Price forecast from 26 to 30 of April 2021

-

Energy market:

The oil market continues to be in equilibrium. On the one hand, the prices are depressingly affected by messages from India and central Europe, where the situation with the incidence of Chinese coronavirus is critical. On the other hand, the optimistic data for the United States and Great Britain, where the population reached the pre-crisis level of gasoline consumption, supports the quotes.

Unfortunately, it is already clear that there will be no full-fledged tourist season. The volume of international flights will be significantly reduced. In many states, people will rest within their own countries.

Hence, all this will inevitably lead to a reduction in the consumption of aviation kerosene and the bright hopes of OPEC for oil consumption in the amount of 96 million barrels per day on average for 2021 will not come true.

A direct deal between Iran and China for the supply of oil is capable of concealing 1-1.5 million barrels a day from analysts in the future. Hardly anyone will be able to understand what will happen to this oil, whether it will be pumped into storage facilities, or will it be immediately processed. If in the future, for some reason, Iran stumbles due to war, revolution, reforms or sanctions, then this may cause a strong rise in prices, since in the face of a shortage of real data, traders will have to assume the worst.

Grain market:

We see that the bulls completely control the grain market. Prices are accelerating ahead of the USDA meeting in May. Most likely, after the rapid growth, the market will roll back down in May. But the depth of the rollback will depend on the weather conditions. It should be reminded that, judging by the fact that demand has practically caught up with the gross harvest in terms of volume, the market will be saved from extremely high prices only by a record grain harvest. And he is already in question, at least in the United States, in many states it is corny cold and dry.

The Chinese Communist Party ordered to feed pigs with wheat and other feed, but not expensive corn. That’s all right. Well done. Only this is unlikely to help. Producers of other fodder crops such as rice, cassava, barley and sorghum will not give their crops at low prices under current conditions.

Note that soybean meal will soon become a delicacy for livestock, the price of soybeans has gone up 55% over the past six months. Against this background, the announcement of the launch in Russia of a plant for the production of feed protein from insects is no longer surprising.

By reading our predictions, you could have made money in the sugar market by moving up from 14.60 to 16.90 cents per pound.

USD/RUB:

The Central Bank of the Russian Federation raised the rate at its meeting on Friday by 0.5%. This is a forward move against the backdrop of political tensions and should help the ruble stay in the 75.00 — 80.00 range over the summer.

As long as oil is above $60 per barrel, and gas demand in Europe remains high, there are no major threats to the budget and economic stability.

The Ministry of Economic Development has lowered the growth prospects of the Russian economy from 3.3% to 2.9% this year. But as long as we are basically talking about some kind of growth and recovery, this is an absolute boon for the ruble.

Let’s hope that the political swamp that was swollen with gases will finally calm down within ten to fifteen days, otherwise the ruble will be exposed to the risk of weakening even despite the rise in the interest rate.

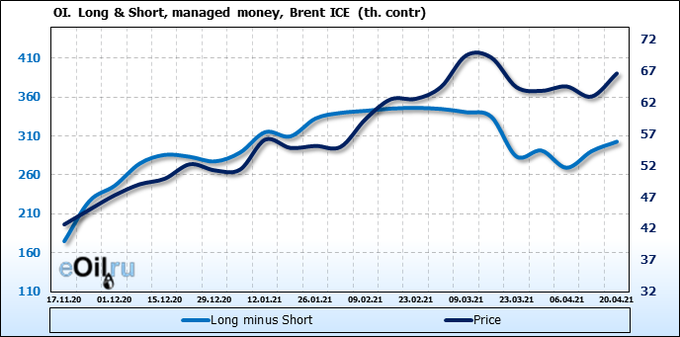

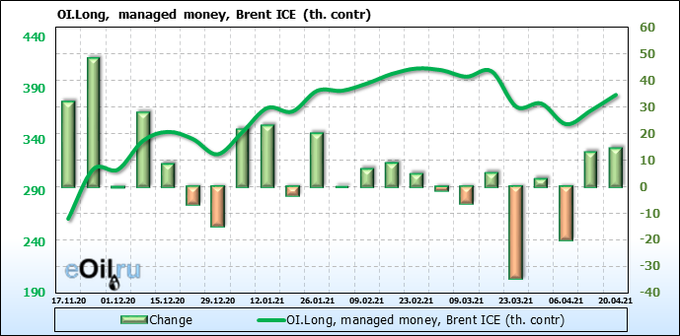

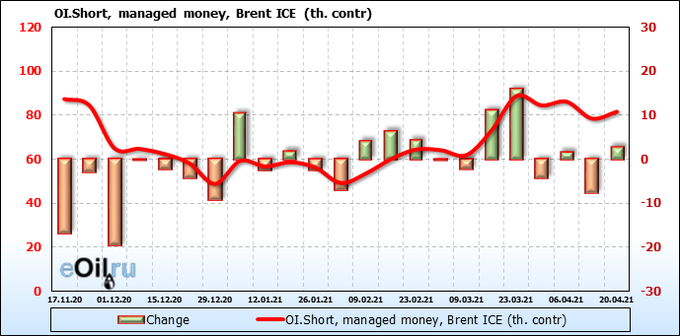

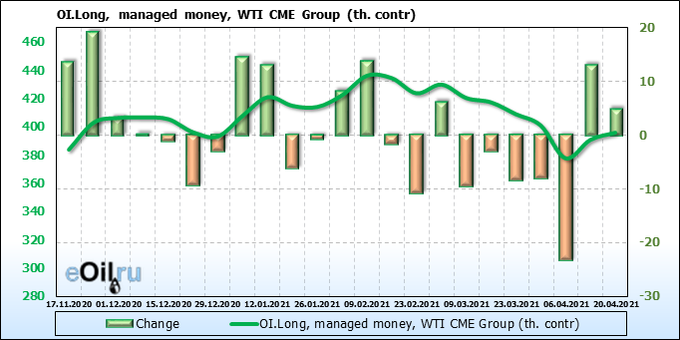

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Bulls — speculators pour money into the market, but in fact it does not want to grow. This fact creates preconditions for buyers to leave the market in the event of an insignificant decrease in prices, which can lead to a strong fall.

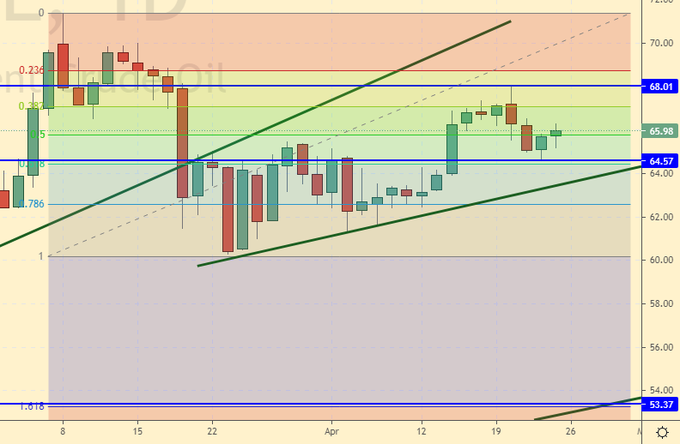

Growth scenario: April futures, expiration date April 30. As in the previous week, we will continue to interpret the current situation in favor of sellers, we do not buy.

Falling scenario: sell here. The buyers did not convince us of their strength last week. Recommendation:

Purchase: no.

Sale: now. Stop: 67.80. Target: 53.60. Those who are in the position from 66.10, move the stop to 67.80. Target: 53.60.

Support — 64.57. Resistance — 68.01.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 1 to 343.

Commercial oil reserves in the US increased by 0.594 to 493.017 million barrels. Gasoline inventories rose 0.085 to 234.982 million barrels. Distillate stocks fell -1.073 to 142.391 million barrels. Cushing’s stocks fell -1.318 to 45.35 million barrels.

Oil production has not changed at 11 million barrels per day. Oil imports fell by -0.447 to 5.405 million barrels per day. Oil exports fell by -0.031 to 2.548 million barrels per day. Thus, net oil imports fell by -0.416 to 2.857 million barrels per day. Oil refining remained unchanged and remained at 85 percent.

Gasoline demand rose 0.16 to 9.104 million barrels per day. Gasoline production fell by -0.229 to 9.386 million barrels per day. Gasoline imports rose 0.28 to 1.119 million barrels per day. Gasoline exports rose 0.014 to 0.677 million barrels per day.

Distillate demand fell by -0.274 to 3.854 million barrels. Distillate production fell by -0.088 to 4.555 million barrels. Distillate imports fell by -0.099 to 0.162 million barrels. Distillate exports fell by -0.058 to 1.016 million barrels per day.

The demand for petroleum products fell by -1.566 to 18.762 million barrels. Production of petroleum products fell by -1.109 to 20.25019 million barrels. Imports of petroleum products rose by 0.02 to 2.468 million barrels. Exports of petroleum products rose by 0.406 to 5.467 million barrels per day.

Propane demand fell by -0.433 to 0.679 million barrels. Propane production fell by -0.051 to 2.238 million barrels. Propane imports fell by -0.002 to 0.128 million barrels. Propane exports rose 0.537 to 1.698 million barrels per day.

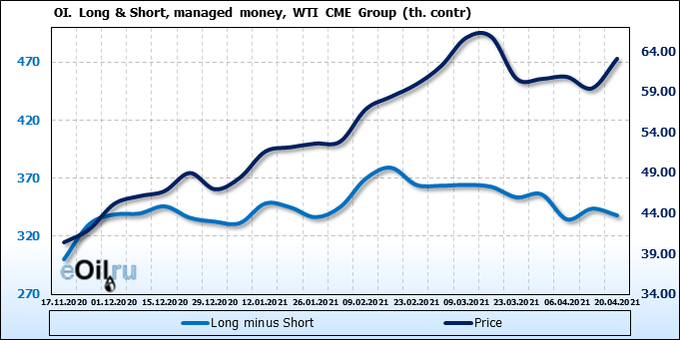

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Both buyers and sellers enter the market, and sellers are somewhat more active. In case of failure to continue the growth that buyers want to organize, we will have a good market move down.

Growth scenario: June futures, expiration date May 20. Nothing has changed for the bulls since last week: in case of growth above 65.00 on the 1H you can buy with targets at 71.80. We do not recommend do purchases on daily intervals.

Falling scenario: sell here. Yes, there is a risk of rising to 71.80, and we may fail, but in that case, we will simply return to shorts again from higher values.

Recommendation:

Purchase: no.

Sale: now. Stop: 63.80. Target: 46.00. Whoever is in positions from 61.00, 61.50 and 62.50, move the stop to 63.80. Target: 46.00.

Support — 57.14. Resistance — 64.02 (71.85).

Gas-Oil. ICE

Growth scenario: May futures, the expiration date is May 12. We continue to wait for the market to fall. We do not buy.

Falling scenario: sell here. The bulls did not surprise, they did not even set a new local maximum, unlike the oil market.

Recommendation:

Purchase: no.

Sale: now. Stop: 543.0. Target: 410.0. Who is in positions from 538.0, 530.0, 520.0, 515.0 and 510.0, keep the stop at 543.0. Target: 460.0 (revised).

Support — 518.25. Resistance — 536.50.

Natural Gas. CME Group

Growth scenario: June futures, expiration date May 26. Europe began to actively pump gas into empty storage facilities. We keep longs.

Falling scenario: when approaching 3.50, we will think about sales. Not earlier.

Recommendation:

Purchase: no. Those who are in the position from 2.52, move the stop to 2.64. Target: 3.615.

Sale: no.

Support — 2.652. Resistance — 2.871.

Wheat No. 2 Soft Red. CME Group

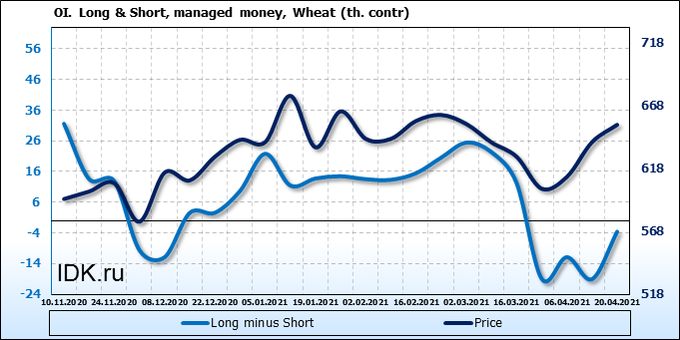

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Bulls come to the market, sellers flee. This behavior is in good agreement with actual price increases. The market may show another 3-5% growth from the current levels.

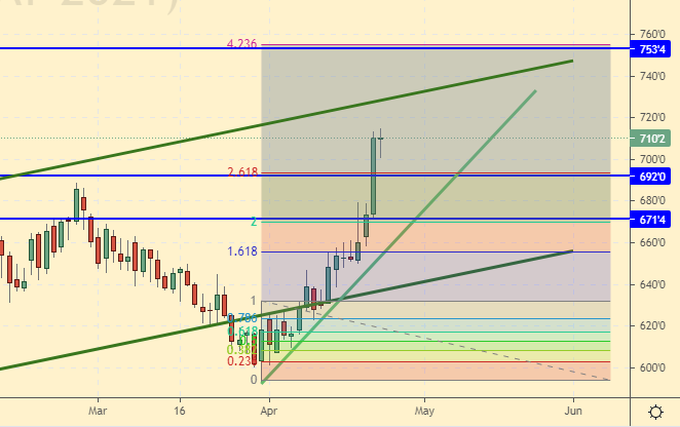

Growth scenario: May futures, expiration date May 14. «Suddenly we went to 800.0» we assumed last week. 800.0 is probably too ambitious, but we can get to 750.0. Cold weather in the US makes bulls nervous. We keep longs.

Falling scenario: when approaching 750.0, we will sell. It is unlikely that the market will go higher until the May USDA report.

Recommendation:

Purchase: no. Those who are in the position from 622.0, move the stop to 670.0. Target: 750.0.

Sale: on touch 750.0. Stop: 770.0. Target: 676.0.

Support — 692.0. Resistance — 753.4.

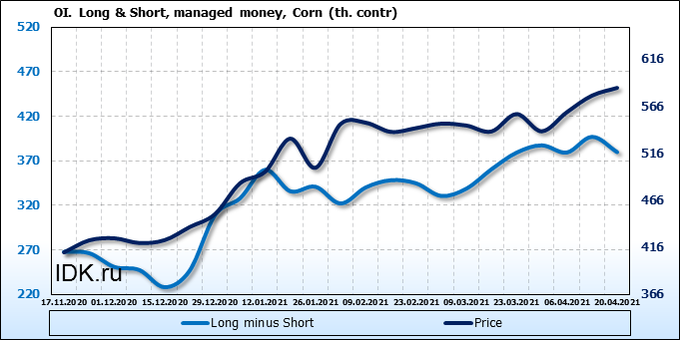

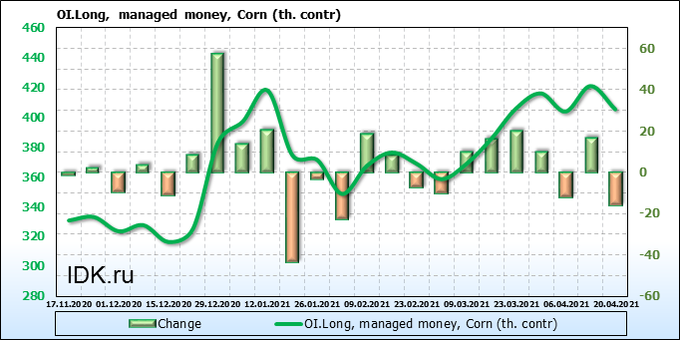

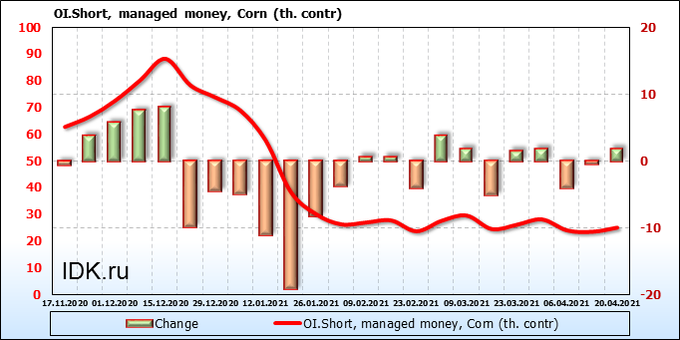

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The market continues to grow, while it cannot be said that there are many new buyers, which means the fragility of this design, but in a panic we can reach 760.0.

Growth scenario: May futures, expiration date May 14. In case of a rollback to 600.0, it is worth buying. Doing this from the current levels is uncomfortable. Falling scenario: prices did not roll back. Let’s say thanks to China for the bulk purchases of corn in the United States. We will refrain from sales for now.

Recommendation:

Purchase: on a rollback to 600.0. Stop: 580.0. Target: 760.0.

Sale: no.

Support — 626.2 (605.4). Resistance — 766.6.

Soybeans No. 1. CME Group

Growth scenario: May futures, expiration date May 14. We did go to 1700. You should be in longs from 1470. As per our recommendation.

Falling scenario: when approaching 1700 — sell. The market is clearly overbought.

Recommendation:

Purchase: no. Those who are in the position from 1470.0, move the stop to 1440. Target: 1700.0.

Sale: on touch 1700.0. Stop: 1740.0. Target: 1460.0.

Support — 1459.0. Resistance — 1717.6.

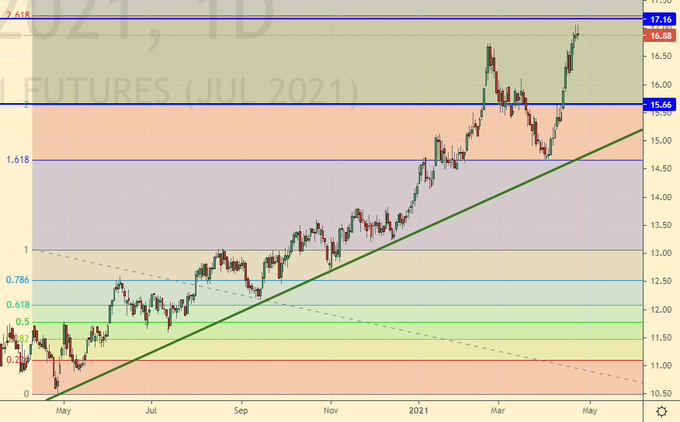

Sugar 11 white, ICE

Growth scenario: July futures, expiration date June 30. We continue to note that the purchase from 14.60 turned out to be successful. We fix the profit at current prices. We do not open new positions.

Falling scenario: sell here. It is unlikely that we can count on a turning point in the event of a strong excitement in the food market, but we can hope for a rollback by 16.00.

Recommendation:

Purchase: no. Who is in a position from 14.60 to close all positions in the area of 16.90. All with a profit. Sale: now. Stop: 17.40. Target: 16.00.

Support — 15.66. Resistance — 17.16.

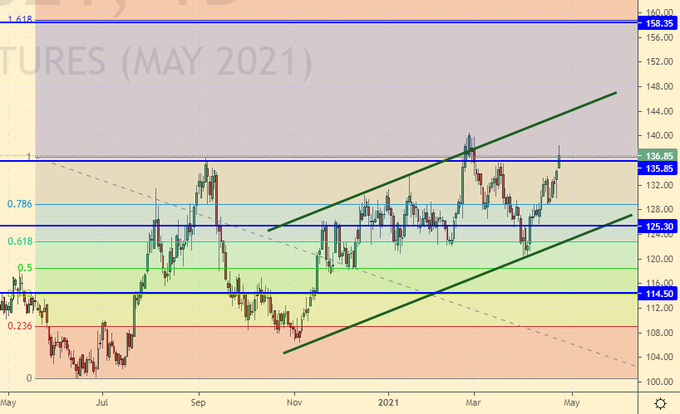

Сoffee С, ICE

Growth scenario: considering the May futures, the expiration date is May 18. We took and rose above 135.0. If you have not entered long yet, do so and add in case of rollback to 130.0.

Falling scenario: yes, there will be a rollback here, but we are not talking about a fall. We do not sell.

Recommendation:

Purchase: on touch 130.00. Stop: 123.80. Target: 157.00. Anyone in the position from 135.00, move the stop to 123.80. Target: 157.00.

Sale: no.

Support — 135.85. Resistance — 158.35.

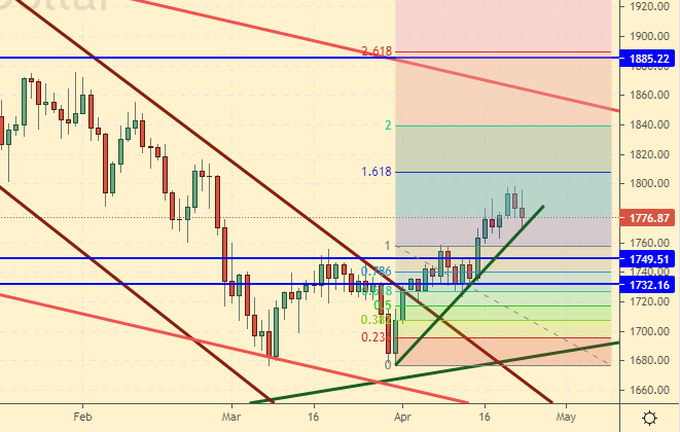

Gold. CME Group

Growth scenario: with a rollback to 1750, you can consider entering a long. Gold is stubbornly forming an uptrend and this encourages buyers to place new bets on growth.

Falling scenario: we continue to believe that it is better not to sell yet. The dollar index is trying to recover, but so far these attempts look extremely unconvincing.

Recommendations:

Purchase: on a pullback to 1750. Stop: 1743. Target: 1885. Who is in position from 1760, move the stop to 1743. Target: 1885.

Sale: no.

Support — 1749. Resistance — 1885.

EUR/USD

Growth scenario: the market passed above 1.2050, which forced us to enter purchase. Indeed, we can go to 1.2800.

Falling scenario: the market was unable to return below 1.2000. This means that you should not have considered the possibility of entering the short. We do not sell.

Recommendations:

Purchase: no. Those who are in the position from 1.2050, move the stop to 1.1930. Target: 1.2800.

Sale: no.

Support — 1.1931. Resistance — 1.2774.

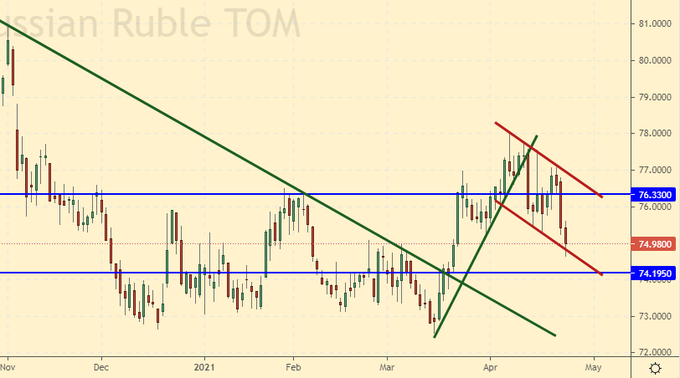

USD/RUB

Growth scenario: The market reaction to the RF Central Bank rate hike is quite moderate. We have drawn the correction in the form of a «flag». If an exit above 77.00 follows, then a fast move to the area of 82.00 may await us. We will buy from the current levels.

Falling scenario: it is difficult to recommend selling in the current situation. Only the descent under 73.00 will make you rethink what is happening.

Purchase: now. Stop: 73.80. Target: 82.00. Consider the risks!

Sale: no.

Support — 74.19. Resistance — 76.33.

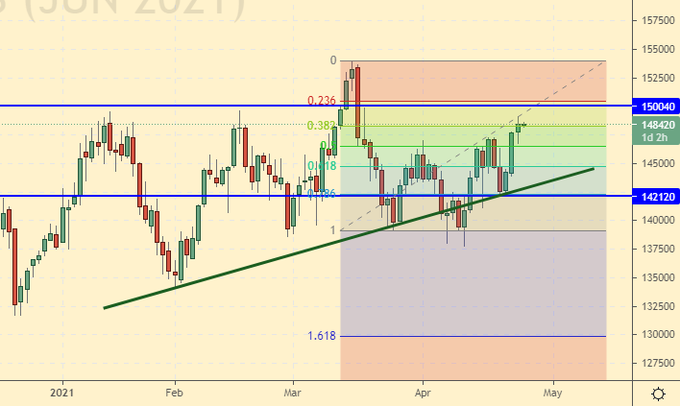

RTSI

Growth scenario: according to the classic, after the rate hike, the stock market should start falling, since the risk-free profitability of deposits should attract free resources to deposits in banks, and not to the stock market. We do not buy.

Falling scenario: most likely, we will face a cooling of the stock market. Let’s not talk about a crash or a crisis, but an increase in the rate by the Bank of Russia can provoke a rollback to 130000 region.

Recommendations:

Purchase: no.

Sale: now. Stop: 150800. Target: 130000. Consider the risks!

Support — 142120. Resistance — 150040.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.