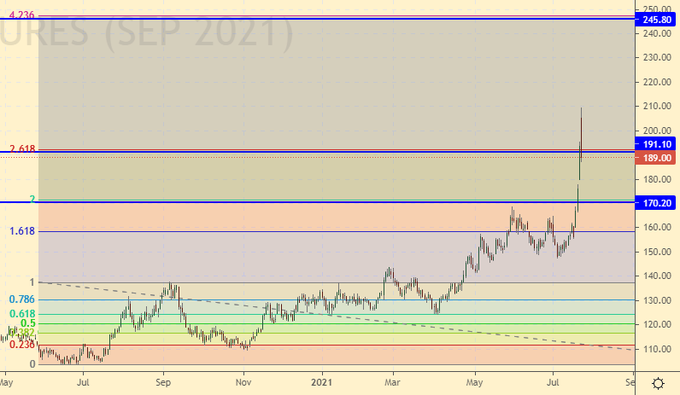

Сoffee С, ICE

Growth scenario: September futures, expiration date September 20. Great leap up. Took a profit of 194.00. Further growth is also possible. But here you should be careful and consider the risks.

Falling scenario: we will not go short for now. Let’s look at the development of events.

Recommendation:

Purchase: now. Stop: 168.00. Target: 245.00.

Sale: not yet.

Support — 191.10. Resistance — 245.80.

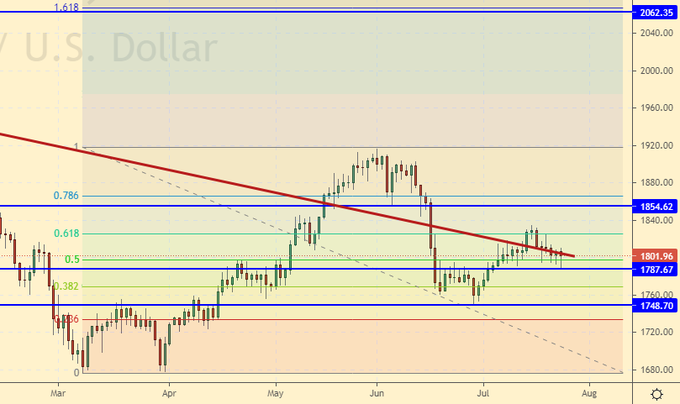

Gold. CME Group

Growth scenario: the market cannot go below 1800. Buying by a number of investors creates conditions for growth. Nevertheless, in order to build up longs, we will wait for the rise in prices above 1830.

Falling scenario: the market is clearly waiting for the Fed meeting. Since after him no strong statements by Powell are expected, it is unlikely that we will see the strengthening of the dollar.

Recommendations:

Purchase: after rallying above 1830. Stop: 1790. Target: 2060. Those in positions between 1760, 1770 and 1800, keep the stop at 1760. Target: 2060.

Sale: after rising to 1850 and then returning below 1830. Stop: 1856. Target: 1600 ?!

Support — 1787. Resistance — 1854.

EUR/USD

Growth scenario: Europe is not going to wind down its asset repurchase program, while the US is expected to take more decisive action in the fall. In this regard, downward pressure is visible on the pair. Buy only after rising above 1.2100.

Falling scenario: keep short. It is not excluded that investors in August will bet on the strengthening of the dollar.

Recommendations:

Purchase: think after a rise above 1.2100.

Sale: whoever is in position from 1.1950, keep the stop at 1.1980. Target: 1.1050? !!!

Support — 1.1701. Resistance — 1.1969.

USD/RUB

Growth scenario: the market reaction to the RF Central Bank rate hike to 6.5% looks subdued. We are waiting for the continuation of the growth of the American currency. The pair needs to go below 72.60 for the ruble expectations to become positive.

Falling scenario: we continue to believe that we can sell when rising to 76.20. However, let’s look at the general mood in the markets. If the Fed makes strong statements on the dollar, or they are assumed by the market, growth may continue to 79.00. Recommendations:

Purchase: now. Stop: 72.60. Target: 79.00. Those who are in the position from 72.07, move the stop to 72.60. Target: 80.00.

Sale: thinking when approaching 76.20.

Support — 73.35. Resistance — 73.88 (74.78).

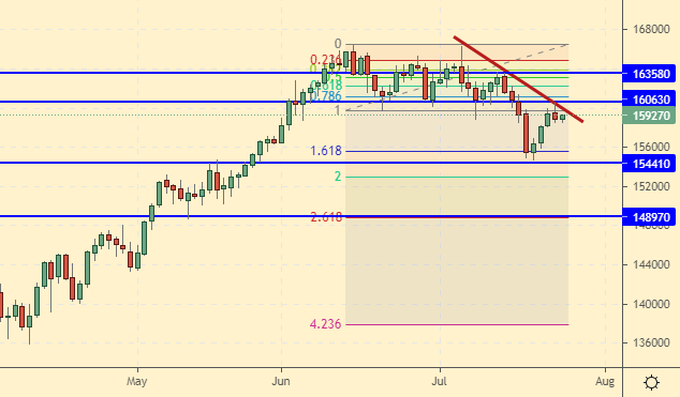

RTSI

Growth scenario: growth will be difficult for us even with high oil. The rise in the Central Bank rate will remove some of the potential buyers from the market. The people will take bonds and go to deposits. We will not buy.

Falling scenario: in the current area, we must continue to fight for the short. Only the growth of quotes above 164,000 will force us to postpone the bearish scenario. Recommendations:

Purchase: no.

Sale: now and on the rise to 162000. Stop: 164600. Target: 149000 (135000). Whoever is in the position from 162000, keep the stop at 164600. Target: 149000 (135000).

Support — 154410. Resistance — 160630.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.